Privacy and compliance are often at odds in the crypto world, but regulated USDT mixers are bridging that gap for Tether transactions. With USDT (Tether) sitting at $1.00 and a market cap of $192,755,307.45 as of October 23,2025, demand for secure, private, and legal stablecoin transfers is at an all-time high. The explosion of multi-chain USDT support – from Ethereum (ERC-20) and Tron (TRC-20) to Arbitrum, Avalanche, and Solana – has only amplified the need for privacy tools that don’t cross legal lines.

What Sets a Regulated USDT Mixer Apart?

Most crypto mixers focus on privacy, but regulated USDT mixers add a critical layer: compliance with AML and KYC frameworks. These platforms are engineered to anonymize transactions while adhering to local and global regulations. That means users can break the on-chain link between deposit and withdrawal addresses, but without risking legal fallout.

Key features of compliant Tether mixing services include:

Key Features of Regulated USDT Mixers

-

Compliance with AML/KYC Regulations: Regulated USDT mixers conduct Anti-Money Laundering (AML) and Know Your Customer (KYC) checks, verifying user identities to prevent illicit activity and ensure legal compliance.

-

Transparent Auditing and Reporting: These services undergo regular third-party audits and provide transparent transaction records, giving users and regulators confidence in their operations.

-

Licensing and Regulatory Oversight: Regulated mixers operate under government-issued licenses and are monitored by financial authorities, distinguishing them from unregulated mixers that lack oversight.

-

Enhanced User Protection: With clear terms of service and dispute resolution mechanisms, regulated mixers prioritize user security and recourse in case of issues.

-

Integration with Major Blockchains: Regulated mixers support cross-chain USDT mixing across networks like Ethereum, Tron, Binance Smart Chain, Arbitrum, and Avalanche, ensuring legal privacy solutions for multi-chain users.

This approach is especially valuable for organizations and high-net-worth individuals who need to maintain confidentiality without triggering compliance red flags. For example, law firms, OTC desks, and DAOs can use these tools to shield treasury movements or client payouts without violating regulatory standards.

How Regulated Mixers Work Across Multiple Blockchains

Modern regulated USDT mixers are not limited to a single chain. They support cross-chain privacy for Tether on networks like Ethereum, Tron, Binance Smart Chain, Polygon, Solana, Toncoin, Arbitrum, and Avalanche. The process is straightforward but effective:

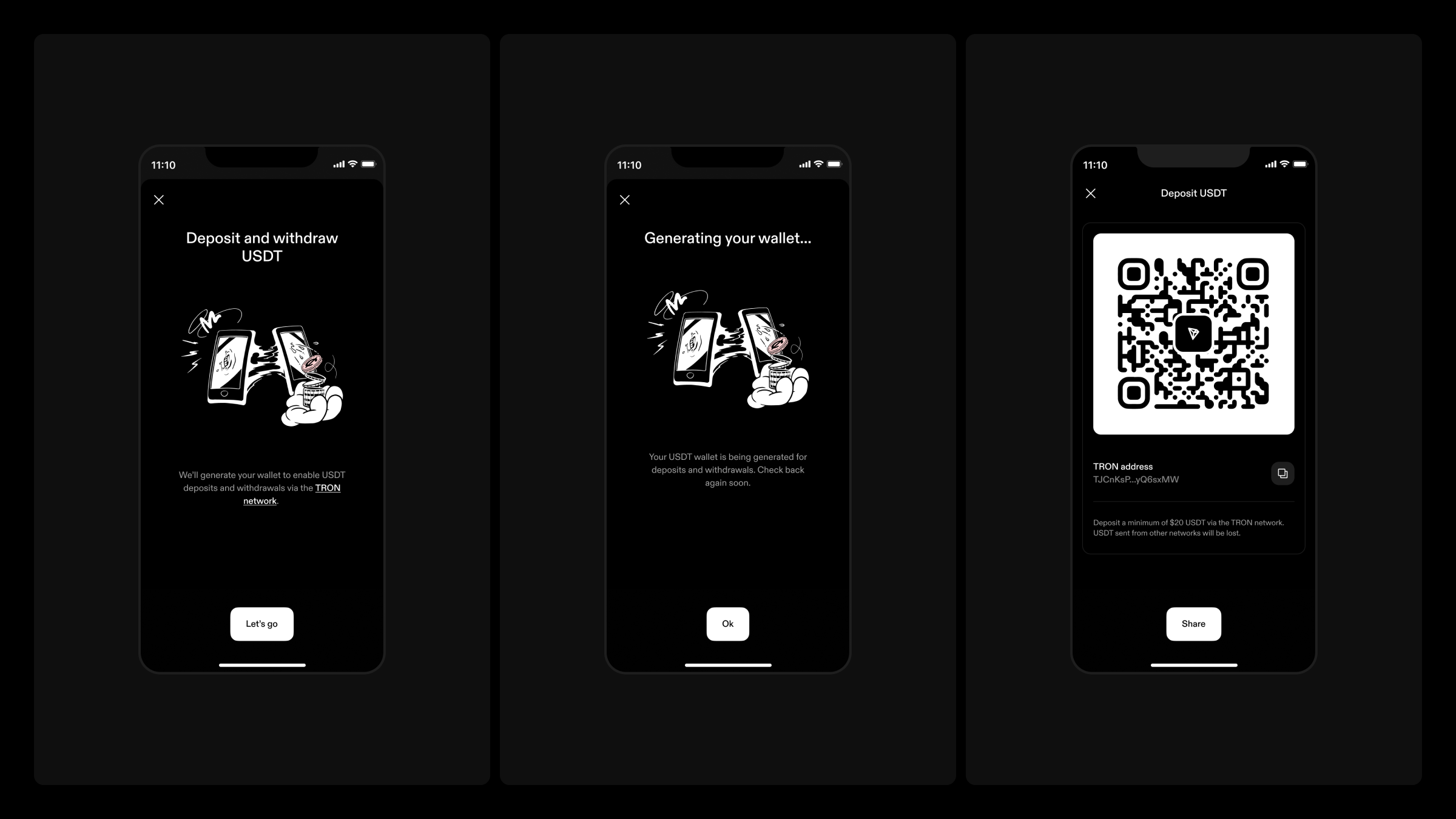

- Deposit: The user sends USDT to a unique address generated by the mixer on their chosen network (e. g. , Arbitrum or Avalanche).

- Mixing: The mixer pools user funds, shuffles them using advanced algorithms, and severs the transaction trail.

- Withdrawal: After an optional delay (for extra obfuscation), the mixed USDT is sent to the user’s specified address on any supported chain.

This multi-chain capability is crucial as users increasingly bridge assets between networks. Services like Defiway and Celer cBridge facilitate fast, low-cost USDT transfers from Arbitrum to Avalanche and beyond. A regulated mixer fits into this workflow, letting users anonymize funds before or after bridging – all while staying compliant.

Why Privacy Still Matters for Legal Crypto Users

There’s a misconception that only illicit actors seek transactional privacy. In reality, legitimate users have valid reasons to keep their financial activity confidential. Consider the following scenarios:

- Protecting business strategy from competitors

- Safeguarding personal wealth from targeted attacks

- Maintaining client confidentiality in professional services

Regulated USDT mixers enable these outcomes by providing robust privacy controls without bypassing AML or KYC requirements where mandated. Many platforms offer features like customizable time delays, non-custodial operation, and support for multiple address formats (ERC-20, TRC-20, BEP-20, etc. ).

The bottom line: privacy is a right, not a red flag – provided it’s executed within a legal framework. For more details on compliant Tether mixing strategies and legal considerations, check out this in-depth guide.

