The regulatory landscape for cryptocurrency mixers in the United States shifted dramatically in 2024, reshaping how privacy-focused platforms approach compliance. The U. S. Treasury’s latest Mixer Rule, along with the rollout of the Beneficial Ownership Information (BOI) database and heightened AML/CFT expectations, places new demands on regulated cryptocurrency mixers. These developments are not just legal hurdles; they’re catalysts for innovation and operational change across the privacy sector.

![]()

Understanding the Treasury’s Mixer Rule: Why Compliance Matters More Than Ever

In October 2023, FinCEN proposed designating international Convertible Virtual Currency (CVC) mixing as a ‘Primary Money Laundering Concern. ’ This move was swiftly followed by the launch of the BOI database in January 2024, requiring financial institutions to verify beneficial ownership information and report suspicious activities involving crypto mixers. The message is clear: compliance is now a baseline expectation, not a competitive advantage.

Recent legal events have only intensified scrutiny. The Tornado Cash sanctions saga culminated in a pivotal appeals court decision in November 2024, which found that certain smart contracts did not constitute property under federal law. While this ruling led to the lifting of sanctions in March 2025, it left no doubt that regulators will continue to target mixers that fail to meet Bank Secrecy Act (BSA) and Financial Action Task Force (FATF) requirements.

Five Critical Compliance Strategies for Regulated Crypto Mixers

To thrive under these new rules, and maintain both user trust and operational legitimacy, regulated cryptocurrency mixers must adopt comprehensive compliance strategies tailored to current U. S. Treasury requirements. Here’s how leaders in this space are responding:

Top 5 Compliance Strategies for Crypto Mixers in 2024

-

Implement Enhanced KYC and Beneficial Ownership Verification Aligned with BOI Database RequirementsLeverage advanced KYC solutions—such as Chainalysis or Trulioo—to verify user identities and beneficial ownership. Ensure data is compatible with the FinCEN Beneficial Ownership Information (BOI) database introduced in 2024, supporting law enforcement access and regulatory compliance.

