In the ever-evolving world of digital assets, the tension between privacy and compliance has never been sharper. As regulators intensify their scrutiny of cryptocurrency mixers, new cryptographic breakthroughs are emerging to help institutions navigate this minefield. One technology stands out: Fully Homomorphic Encryption (FHE). By enabling computations on encrypted data without ever exposing the underlying information, FHE is poised to transform how mixers deliver both privacy and regulatory alignment for institutional users.

Why Mixers Need a New Approach: Privacy vs. Compliance

Traditional crypto mixers, like Tornado Cash, have long been used to break the link between sender and receiver, offering users a cloak of anonymity. But that very capability has put them in regulators’ crosshairs due to concerns about money laundering and illicit finance. The market is shifting rapidly: as Chainalysis notes, compliance with anti-money laundering (AML) laws is now non-negotiable for any mixer hoping to serve institutional clients or operate in regulated jurisdictions.

This is where FHE comes in. Unlike older privacy tech that simply hides transaction details, FHE allows platforms to process transactions and verify compliance requirements, such as sanctions screening or AML checks, while all sensitive data remains fully encrypted. The result? Privacy for users, auditability for regulators, and peace of mind for institutions seeking compliant crypto privacy solutions.

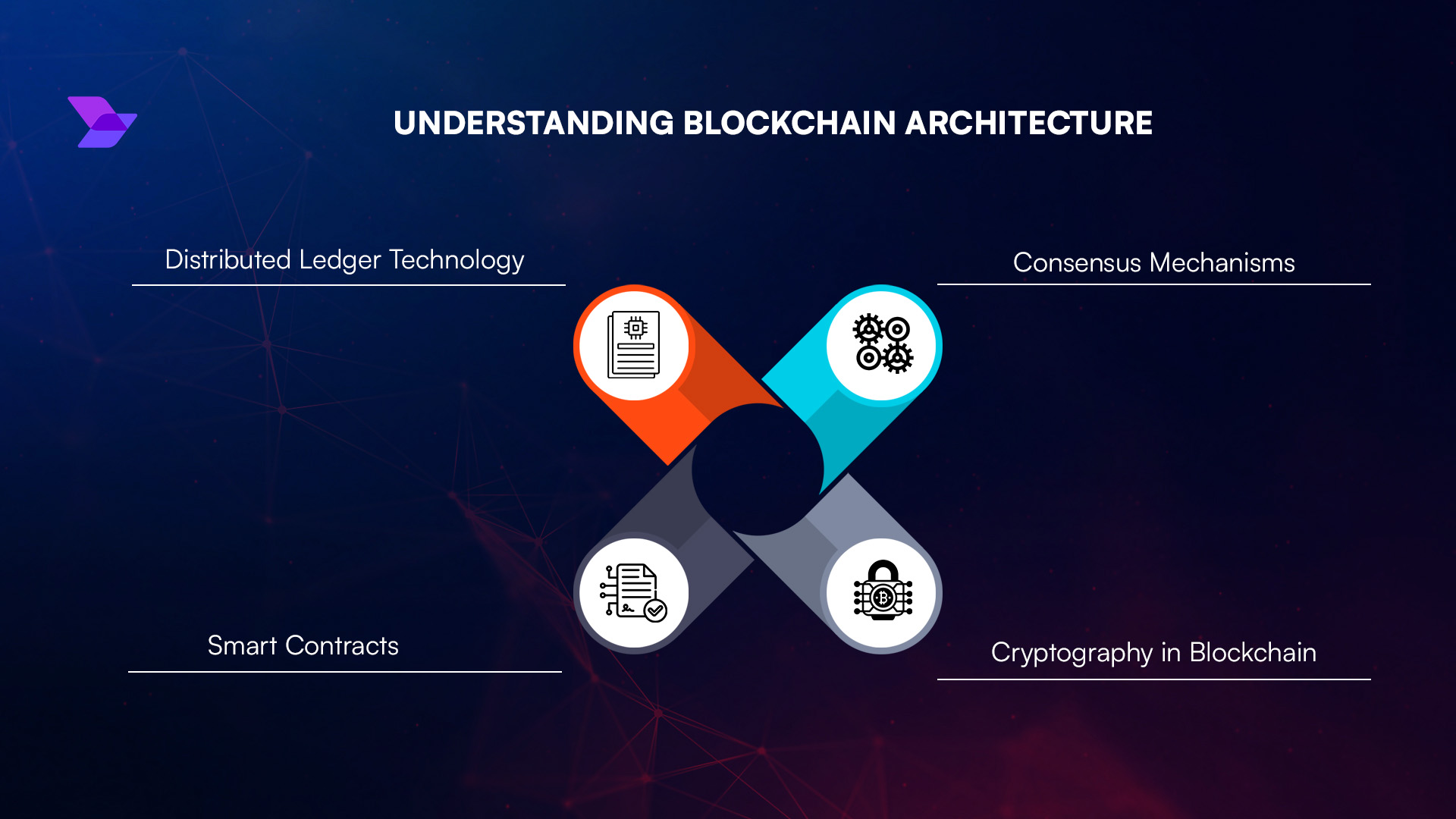

How Fully Homomorphic Encryption Works in Regulated Mixers

The magic of FHE lies in its ability to perform computations directly on ciphertexts. Imagine being able to check whether a transaction complies with AML rules or matches against watchlists, all without ever decrypting user data. This means:

