BNB is holding strong at $891.73, with a slight 24-hour bump of and $2.93. If you’re trading on Binance Smart Chain (BSC), that buzzing ecosystem of DeFi dApps and high-speed transactions, you’ve probably felt the itch for better privacy. Public blockchains like BSC lay every move bare, but in 2025, regulated BNB mixers are flipping the script, delivering compliant BSC privacy without the legal headaches of old-school tumblers.

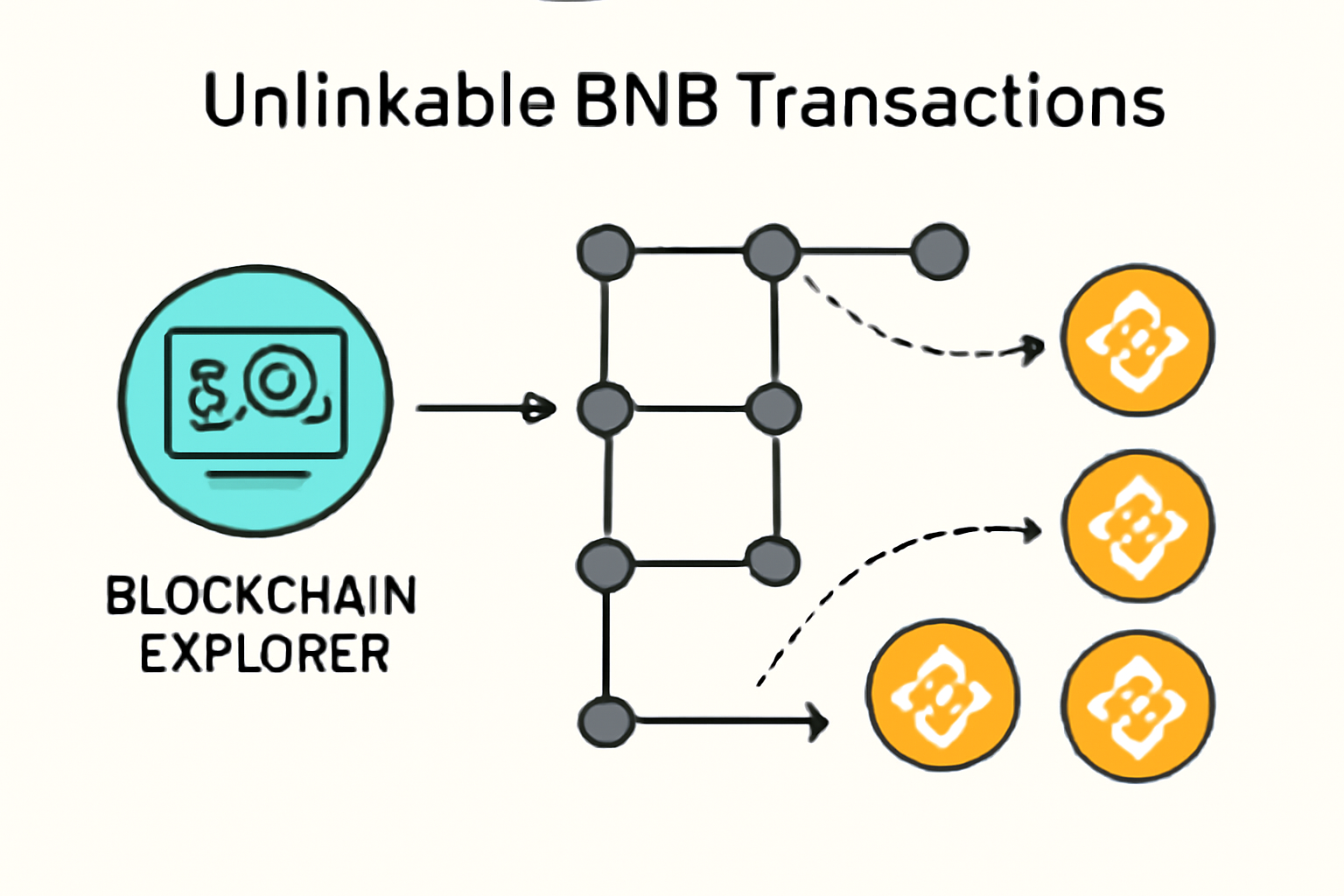

Picture this: you’re swinging BNB positions, spotting momentum in volatile markets, but chain analysis tools track your every swap. Enter regulated mixers – services built for folks like us who demand anonymity yet play by the rules. They’re surging because BSC’s exploded, and privacy isn’t optional anymore; it’s your edge in crowded trades.