-

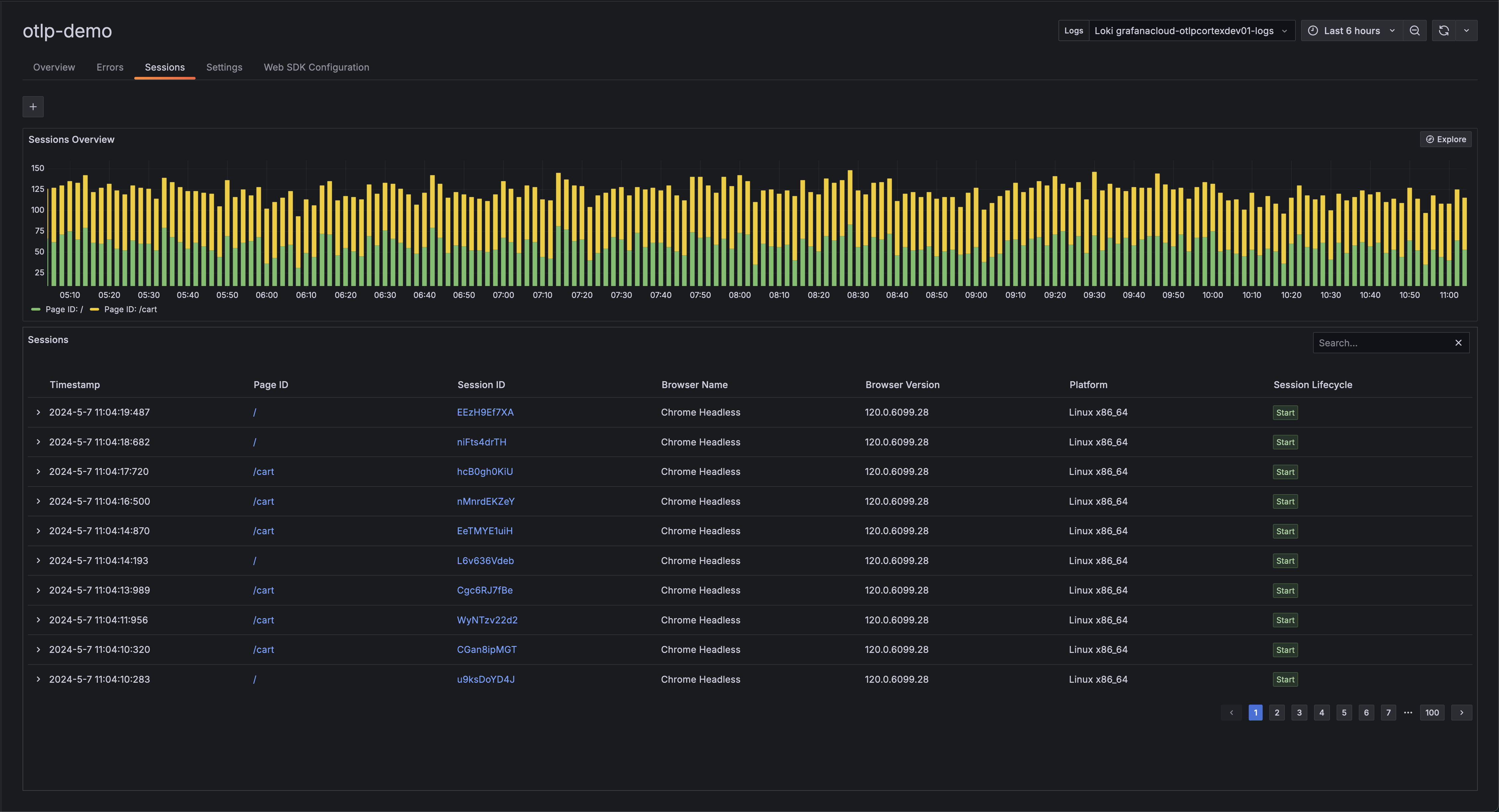

Integrate Automated Transaction Monitoring and Suspicious Activity Reporting (SAR) Systems for Mixer TransactionsUtilize platforms like Solidus Labs or Elliptic to implement real-time transaction monitoring. These tools help detect suspicious patterns and facilitate timely SAR filings, as required by the Bank Secrecy Act (BSA) and FinCEN’s 2024 guidance.

