As regulatory scrutiny intensifies, mixing Tether (USDT) for privacy is no longer a simple click-and-go affair. Today, users seeking multi-chain privacy solutions must navigate a complex landscape of compliance, technology, and evolving legal frameworks. In this guide, we break down how to use a regulated Tether mixer for lawful privacy, focusing on USDT’s unique position as a cross-chain stablecoin and the latest compliance developments.

![]()

Why USDT Mixing Demands Extra Vigilance

USDT’s omnipresence across ERC20, TRC20, and other chains makes it a favorite for both legitimate privacy seekers and bad actors. This duality has put Tether mixers under the microscope. According to recent reports, USDT mixers protect privacy in cross-chain transactions by pooling and redistributing funds, making it difficult to trace asset flows (hunbiusdt.com). However, regulators increasingly view these services as potential vehicles for illicit finance, especially when they operate without oversight or KYC protocols.

In the United States, for example, the Financial Crimes Enforcement Network (FinCEN) now classifies most mixers as money transmitters. This means any multi-chain USDT mixer must implement robust AML and KYC programs to stay on the right side of the law. The crackdown isn’t theoretical: the DOJ’s recent actions against privacy wallets and unregulated mixers underscore the risks of using non-compliant services (Elliptic).

How Do Regulated USDT Mixers Work?

The core principle behind a legal crypto mixer for USDT is simple: obfuscate transaction trails while adhering to regulatory requirements. A compliant mixer will:

Key Features of Regulated USDT Mixers

-

Mandatory KYC Verification: Regulated USDT mixers require users to complete Know Your Customer (KYC) checks, collecting identity documents and verifying user information before allowing access to mixing services. This ensures compliance with financial regulations and helps prevent illicit activity.

-

Comprehensive AML Compliance: These platforms implement robust Anti-Money Laundering (AML) procedures, including transaction monitoring, risk assessments, and reporting of suspicious activities to authorities. This aligns the service with international regulatory standards.

