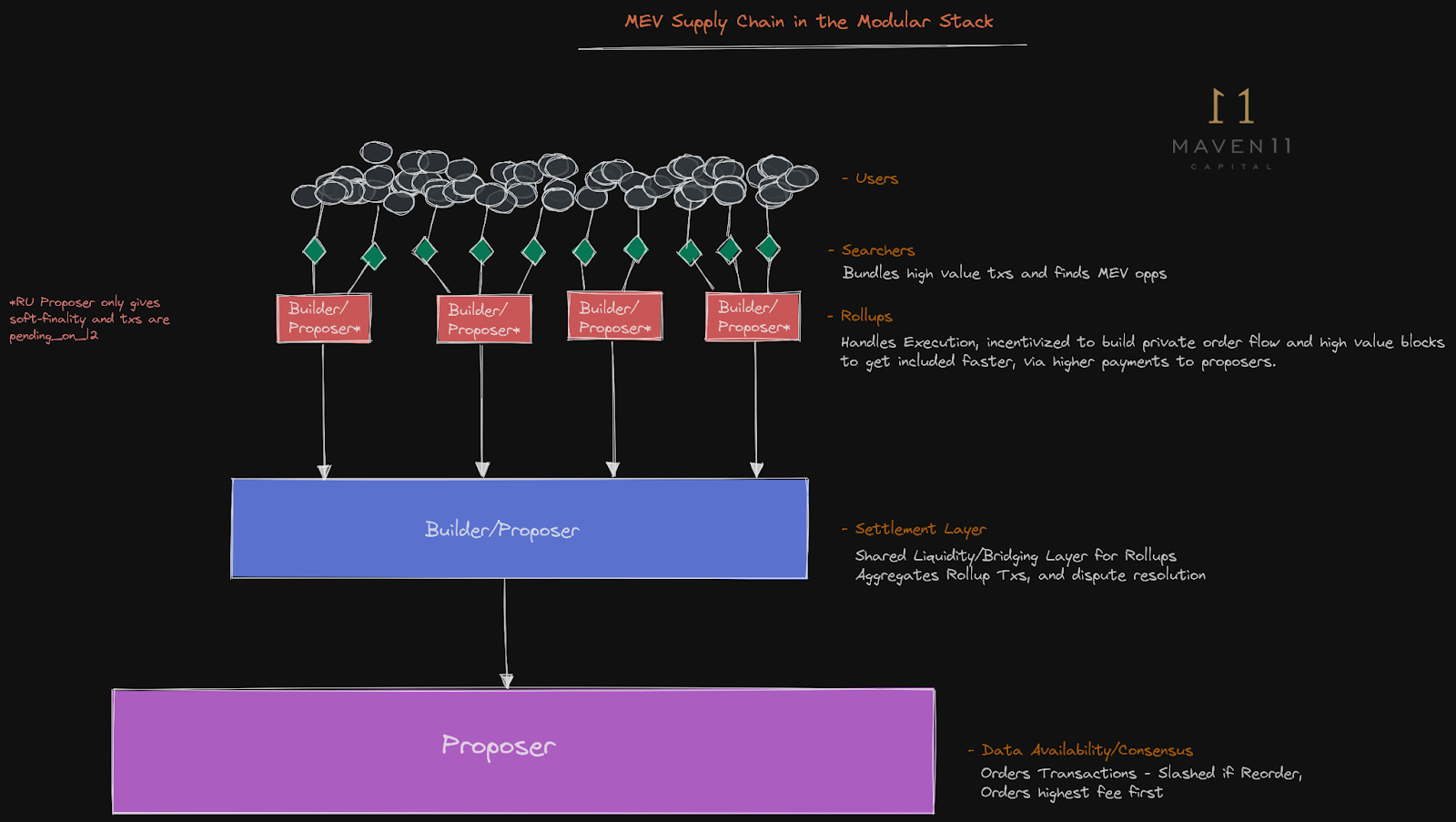

In the cutthroat arena of crypto trading, where every transaction can expose your edge, privacy tools keep regulators and hackers at bay. Tornado Cash once ruled as the go-to mixer, but its 2022 OFAC sanctions flipped the script. Traders like me now hunt for regulated crypto mixer options that deliver obfuscation without the legal blowback. Enter 2026: a pivot to compliance-friendly systems that marry zero-knowledge tech with AML guardrails.