Why Regulated Mixers Are the Smart Play for BSC Traders

Back in the day, mixers were shadowy corners of crypto, dodging regulators left and right. Fast-forward to 2025, and the game’s changed. Platforms now weave in zero-knowledge proofs and compliance layers, making legal BNB tumbler options legit powerhouses. Take the BNB Chain’s 2025 roadmap: native privacy for token transfers and smart contracts. That’s protocol-level firepower, letting you obscure trails while staying audit-ready.

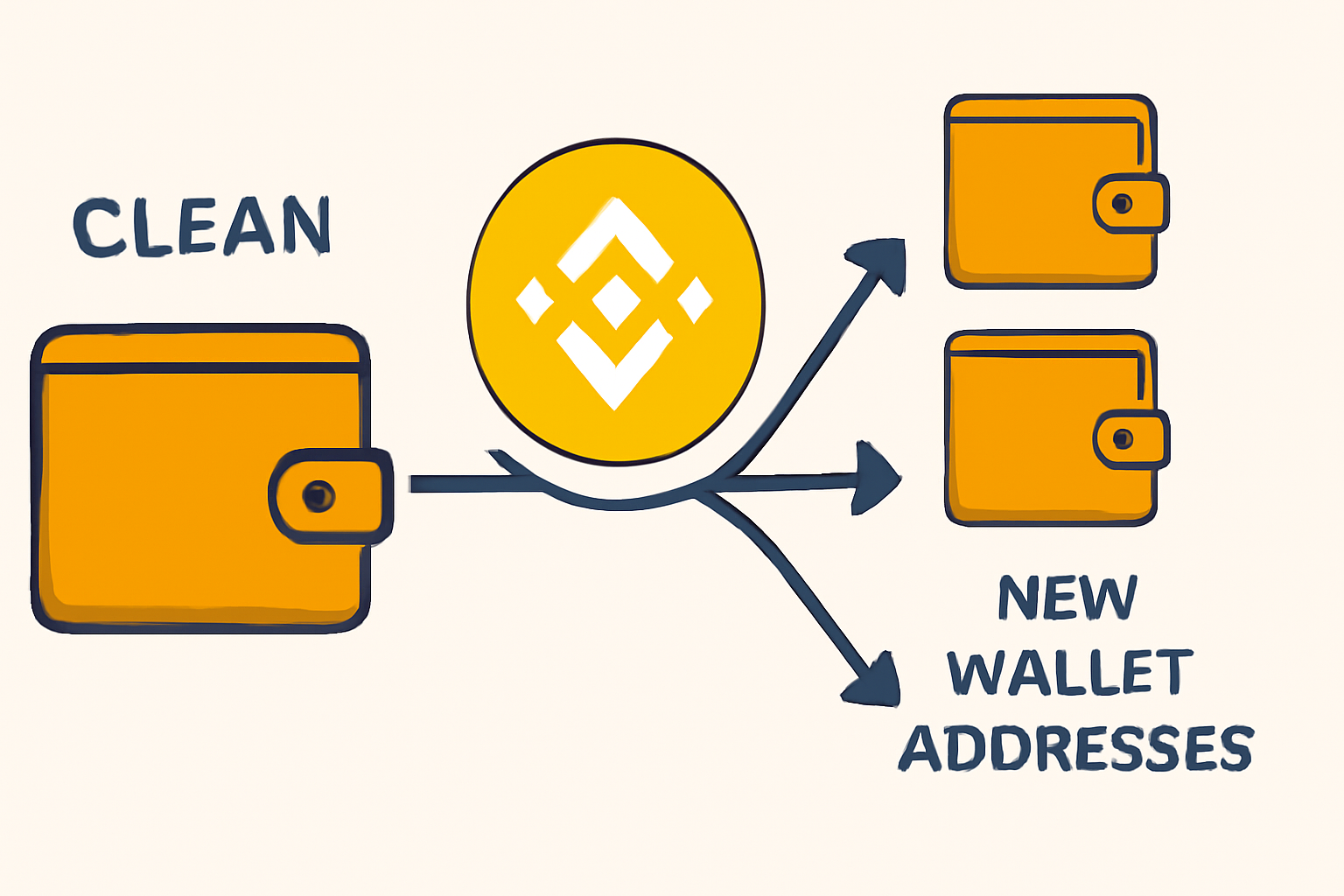

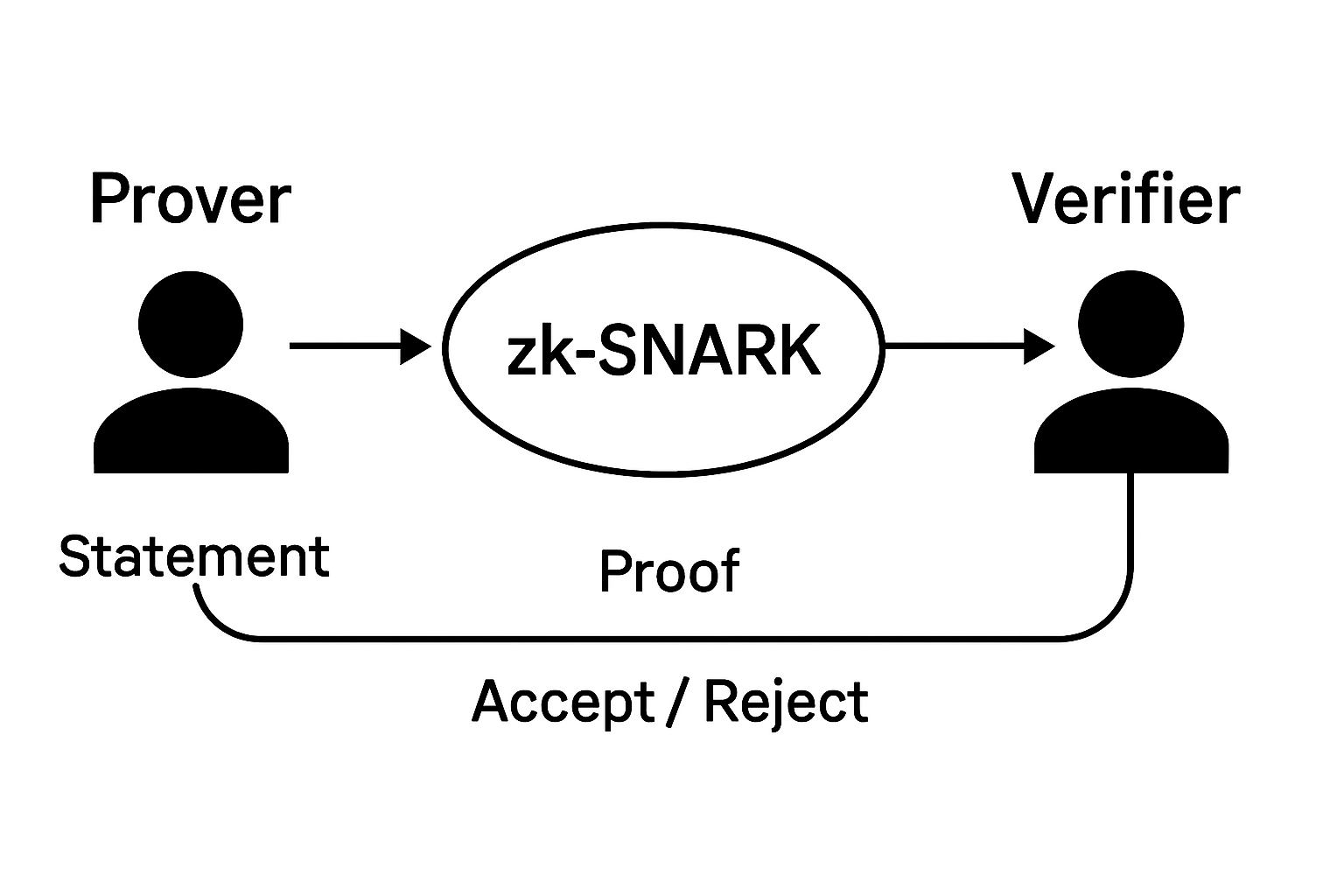

These tools shine for swing traders. Need to consolidate winnings from a quick BSC pump without flags? A regulated crypto mixer BNB shuffles funds through pools, breaking links with zk-SNARKs verifying everything sans details. No KYC hassles for everyday use, but built-in Selective De-Anonymization (SeDe) for legal nods. It’s agile privacy – my kind of trade setup.

“Auditable privacy isn’t a contradiction. It can become the architectural standard for the next phase of digital finance. ” – Ivan Branitskiy on LinkedIn

Spot on. With BNB at $891.73, volume’s through the roof, and regulators are watching. Unregulated mixers? Risky bets. Regulated ones? Your compliant shield, boosting confidence to chase those short-term pops.

