In the fast-evolving world of digital assets, privacy and compliance often find themselves at odds. Nowhere is this tension more apparent than in the ongoing debate around cryptocurrency mixers, especially as the U. S. Treasury’s proposed “Mixer Rule” shakes up expectations for crypto privacy services. At its core, this rule aims to bring greater transparency to an industry long prized for its anonymity – but what does it really mean for users and providers who value lawful privacy?

The Anatomy of the U. S. Treasury Mixer Rule

In October 2023, the Financial Crimes Enforcement Network (FinCEN), an arm of the U. S. Treasury, unveiled a proposal that would classify international Convertible Virtual Currency (CVC) mixing as a primary money laundering concern. The move is rooted in anti-money laundering (AML) efforts and leverages powers from the PATRIOT Act to extend regulatory oversight into previously gray areas of crypto activity.

Under this proposal, any transaction involving a crypto mixer would trigger mandatory reporting requirements for U. S. -regulated financial institutions. This includes not just traditional mixers but potentially any tool or method that obscures transaction trails, such as splitting funds across multiple wallets or using privacy-enhancing protocols.

The government’s rationale is clear: while mixers serve legitimate purposes by providing financial privacy, they have also become tools for cybercriminals and sanctioned entities. Notably, groups like North Korea’s Lazarus Group have exploited mixers to launder proceeds from high-profile hacks. The notorious Tornado Cash case – which saw over $7 billion allegedly laundered before sanctions were ultimately lifted in March 2025 – remains a defining example (see Treasury press release).

Privacy Versus Compliance: The New Fault Line

The mixer rule has ignited passionate debate across Web3 communities and compliance circles alike. Proponents argue that enhanced oversight is overdue given the scale of illicit flows through unregulated mixers. Critics warn that blanket reporting threatens individual rights to financial privacy and risks stifling innovation in blockchain technology.

Importantly, FinCEN has clarified that this is not a ban on mixers themselves but rather an attempt to increase transparency around their use (FinCEN.gov announcement). The agency acknowledges legitimate uses for privacy tools and has expressed openness to industry collaboration on solutions that preserve both compliance and confidentiality.

Key Features of Compliant Crypto Mixers Under US Law

-

Robust Anti-Money Laundering (AML) Controls: Mixers must implement comprehensive AML programs, including customer due diligence and transaction monitoring, to detect and prevent illicit activities.

-

Mandatory Reporting to FinCEN: Under the proposed rule, U.S. financial institutions are required to report transactions involving cryptocurrency mixing to the Financial Crimes Enforcement Network (FinCEN).

-

Know Your Customer (KYC) Procedures: Compliant mixers must verify the identities of their users to ensure transparency and accountability, aligning with broader financial regulations.

-

Transparent Record-Keeping: Mixers should maintain detailed records of transactions and user information for a minimum period, as required by U.S. law, to facilitate audits and investigations.

-

International Cooperation and Information Sharing: To address cross-border risks, compliant mixers may need to collaborate with global regulators and share information on suspicious activities.

-

Privacy-Preserving Compliance Solutions: Innovative approaches, such as zkKYC (zero-knowledge KYC), are encouraged to balance user privacy with regulatory requirements, allowing verification without exposing sensitive data.