As Tether (USDT) continues to anchor itself as the stablecoin of choice across both centralized and decentralized exchanges, regulated USDT mixers are evolving to keep pace with the rapidly changing compliance landscape. With the SEC’s recent moves to streamline crypto ETF approvals and exchanges like Binance integrating USDT on Arbitrum and Optimism, the regulatory bar for privacy tools has never been higher. If you’re moving USDT between networks, especially with the current price locked at $1.00 and a robust on-chain market cap of $192,755,307.45, cutting corners on compliance is no longer an option.

Tactical Tips for Using a Compliant USDT Privacy Mixer

For users and organizations determined to maintain both privacy and legality, there are several tactical steps to maximize the benefits of a regulated USDT mixer:

Checklist for Safe, Legal Use of Regulated USDT Mixers

-

Verify the Mixer’s Regulatory Status: Choose a regulated USDT mixer such as Stablecoin Mixer or USDT Mixer. Confirm they operate within legal frameworks and display clear compliance information.

-

Check Supported Blockchains: Ensure the mixer supports the blockchain network you use (e.g., Ethereum (ERC-20), Tron (TRC-20), Binance Smart Chain (BEP-20), Solana, Polygon, Arbitrum, Avalanche).

-

Review Privacy Features: Look for mixers offering no KYC requirements, customizable time delays, and non-custodial operations to maximize privacy and reduce risk.

-

Comply with Local Laws: Research and follow local regulations regarding privacy coins and mixing services. Some jurisdictions restrict or prohibit mixer use.