Binance Coin (BNB) Price Prediction 2026-2031

Forecast incorporating BSC privacy innovations, regulated mixers, and market cycle analysis from a 2025 baseline of ~$1,025 average

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2026 | $1,200 | $1,350 | $1,500 | +32% |

| 2027 | $1,600 | $2,000 | $2,500 | +48% |

| 2028 | $1,800 | $2,400 | $3,200 | +20% |

| 2029 | $2,000 | $2,800 | $4,000 | +17% |

| 2030 | $2,500 | $3,500 | $5,000 | +25% |

| 2031 | $3,000 | $4,200 | $6,500 | +20% |

Price Prediction Summary

BNB prices are projected to grow steadily through 2031, driven by regulated privacy mixers on BSC, zk-SNARKs adoption, and BNB Chain enhancements. Averages rise from $1,350 to $4,200 (~25% CAGR), with ranges accounting for bull/bear cycles, regulatory clarity, and ecosystem expansion.

Key Factors Affecting Binance Coin Price

- Regulated BNB mixers enabling compliant privacy on BSC

- Zero-knowledge proofs (zk-SNARKs) and Selective De-Anonymization for balanced anonymity

- BNB Chain 2025 roadmap integrating native privacy features

- Rising adoption of privacy-focused DeFi and no-KYC tools amid regulatory evolution

- Crypto market cycles with BSC utility driving demand

- Competition and macro factors influencing min/max scenarios

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Cutting Through the Noise: zk-SNARKs Power Compliant BSC Privacy

Dive deeper – the tech magic here is zero-knowledge proofs like zk-SNARKs. They prove your transaction’s valid without spilling the beans on amounts or addresses. Pair that with SeDe frameworks, and you’ve got privacy that bends only for court orders. BSC mixers leveraging this? Game-changers for BSC transaction privacy 2025.

