As we enter the final quarter of 2025, the legal landscape for regulated cryptocurrency mixers in the United States is more complex and dynamic than ever. The intersection of privacy, compliance, and enforcement is shaping not only how mixers operate but also how users and institutions approach crypto mixer compliance in 2025. A series of regulatory pivots, high-profile legal rulings, and shifting enforcement priorities have created both new opportunities and new risks for those seeking privacy in digital asset transactions.

Key Regulatory Shifts: From Blanket Sanctions to Targeted Enforcement

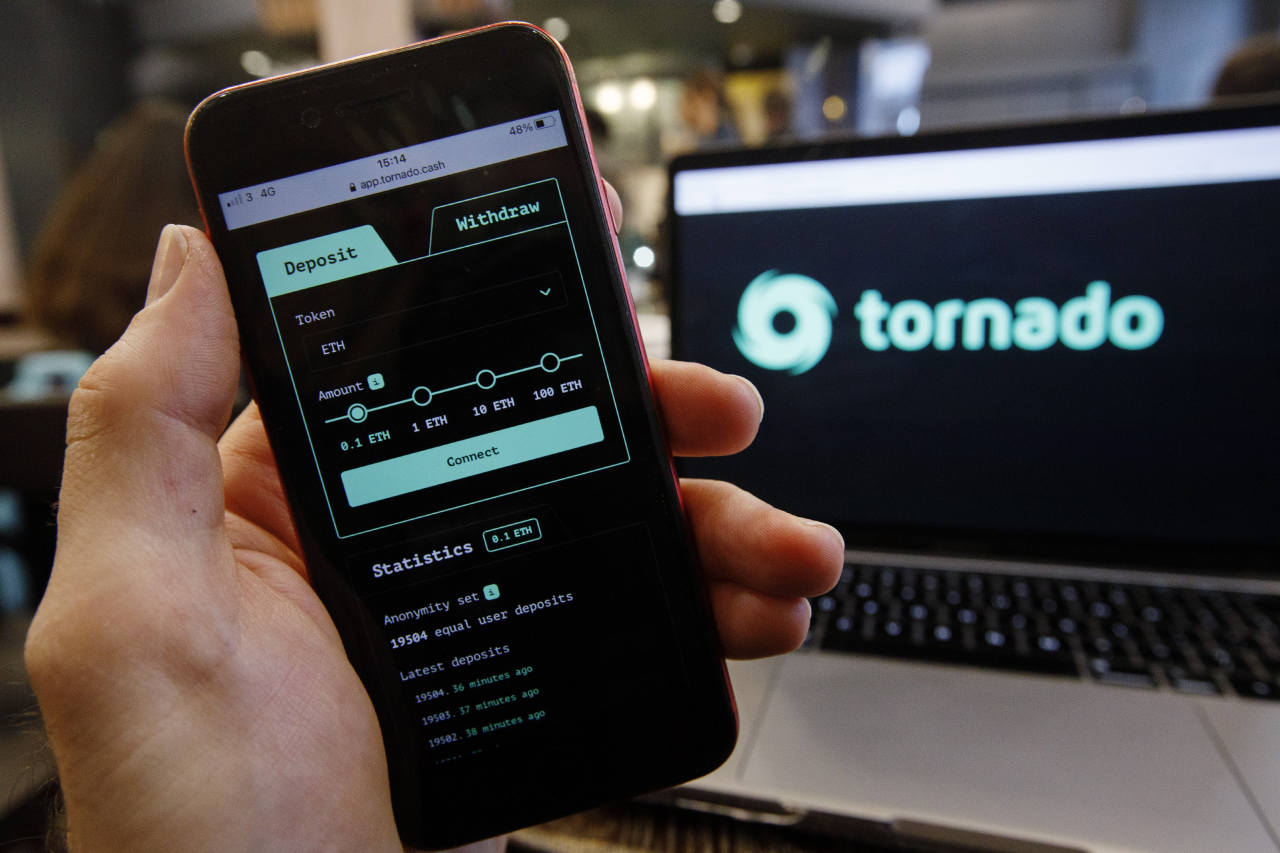

In a landmark decision in March 2025, the U. S. Treasury Department lifted sanctions on Tornado Cash, a move that sent shockwaves through the privacy and compliance sectors. This reversal followed a pivotal Fifth Circuit Court of Appeals ruling in late 2024, which found that the Treasury had overreached by sanctioning Tornado Cash’s immutable smart contracts, as these did not constitute “property” under existing law. This legal nuance is crucial: the technology itself is not inherently illegal, but its use for illicit purposes remains a core concern for regulators. (Reuters)