-

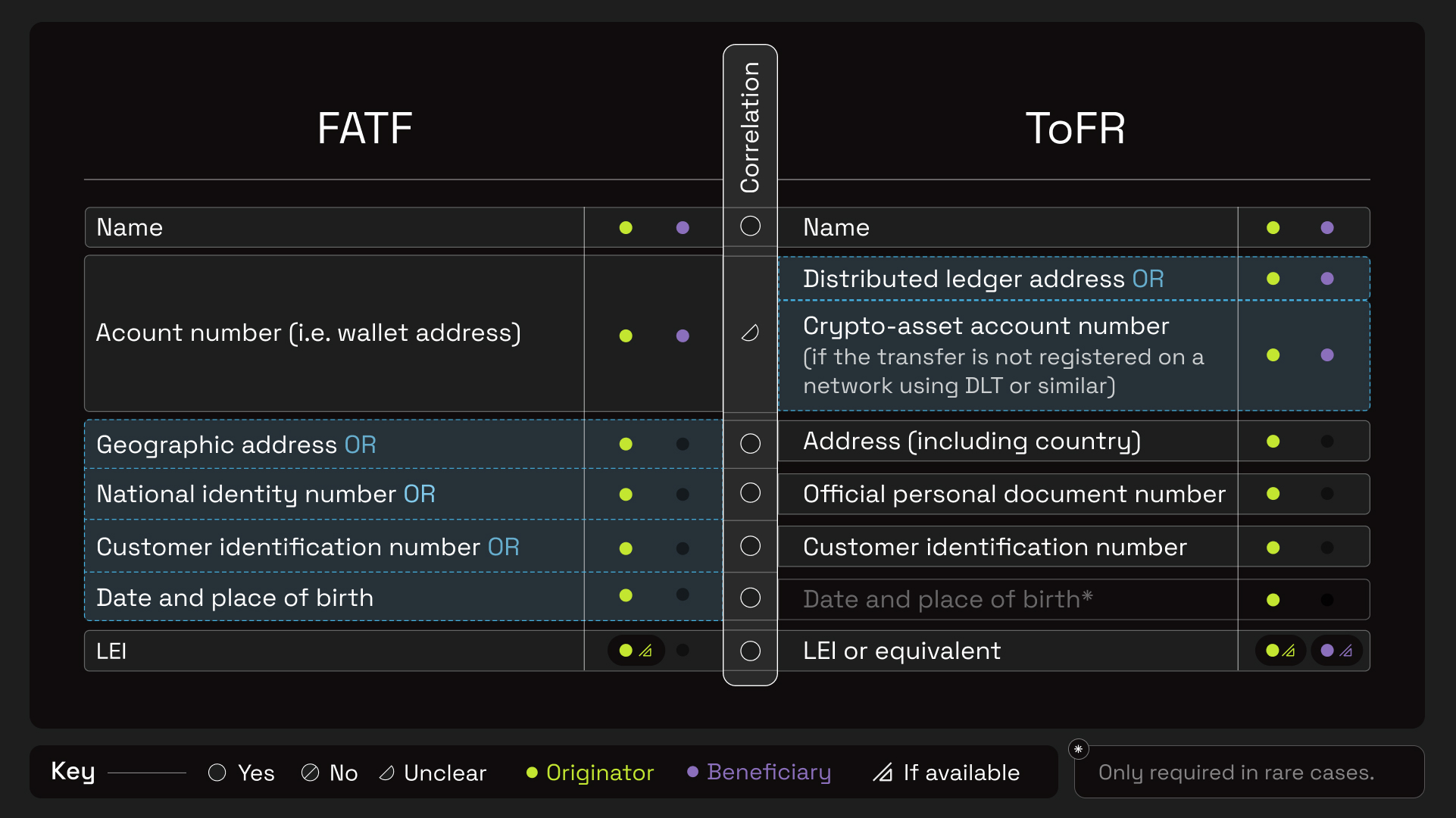

Adopt Robust AML/CFT Policies Consistent with BSA and FATF Travel Rule Guidance for Crypto MixersDevelop and regularly update AML/CFT policies in line with FATF and FinCEN guidance. Ensure your compliance framework covers the Travel Rule, requiring the exchange of sender and receiver information for qualifying transactions.

-

Establish Transparent Audit Trails and Record-Keeping Mechanisms to Facilitate Regulatory InspectionsImplement immutable, timestamped logs using solutions like Hyperledger Fabric to create transparent audit trails. This supports regulatory audits and demonstrates adherence to record-keeping mandates under the BSA and new Treasury requirements.

-

Deploy Privacy-Preserving Technologies that Enable Compliance without Compromising User ConfidentialityAdopt innovations such as Aztec Network or zkSNACKs, which use zero-knowledge proofs to maintain user privacy while enabling compliance checks. These technologies help mixers balance regulatory obligations with the need for confidentiality.

1. Implement Enhanced KYC and Beneficial Ownership Verification Aligned with BOI Database Requirements

The BOI database represents a paradigm shift for crypto mixer compliance. Platforms must now collect, verify, and regularly update customer identification data, including beneficial ownership details, to ensure all parties involved meet regulatory standards. This goes beyond traditional KYC; it means integrating systems capable of cross-referencing user data against government-maintained registries.

For regulated cryptocurrency mixers, this step is foundational to demonstrating good faith with regulators and deterring illicit actors seeking anonymity for nefarious purposes.

2. Integrate Automated Transaction Monitoring and Suspicious Activity Reporting (SAR) Systems for Mixer Transactions

The days of manual monitoring are over. To comply with BSA reporting requirements and FinCEN guidance, leading platforms are deploying automated transaction monitoring tools that flag unusual patterns, such as rapid cycling of funds or high-volume transactions from newly created wallets.

This automation enables timely Suspicious Activity Report (SAR) filings when red flags appear, creating an auditable trail that can be shared with authorities upon request without sacrificing operational efficiency or user experience.

Navigating BSA and FATF Obligations While Protecting User Privacy

The intersection between privacy-preserving crypto solutions and regulatory mandates is where innovation thrives, or stalls. With FATF Travel Rule guidance now extending explicitly to virtual asset service providers (VASPs), including mixers, platforms must:

- Adopt robust AML/CFT policies consistent with BSA and FATF guidance

- Establish transparent audit trails and record-keeping mechanisms

- Deploy privacy-preserving technologies that enable compliance without compromising confidentiality

This balancing act is at the heart of modern crypto mixer compliance. In the next section, we’ll explore how these strategies work together, and what innovators are doing to stay ahead as regulations evolve further into 2025.