-

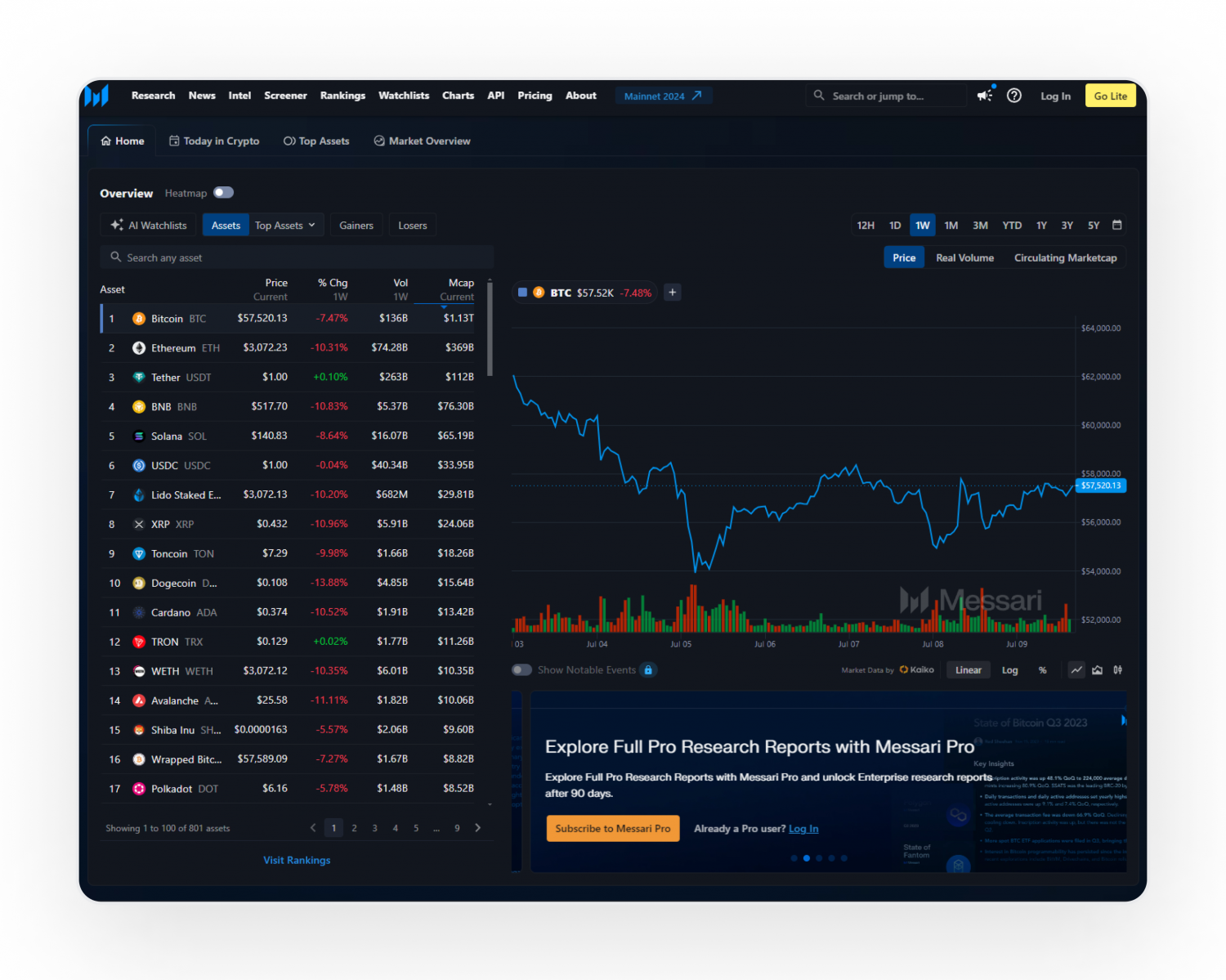

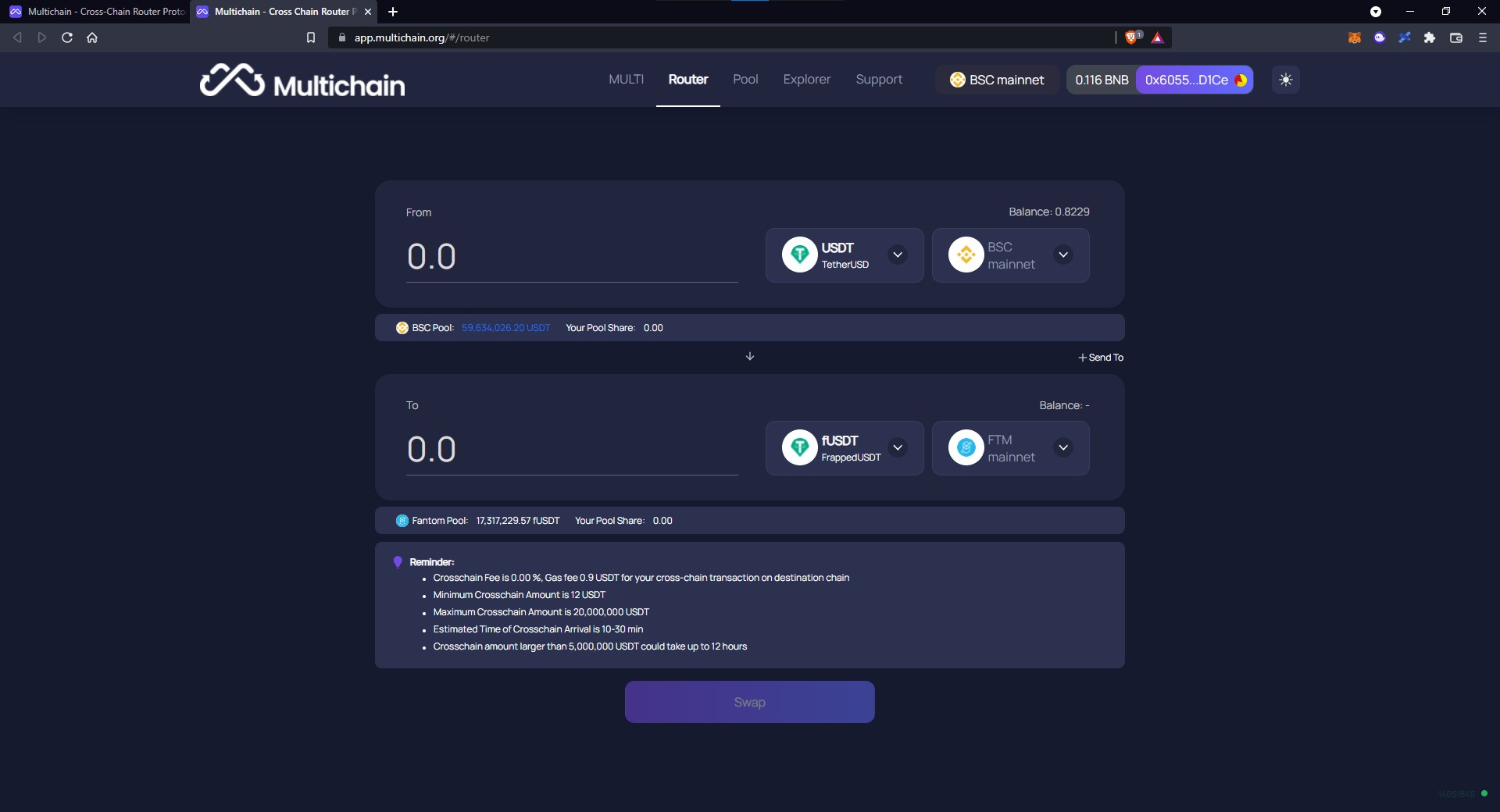

Multi-Chain Support: Leading regulated mixers facilitate USDT mixing across multiple blockchains, such as Ethereum, Tron, and Binance Smart Chain, enabling privacy for cross-chain transactions while maintaining compliance.