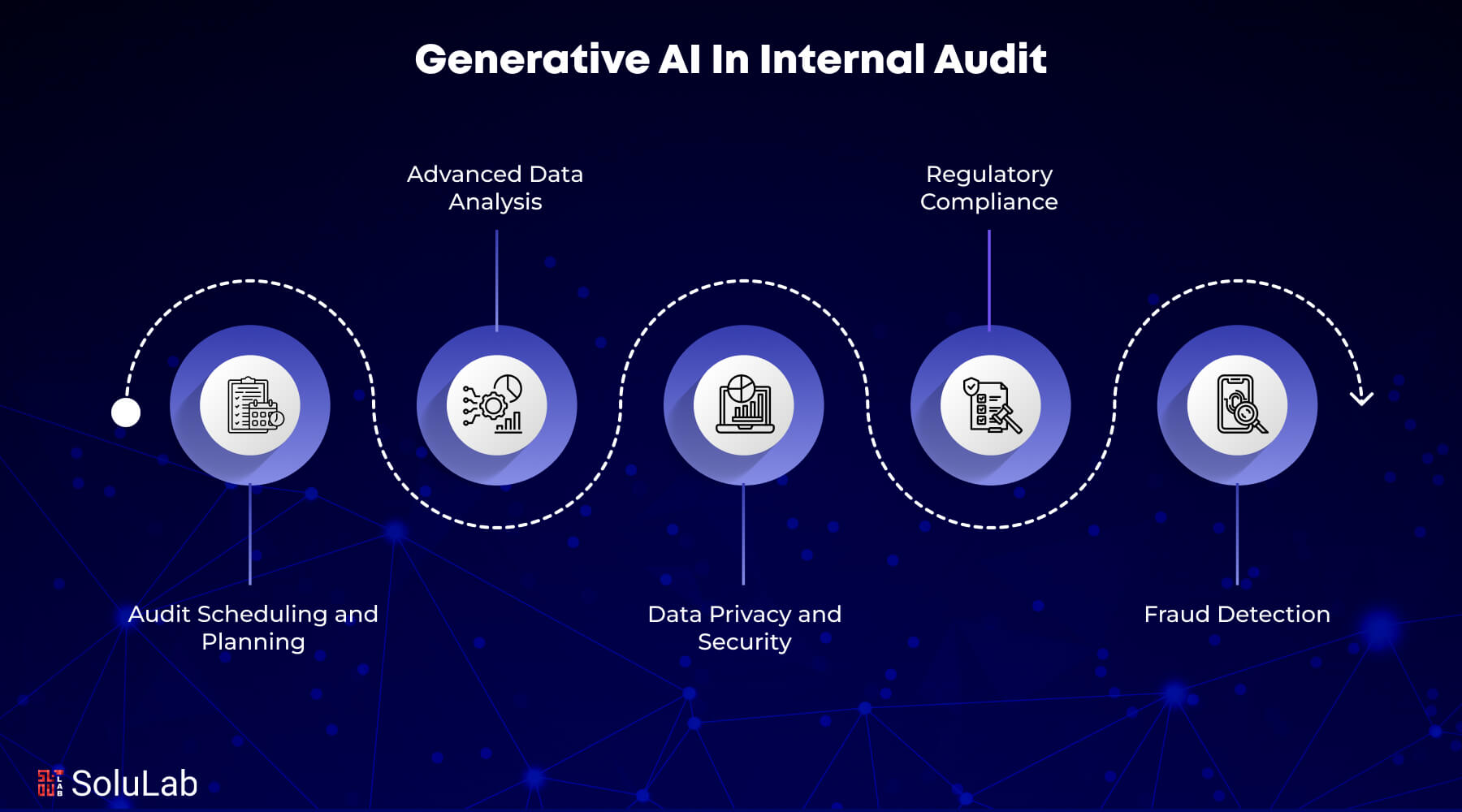

Key Benefits of FHE Mixers for Institutional Crypto Privacy

-

Privacy-Preserving Regulatory Compliance: FHE mixers enable institutions to meet AML and KYC requirements by allowing compliance checks on encrypted data—ensuring sensitive information stays confidential while still being auditable for regulators.

-

Confidential Collaborative Analysis: With FHE, financial institutions can jointly analyze transaction data to detect suspicious activity without exposing individual customer details, supporting secure, privacy-first anti-money laundering efforts.

-

Enhanced Blockchain Security: Integrating FHE with blockchain mixers allows secure computations on encrypted data, addressing privacy concerns in transparent ledger systems and enabling new use cases for sensitive financial data.

