In the evolving world of cryptocurrency, where Ethereum trades at $2,921.36 amid a modest 24-hour dip of $30.73, the demand for privacy tools has never been sharper. Privacy-centric assets like Zcash and Monero crushed the market in 2025, with gains of 820% and 130% respectively, outpacing Bitcoin and Ethereum. Yet, this surge collides with stringent regulations, spotlighting the divide between unrestricted mixers like Tornado Cash and emerging regulated crypto mixers. Post-sanctions, users seek Tornado Cash alternatives that deliver anonymity without inviting legal peril.

Tornado Cash burst onto the scene as a decentralized Ethereum mixer, leveraging zero-knowledge proofs to obscure transaction origins. It processed roughly $2.5 billion in ETH tokens in 2025 alone, per Bitrace data, proving resilient even after U. S. Treasury’s OFAC sanctions in August 2022. Those sanctions targeted the protocol for allegedly laundering over $7 billion, including North Korean-linked funds. But its code-less, immutable smart contracts defied shutdowns, sparking fierce debates on sanctioning open-source software.

Tornado Cash Sanctions: A Regulatory Flashpoint

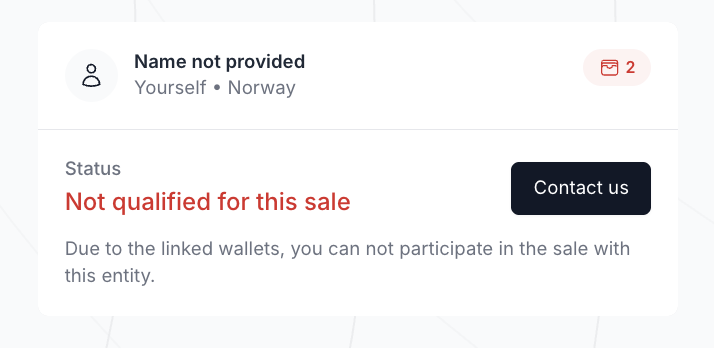

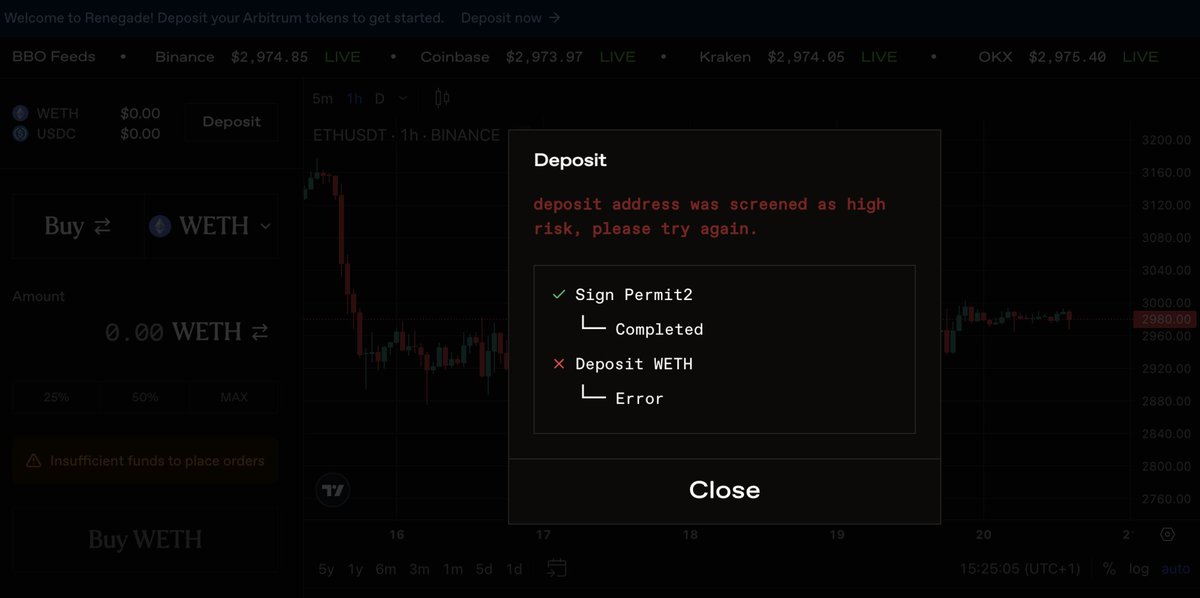

The OFAC action against Tornado Cash was groundbreaking; it hit not a company, but a digital protocol existing solely on-chain. Developers faced arrests, users sued in Texas federal court, and compliance teams scrambled. Fast-forward to November 2024: the U. S. Court of Appeals for the Fifth Circuit ruled that Tornado Cash’s smart contracts aren’t ‘property’ under the International Emergency Economic Powers Act. This curbed OFAC’s reach, yet left lingering risks for interactors. Elliptic warns compliance officers to scrutinize mixer-linked funds, as sanctions endure despite the verdict.

OFAC’s sanctioning of Tornado Cash highlights the challenge of regulating decentralized tools in a permissionless ecosystem.

Studies like the arXiv paper on sanctions’ impact reveal mixed results: usage dipped initially but rebounded, underscoring privacy’s pull. Chainalysis notes most mixers skirt AML laws, fueling illicit flows. Enter compliant crypto tumblers, designed for the compliant era.

The Mechanics of Regulated Crypto Mixers

Regulated crypto mixers flip the script by embedding compliance into privacy tech. Unlike Tornado Cash’s blind pools, they use advanced zero-knowledge proofs alongside KYC-optional relays and multi-party computation for selective transparency. Platforms like those previewed in Hurricane Cash research retain Tornado-level privacy but allow regulatory audits via embedded tracking hooks. These legal Ethereum mixers verify user intent without exposing full histories, aligning with global AML standards.