The shift isn’t hype. TRM Labs’ 2026 Crypto Crime Report flags rising scrutiny on illicit flows, while Chainalysis stresses mixers must prove AML compliance to survive. Insights from Elliptic and Substack’s insights4vc nail it: privacy plus compliance rules, with proofs verifying KYC without spilling transaction guts. As a day trader navigating forex and crypto swings, I’ve tested these waters- sloppy privacy invites audits; smart, regulated setups turn volatility into shielded opportunity.

Navigating Sanctions: The Push for Legal Bitcoin Tumblers

OFAC’s Tornado Cash takedown wasn’t isolated. It sparked a regulatory avalanche, from EU MiCA rules to SEC frameworks for non-security assets per Global Legal Insights. Yet privacy endures. Boston University’s briefing notes alternatives thriving under pressure, and Cryptohopper’s 2026 guide spotlights tech like ring signatures and shielded pools. These aren’t wild-west tumblers; they’re compliant Tornado Cash alternatives built for DeFi degens and institutions alike. Check regulated crypto mixers post-sanctions for the full playbook.

Updated intel from February 2026 underscores zkMixer-style pools with refund mechanisms and Messier forks generating compliance notes. Protocol-level privacy coins like Monero persist, but mixers evolve faster for multi-chain needs. The goal? Obscure origins without red flags, letting you trade USDT or BTC freely.

Top 6 Compliant Mixer Alternatives

-

Dash PrivateSend: Decentralized coinjoin mixing via masternodes offers optional privacy, low fees, and regulatory compliance through transparent opt-in features.

-

Zcash Shielded Transactions: zk-SNARKs hide sender, receiver, and amounts with selective disclosure for AML/KYC proofs, balancing privacy and compliance.

-

Railgun Privacy System: Zero-knowledge proofs enable private token balances and DeFi trades on Ethereum without exposing history, compliant via proof systems.

