For anyone who values both privacy and compliance in crypto, the stablecoin landscape has reached a fascinating crossroads. As regulatory frameworks like the EU’s Markets in Crypto-Assets Regulation (MiCA) gain traction, users and institutions are seeking ways to keep their transactions private without stepping outside the law. This is where regulated crypto mixers step up, offering an innovative balance between confidentiality and legal accountability for stablecoin transactions.

![]()

Why Stablecoin Privacy Matters More Than Ever

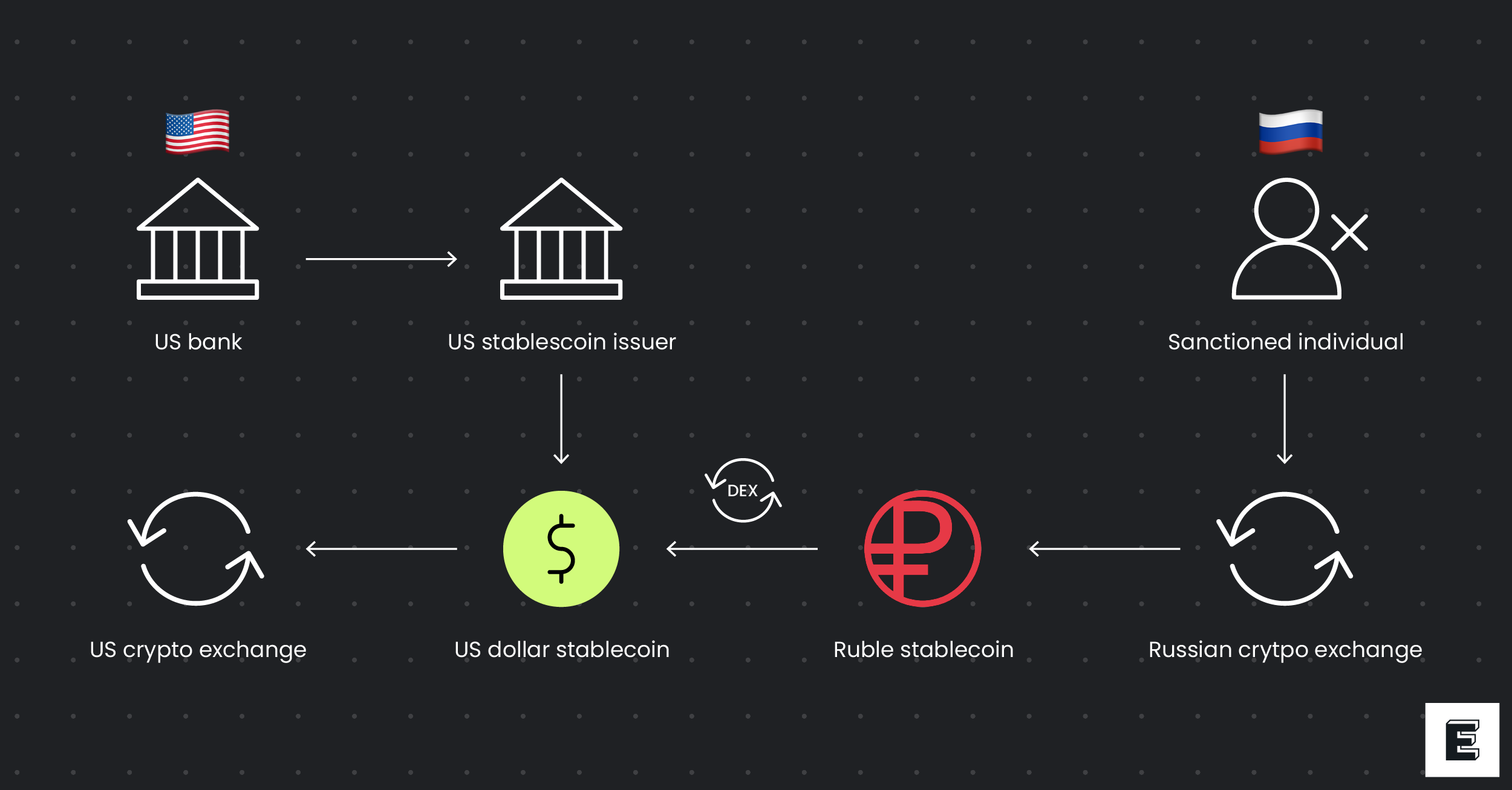

Stablecoins like USDT and USDC have become the backbone of many crypto portfolios thanks to their price stability. But with this popularity comes increased scrutiny from regulators, especially as concerns about money laundering and illicit finance grow. For everyday users, privacy isn’t just about hiding something shady – it’s about protecting sensitive business information, safeguarding personal finances, and retaining autonomy in a world that’s increasingly surveilled.

