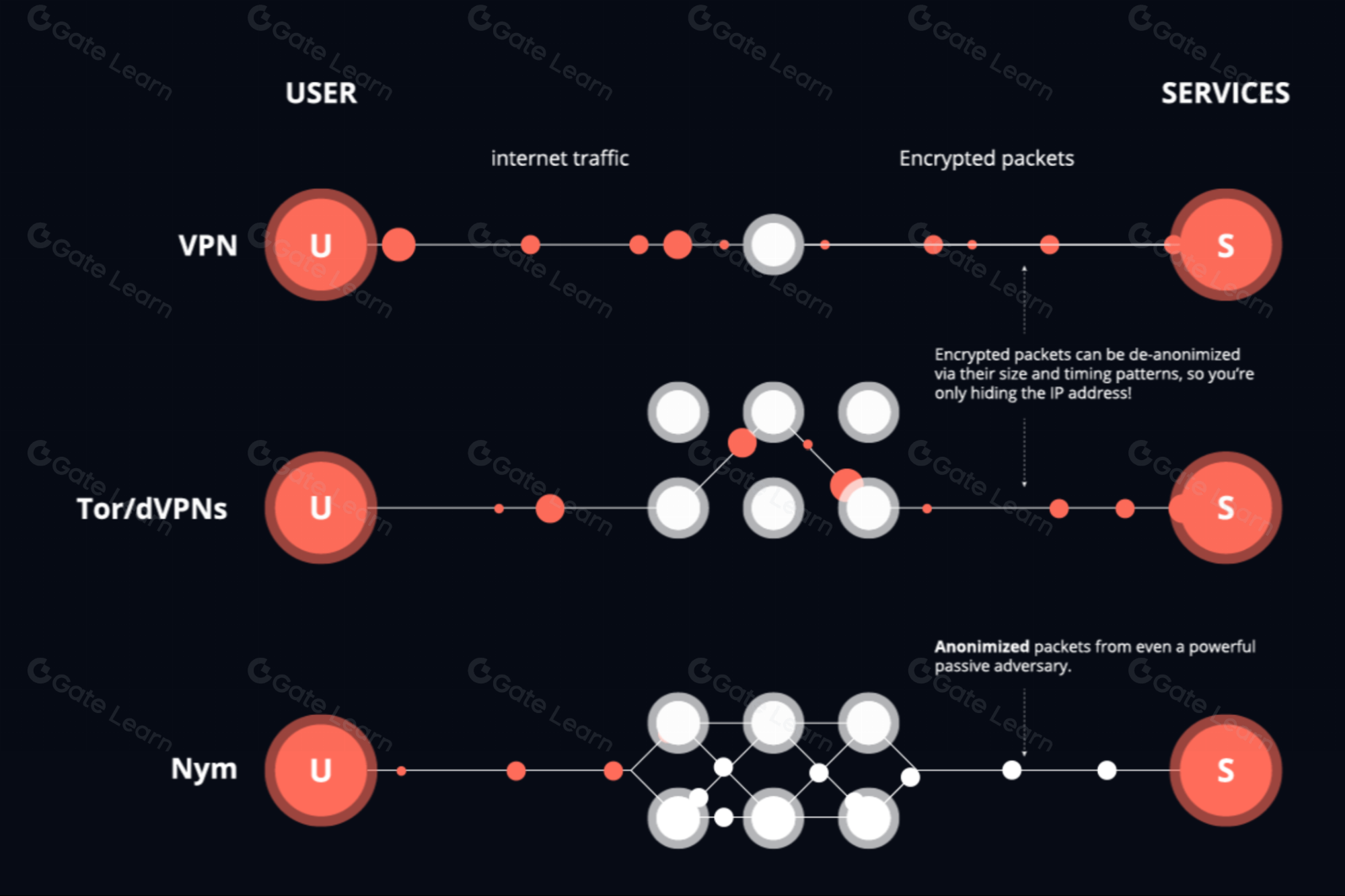

In 2024, the landscape for legal crypto privacy is being redefined by a new breed of regulated crypto mixers. These platforms are engineered to deliver robust privacy features that comply with evolving regulatory frameworks in the US, EU, and beyond. The tension between transparency and confidentiality on public blockchains has never been sharper, with recent policy moves and court decisions highlighting both risks and opportunities for privacy-conscious users.