Yet, the regulatory pendulum has not swung entirely in favor of privacy advocates. In May 2024, the Blockchain Integrity Act was introduced in Congress, proposing a two-year ban on mixers and hefty civil penalties for financial institutions processing mixer-related transactions. As of October 2025, this bill remains unenacted, but its existence signals persistent legislative interest in tightening controls around legal crypto tumblers and their potential misuse. (Cointelegraph)

Compliance Risks and Institutional Caution

Despite the absence of a formal ban, compliance risks for crypto mixers have intensified. According to CoinLaw’s 2025 data, 69% of crypto exchanges fail to meet new compliance benchmarks set by global regulators. Heightened scrutiny from agencies like FinCEN and the CFTC means that even regulated mixers must implement robust anti-money laundering (AML) and know-your-customer (KYC) protocols to avoid enforcement actions. The focus has shifted from technology to intent: mixers that can demonstrate strong compliance programs and transparency are less likely to face blanket prohibitions but remain under watchful regulatory eyes.

Top Compliance Risks for Crypto Mixers in 2025

-

Anti-Money Laundering (AML) Violations: Crypto mixers face heightened scrutiny under evolving AML regulations, with global authorities prioritizing enforcement against services facilitating illicit transactions.

-

Uncertain Legal Status: The legal landscape remains complex, as seen with the Tornado Cash case and the pending Blockchain Integrity Act, creating ongoing uncertainty for operators and users.

-

Banking and Exchange Restrictions: Proposed legislation such as the Blockchain Integrity Act could prohibit financial institutions from processing mixer-related transactions, risking de-banking and delisting from major exchanges.

-

Regulatory Reporting Obligations: Mixers may be required to implement robust transaction monitoring and reporting systems to comply with new regulatory expectations, increasing operational complexity and costs.

-

Reputational Damage and Loss of Trust: Association with illicit activity or non-compliance can result in significant reputational harm, deterring legitimate users and partners from engaging with mixer platforms.

This evolving environment is also influencing Web3 founders and DeFi projects. TokenMinds notes that mixers pose risks beyond legal exposure: exchange listing delays, reputational harm, and fractured community trust are all on the table. The message is clear: crypto privacy compliance is now a business-critical issue for any project seeking mainstream adoption.

The DOJ’s Policy Pivot: Individuals Over Infrastructure

April 2025 saw another significant shift as the U. S. Department of Justice disbanded its National Cryptocurrency Enforcement Team. Instead of targeting mixer platforms indiscriminately, the DOJ is now prioritizing investigations into individuals and organizations using digital assets for criminal purposes such as terrorism financing and organized crime. This nuanced approach reflects a broader policy change under the Trump administration and aligns with emerging global standards that distinguish between lawful privacy tools and those used for illicit finance. (Reuters)

This policy realignment does not eliminate risk for users or operators of mixers but does offer a clearer path for compliant operations. Regulated cryptocurrency mixers that invest in advanced analytics, real-time monitoring, and transparent reporting are better positioned to withstand scrutiny from both regulators and banking partners. For users, this means that choosing a mixer with a documented track record of compliance is more important than ever.

Global Trends: MiCA and International Regulatory Momentum

The U. S. is not alone in its evolving stance on regulated mixers. Across the Atlantic, the EU’s Markets in Crypto-Assets (MiCA) framework is coming into force with explicit provisions around privacy tools and transaction tracing. Meanwhile, Asia-Pacific regulators are taking a risk-based approach that balances innovation with financial integrity. For global users and projects, staying ahead of these regional differences is essential to avoid cross-border legal pitfalls.

Comparing US, EU (MiCA), and Asia-Pacific Crypto Mixer Regulations

-

United States: In 2025, the US regulatory approach to cryptocurrency mixers is in flux. The U.S. Treasury Department lifted sanctions on Tornado Cash in March 2025 after a court ruling, but legislative efforts like the Blockchain Integrity Act (proposed but not enacted) aim to ban mixers for two years. Enforcement has shifted to targeting criminal use rather than the technology itself, reflecting a nuanced, case-by-case approach.