The catch? Traditional mixers have faced major takedowns for enabling money laundering (think ChipMixer and Bitzlato), leaving users in a bind: How do you achieve transaction privacy while remaining compliant with tough anti-money laundering (AML) laws?

The Rise of Regulated Crypto Mixers

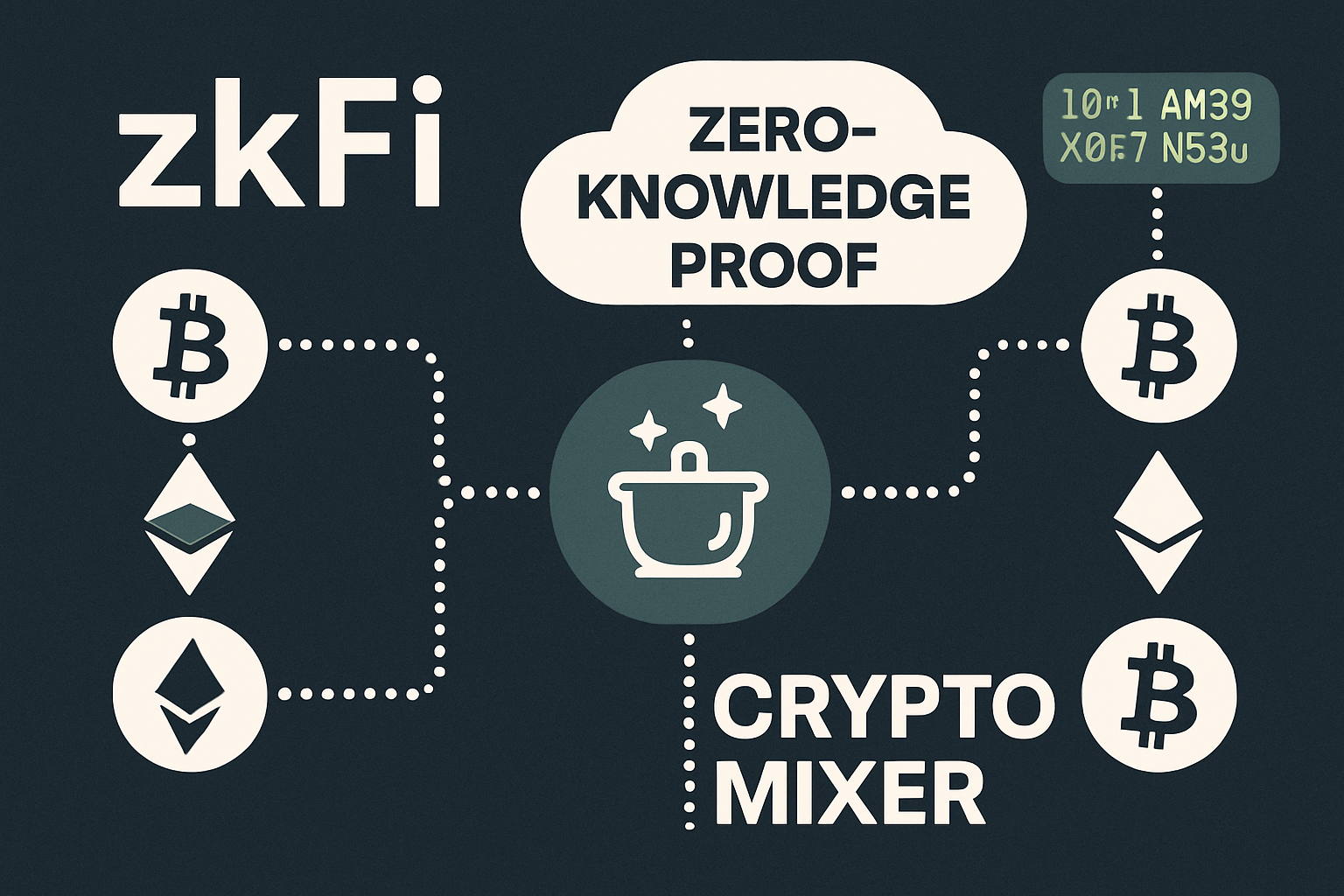

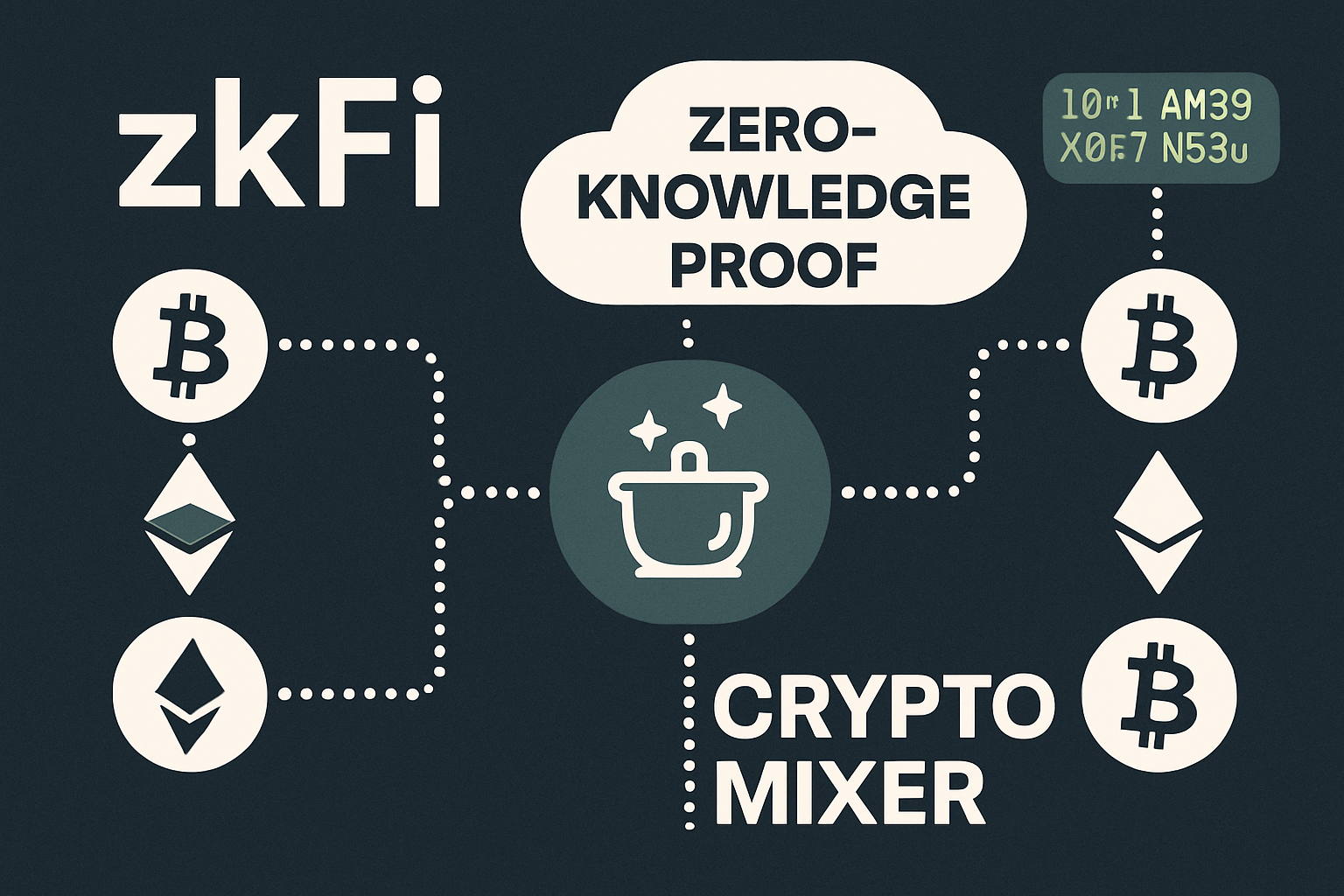

This is where regulated cryptocurrency tumblers come into play. Unlike old-school mixers that operated in the shadows, today’s solutions are designed to meet global standards like MiCA, GDPR, and evolving AML rules. These mixers use advanced cryptography – think zero-knowledge proofs (as seen with protocols like zkFi) or selective de-anonymization (like SeDe) – to anonymize transactions while maintaining an auditable trail that can satisfy regulators if required.

