As the regulatory landscape for cryptocurrencies evolves, Know-Your-Transaction (KYT) has emerged as a cornerstone of compliance in privacy-focused crypto services. For regulated mixers, which offer transaction confidentiality while adhering to legal frameworks, KYT provides a critical bridge between user privacy and regulatory obligations. By enabling real-time monitoring and risk assessment of crypto flows, KYT helps these platforms detect suspicious activity, prevent money laundering, and maintain trust with both users and authorities.

Why KYT Matters for Regulated Mixers

Unlike traditional Know-Your-Customer (KYC) processes that focus on identifying individuals, KYT zeroes in on the behavior of transactions themselves. In the context of mixers, services designed to obfuscate transaction trails, this distinction is essential. Regulators worldwide are increasingly scrutinizing mixers due to their potential misuse for illicit finance. However, regulated mixers can leverage KYT to demonstrate proactive compliance without sacrificing user privacy.

KYT enables continuous transaction monitoring within the mixer ecosystem. Each incoming and outgoing transfer is analyzed for red flags such as abnormal volume spikes, rapid movement across wallets, or links to high-risk jurisdictions. According to Chainalysis, this real-time scrutiny is vital for identifying patterns associated with money laundering or terrorist financing before they become systemic threats.

Core Functions of KYT in Crypto AML Technology

Top 5 Ways KYT Enhances AML Compliance in Crypto Mixers

-

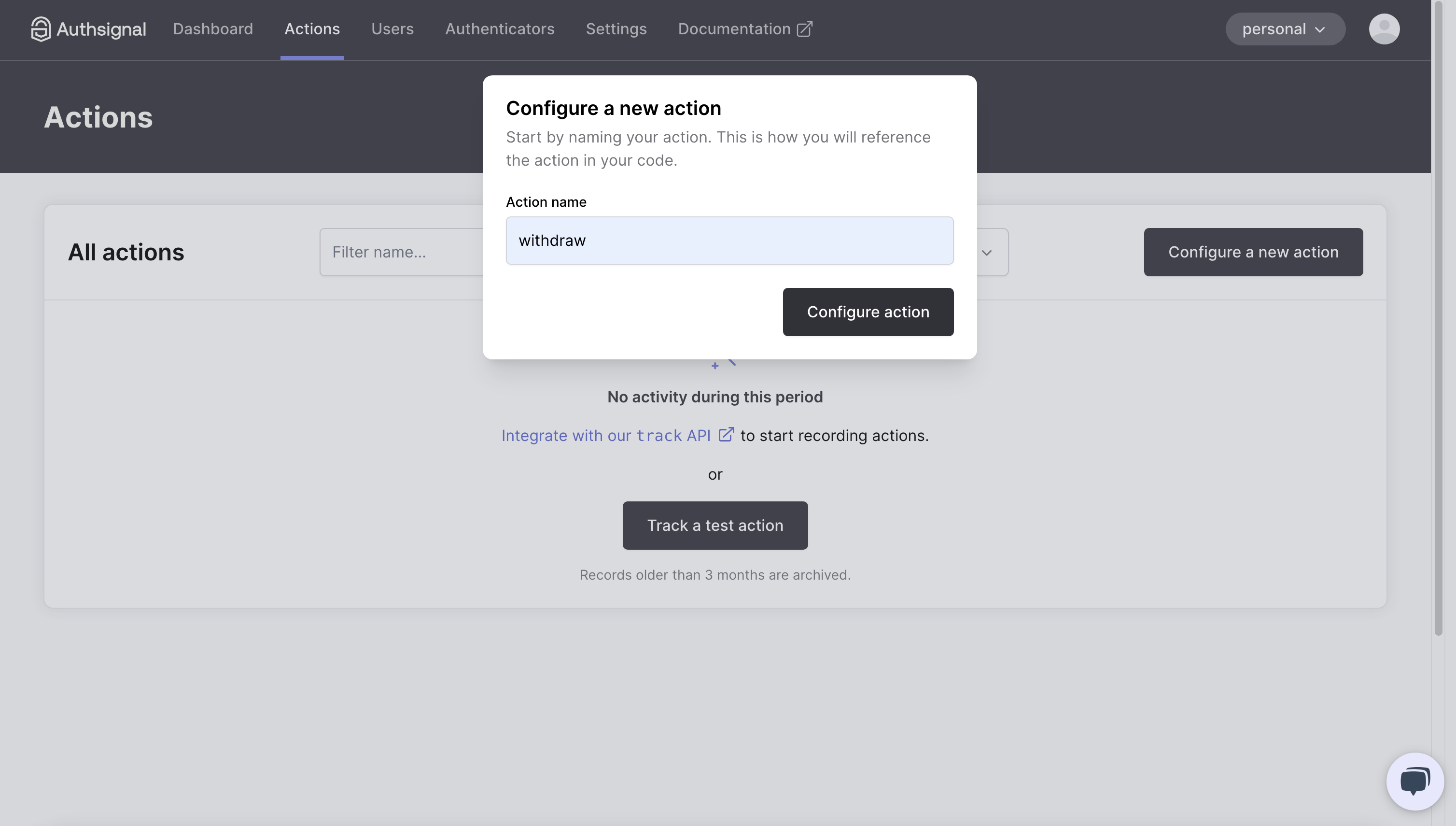

Real-Time Transaction Monitoring: KYT systems like Chainalysis KYT provide continuous, real-time monitoring of all transactions within regulated mixers, enabling immediate detection of suspicious activity and potential AML breaches.

-

Risk Assessment and Scoring: Solutions such as TheExChain KYT assign risk scores to each transaction based on factors like size, origin, and destination, helping compliance teams prioritize investigations and focus on high-risk activities.

-

Pattern Analysis and Anomaly Detection: Platforms like AML Crypto.io KYT analyze transaction patterns to identify anomalies, such as rapid fund movements across multiple wallets—common indicators of money laundering attempts.

-