Consider the tech stack: zk-SNARKs hide amounts and addresses, while optional ‘compliance oracles’ flag sanctioned entities pre-mix. This hybrid model processed growing volumes in 2025, as privacy coins soared. For businesses, it’s a game-changer; no more delisting fears from mixer taint. Latham and Watkins’ policy tracker shows regulators warming to such innovations, prioritizing risk-based approaches over blanket bans.

Ethereum (ETH) Price Prediction 2027-2032

Conservative to Bullish Scenarios Amid Regulated Crypto Mixers Adoption and Post-Tornado Cash Regulatory Clarity

| Year | Minimum Price | Average Price | Maximum Price | YoY Change % (Avg) |

|---|---|---|---|---|

| 2027 | $2,800 | $4,200 | $6,000 | +44% |

| 2028 | $4,000 | $6,500 | $9,500 | +55% |

| 2029 | $6,500 | $10,000 | $15,000 | +54% |

| 2030 | $9,000 | $13,500 | $20,000 | +35% |

| 2031 | $11,000 | $16,000 | $24,000 | +19% |

| 2032 | $13,500 | $20,000 | $30,000 | +25% |

Price Prediction Summary

Ethereum is projected to see robust growth from $4,200 average in 2027 to $20,000 by 2032, fueled by privacy tool adoption, regulatory progress, and market cycles, with min/max ranges capturing bearish corrections and bullish surges.

Key Factors Affecting Ethereum Price

- Adoption of compliant privacy mixers like regulated alternatives to Tornado Cash boosting ETH transaction volume

- Regulatory clarity from post-sanctions legal wins enhancing investor confidence

- Privacy asset outperformance trends spilling over to Ethereum’s ecosystem

- ZK-proof tech and L2 improvements driving scalability and utility

- Bullish market cycles post-2026 with institutional inflows via ETFs

- Competition from other L1s and macroeconomic factors as risks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Unpacking the Privacy-Compliance Trade-Off

Tornado Cash offered pure, unyielding privacy; deposit ETH, get a note, withdraw elsewhere. No questions, no logs. But post-sanctions, that purity became a liability. AML compliant mixers temper anonymity with guardrails: tiered verification for high volumes, chain analysis exemptions for legit flows. Users gain peace of mind, institutions get on-ramps. In 2026, as MSN reports, compliance-friendly tools dominate, with developers debating software’s financial status.