-

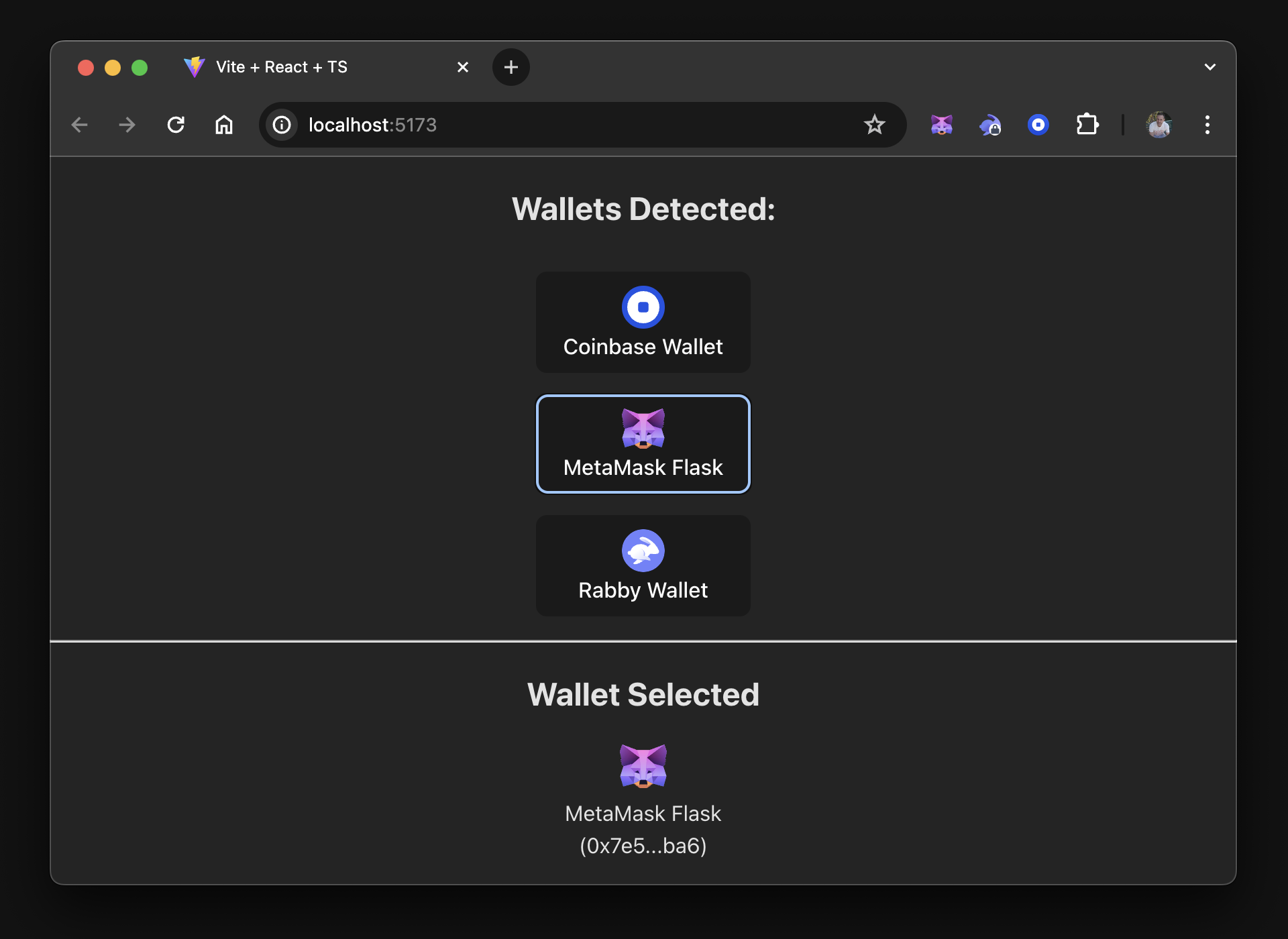

Use Secure Wallets: Only interact with mixers from trusted, non-custodial wallets that support your chosen blockchain (e.g., MetaMask, Trust Wallet).