Regulated cryptocurrency mixers are now tasked with building frameworks that not only satisfy the letter of the law but also preserve the spirit of privacy that attracts users to these platforms in the first place. Let’s break down how the remaining three compliance strategies empower mixers to meet these dual objectives.

3. Adopt Robust AML/CFT Policies Consistent with BSA and FATF Travel Rule Guidance for Crypto Mixers

Compliance isn’t just about ticking boxes, it’s about embedding anti-money laundering (AML) and counter-financing of terrorism (CFT) safeguards into every operational layer. The BSA and FATF Travel Rule now require mixers to collect, store, and transmit sender/recipient information for qualifying transactions. This means regulated platforms must:

- Develop clear internal policies for risk assessment and mitigation

- Train staff on red flag indicators specific to crypto mixing

- Ensure information sharing protocols are secure yet accessible for regulatory review

Proactive adoption of these standards positions mixers as trustworthy partners in the broader financial ecosystem, while reducing exposure to enforcement actions.

4. Establish Transparent Audit Trails and Record-Keeping Mechanisms to Facilitate Regulatory Inspections

The U. S. Treasury’s action plan emphasizes transparency. For crypto mixers, this translates into implementing immutable audit trails, records that document every transaction, user verification step, and compliance decision made on the platform. Secure digital ledgers, timestamped logs, and encrypted backups are now baseline requirements for passing regulatory inspections or responding swiftly to subpoenas.

This level of record-keeping not only satisfies regulators but also protects platforms in legal disputes, as demonstrated by the Tornado Cash case. It’s a crucial pillar of any defensible compliance program.