-

European Union (MiCA): Under the Markets in Crypto-Assets Regulation (MiCA), the EU imposes strict anti-money laundering (AML) requirements on crypto service providers. While MiCA does not explicitly ban mixers, it mandates robust customer due diligence and transaction monitoring, making it difficult for regulated entities to interact with anonymous mixer services. National authorities retain discretion to restrict or prohibit high-risk services.

-

Asia-Pacific: The Asia-Pacific region features a patchwork of regulatory responses. Singapore and Japan enforce stringent AML/CFT rules, effectively prohibiting licensed exchanges from engaging with mixers. Hong Kong and Australia focus on compliance, requiring exchanges to report suspicious transactions and implement KYC measures, but have not issued explicit bans on mixers. Enforcement varies widely across jurisdictions.

The maturation of the crypto sector is unmistakable: privacy and compliance are no longer mutually exclusive but deeply intertwined. For those navigating this new landscape, understanding both the letter and spirit of emerging regulations is key to sustainable participation in digital asset markets.

Looking ahead, the regulatory focus on crypto mixer compliance in 2025 is likely to intensify as both lawmakers and enforcement agencies adapt to the realities of decentralized finance. The trend is clear: while outright bans remain politically contentious and technologically challenging, a blend of targeted enforcement and strict compliance standards is becoming the global norm. This means that regulated cryptocurrency mixers must continuously evolve their risk management frameworks to align with shifting expectations from FinCEN, the CFTC, and their international counterparts.

One of the most significant developments is the emergence of sophisticated analytics and monitoring technologies. Modern mixers are increasingly integrating blockchain surveillance tools to flag suspicious transactions, automate AML checks, and generate audit trails. This technological pivot not only helps satisfy regulators but also reassures institutional partners wary of reputational or legal fallout. The days of “black box” privacy solutions are fading as transparency becomes a competitive differentiator.

Opportunities for Lawful Privacy and Innovation

Despite the regulatory squeeze, there is a clear path forward for innovators. Mixers that proactively build compliance into their core architecture, embedding KYC modules, real-time transaction screening, and robust reporting, are more likely to secure banking relationships and exchange listings. These features are rapidly becoming table stakes for any project seeking legitimacy in the eyes of regulators and the broader financial ecosystem.

For privacy-conscious users, the message is nuanced but optimistic. While anonymity in crypto transactions will always attract scrutiny, there is growing recognition that privacy itself is not a crime. The distinction lies in intent and execution: mixers that operate transparently, cooperate with authorities when required, and adhere to evolving AML standards are carving out a space for lawful privacy in digital finance.

Strategic Considerations for 2025 and Beyond

As we move further into 2025, both individuals and organizations must reassess their approach to crypto privacy. Here are key strategies for navigating the new landscape:

Best Practices for Crypto Mixer Compliance in 2025

-

Implement Robust KYC/AML Procedures — Use established compliance tools like Chainalysis or TRM Labs to screen users and monitor transactions for suspicious activity, aligning with evolving U.S. regulatory expectations.

-

Monitor Regulatory Developments — Regularly track updates from the U.S. Treasury Department, OCC, and Congress (e.g., the Blockchain Integrity Act) to ensure your operations remain legal as policies shift.

-

Document and Disclose Compliance Efforts — Maintain detailed records of compliance activities and be prepared to provide transparency to regulators, leveraging solutions from Elliptic or Solidus Labs.