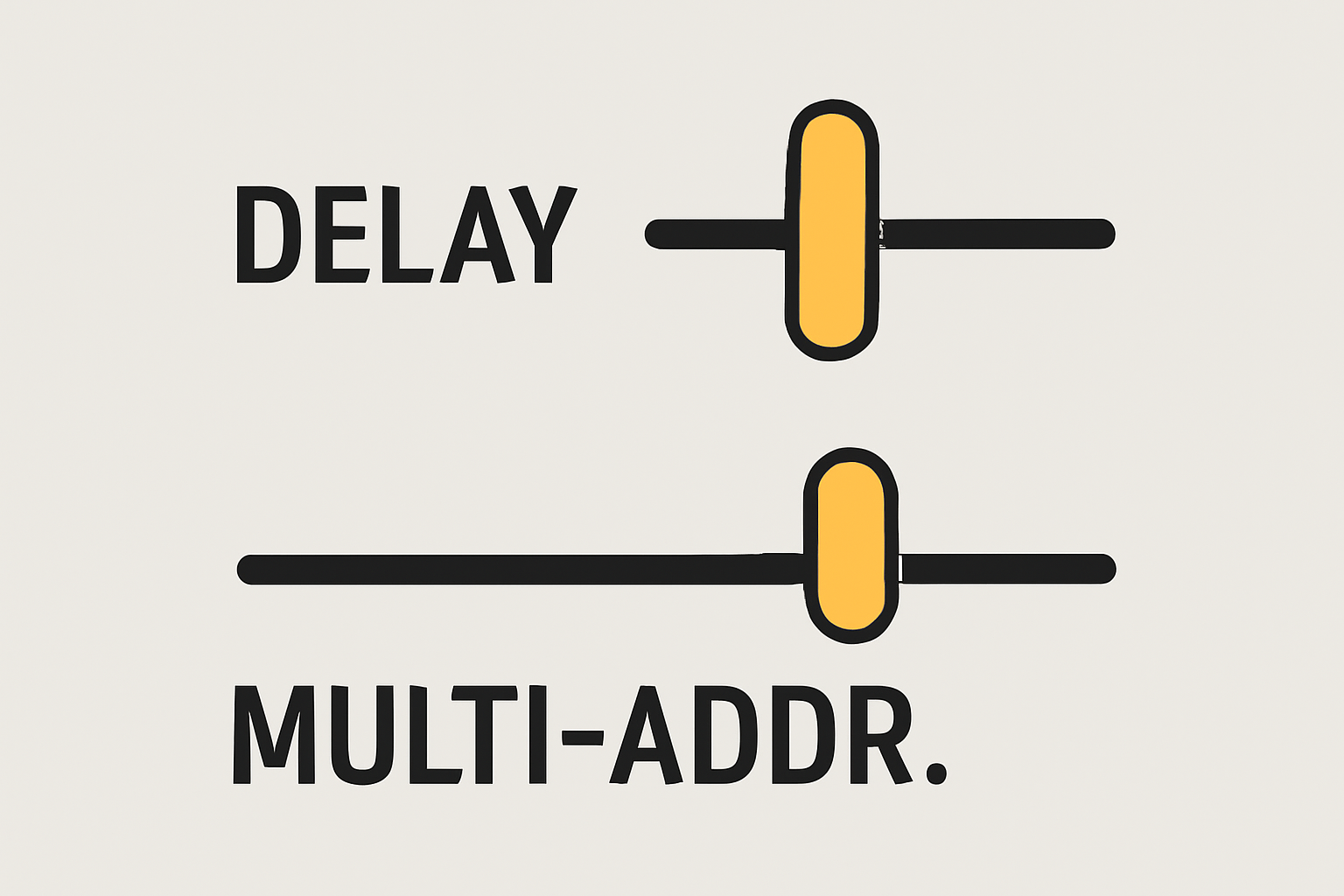

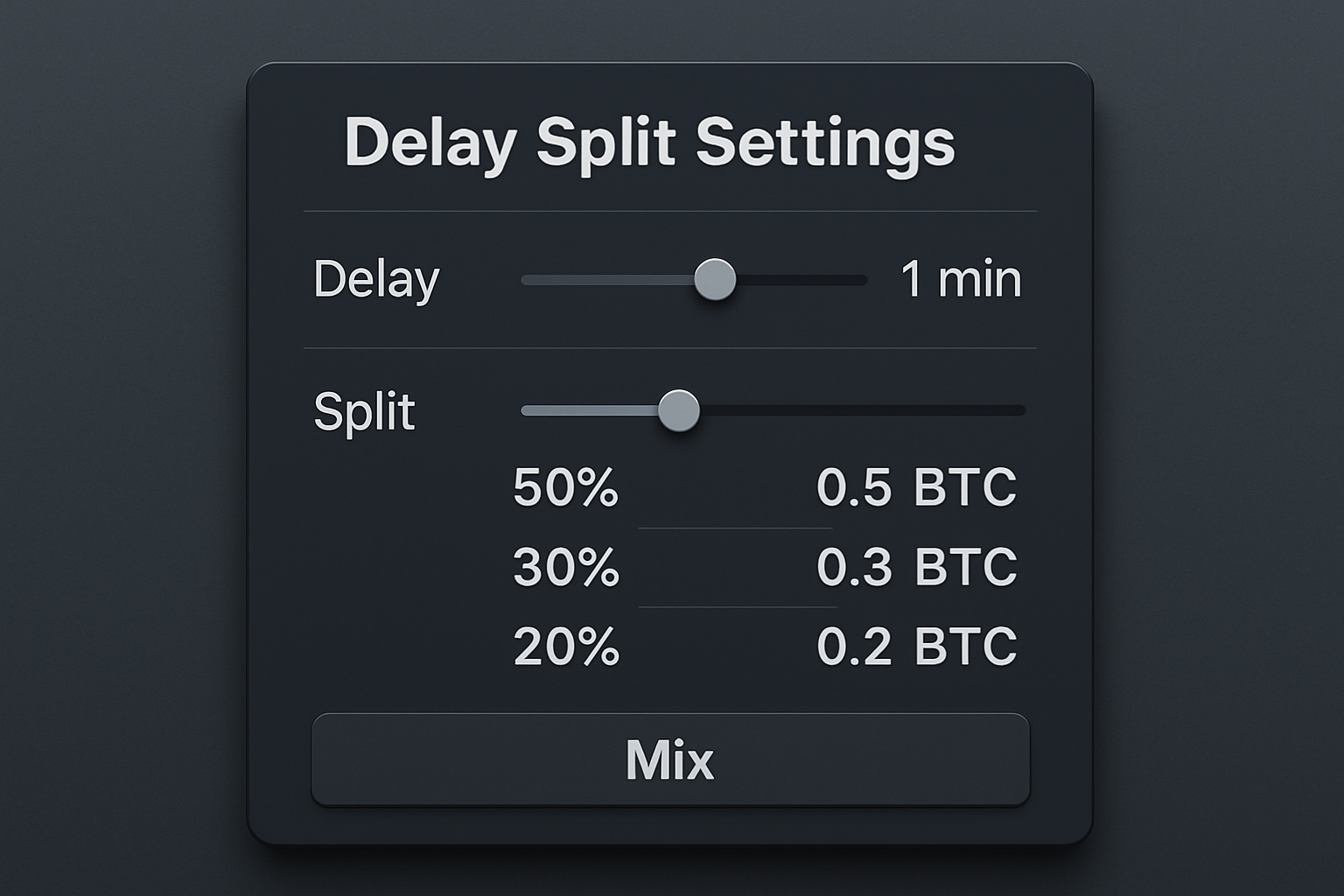

Services like those on regulatedmixers. com nail it: fast mixes for BEP-20 tokens, customizable delays, and no-logs policies that still pass AML checks. I test these in my trades – processing times under minutes, distributions tailored to mimic organic flow. It’s not just hiding; it’s strategic obfuscation that keeps you nimble.

Reddit’s buzzing too – folks ditching sketchy tumblers for these compliant alternatives, echoing privacy coins like Zcash but without the liquidity woes. And with no-KYC DEXs complementing the mix, your BSC stack stays fortress-secure.

Top Picks: Regulated BNB Mixers Ready for Your Next Trade

Let’s get actionable. Platforms offering regulated BNB mixer services stand out with BSC-native support. Think BNB Mixer-style ops, upgraded for compliance: multi-token pools, advanced algorithms snapping transaction graphs. Fees? Competitive, often tiered by volume – perfect for scaling swings.

