With Bitcoin trading at a robust $112,512 as of October 29,2025, privacy-conscious users are more motivated than ever to protect their digital assets. But in a landscape where regulators are doubling down on compliance, choosing a compliant cryptocurrency mixer is not just about obscuring your transaction trail, it’s about doing it legally and securely. Let’s break down the tactical must-haves for picking a regulated Bitcoin mixer that delivers both privacy and peace of mind.

Regulatory Compliance and Licensing: The Non-Negotiable Foundation

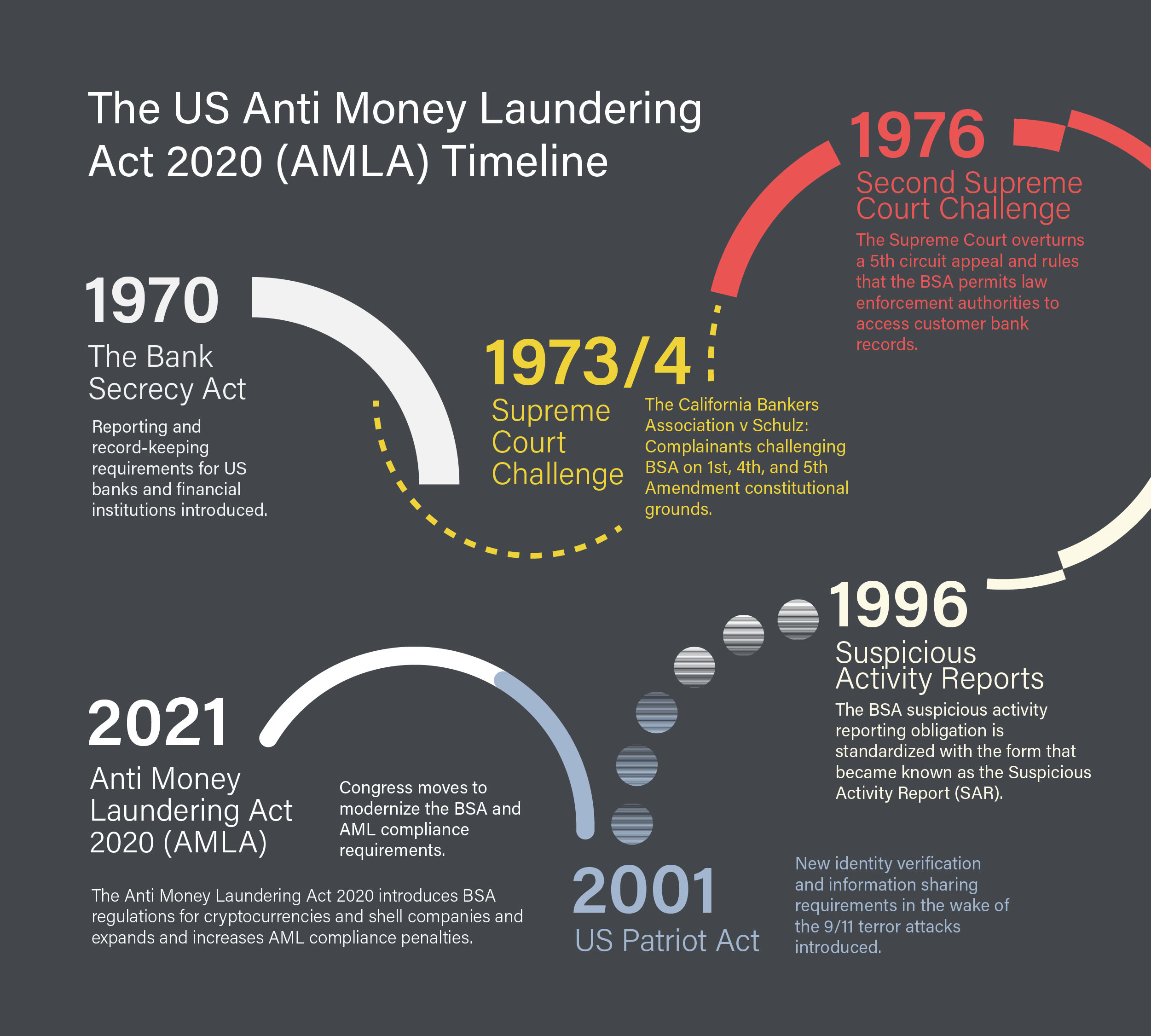

First up: regulatory compliance and licensing. If your chosen mixer isn’t registered with authorities like FinCEN (US) or the FCA (UK), you’re rolling the dice with your funds, and potentially with the law. Top-tier mixers enforce AML (Anti-Money Laundering) and KYC (Know Your Customer) protocols, verifying user identities while monitoring for suspicious activity. This isn’t just box-ticking; it’s what separates legitimate privacy from criminal obfuscation. Always check for visible proof of registration and clear compliance statements before you trust a platform.

