In early 2026, the cryptocurrency privacy landscape stands at a pivotal crossroads. Services once heralded for unbreakable anonymity, like Helix and Tornado Cash, now symbolize the perils of operating outside regulatory bounds. Meanwhile, regulated crypto mixers have risen as sophisticated alternatives, blending user privacy with ironclad compliance. This guide dissects the chasm between sanctioned relics and lawful innovators, equipping you with strategic insights for navigating legal crypto privacy 2026.

The Downfall of Unregulated Mixers: Lessons from Helix and Tornado Cash

Helix, a Bitcoin mixer tied to darknet markets, met its end in a dramatic U. S. DOJ seizure of $400 million in assets. This action, part of a broader crackdown, exposed how non-compliant tools fuel illicit flows, prompting exchanges to freeze tainted funds. Tornado Cash faced even fiercer scrutiny: OFAC sanctions in 2022 targeted its smart contracts, freezing billions in Ethereum-linked addresses. Developers landed in legal crosshairs, underscoring the risks of decentralized anonymity without oversight.

Key Events in Crypto Mixer Regulation

| Year | Event |

|---|---|

| 2022 | Tornado Cash sanctions 🚫 |

| 2023 | Helix $400M seizure 💰 |

| 2024 | Fifth Circuit overturns OFAC ⚖️ |

| 2024 | Blockchain Integrity Act proposed 📜 |

| 2025 | Treasury delists Tornado Cash ✅ |

These cases weren’t isolated. Enhanced chain analysis from firms like Chainalysis and Elliptic revealed mixers’ role in laundering, accelerating regulatory momentum. Yet, the Helix mixer seizure and Tornado fallout birthed a silver lining: heightened demand for Tornado Cash alternatives that don’t court disaster.

Court Rulings Reshape the Battlefield

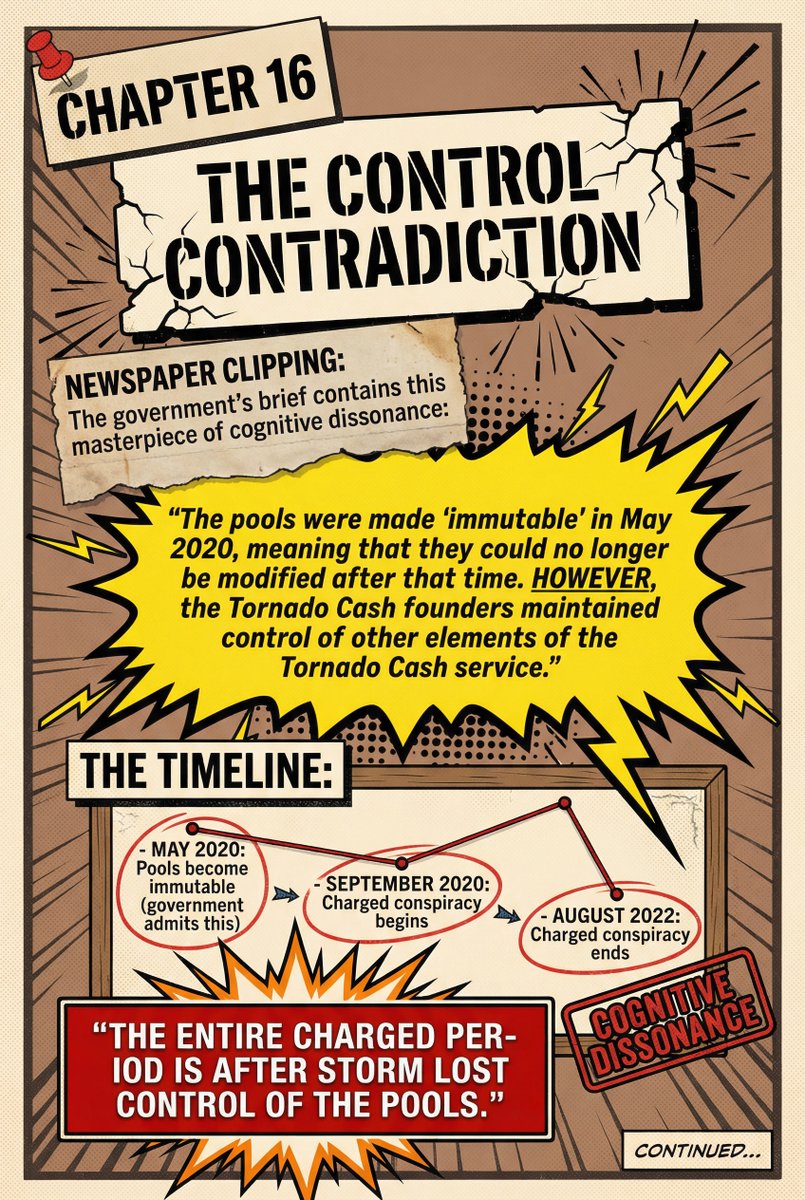

The Fifth Circuit’s 2024 bombshell ruling marked a seismic shift. Declaring Tornado Cash’s immutable smart contracts outside OFAC’s ‘property’ definition under IEEPA, the court curbed Treasury overreach. By March 2025, sanctions lifted, though with stern warnings on illicit monitoring. This judicial pivot didn’t greenlight chaos; it spotlighted the need for compliant innovation.