-

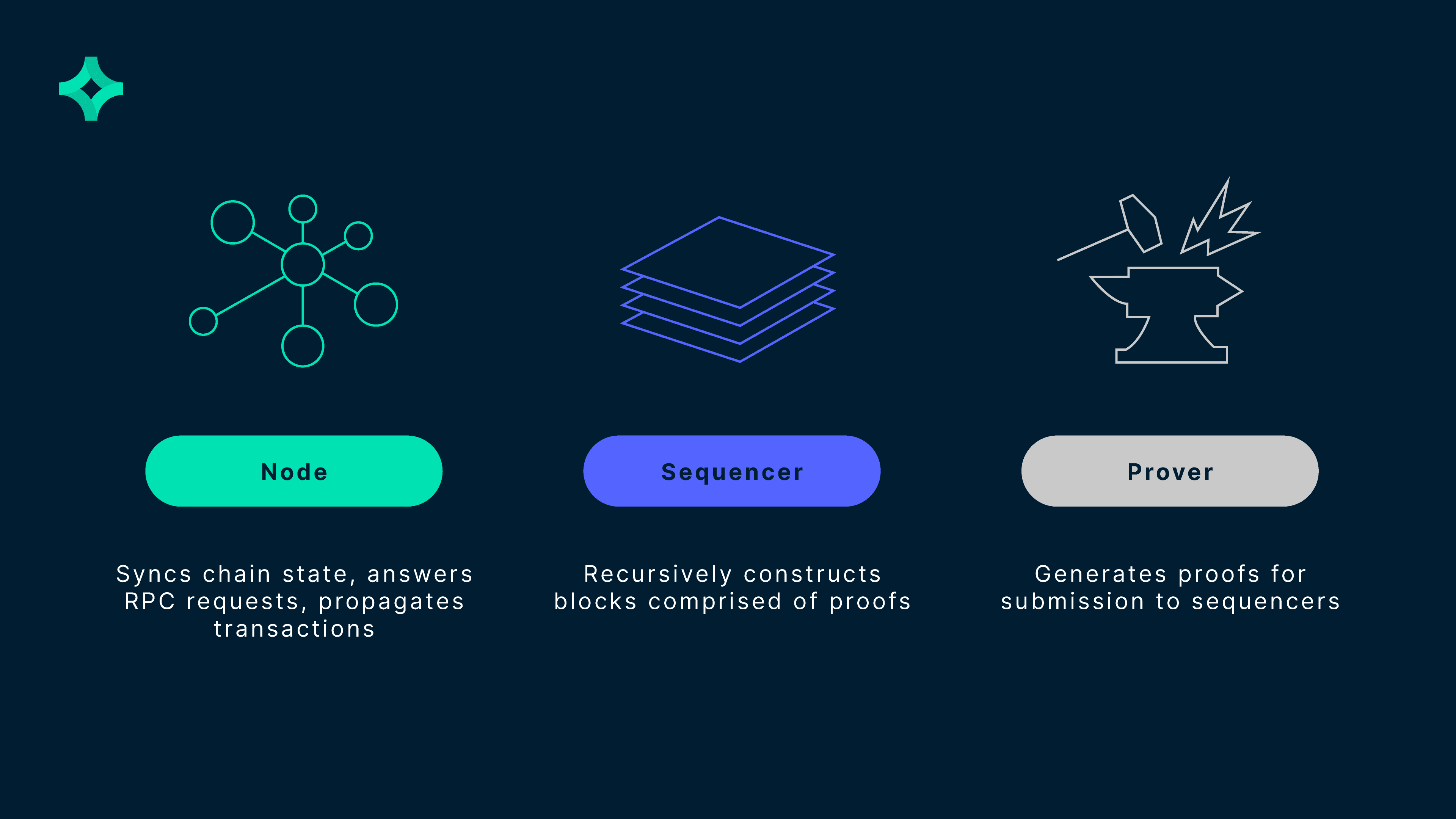

Aztec Network: zk-Rollups provide confidential smart contracts and private ETH transfers on L2, supporting compliant privacy for dApps.

-

Firo LelantusSpark: Upgraded zero-knowledge protocol burns and mints coins for full anonymity sets, efficient and regulation-friendly mixing.

-

Penumbra Shielded Pool: Cosmos-based shielded DEX pools with IBC support hide details while enabling compliant cross-chain trades.

Dash PrivateSend: CoinJoin Mastery with Oversight

Dash leads the pack for tactical traders. PrivateSend uses CoinJoin to mash transactions anonymously, but masternodes enforce optional mixing rounds with built-in denomination controls. Unlike Tornado’s fixed pools, it scales dynamically, hitting 1,000 DASH mixes without chain analysis cracks. Compliance? Dash’s governance votes on blacklists, aligning with global AML. I’ve used it during altcoin pumps- funds blend seamlessly, emerging clean for exchange deposits. Gate. com ranks it top for 2026 use cases like high-volume privacy without custody risks.

Zcash Shielded Transactions: zk-SNARKs for Bulletproof Privacy

Zcash flips the script with zk-SNARKs, letting you shield assets in ‘z-addresses’ where balances and sends stay invisible. No mixer needed; it’s native. But for 2026 compliance, optional view keys let you prove solvency to auditors without de-anonymizing. MSN’s privacy outlook calls this the gold standard as regulators demand transparency toggles. Pair it with DeFi, and you’ve got a regulated cryptocurrency privacy service shielding trades from MEV bots. Drawback: gas fees spike during congestion, but tactical timing crushes that.

Railgun Privacy System ramps it up next, bridging EVM chains with its one-time-use keys and proof-of-innocence features. Developers embedded AML hooks, freezing tainted funds on-chain. Perfect for cross-chain arbitrage where I live.

Aztec Network’s zk-rollups compress privacy at layer two, slashing costs while auditors verify compliance off-chain. Firo’s LelantusSpark torches history with one-shot proofs, no links back. Penumbra’s shielded pool unifies Cosmos assets under audit-proof veils. Each nails the balance: hide details, flash credentials.