Transparent Privacy Policies: Know How Your Data Is Handled

You want anonymity, but you also want to know how your data is managed behind the scenes. That’s where transparent privacy policies come in. A trusted crypto mixer should clearly outline its data collection, retention, and deletion practices. Look for services that commit to no-log operations but still operate within regulatory frameworks. If these details are buried or missing altogether, consider it a red flag. Transparency here means you can enjoy privacy without stepping outside legal boundaries.

Tactical Tip: Mixers that openly publish their compliance audits and data handling policies signal both confidence and credibility, don’t settle for less.

Security Protocols and Audits: Fortify Your Transactions

No matter how slick the interface or bold the privacy claims, if security protocols are lax, your coins, and your identity, are at risk. The best regulated bitcoin mixers deploy end-to-end encryption, use multi-signature wallets, and undergo regular third-party security audits to identify vulnerabilities before bad actors do. Don’t just take their word for it; look for published audit reports or third-party certifications as part of your due diligence.

- End-to-End Encryption: Ensures only you and the recipient can decipher transaction details.

- Multi-Signature Wallets: Require multiple approvals before funds move, thwarting single-point failures.

- Regular Security Audits: Prove ongoing commitment to safeguarding user funds against evolving threats.

If any of these pillars are missing from a service’s feature set or documentation, keep searching, your financial safety net depends on it.

Reputation and Track Record: Trust Is Earned, Not Claimed

When it comes to trusted crypto mixers, reputation is everything. The market is littered with platforms that promise privacy but have a checkered history or, worse, ties to illicit activity. Do your homework: scour user reviews, look for independent ratings, and dig into the mixer’s operational history. Has the service ever been flagged by regulators? Are there public records of law enforcement actions? A regulated bitcoin mixer with a clean record and years of reliable operation is a strong indicator you’re dealing with professionals who prioritize both compliance and user trust.

Pro Tip: Don’t just trust marketing claims, verify them by searching for the platform’s name alongside terms like “audit, ” “regulator warning, ” or “security breach. ”

Transaction Limits and Reporting Thresholds: Staying Within Legal Boundaries

Even the most privacy-forward platforms must operate within legal guardrails. That’s why compliant mixers enforce transaction limits and reporting thresholds. These caps aren’t arbitrary, they’re set to ensure the service does not inadvertently facilitate large-scale laundering or fall afoul of regulatory scrutiny. Confirm that your chosen platform sets clear maximums per transaction and outlines what triggers reporting obligations. This way, you can structure your secure bitcoin transactions to maximize privacy while steering clear of regulatory trouble.

- Transaction Caps: Prevent misuse by limiting how much can be mixed at once.

- Reporting Mechanisms: Ensure suspicious activity is flagged in line with AML requirements, protecting both you and the platform from legal fallout.

If a mixer boasts “no limits” or refuses to discuss reporting practices, consider it a major warning sign, compliance is not optional in today’s climate.

Your Tactical Playbook: Choosing a Regulated Bitcoin Mixer in 2025

The market for compliant cryptocurrency mixers is evolving as fast as Bitcoin’s price action, currently holding strong at $112,512. To recap, here are the tactical essentials you need on your radar:

- Regulatory Compliance and Licensing: Only use platforms registered with authorities like FinCEN or FCA that enforce AML/KYC.

- Transparent Privacy Policies: Demand clarity on how your data is handled from start to finish.

- Security Protocols and Audits: Insist on end-to-end encryption, multi-signature wallets, and third-party audits.

- Reputation and Track Record: Trust only those with proven compliance histories and positive community feedback.

- Transaction Limits and Reporting Thresholds: Make sure caps are in place to keep both you and the platform within regulatory lines.

No one should have to sacrifice privacy for compliance, or vice versa. By focusing on these five pillars, you’ll find a regulated bitcoin mixer that delivers robust privacy without putting your assets or freedom at risk. For more tactical guides on navigating this space legally and securely, explore our step-by-step breakdowns at How to Choose a Compliant Cryptocurrency Mixer for Secure and Legal Transactions.