Legislators responded swiftly. The Blockchain Integrity Act, floated by House Democrats in 2024, eyed a two-year mixer ban for financial institutions, buying time for studies on privacy versus crime. Globally, MiCA in the EU and CFTC pilots signal convergence: CFTC regulated mixer frameworks and MiCA-compliant platforms may soon interoperate, even eyeing U. S. access. As one analyst notes, traceability rivals bank wires now, rendering pure anonymity obsolete.

These developments force a reckoning. Unregulated mixers like Cyclone on IoTeX or BSC persist underground, echoing Reddit raves for tools like BlockBlend. But strategic users pivot to vetted options, dodging the Helix mixer seizure fate.

Regulated Mixers: Compliance Meets Concealment

Enter compliant bitcoin mixers and their ilk: platforms engineered for AML/KYC adherence while obscuring transactional fingerprints legally. Unlike Tornado Cash’s fixed pools, these employ dynamic pooling, whitelisting, and audit trails, satisfying FinCEN and beyond. Picture privacy without the paranoia – transactions shielded yet reportable if flagged.

Why the edge? Regulated services integrate with CFTC-approved exchanges and MiCA ecosystems, ensuring seamless on-ramps. They sidestep sanctions by design, offering MiCA compliant mixer features like timed delays and cross-chain swaps under supervision. For businesses, this means defensible privacy; for individuals, peace amid 2026’s regulatory storm. As cycles turn, those ignoring compliance risk obsolescence, while adopters seize the compliant frontier.

Explore regulated alternatives post-Tornado delisting, where strategy trumps speculation.

Strategic minds recognize that the true value in crypto privacy lies not in evasion, but in architecture – building systems resilient to scrutiny while preserving utility. Regulated mixers excel here, deploying tiered obfuscation: initial KYC gates filter high-risk actors, followed by algorithmic tumbling that mimics organic flows without fixed pools vulnerable to taint analysis. This contrasts sharply with Helix’s centralized vaults, cracked open by DOJ forensics, or Tornado Cash’s permissionless contracts, now relics haunted by relisting fears.

Head-to-Head: Regulated Mixers Outmaneuver Sanctioned Fossils

Regulated Crypto Mixers vs Sanctioned Services Like Helix and Tornado Cash (2026 Comparison)

| Feature | Regulated Mixer | Sanctioned (Helix/Tornado) |

|---|---|---|

| Compliance | AML/KYC enforced ✅ | None ❌ |

| Privacy Mechanism | Dynamic, audited pools | Fixed anonymity sets |

| Risk of Seizure | Minimal (CFTC/MiCA aligned) | High ($400M Helix case) |

| Integration | Exchanges and DeFi compliant ✅ | Frozen by platforms ❌ |

| Future-Proof | 2026 ready ✅ | Obsolete ❌ |

Such frameworks don’t just comply; they anticipate. As CFTC pilots test CFTC regulated mixer integrations and MiCA platforms eye U. S. bridges, regulated services position users ahead of the curve. Sanctioned alternatives like Cyclone or BlockBlend, hyped on Reddit threads, lure with no-wallet swaps but crumble under chainalysis probes – a gambler’s bet in a regulator’s world.

Consider the economics: Post-delisting, Tornado Cash volumes plummeted 80% amid user caution, per Elliptic data. Regulated platforms, conversely, report 3x growth in 2025, capturing institutional flows wary of Helix mixer seizure echoes. For privacy-conscious businesses, this shift means legal crypto privacy 2026 via whitelisted endpoints, where audits prove clean origins without exposing intent.

This timeline underscores cycles at play: crackdown breeds compliance, compliance unlocks scale. In 2026, previewed by Chainalysis round-ups, expect CFTC approvals for event contracts tied to mixer metrics, normalizing privacy as a regulated asset class. MiCA’s stablecoin rules further cement MiCA compliant mixer viability, potentially allowing EU firms U. S. access via coordinated SEC nods.

Seizing the Compliant Edge: Practical Strategies

Navigating this demands precision. Prioritize platforms with FinCEN registration and real-time AML screening – hallmarks of Tornado Cash alternatives that endure. Test cross-chain support for USDT TRC20/ERC20/SOL, ensuring liquidity without legacy risks. Businesses should layer on-chain proofs with off-chain attestations, turning privacy into a competitive moat.

Opinion: Pure anonymity died with Helix; its $400M forfeiture wasn’t tragedy, but evolution’s forge. Regulated mixers aren’t compromises – they’re apex predators in a traced ecosystem, where compliant bitcoin mixer tech like zero-knowledge range proofs delivers concealment compliant with Treasury’s mixer rule. Ignore them, and you’re Helix 2.0; embrace, and you cycle into prosperity.

For hands-on guidance, delve into selection criteria for regulated mixers tailored to 2026 realities. Pair with USDT mixer compliance post-takedowns, fortifying your stack.

The opportunity crystallizes: as macro trends favor traceable yet private rails, regulated mixers bridge yesterday’s shadows to tomorrow’s standards. Understand the regime, align your moves, and privacy becomes not a risk, but your greatest leverage.