-

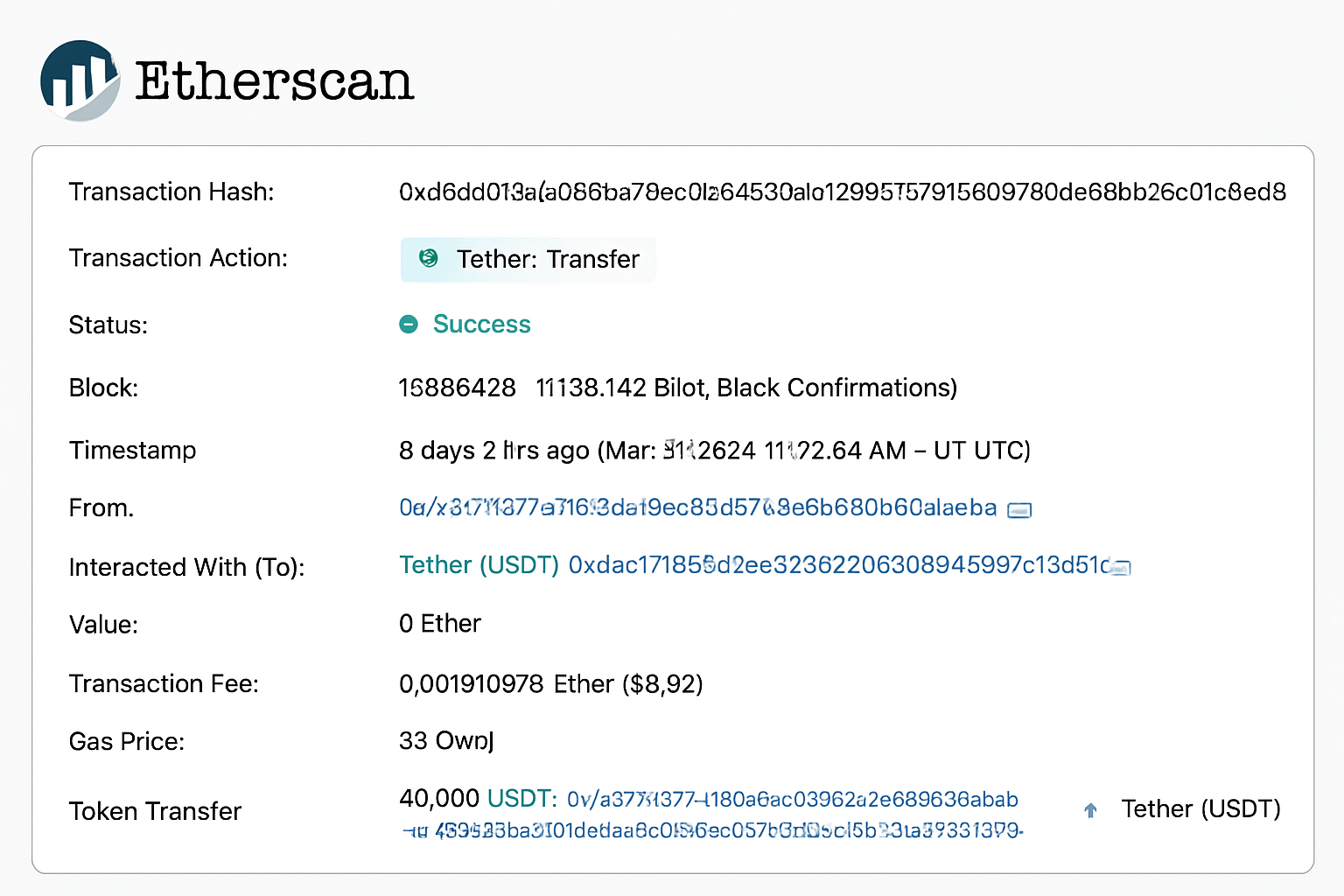

Double-Check Addresses and Amounts: Carefully verify the deposit and withdrawal addresses and the exact USDT amount before confirming any transaction. USDT price as of Oct-23-2025: $1.00.

-

Monitor Transaction Status: Track your transaction on a blockchain explorer (e.g., Optimistic Etherscan for Arbitrum/Optimism) to confirm completion.

-

Keep Records for Compliance: Save transaction IDs, receipts, and mixer confirmations in case you need to demonstrate legal compliance or source of funds.