Integration with Sanctions and Watchlists: KYT tools cross-reference wallet addresses and transactions against global sanctions lists, ensuring regulated mixers avoid processing funds linked to sanctioned entities or individuals.

-

Regulatory Reporting and Audit Trails: Leading KYT solutions generate comprehensive reports and maintain detailed audit trails, supporting transparent compliance and facilitating regulatory audits and investigations.

The effectiveness of KYT crypto compliance hinges on several advanced analytics capabilities:

- Real-Time Transaction Monitoring: Automated systems scan every mixer transaction as it happens, flagging anomalies instantly.

- Risk Scoring: Transactions receive dynamic risk scores based on factors like size, frequency, origin wallet reputation, and destination analysis.

- Anomaly Detection: Sophisticated algorithms identify unusual behavior such as rapid cycling through multiple wallets or attempts at layering funds, common techniques in illicit finance.

- Sanctions Screening: Mixer addresses are cross-referenced with global watchlists to prevent interaction with sanctioned entities or individuals.

- Regulatory Reporting: Comprehensive audit trails ensure that all flagged activity can be documented and disclosed to authorities when necessary.

This multi-layered approach not only helps platforms meet Anti-Money Laundering (AML) requirements but also reassures users that their privacy does not come at the expense of legal integrity. For more detail on how these features work in practice, see this overview from AML Crypto. io.

The Shift from KYC to Holistic Transaction Monitoring

The move toward comprehensive transaction monitoring signals a new paradigm in financial compliance. While KYC remains essential for user onboarding, it is no longer sufficient by itself, especially given the pseudonymous nature of blockchain transactions. As noted by industry leaders like Scorechain and ChainUp, integrating KYT with existing KYC procedures creates a robust defense against both known and emerging threats in the digital asset space.

This integrated stance allows regulated mixers to maintain operational transparency while delivering privacy-centric services that comply with global standards. As regulators continue to refine expectations around virtual asset service providers (VASPs), those who invest early in KYT technology will be best positioned to thrive amid tightening oversight.