Regulatory Shifts: From Blanket Bans to Smart Compliance

The first half of 2024 saw pivotal legal events that shaped the mixer market. In May, the US House introduced the Blockchain Integrity Act, proposing a two-year ban on mixers and hefty penalties for financial institutions interacting with mixed funds. Yet by November, a US appeals court overturned sanctions against Tornado Cash, ruling its smart contracts were not property under federal law. This ruling underscored the complexity of regulating decentralized protocols and signaled that outright bans may be legally tenuous.

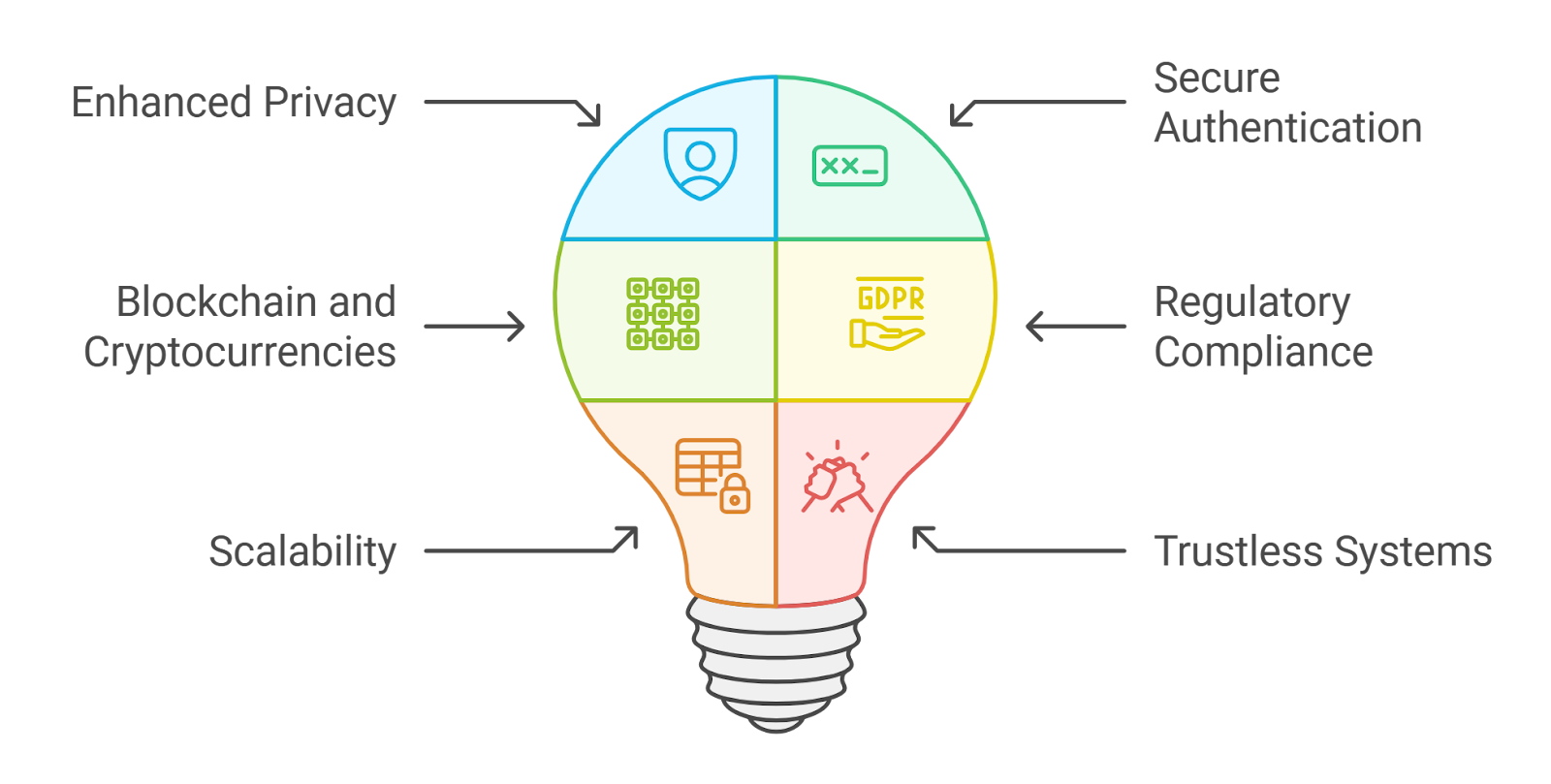

Meanwhile, the EU’s Markets in Crypto-Assets (MiCA) regulation introduced new governance rules for DeFi and custodial mixers, holding operators accountable for compliance. Across jurisdictions, regulators now favor a more nuanced approach: allowing privacy tools that integrate KYC/AML checks, selective disclosure mechanisms, and zero-knowledge proof (ZKP) compliance.