-

Transparent Legal Registration: Reputable mixers display clear information about their registration with financial authorities (such as FinCEN in the US or FCA in the UK), providing users with confidence in the platform’s legitimacy and regulatory adherence.

-

Detailed Privacy and Security Policies: Regulated mixers publish comprehensive privacy policies outlining data handling, retention, and user rights, ensuring transparency about how personal information is managed in accordance with legal requirements.

Unlike legacy mixers, which often operate in the shadows, regulated platforms are transparent about their compliance measures. They typically require users to verify their identity and may restrict service in sanctioned jurisdictions. While this adds friction, it also provides a legal shield for both users and operators.

Key Steps for Legal USDT Mixing

Before using any TRX USDT mixer or ERC20-based privacy tool, it’s critical to conduct due diligence. Here’s a practical roadmap:

Even with a compliant platform, users should keep records of transactions and be prepared to explain their activity if questioned by authorities. This is especially important for organizations or high-net-worth individuals subject to stricter reporting requirements.

The Compliance-Privacy Tradeoff: What Users Need to Know

Mixing USDT legally is a balancing act. On one hand, privacy is a fundamental right for many crypto users. On the other, regulators are clear: anonymity cannot come at the expense of anti-money laundering safeguards. The best regulated crypto privacy solutions are those that offer transparency, robust security, and clear communication about their legal status.

For users prioritizing privacy and compliance, sticking to platforms with clear registration, published policies, and multi-chain support is non-negotiable. As the regulatory environment evolves, expect new requirements for reporting, transaction monitoring, and cross-chain analytics, especially as USDT continues to dominate stablecoin flows across blockchains.

Choosing a compliant crypto mixing service is not just about ticking boxes, it’s about future-proofing your privacy strategy. With enforcement actions ramping up and blockchain analytics becoming more sophisticated, the days of “set-and-forget” privacy are over. Instead, users should adopt a proactive approach, treating privacy as a process rather than a one-off event.

Best Practices for Using Regulated Tether Mixers

To maximize both privacy and compliance when mixing USDT, consider these practical guidelines:

Always initiate transactions from wallets you control, avoid reusing addresses, and never attempt to circumvent KYC procedures. For multi-chain operations, such as moving USDT between TRC20 and ERC20, ensure the mixer supports cross-chain compliance checks. This reduces the risk of your funds being flagged or frozen by exchanges downstream.

The Multi-Chain Challenge: ERC20, TRC20, and Beyond

USDT’s flexibility is part of its appeal, but it also complicates compliance. Each blockchain, whether Ethereum (ERC20), Tron (TRC20), or others, has unique technical and regulatory nuances. A regulated Tether mixer must adapt its AML monitoring to each chain’s characteristics. For example, TRC20 mixers may process higher volumes due to lower fees, but this can attract more scrutiny from authorities tracking large flows.

If you are using a mixer that claims support for multiple chains, verify that their compliance protocols extend across all supported networks. Some platforms only apply rigorous checks to ERC20 flows, leaving TRC20 or other chains exposed to regulatory gaps.

Staying Ahead: Regulatory Trends and User Responsibilities

The global trend is unmistakable: regulators are closing loopholes and pushing for greater transparency in crypto privacy tools. Sanctions on non-compliant mixers, such as those seen in the Tornado Cash case, set clear precedents. Users who ignore these signals risk not just loss of funds but also potential legal exposure.

It’s vital to keep up with the latest guidance from authorities like FinCEN, FATF, and local regulators. Many compliant mixers now provide transparency reports and open-source their compliance logic, look for these disclosures before committing funds.

For those who require institutional-grade privacy or handle significant volumes, consider working with legal counsel or specialist compliance advisors. They can help design workflows that both protect privacy and withstand regulatory audits.

Final Thoughts: Privacy Without Compromise

The future of USDT mixing is not about evading oversight but about integrating privacy with legal certainty. As the landscape matures, users who embrace regulated solutions will find themselves better positioned, both technically and legally, to transact with confidence.

Ultimately, the safest path is to choose mixers that are proactive about compliance, transparent in their policies, and committed to supporting multi-chain privacy without cutting corners. By following these principles, users can enjoy the benefits of Tether’s versatility while minimizing regulatory risk.