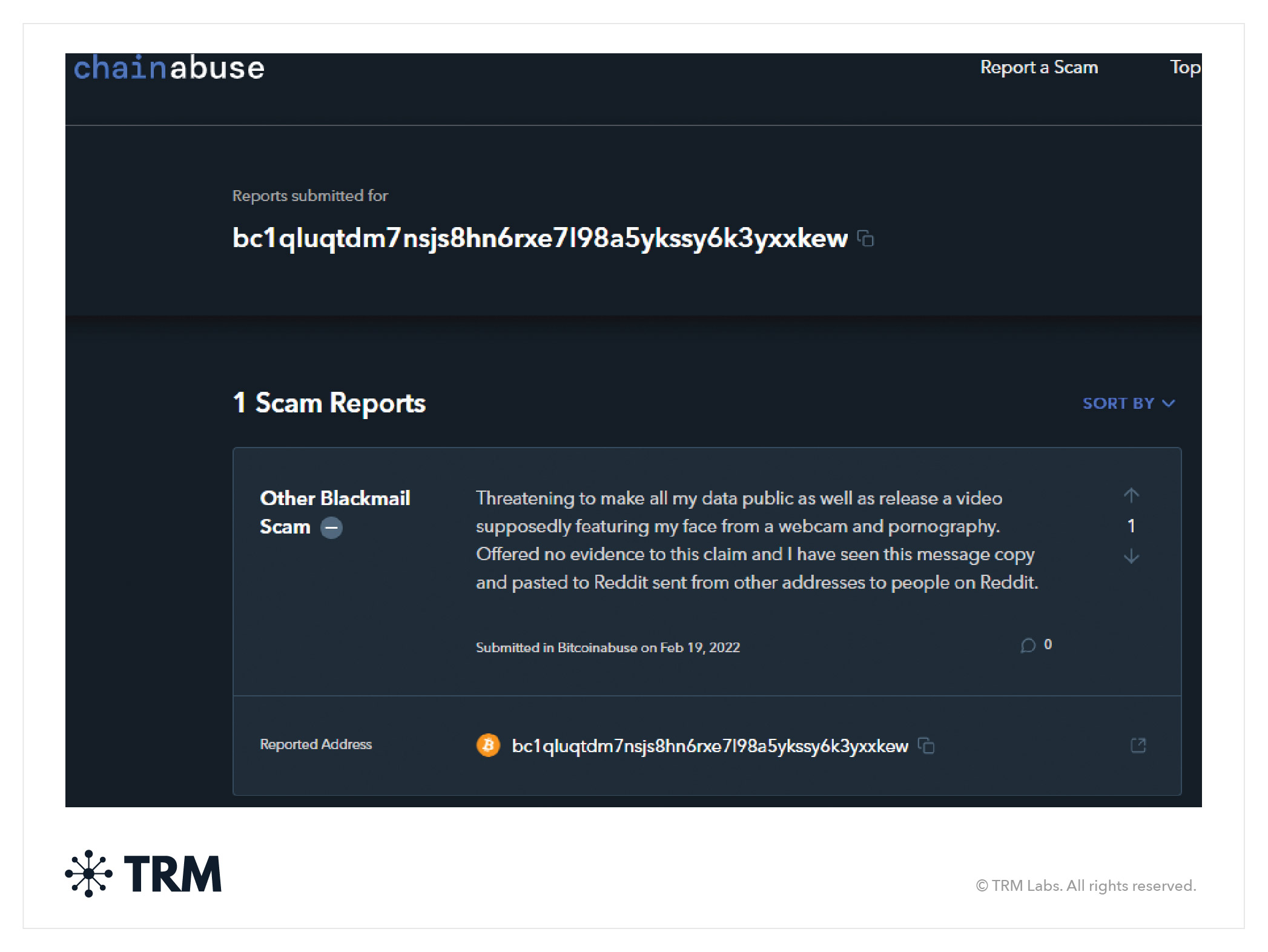

Choosing the right service is essential. Look for mixers that publish transparency reports, offer audit trails when required by law, and provide clear documentation on how they comply with AML and KYC mandates. Avoid platforms that promise absolute anonymity but can’t articulate their regulatory posture, those are red flags in today’s environment.

Current Trends: Multi-Chain Support and Market Demand

Demand for compliant Tether mixing is surging as users increasingly bridge USDT between networks like Arbitrum, Avalanche, and Polygon. Tools such as Defiway and Celer cBridge make it seamless to move USDT across chains, but privacy gaps can emerge if transactions are not properly obfuscated. A regulated USDT mixer that supports all major blockchains fills this gap, letting users anonymize transfers regardless of the network.

With over 1,183,738 USDT holders on the Optimistic Etherscan as of October 23,2025, the appetite for privacy isn’t going away. Instead, it’s evolving to meet new compliance standards, especially as institutions and high-net-worth actors enter the space. The right mixer will offer multi-chain compatibility, transparent compliance measures, and granular privacy controls, without sacrificing speed or cost-efficiency.

Frequently Asked Questions: Regulated USDT Mixers

Ultimately, the intersection of privacy and regulation is where the future of crypto is headed. Regulated USDT mixers are proof that you don’t have to choose between confidentiality and compliance. By leveraging these tools, both individuals and organizations can move Tether securely across any supported blockchain, without leaving themselves exposed to legal or reputational risk.

Ready to take your privacy and compliance game to the next level? Dive deeper with our tactical guide: How to Mix USDT Legally: Guide to Regulated Tether Mixers for Multi-Chain Privacy.