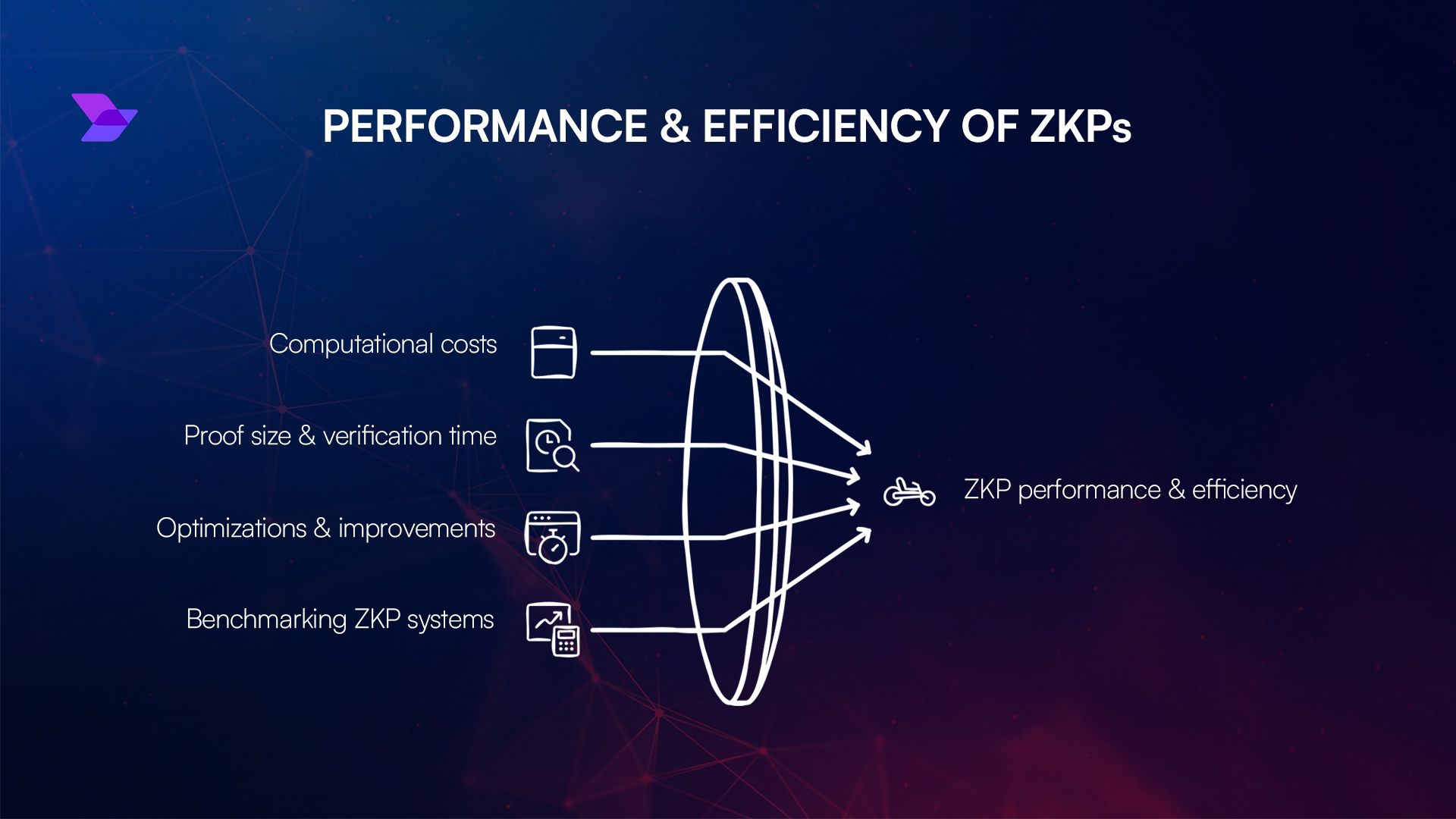

The Rise of Zero-Knowledge Proof Compliance

Zero-knowledge proofs have emerged as the technological linchpin for balancing privacy with compliance. Advanced solutions like zkKYC enable users to prove they meet verification requirements without exposing personal data to counterparties or service providers. Industry experts point to these innovations as critical for meeting both user demand for confidentiality and regulator demands for traceability.

For example, zkMixer, launched in 2024, lets user groups configure pools with custom governance rules, such as deposit delays or refund/confiscation protocols, while using ZKPs to validate compliance without leaking sensitive information. Similarly, frameworks like SeDe enable distributed de-anonymization only in cases of proven illicit activity, ensuring lawful users retain full privacy.