-

Secure Federated Learning: FHE enables institutions to train machine learning models on encrypted data across multiple parties, preserving privacy and compliance while improving fraud detection and risk assessment.

-

Future-Proof Privacy Solutions: As regulatory scrutiny increases, FHE mixers offer a scalable and adaptable privacy framework that keeps pace with evolving compliance standards and technological advancements.

This approach unlocks a new paradigm: privacy-preserving compliance. As explained by Zama, a leader in the space who recently became the first $1B FHE unicorn (Coinpaper): regulatory compliance demands auditability but not radical transparency. With FHE-powered mixers, institutions can provide cryptographic proofs of compliance without revealing customer identities or transaction specifics.

Real-World Applications: Institutional Crypto Privacy Meets Regulation

The promise of FHE isn’t just theoretical, it’s already being explored across multiple financial use cases:

- Collaborative AML Analysis: Banks can collectively analyze transaction graphs for suspicious activity while keeping individual customer data private (arxiv.org).

- Federated Learning: Institutions train shared machine learning models on encrypted data sets, no raw data exchanges required (arxiv.org).

- Blockchain Security: Sensitive computations occur on-chain without exposing confidential details, enhancing both security and utility (ScienceDirect.com).

This is more than just an incremental step forward, it’s a fundamental shift in how regulated mixers can deliver real-world value for enterprises who demand both secrecy and legal clarity.

But as with any disruptive innovation, the road to mainstream adoption of fully homomorphic encryption mixers comes with its own set of obstacles. For many institutional players, the primary concern is performance: FHE computations have historically been resource-intensive, leading to slower transaction speeds and increased costs. However, this landscape is changing quickly as research teams and startups race to optimize FHE protocols and develop hardware accelerators purpose-built for encrypted computation.

Recent advancements are closing the gap between privacy and usability. For example, hybrid frameworks now combine FHE with other cryptographic techniques to balance speed and security. Hardware accelerators, as detailed in recent studies (arxiv.org), are slashing computational overhead, making it feasible for regulated mixers to process large transaction volumes without sacrificing compliance or confidentiality.

The Future of Institutional Crypto Privacy: From Theory to Practice

The implications of institutional crypto privacy FHE go far beyond simple anonymity. We’re talking about a future where banks, asset managers, and even governments can participate in digital asset markets without exposing sensitive data or running afoul of evolving regulations. Imagine a regulated mixer that can provide zero-knowledge proofs to auditors or regulators, demonstrating full AML compliance, while ensuring that no private information ever leaves the encrypted domain.

This isn’t just wishful thinking; pilot projects are already underway across Europe and Asia where compliance teams leverage FHE-powered systems for secure due diligence and transaction monitoring. The technology’s ability to enable reversible unlinkability, where transactions are private by default but can be selectively disclosed under legal compulsion, offers a compelling middle ground between absolute privacy advocates and regulatory authorities (ScienceDirect.com).

What’s Next for Regulated Mixers?

The next phase of evolution will likely see greater collaboration between cryptographers, compliance officers, and policymakers. As platforms like Zama push the envelope on commercial-grade FHE solutions, and as more jurisdictions clarify their stance on compliant privacy, expect FHE regulated mixers to become a foundational layer for institutional crypto adoption.

Top Emerging FHE Use Cases in Regulated Crypto Mixers

-

Privacy-Preserving AML Compliance: FHE enables mixers to run anti-money laundering (AML) checks on encrypted transaction data, allowing platforms to detect suspicious activity without exposing user details. This approach supports compliance with regulations while maintaining user privacy.

-

Regulator-Ready Auditing: With FHE, mixers can provide auditors or regulatory bodies with verifiable proofs of compliance—such as transaction legitimacy or KYC status—without revealing underlying sensitive data. This balances transparency with confidentiality.

-

Secure Federated Learning for Risk Detection: Mixers and financial institutions can use FHE to collaboratively train machine learning models on encrypted transaction data, improving fraud and risk detection while ensuring no party accesses raw user information.

-

Conditional Data Disclosure: FHE allows mixers to offer conditional privacy, enabling users or platforms to selectively disclose transaction details (for example, in response to a legal request) without compromising the privacy of unrelated data.

-

Enhanced Blockchain Privacy: Integrating FHE with blockchain-based mixers enables computations on encrypted data directly on-chain, protecting user privacy even in transparent ledger environments and expanding the use of mixers in regulated settings.

If you’re an enterprise considering privacy-centric crypto operations, now’s the time to start evaluating these new tools. The convergence of regulatory clarity and technical maturity means that compliant privacy is no longer a contradiction, it’s rapidly becoming best practice.

The bottom line? Fully homomorphic encryption isn’t just a buzzword or academic curiosity anymore. It’s the linchpin for building trust in digital finance, a way for institutions to embrace blockchain innovation without compromising on either user confidentiality or regulatory obligations.