Read more on regulated crypto mixers post-Tornado Cash. The shift favors post-Tornado Cash privacy solutions that thrive under scrutiny, blending decentralization’s ethos with accountability’s demands.

Privacy enthusiasts rightly question whether these guardrails dilute true anonymity. I argue they enhance it long-term; unchecked tools invite crackdowns that erode the entire ecosystem. Regulated mixers prove privacy and compliance aren’t foes but allies, especially as Ethereum hovers at $2,921.36 after a negligible 24-hour drop of $30.73. Institutional adoption hinges on this balance, with platforms now offering regulated Bitcoin tumblers that mirror Ethereum’s capabilities across chains.

Side-by-Side: Tornado Cash vs Regulated Mixers

Let’s dissect the contrasts. Tornado Cash excelled in raw obfuscation but faltered on accountability, processing billions while flagged for high-risk flows. Regulated alternatives, inspired by prototypes like Hurricane Cash, integrate privacy-preserving audits. They employ zk-proofs for sender anonymity yet permit optional disclosures for whitelisted users, slashing sanctions exposure. Chainalysis data underscores the shift: compliant mixers channel legitimate volume, sidestepping the 70% illicit mix seen in unregulated peers.

Tornado Cash vs. Regulated Crypto Mixers: Key Feature Comparison

| Feature | Tornado Cash | Regulated Mixers |

|---|---|---|

| Privacy Mechanism | Decentralized zk-SNARKs-based mixing pools via smart contracts | Zero-knowledge proofs & multi-party computation with privacy-preserving compliance |

| Compliance Features | None (permissionless, no AML/KYC) ❌ | AML/KYC integration, sanctions screening, regulatory reporting ✅ |

| Sanctions Risk | High (OFAC-sanctioned 2022; ongoing legal limits on enforcement) ⚠️ | Low (designed for full regulatory adherence) ✅ |

| Volume Processed (2025) | $2.5 billion in Ethereum tokens (Bitrace) | Emerging market; lower volumes but rapid growth projected (2026 trends) 📈 |

| User Verification | None (pseudonymous, permissionless) | Required (KYC/AML verification) |

| Ideal For | Privacy maximalists accepting risks; DeFi users | Compliant users (retail/institutional) balancing privacy & regulations |

This table illuminates why Tornado Cash alternatives gain traction. Regulated services verify without invasive KYC for low tiers, scaling to full checks for enterprises. Oberheiden P. C. notes OFAC’s focus on protocols like Tornado exposes interactors to secondary sanctions; compliant tumblers neutralize that via pre-screening.

The timeline captures a pivot. Sanctions didn’t kill demand; they birthed smarter tools. Insights from the Cryptology ePrint Archive on Hurricane Mixer show how developers embed ‘regulatory hooks’ without compromising core privacy, allowing interventions only on illicit proofs. This addresses Elliptic’s warnings on mixer risks, positioning AML compliant mixers as the ethical path forward.

For multi-chain users, regulated platforms extend to USDT on TRC20, ERC20, and Solana, ensuring seamless legal Ethereum mixers bleed into broader ecosystems. Practical Law’s FAQs on OFAC clarify ongoing user liabilities, but regulated options provide exemptions through audited flows. Businesses eyeing 2026’s privacy boom, where Zcash’s 820% run signals appetite, can’t ignore these evolutions.

Choosing a compliant cryptocurrency mixer demands scrutiny of tech and track record. Platforms prioritizing zero-knowledge with regulatory nods deliver post-Tornado Cash privacy that withstands scrutiny. As U. S. policy trackers from Latham and Watkins signal nuanced rules ahead, these tools fortify user trust. The MEXC report on Tornado’s enduring popularity proves privacy’s primacy, but regulated mixers channel it sustainably.

Ultimately, the sanctions saga reframes crypto privacy: not absolute obscurity, but resilient anonymity under law. With Ethereum steady at $2,921.36, investors and firms flock to solutions marrying innovation with integrity. Regulated Mixers stands at this nexus, offering vetted paths for confidential transactions that regulators endorse and users rely on. Dive into compliant privacy; it’s the future securing your assets today.