Regulated Crypto Mixers Using Zero-Knowledge Proofs in 2024

-

zkMixer: An open-source, configurable mixer leveraging zero-knowledge proofs to enable privacy-preserving crypto transactions. zkMixer allows user groups to establish governance rules, supports KYC/AML compliance, and provides mechanisms for selective de-anonymization in cases of suspected illicit activity. Read the zkMixer whitepaper.

-

SeDe Framework: A compliance-focused privacy protocol that integrates zero-knowledge proofs with distributed governance. SeDe enables privacy for legitimate users while allowing authorized parties to de-anonymize transactions linked to criminal activity, aligning with regulatory requirements. Explore SeDe framework details.

-

zkKYC Solutions (e.g., zkMe): Platforms like zkMe offer zero-knowledge KYC protocols that allow users to prove compliance without revealing personal data. These solutions are increasingly integrated into regulated mixers, enabling privacy-preserving on-chain activity while satisfying AML and regulatory checks.

Privacy vs Compliance: How Regulated Mixers Bridge the Gap

The debate around “privacy vs compliance” is no longer binary. Regulated crypto mixers now offer a spectrum of features designed to satisfy both sides:

- KYC/AML Integration: Users verify identities when required by law but maintain transactional anonymity otherwise.

- Selectively Auditable Trails: Lawful users can provide cryptographic proof of clean funds if challenged by authorities or financial institutions.

- Automated Risk Controls: Suspicious transactions can be flagged or frozen based on pre-set governance rules without compromising honest users’ privacy.

This evolution marks a decisive shift away from unregulated “black box” mixers toward transparent platforms that empower legitimate users while deterring illicit activity. The result is a more mature market where blockchain privacy is not just technically possible but also legally sustainable.

Importantly, the latest compliance-driven mixers are not one-size-fits-all. Users can choose from a range of privacy levels, governance settings, and verification methods to match their risk tolerance and jurisdictional requirements. This flexibility is key as both the US and EU continue to refine their approaches to crypto regulation, with the GENIUS Act and MiCA setting new standards for mixer accountability and user protections.

As we look toward 2025, industry observers anticipate that zero-knowledge proof compliance will become the gold standard for privacy-preserving financial tools. The ability to cryptographically prove regulatory adherence, without exposing transaction details, addresses both institutional concerns about money laundering and user demands for confidentiality.

Key Features Driving Adoption of Regulated Mixers

What sets regulated crypto mixers apart in 2024 is their commitment to transparency, security, and adaptability. Here are the features most cited by users and regulators alike:

Key Compliance Features in Regulated Crypto Mixers (2024)