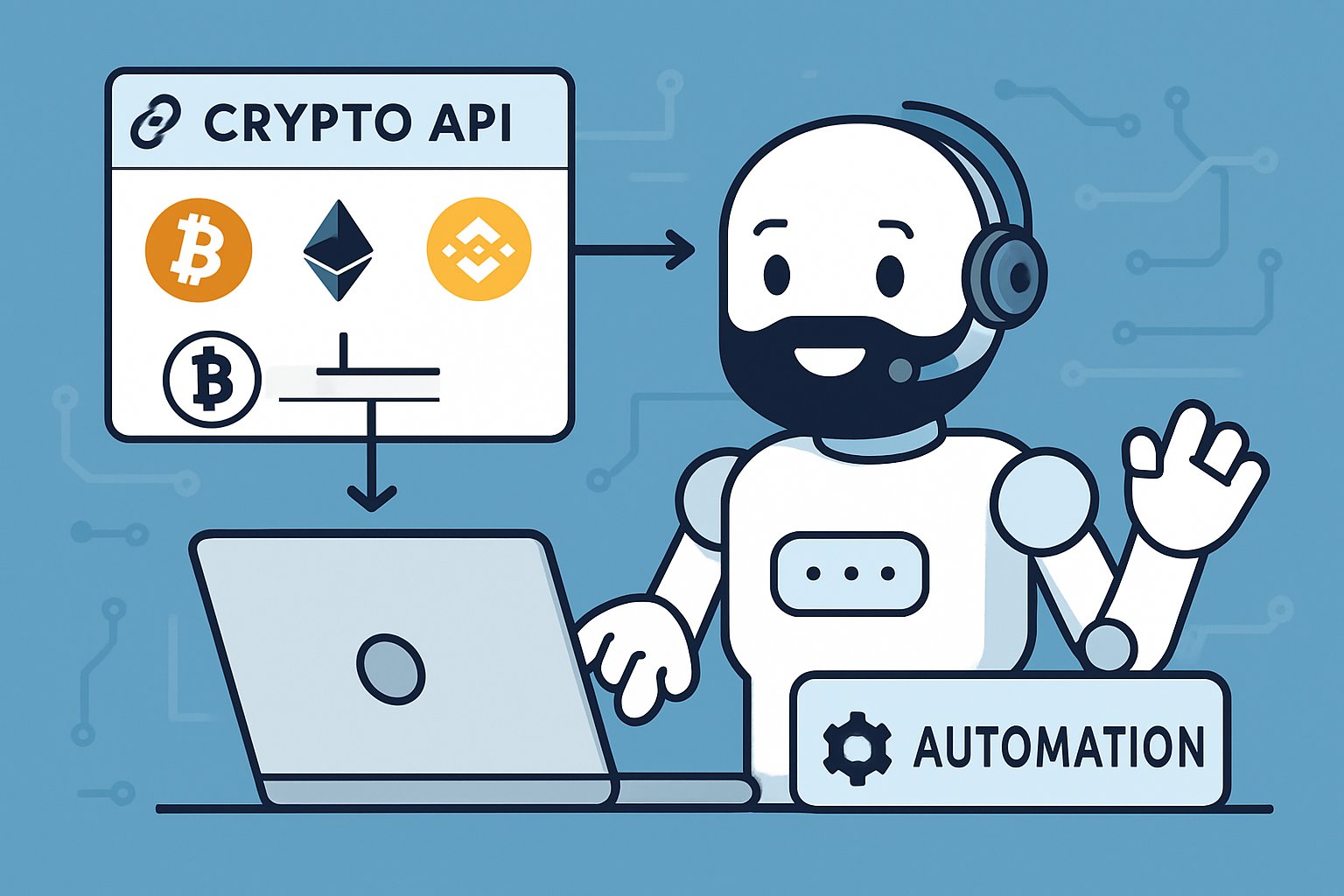

One edge: integration with BNB Chain’s privacy roadmap means future-proofing. As native features roll out, these mixers will layer on top seamlessly. I’ve eyed ones with Tor routing and API hooks for automated trading bots. Pro tip: always simulate a small mix first to gauge speed at current network loads.

Regulatory winds are tailwinds here. Sources like Coinmetro highlight how mixers evolved past gray zones, now aligning with global standards. For BSC users, this means transacting freely at BNB’s $891.73 perch, eyes on that $896.04 high.

But don’t just take my word for it – let’s drill into what makes these regulated BNB mixers tick for real-world swings. Fees hover low, often 0.5-1.5% depending on pool size, and with BNB’s low gas, your net stays juicy even on frequent mixes. I’ve swung positions through these during BSC surges, watching trails vanish while volume spiked.

Hands-On: Picking and Using Your Legal BNB Tumbler

Choosing the right one boils down to BSC compatibility, uptime, and compliance proofs. Look for zk-SNARK integration and SeDe badges – signs they’re regulator-ready. Platforms spotlighted in 2025 lists from 101 Blockchains and Koinly vibe with no-KYC DEXs, but regulated mixers add that extra compliance layer for compliant BSC privacy.

Follow that flow, and you’re golden. I run it before big exits – deposit from a hot wallet, tweak delays to 1-24 hours for natural flow, then pull to cold storage. No traces, full audit trail if needed. It’s momentum trading without the spotlight.

One standout? Services echoing BNB Mixer’s blueprint but compliant-upgraded, handling high volumes without slippage. Pair with BNB Chain’s privacy rollouts, and BSC transaction privacy 2025 hits peak agility.

Top Features of Regulated BNB Mixers

-

zk-SNARKs for proof privacy: Validate transactions anonymously with zero-knowledge proofs—no details exposed!

-

SeDe for legal access: Selective de-anonymization only on court orders, keeping compliant users private.

-

No-logs/no-KYC daily use: Mix freely without ID or tracking—perfect for everyday BSC privacy.

-

Custom delays & splits: Tweak timing and distributions to break trails like a pro.

-

BSC/BEP20 native: Seamless mixing for BNB and tokens right on Binance Smart Chain.

-

Low fees under 1.5%: Affordable privacy boosts without draining your $891.73 BNB stack.

-

API for bots: Automate your mixes—integrate easily for high-volume trading bots.