-

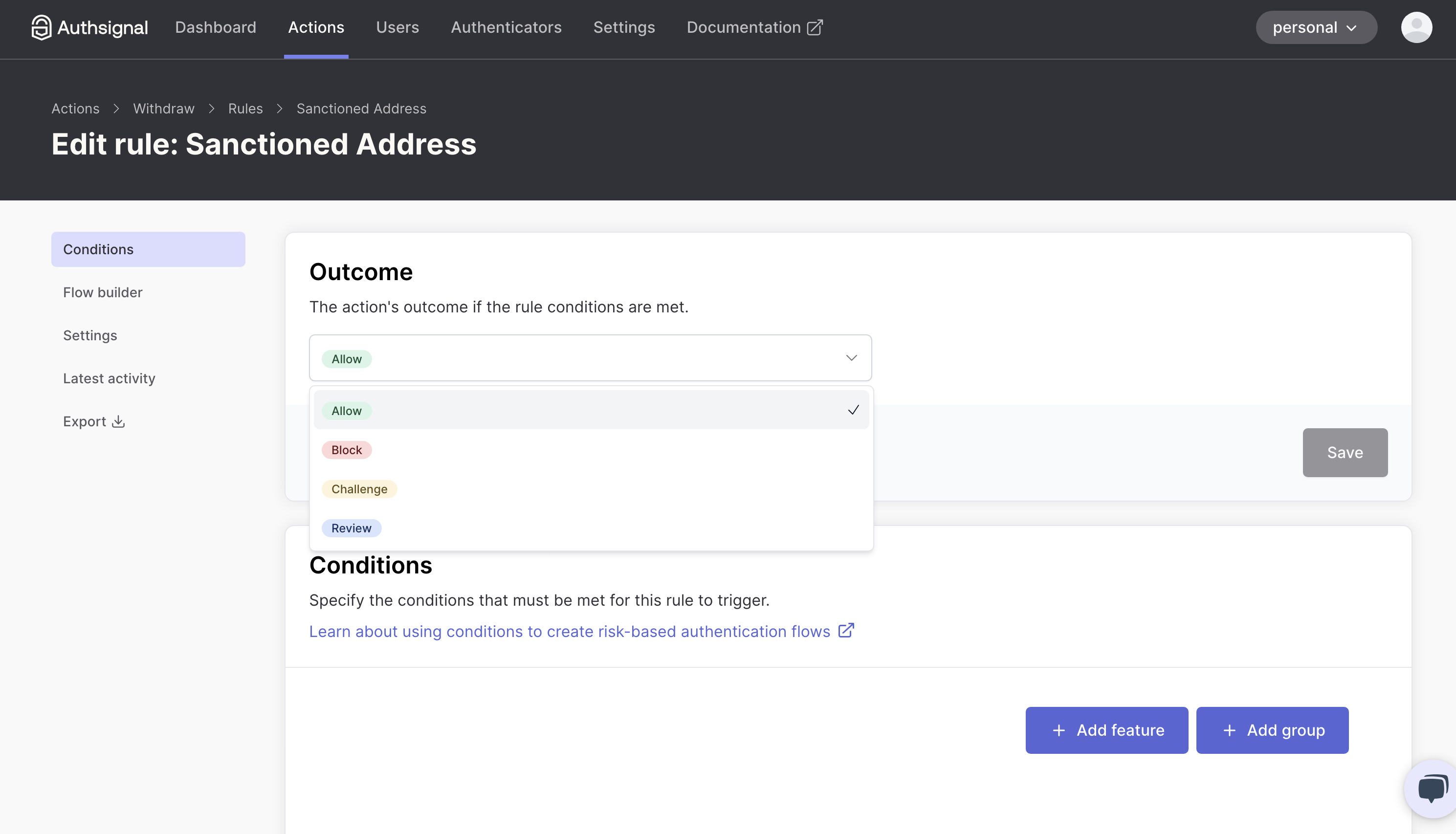

Restrict Access from Sanctioned Jurisdictions — Use geo-blocking and wallet screening tools to prevent users from OFAC-sanctioned countries or entities, even after the lifting of specific sanctions (e.g., Tornado Cash).

-

Engage Legal Counsel with Crypto Expertise — Consult firms like Latham & Watkins LLP or Perkins Coie to interpret complex, evolving regulations and minimize legal risk.