-

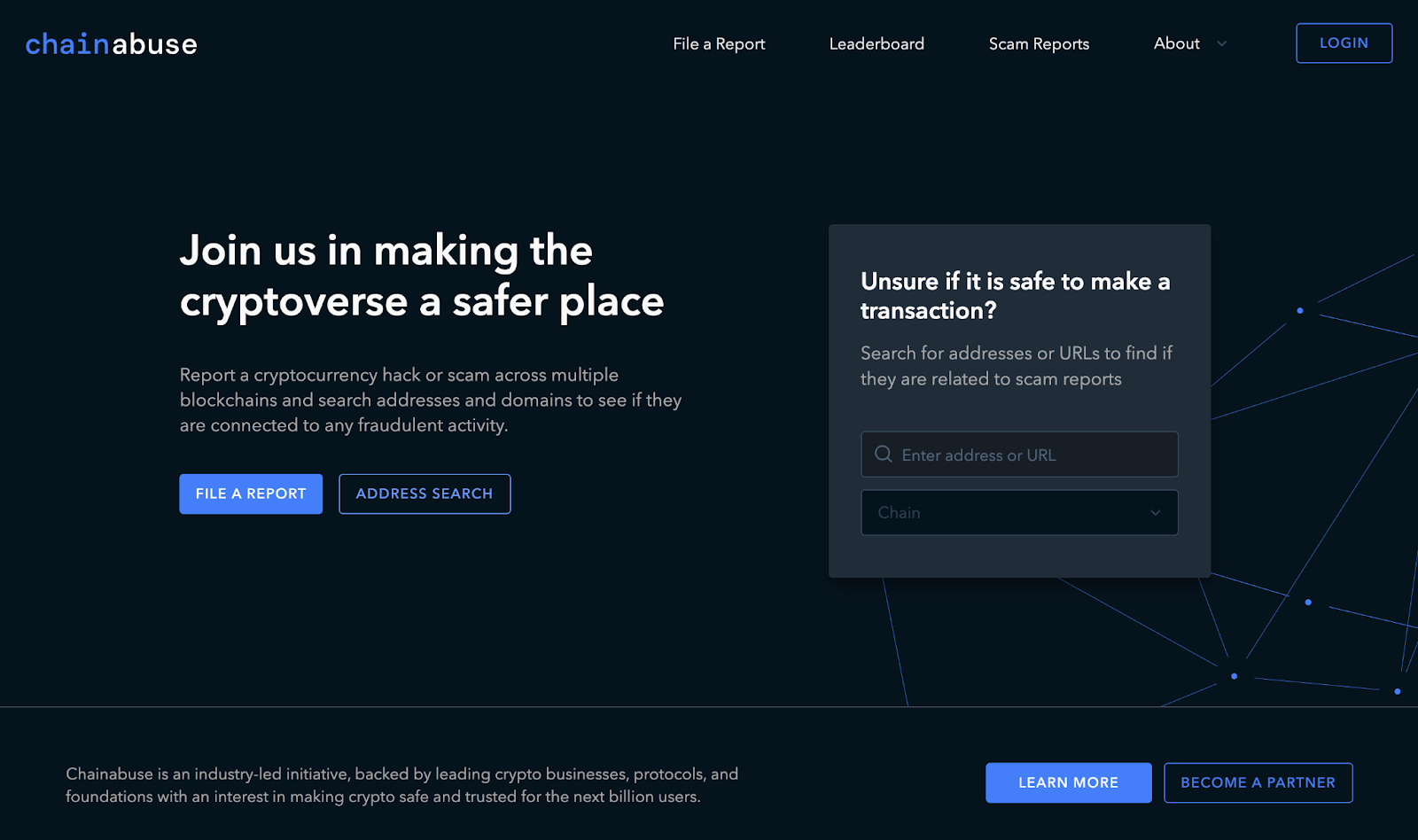

Integrated KYC/AML Protocols: Leading regulated mixers like zkMe and Chainalysis Reactor incorporate robust Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, verifying user identities and monitoring transactions to prevent illicit activity.

-

Zero-Knowledge Proofs (zkKYC): Platforms such as zkMe and the zkMixer framework leverage zero-knowledge proofs to allow users to prove compliance without exposing personal data, preserving privacy while meeting regulatory standards.

-

Selective De-anonymization Mechanisms: Solutions like the SeDe framework enable authorized parties to de-anonymize transactions in cases of suspected illicit activity, balancing user privacy with legal accountability.

-

Configurable Governance and Deposit Controls: Advanced mixers such as zkMixer offer customizable governance, deposit delays, and mechanisms to refund or confiscate suspicious funds, aligning operations with regulatory requirements.

-

Regulatory Reporting and Auditability: Compliance-focused services like Chainalysis Reactor provide transparent audit trails and real-time reporting features, enabling mixers to demonstrate ongoing adherence to evolving laws such as the US GENIUS Act and EU MiCA.

Automated reporting tools now enable seamless integration with financial institutions’ existing AML frameworks, while selective de-anonymization ensures only suspicious activity triggers investigation, reducing false positives and protecting innocent users.

The introduction of distributed accountability models (such as SeDe) means that no single entity holds unilateral power over user data or privacy decisions. This distributed approach builds trust among users who value both autonomy and legal certainty.

What This Means for Blockchain Privacy in 2024

The maturation of regulated crypto mixers signals a new era where legal crypto privacy is accessible without sacrificing security or regulatory alignment. For organizations managing sensitive transactions or individuals seeking financial discretion, these platforms offer a practical solution that meets global compliance standards.

The impact goes beyond technical innovation, it’s reshaping how policymakers view blockchain privacy tools. By proving that robust privacy can coexist with effective oversight, regulated mixers are reducing the stigma around confidential transactions while raising the bar for transparency among service providers.

The Road Ahead: Trends to Watch

- AI-driven compliance: Expect more mixers to integrate AI analytics for proactive risk detection without invasive surveillance.

- International harmonization: As US and EU rules converge, cross-border mixer platforms will streamline onboarding for global users.

- User-centric governance: Community-driven protocols will allow users to vote on key policy settings within mixing pools.

The bottom line: In 2024, regulated crypto mixers have proven that it’s possible to deliver meaningful blockchain privacy while staying on the right side of evolving laws. Forward-thinking platforms leveraging zero-knowledge proofs are setting a precedent others will follow, making private yet compliant transactions a reality for mainstream crypto adoption.