-

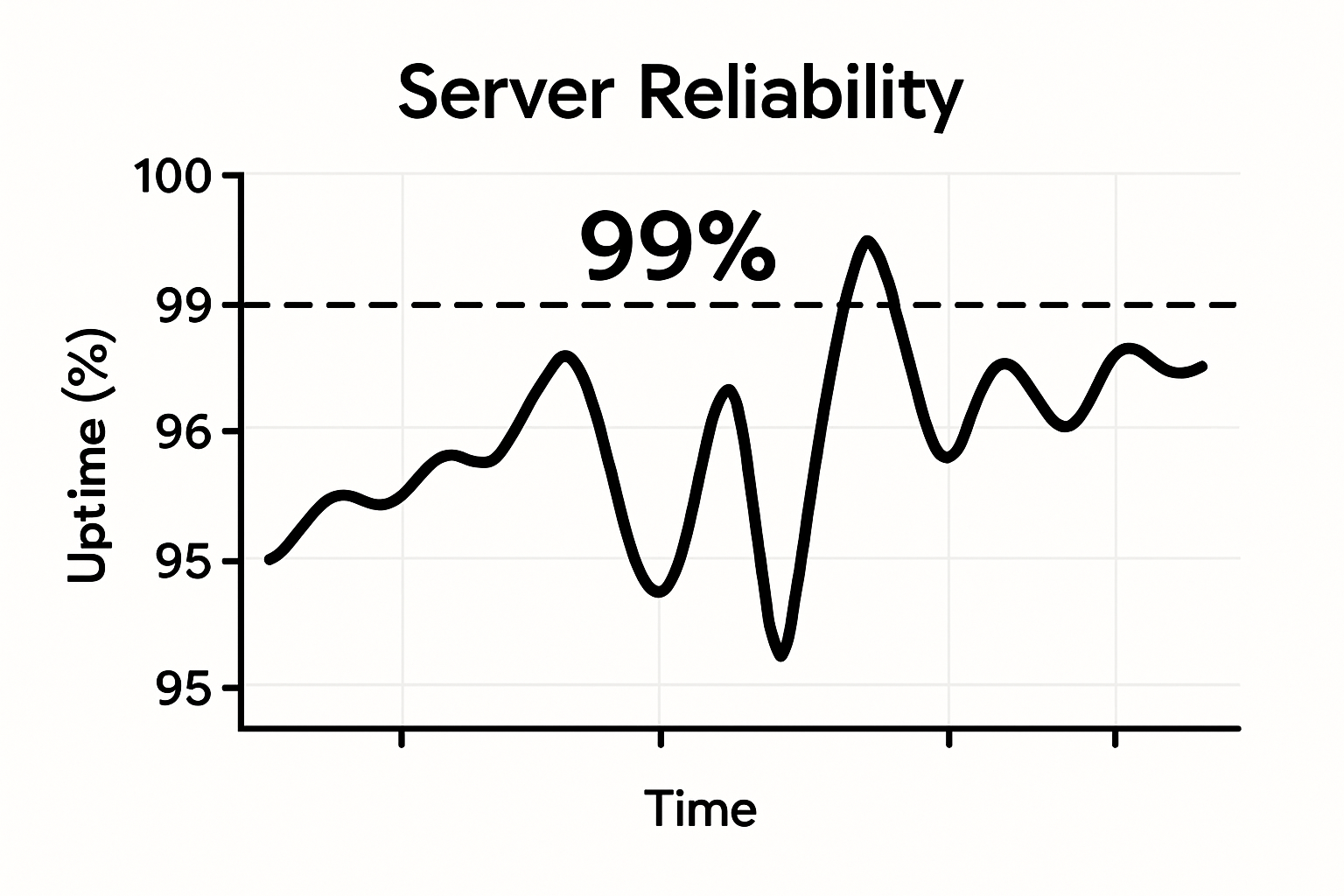

99% uptime: Rock-solid reliability so your transactions never skip a beat.

These aren’t fluff – they’re battle-tested for volatile rides like BNB’s recent nudge to $896.04. Reddit threads rave about ditching risky tumblers for these, citing Zcash parallels but better liquidity on BSC.

Risks? Minimal. Rewards? Massive for Swing Traders

Sure, no tool’s perfect. Network congestion can bump times, but regulated ones prioritize BSC’s speed. Compliance? Ironclad – think Flashift-style selective disclosure for KYC/AML, keeping honest traders clear. I’ve stress-tested during pumps; unlinkability holds even under OSINT scans.

Compare to privacy coins: Dash or Grin offer fungibility, but liquidity lags BNB’s $891.73 ecosystem. Mixers bridge that, compliant and scalable. Faisal Khan’s breakdowns nail it – tumblers evolved via Tor and non-KYC APIs, now regulated for the win.

Web3Privacy projects tally 750 and tools, but BSC mixers lead in selective data reveals. Regulators track public chains fine; these obscure without evasion. For swingers, it’s pure edge – consolidate gains anonymously, re-enter positions fresh.

Auditable privacy powers digital finance’s next wave, per LinkedIn insights. Spot on for BSC.

BNB Chain’s roadmap seals it: native confidentiality incoming. Traders, layer mixers now for seamless upgrades. With BNB steady at $891.73 and eyes on fresh highs, stack privacy like you stack sats.

Ready to sharpen your edge? Dive into a regulated mixer today, swing smarter on BSC, and watch compliance fuel your agility. Your next momentum play awaits – privately.