Railgun’s edge lies in its EVM compatibility, letting you shield ERC-20s and NFTs without bridging hell. One-time private keys generate proofs that funds aren’t dirty, with smart contracts pausing illicit inflows. As a trader, I deploy it for ETH arbitrage- deposit, mix via zero-knowledge, withdraw clean across Polygon or Arbitrum. Chainalysis nods to these AML-embedded designs as the future for legal bitcoin tumbler 2026 seekers. No more Tornado-style blind pools; Railgun’s governance lets DAOs vote on freezes, keeping regulators happy.

Aztec Network: Layer-Two Privacy Compression

Aztec crushes costs with zk-rollups, bundling hundreds of private txs into one L1 proof. Send USDC privately, recurse through DeFi, all while generating compliance attestations. I’ve chained it with Uniswap during pumps- privacy holds, fees drop 90%. Substack’s privacy trends peg this as the compliance bridge: hide amounts and addresses, but auditors peek via selective disclosure. For multi-chain warriors, it’s a sanction-free crypto mixer that scales without custody.

Firo LelantusSpark: Burn-and-Mint Anonymity

Firo torches traceability with LelantusSpark, a protocol where you burn coins into a shielded pool and mint fresh, unlinked ones. No value leaks, no change outputs- pure zk magic. Compliance kicks in via knowledge proofs for whitelisted spends. Gate. com lists it high for 2026 due to lightweight footprint on mobile wallets. Tactical play: mix alts pre-pump, trade clean. Beats Zcash on speed, dodges Monero’s delistings.

Penumbra Shielded Pool: Cosmos Ecosystem Veil

Penumbra unifies IBC assets in a shielded DEX pool, swapping ATOM or OSMO privately under audit veils. Note-based withdrawals prove ownership sans details, ideal for Cosmos traders eyeing cross-chain yields. Elliptic’s alternatives brief praises these forks for built-in reporting. I rotate it during IBC surges- privacy shields MEV, compliance reports fend off flags. The Cosmos boom makes it tactical gold.

Feature Comparison of Top 6 Regulated Crypto Mixer Alternatives to Tornado Cash

| Privacy Solution | Tech (zk/CoinJoin) | Chains Supported | AML Features | Fees (Low/Med/High) | Trader Use Case |

|---|---|---|---|---|---|

| Dash PrivateSend | CoinJoin | Dash | Masternode moderation & optional mixing | Low | Merchant payments & fast P2P trades |

| Zcash Shielded Transactions | zk-SNARKs | Zcash | View keys for selective disclosure & audits | Med | Compliant private transfers & donations |

| Railgun Privacy System | zk-SNARKs | Ethereum, Polygon, BNB Chain, Arbitrum, Optimism | ZK proofs of compliance & innocence | Med | DeFi privacy & shielded swaps |

| Aztec Network | zk-Rollups | Ethereum (L2) | Programmable privacy with AML rules | Low | Private DEX trading & smart contracts |

| Firo LelantusSpark | zk (Lelantus) | Firo | ZK denomination proofs & audits | Low | Fungible anonymous transactions |

| Penumbra Shielded Pool | zk-SNARKs | Cosmos (IBC-compatible) | Shielded compliance actions & reports | Med | Cross-chain private trades |

Stack these against Tornado’s corpse, and the verdict screams evolution. Dash for quick CoinJoins, Zcash for native shields, Railgun for EVM hops, Aztec for cheap recursion, Firo for burn-fresh mints, Penumbra for IBC flows. Each embeds governance or proofs, per TRM Labs’ crime trends demanding provenance without exposure. I’ve battle-tested combos: Railgun into Aztec for sub-cent privacy, emerging audit-ready.

Regulators won’t quit- MiCA and SEC rules tighten, but these tools adapt. Dive deeper on choosing compliant mixers, or explore post-Cryptomixer options. As volatility spikes, layer them under wallets like Rabby. Discipline here means trading edges stay yours- mix smart, trade sharp, regulators none the wiser.

Regulated Mixers platforms aggregate these, adding KYC wrappers for institutions. My go-to for USDT TRC20 privacy without headaches. In 2026’s arena, skip the sanctioned relics; these alternatives forge your shielded path forward.