How Mixers Work – And Why They Matter

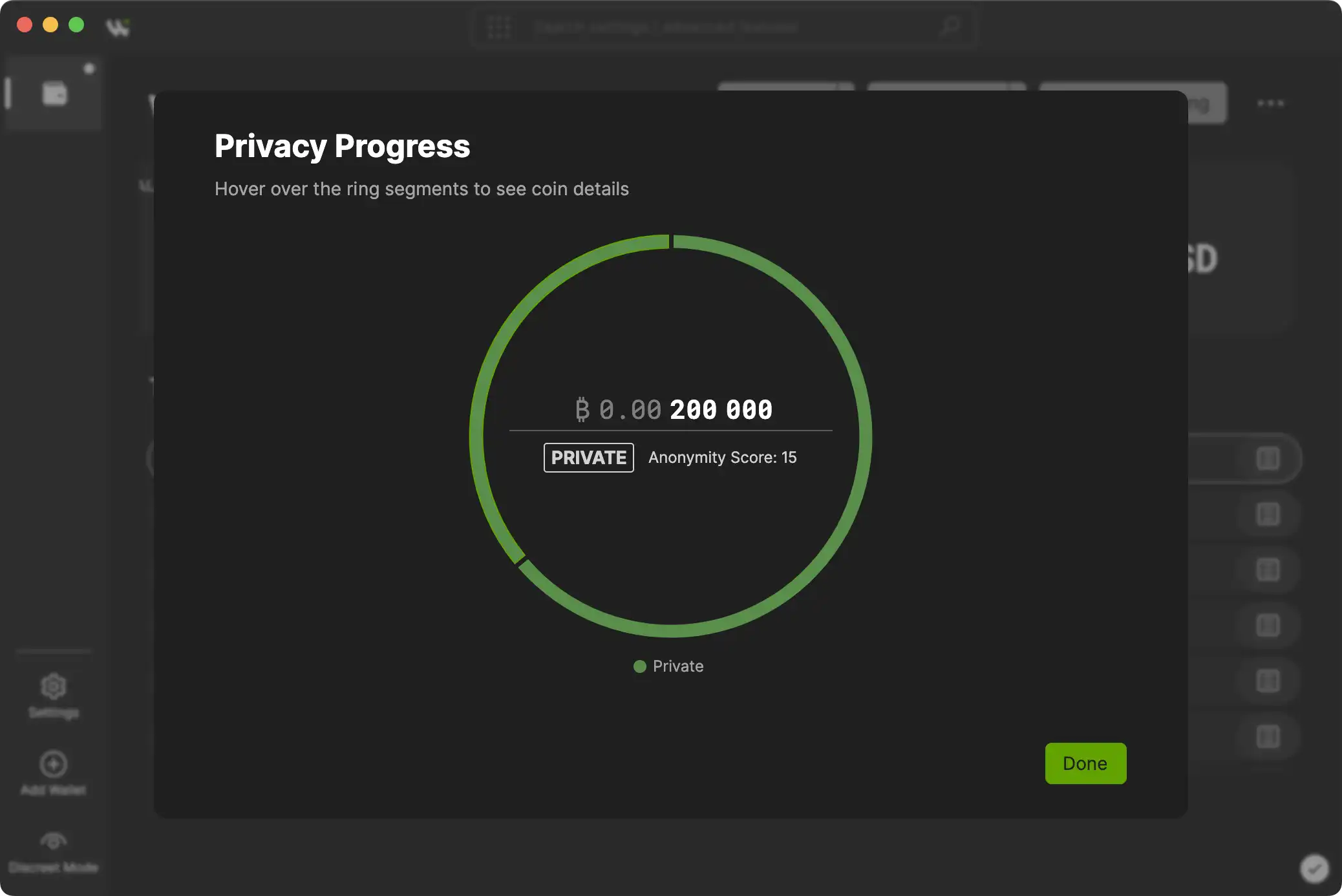

To understand why regulators are so focused on mixers, it helps to know how these services operate. Mixers pool together cryptocurrency from multiple users before redistributing it in randomized batches. This process breaks direct links between sender and recipient addresses on public blockchains like Bitcoin or Ethereum.

This obfuscation can be vital for individuals seeking protection from surveillance or censorship – think journalists operating under oppressive regimes or businesses safeguarding sensitive transaction data. Yet these same features make mixers attractive conduits for money laundering, ransomware payments, and terrorist financing.

The new regulatory scrutiny raises critical questions about where society should draw boundaries between personal liberty and collective security within digital finance.

Navigating Compliance: What Users and Providers Need to Know

For both individuals and businesses, the U. S. Treasury mixer rule signals a new era of accountability in crypto privacy. U. S. -regulated financial institutions will be required to file reports on transactions that involve mixers, regardless of whether those mixers are based domestically or abroad. This means users who value privacy will need to carefully consider how they interact with mixing services, as their activities may now be subject to regulatory scrutiny, even if their intentions are entirely legitimate.

Providers of privacy tools face even greater pressure. To remain viable under this evolving regime, compliant mixers must implement robust anti-money laundering (AML) controls, transparent operational practices, and clear reporting mechanisms. The days of “black box” anonymity are fading; instead, we’re entering a phase where BSA-regulated crypto mixers must balance user confidentiality with traceable audit trails for regulators.

This shift is not just about legal boxes to check, it’s about rebuilding trust in privacy tools by demonstrating their legitimate value while actively deterring illicit use. For many in the industry, it’s an opportunity to innovate with privacy-preserving technologies that offer verifiable compliance, such as zero-knowledge proofs or selective disclosure protocols.

The Future: Privacy Tech Meets Regulation

The mixer rule is already inspiring creative solutions at the intersection of cryptography and compliance. Privacy advocates point to emerging standards like zkKYC (zero-knowledge Know Your Customer), which allow users to prove eligibility without revealing unnecessary personal details. Such approaches could satisfy both regulatory demands for transparency and user expectations for discretion, potentially redefining what it means to be a compliant mixer under US law.

The ultimate outcome will depend on ongoing dialogue between regulators, technologists, and civil society groups. The Treasury has signaled willingness to engage with the industry and adapt its approach where warranted (FinCEN.gov announcement). As a result, forward-thinking providers are already building partnerships with compliance experts and integrating advanced analytics to detect suspicious activity without compromising everyday user privacy.

Innovations in Regulated Crypto Mixers Balancing Privacy and Compliance

-

zkKYC by zkMe: zkKYC (zero-knowledge Know Your Customer) by zkMe enables users to prove compliance with regulatory requirements without revealing sensitive personal information, leveraging zero-knowledge proofs for privacy-preserving identity verification.

-

Railgun: Railgun is a smart contract system on Ethereum that uses zero-knowledge cryptography to allow private transactions while supporting regulatory compliance features, such as optional auditability for authorized parties.

-

Compliance Layer by Chainalysis: Chainalysis, a leading blockchain analytics firm, offers compliance solutions that help regulated mixers integrate transaction monitoring and reporting, enabling privacy tools to operate within anti-money laundering (AML) frameworks.

-

Threshold Network’s tBTC: Threshold Network’s tBTC bridges Bitcoin to Ethereum with privacy-preserving features and compliance controls, allowing users to maintain privacy while supporting regulatory audits when required.

-

Wasabi Wallet 2.0: Wasabi Wallet 2.0 introduces coordinated CoinJoin transactions with enhanced privacy, while incorporating features that allow users to comply with jurisdictional regulations and reporting requirements.

What Comes Next?

The debate over the U. S. Treasury mixer rule is far from settled. With sanctions against Tornado Cash recently lifted following legal review (Reuters coverage), there’s renewed momentum for solutions that protect lawful privacy while blocking bad actors. The next phase will likely see more collaborative frameworks emerge, combining rigorous AML oversight with next-generation cryptographic safeguards.

If you’re navigating this landscape as a user or provider, stay informed about evolving requirements and look for services that demonstrate both technical excellence and regulatory foresight. As always in crypto, the most resilient solutions will be those shaped by open dialogue, continuous learning, and a commitment to both individual rights and collective security.