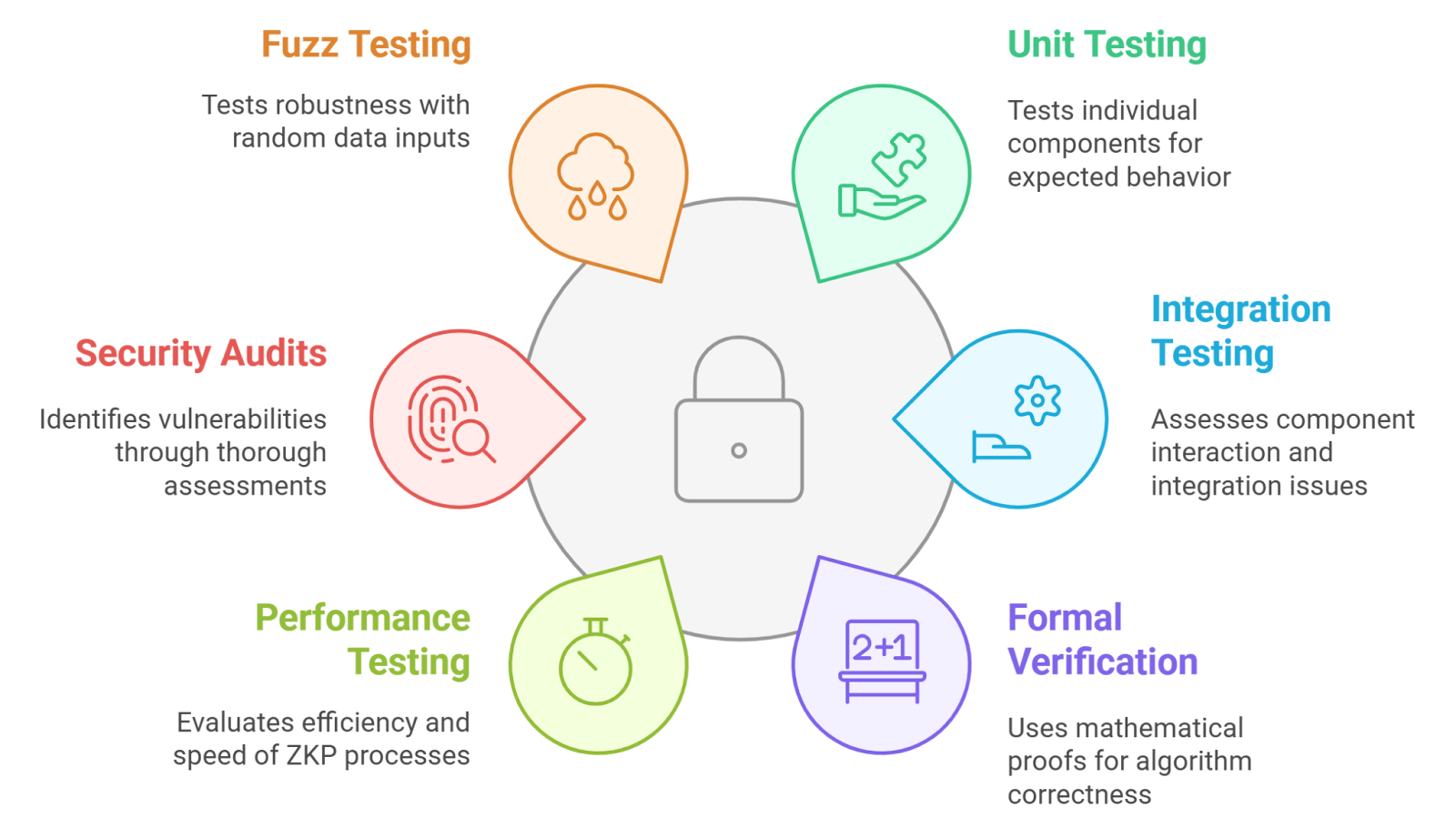

5. Deploy Privacy-Preserving Technologies that Enable Compliance without Compromising User Confidentiality

The real innovation in regulated cryptocurrency mixers is happening at the intersection of privacy technology and compliance architecture. Tools like zero-knowledge proofs allow platforms to verify user identities or transaction legitimacy without exposing sensitive details, even during audits or regulatory reporting.

This approach enables platforms to offer privacy-preserving crypto solutions that still meet BSA reporting requirements and FATF crypto regulations, ensuring users don’t have to choose between security and legality.

Looking Ahead: Building Trust through Transparent Compliance

The debate over crypto mixer regulation is far from settled, as highlighted by ongoing industry pushback against overly broad rules and recent court decisions challenging regulatory overreach. However, regulated cryptocurrency mixers that invest in enhanced KYC/BOI verification, automated monitoring/SAR systems, robust AML/CFT policies, transparent record-keeping, and cutting-edge privacy tech are best positioned to thrive.

For a deeper dive into how these trends shape privacy-focused services, and what it means for your platform, see our detailed analysis at Understanding the U. S. Treasury’s Mixer Rule: What It Means for Crypto Privacy Services.

Top 5 Compliance Strategies for Crypto Mixers in 2024

-

Implement Enhanced KYC and Beneficial Ownership Verification Aligned with BOI Database RequirementsLeverage robust Know Your Customer (KYC) processes and verify beneficial owners using the FinCEN Beneficial Ownership Information (BOI) database to ensure compliance with the latest U.S. Treasury mandates. This step helps mixers prevent illicit use and meet new regulatory expectations.

-

Integrate Automated Transaction Monitoring and Suspicious Activity Reporting (SAR) Systems for Mixer TransactionsDeploy advanced transaction monitoring tools like Chainalysis or Elliptic to detect suspicious activity and streamline the filing of SARs, in accordance with BSA requirements for virtual asset service providers.

-

Adopt Robust AML/CFT Policies Consistent with BSA and FATF Travel Rule Guidance for Crypto MixersDevelop and regularly update Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) policies that align with the FATF Travel Rule and U.S. Bank Secrecy Act (BSA), ensuring all cross-border transactions are properly documented and reported.

-

Establish Transparent Audit Trails and Record-Keeping Mechanisms to Facilitate Regulatory InspectionsUtilize blockchain analytics platforms such as TRM Labs to maintain immutable audit trails and comprehensive records, making regulatory inspections and compliance audits more efficient and transparent.

-

Deploy Privacy-Preserving Technologies that Enable Compliance without Compromising User ConfidentialityIncorporate solutions like Aztec Network or zkSNACKs to implement zero-knowledge proofs and other privacy-enhancing technologies, balancing regulatory compliance with strong user privacy protections.