Crypto privacy has always been a double-edged sword. On one side, you have the promise of financial freedom and confidentiality. On the other, regulators worry about crypto mixers enabling bad actors to hide dirty money. In 2024, the landscape shifted dramatically as compliance-first crypto mixers emerged to bridge this gap, sparking a new era for blockchain privacy compliance.

Why Traditional Crypto Mixers Faced the Heat

The concept behind regulated crypto mixers is simple: blend transactions from multiple users so that no one can trace where funds came from or where they’re going. While this sounds great for privacy, it’s also what landed old-school mixers like Blender. io and Tornado Cash in regulatory crosshairs. The U. S. Treasury’s sanctions on these platforms in 2022 sent shockwaves through the industry, making it clear that unchecked anonymity would no longer fly (Cointelegraph).

In Europe, lawmakers have doubled down on scrutinizing privacy-enhancing technologies. Their focus: making sure crypto tools don’t become safe havens for illicit finance. The result? A chilling effect on traditional mixers and a call for solutions that respect both user privacy and legal obligations.

The Rise of Compliance-First Mixers: Privacy Meets Regulation

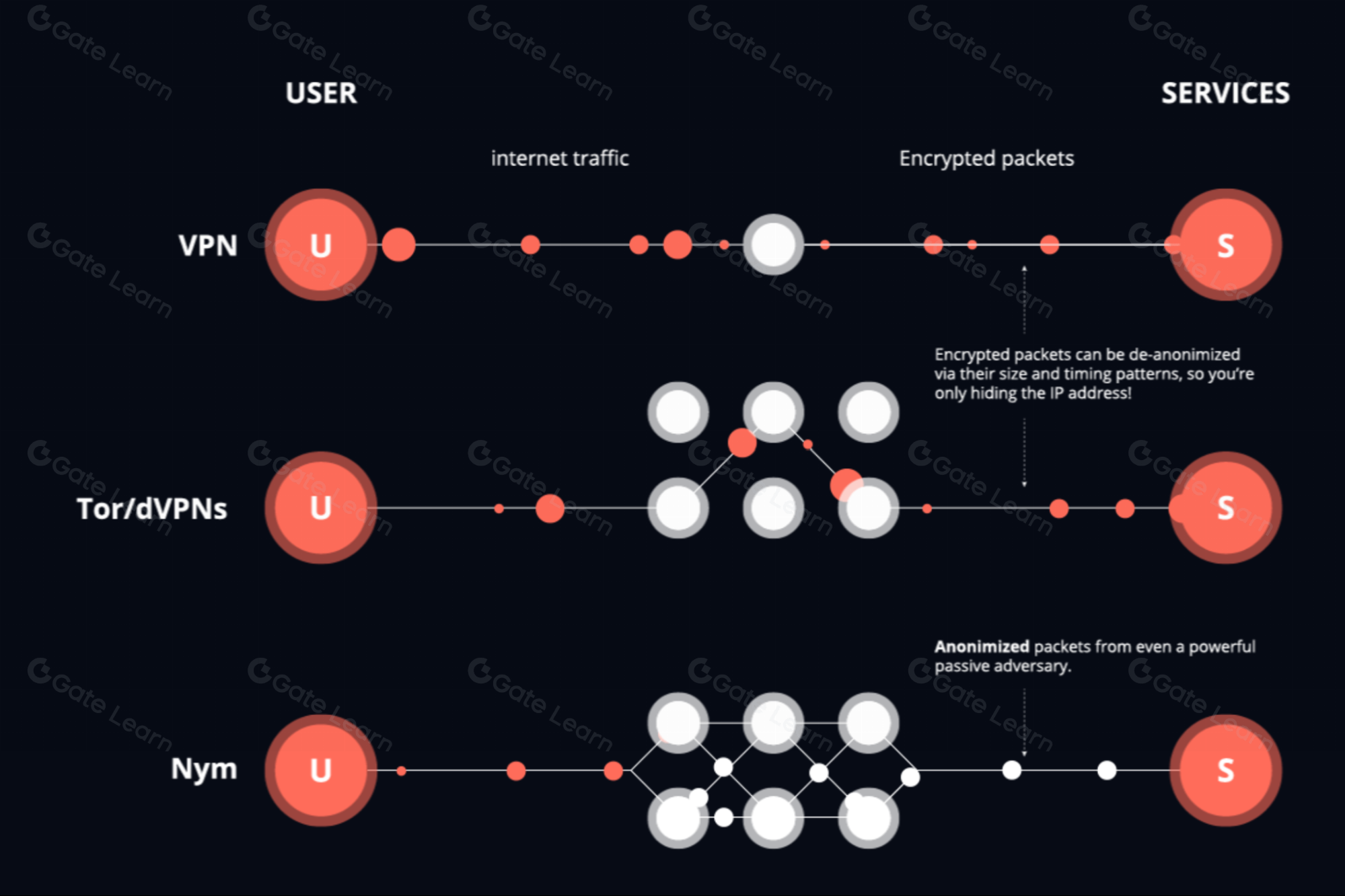

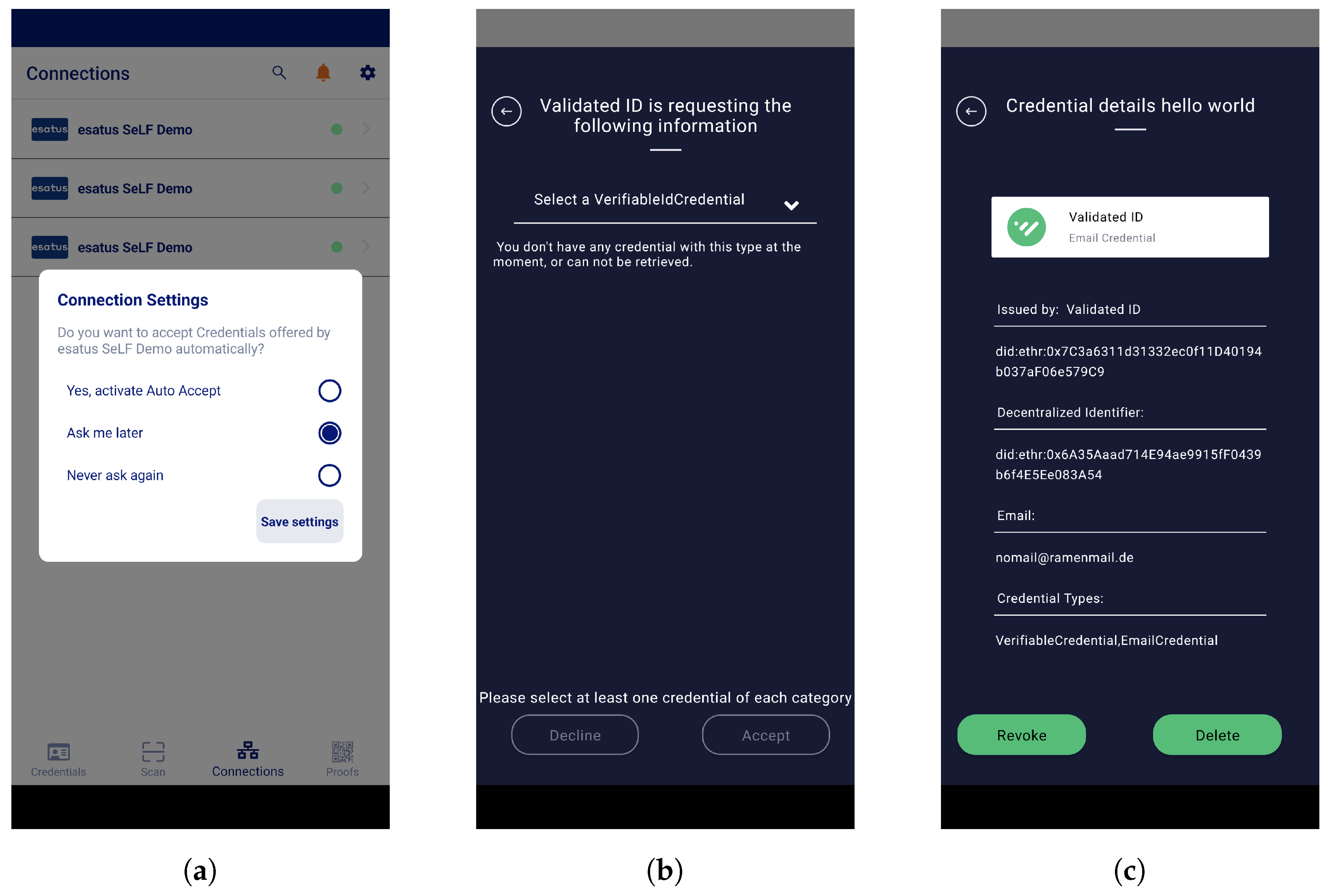

This regulatory squeeze paved the way for compliance-first mixers. These next-gen platforms are rewriting the rules by baking in features like Selective De-Anonymization (SeDe). What does that mean? In short, while your transactions remain private under normal circumstances, authorized parties can request transaction details if there’s a legitimate legal need (arxiv.org). It’s programmable privacy DeFi at its finest – giving users peace of mind without providing cover for crime.

Other innovations include tools like Tutela, which assess user privacy levels on Ethereum-based services and Tornado Cash (arxiv.org). These tools help both users and regulators understand how much anonymity is actually being achieved – a crucial step toward trust and transparency in an industry often accused of opacity.

Top Benefits of Compliance-First Crypto Mixers in 2024

-

Enhanced Privacy With Regulatory Alignment: Compliance-first mixers like Selective De-Anonymization (SeDe) protocols allow users to maintain transaction privacy while enabling lawful de-anonymization under specific, regulated conditions.