-

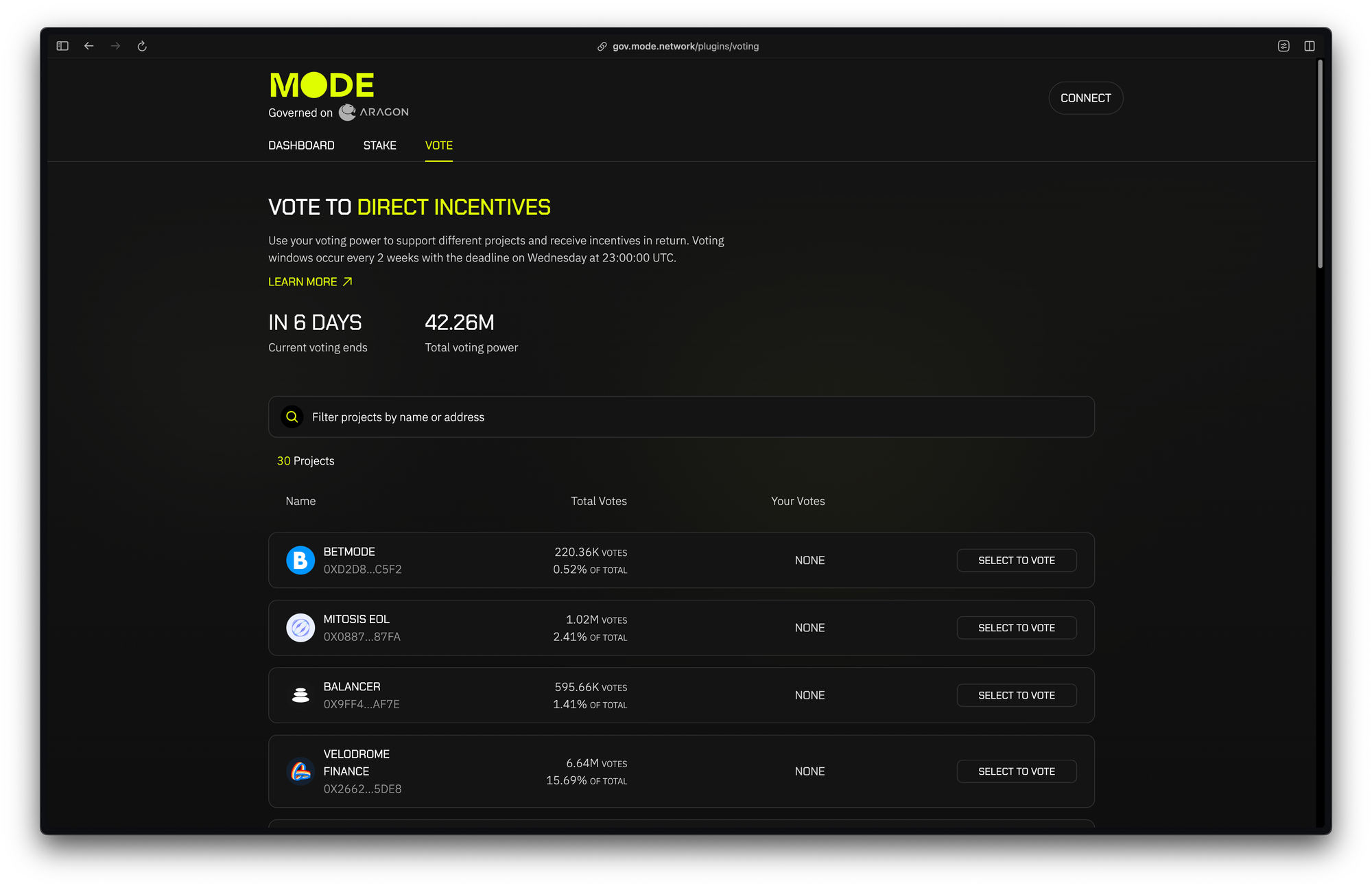

Adopt Transparent Governance Models — Consider implementing on-chain governance (e.g., via Aragon) to demonstrate accountability and community oversight, which can help mitigate regulatory scrutiny.

Continuous monitoring of regulatory developments, such as potential movement on the Blockchain Integrity Act or changes to FinCEN crypto mixer regulation, is essential. Staying agile enables projects to quickly adapt internal policies or technical infrastructure as new guidance emerges. For users, due diligence in selecting mixers with verifiable compliance credentials can mitigate legal exposure.

The current U. S. approach, eschewing blanket bans in favor of targeted enforcement, may serve as a blueprint for other jurisdictions seeking to balance innovation with financial integrity. However, the patchwork nature of global regulation means that cross-border activity remains fraught with risk, especially as MiCA crypto mixers face different obligations than those operating under U. S. or Asia-Pacific frameworks.

Ultimately, the crypto sector’s maturation hinges on its ability to harmonize privacy with compliance. Projects that succeed will not only survive regulatory scrutiny but also unlock new opportunities for trust, adoption, and growth in an increasingly regulated world.