-

Reduced Risk of Regulatory Sanctions: By integrating compliance tools, these mixers help users and platforms avoid the fate of sanctioned services like Blender.io and Tornado Cash, fostering safer participation in the crypto ecosystem.

-

Increased Institutional Adoption: Compliance-first solutions address privacy and regulatory needs, making them more attractive to financial institutions and enterprises that require both confidentiality and legal assurance.

-

Improved Trust and Legitimacy: By aligning with evolving frameworks such as those proposed by the U.S. Treasury and the EU, these mixers help legitimize privacy-enhancing technologies in the eyes of regulators and the public.

-

Advanced Privacy Assessment Tools: Platforms like Tutela provide users with insights into their privacy status, enabling informed choices and proactive compliance.

The Regulatory Landscape: Crypto Mixer Regulation 2024

The U. S. , once notorious for its patchwork approach to digital asset oversight, introduced major new legislation in 2024 specifically targeting crypto mixer regulation. While there’s still no single unified law governing all things crypto as of 2025 (Thomson Reuters Legal Solutions), the writing is on the wall: compliance is no longer optional.

This “compliance as code” movement means regulated mixers now feature robust Know Your Customer (KYC) procedures, transaction monitoring, and even automated reporting when suspicious activity is detected. Japan has taken a similarly progressive stance, shaping its own frameworks based on early lessons learned from high-profile hacks and mixer abuse cases.

So, what does this mean for everyday users and institutions navigating the evolving world of blockchain privacy compliance? The stakes have never been higher. For users, compliance-first mixers offer a rare sweet spot: confidential transactions with the assurance that you’re not inadvertently breaking the law. For institutions and DeFi projects, integrating regulated crypto mixers is quickly becoming a non-negotiable step for onboarding new clients and maintaining banking relationships.

Programmable Privacy: The New Standard for DeFi

One of the most exciting trends is the rise of programmable privacy DeFi. Instead of one-size-fits-all anonymity, users can now customize their privacy settings based on their needs, and legal requirements. Selective disclosure features allow you to prove compliance without revealing your entire transaction history. This flexibility is winning over both privacy advocates and regulators.

Regulated mixers are also leveraging advanced analytics to provide real-time risk assessments. Platforms like Tutela can now quantify just how private your transactions really are, giving users insight into their own exposure while helping platforms demonstrate compliance to auditors or regulators. It’s a win-win for transparency and trust.

What Users Should Look For in 2024’s Regulated Mixers

If you’re considering using a mixer this year, here are some actionable criteria to keep top-of-mind:

Essential Features of Regulated Crypto Mixers

-

Selective De-Anonymization (SeDe): Look for mixers that support Selective De-Anonymization, enabling users or authorities to reveal transaction details under legally defined circumstances. This balances privacy with regulatory needs and is a key compliance feature in platforms like SeDe-enabled mixers.

-

KYC/AML Integration: Leading compliance-first mixers implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. These may include identity verification and ongoing transaction monitoring, as seen in services like Merkle Science analytics integrations.

-

Regulatory Reporting Tools: Modern mixers offer built-in reporting features to help users and businesses comply with regulations such as the Bank Secrecy Act (BSA) and FinCEN guidance. Look for platforms with transparent audit trails and easy access to compliance reports.

-

Privacy Assessment Solutions: Platforms like Tutela provide tools that assess and score the privacy of mixer services, helping users choose compliant options that still protect their anonymity.

-

Sanctions Screening: Top-tier mixers now integrate real-time sanctions screening to block transactions involving addresses flagged by the U.S. Treasury or other regulatory bodies, reducing the risk of inadvertently facilitating illicit activity.

- KYC and AML Integration: Ensure the platform verifies user identities and monitors transactions for suspicious activity.

- Selective De-Anonymization: Look for programmable privacy options that allow lawful unmasking if required.

- Transparent Auditing: Choose services that publish regular audit results or open-source their codebase.

- User-Controlled Privacy Settings: Opt for platforms where you can set your own privacy preferences.

- Global Regulatory Alignment: Make sure the mixer aligns with both local and international regulations, especially if you transact cross-border.

The Real-World Impact: Trust, Adoption, and Market Legitimacy

This new wave of compliance-first mixers is already having ripple effects across the industry. By addressing regulatory blind spots without sacrificing user autonomy, these platforms are restoring confidence in privacy tools on public blockchains. Institutions, once wary of touching anything labeled “mixer”: are now exploring partnerships with compliant providers. As a result, we’re witnessing broader adoption across both retail and enterprise segments.

The upshot? Blockchain privacy is no longer an all-or-nothing proposition. With programmable controls and transparent oversight baked into regulated mixers, users can enjoy robust confidentiality while staying firmly within legal bounds. As regulators continue to clarify expectations, expect these solutions to set the gold standard for blockchain privacy compliance.