Chainalysis explains how modern mixers can be structured to comply with anti-money laundering law by building in controls for Know Your Customer (KYC) checks or allowing legal authorities limited access under specific circumstances. The result? You get privacy-preserving crypto transactions that don’t put your assets or reputation at risk.

Key Features of AML Compliant Mixers for Stablecoins

-

Selective De-anonymization: Protocols like SeDe use cryptography to keep transactions private, but allow details to be revealed to authorities when required, balancing privacy with regulatory needs.

-

Zero-Knowledge Proofs: Solutions such as zkFi employ zero-knowledge proofs to verify transaction validity without exposing user data, ensuring confidentiality and compliance.

-

Regulatory Integration: AML-compliant mixers integrate with frameworks like the EU Markets in Crypto-Assets (MiCA) Regulation, ensuring stablecoin transactions meet legal standards for anti-money laundering and consumer protection.

-

Auditability and Transparency: Leading mixers provide auditable logs and compliance reports, enabling trusted oversight without compromising user privacy.

-

Sanctions Screening: Platforms such as Elliptic offer transaction monitoring and sanctions screening tools, helping mixers prevent illicit activity while supporting privacy-preserving transactions.

Navigating MiCA: What Compliance Looks Like Today

The EU’s MiCA framework is setting a new gold standard for crypto regulation by unifying rules across member states. It specifically addresses risks around market manipulation, financial instability, and consumer protection – all hot topics when discussing stablecoins. Under MiCA, both issuers and service providers must comply with strict licensing requirements, robust AML/CFT checks, and transparent reporting obligations.

This means that any mixer offering privacy services for stablecoins in Europe must be able to prove it isn’t facilitating illicit activity. The latest generation of regulated crypto mixers are rising to this challenge by integrating compliance features directly into their protocols – ensuring that users can enjoy USDT mixing legal, secure transactions without running afoul of new rules.

What’s especially exciting is how these innovations are pushing the boundaries of what’s possible in crypto privacy. Instead of a black-and-white choice between total anonymity and full transparency, users now have access to nuanced options. For example, protocols like SeDe allow for selective de-anonymization: your transaction remains private unless there’s a legitimate regulatory request, at which point only the necessary details can be disclosed. This selective approach helps address concerns about illicit finance while preserving the everyday privacy needs of legitimate users.

Meanwhile, zero-knowledge proof systems like those used in zkFi are game-changers for stablecoin privacy compliance. These cryptographic techniques let you prove that a transaction meets all legal requirements, such as AML checks, without revealing any underlying personal or transaction details. It’s a win-win: regulators get assurance that laws are followed, while users keep their financial activities confidential.

Practical Benefits for Crypto Users and Institutions

Let’s break down why this matters for real people and businesses:

Top Advantages of Regulated Crypto Mixers for Stablecoin Users

-

Enhanced Privacy Without Sacrificing Compliance: Regulated mixers like SeDe use advanced cryptography to anonymize stablecoin transactions, while still allowing selective de-anonymization for regulatory checks. This means users can enjoy privacy and meet legal requirements at the same time.

-

Zero-Knowledge Proofs for Confidentiality: Solutions such as zkFi leverage zero-knowledge proofs, ensuring transaction details remain confidential but verifiable for compliance. This technology empowers both individuals and organizations to transact securely with stablecoins.

-

Reduced Risk of Illicit Activity: By operating within regulatory frameworks like the EU’s MiCA regulation, these mixers help prevent misuse for money laundering or fraud, addressing major concerns linked to traditional, unregulated mixers.

-

Access to Regulated Stablecoin Ecosystems: MiCA-compliant mixers support stablecoins from authorized issuers, ensuring that privacy tools are available for widely-used assets without risking exclusion from regulated markets.

-

Trust and Transparency for Institutions: Regulated mixers provide auditability and clear compliance processes, making them suitable for organizations that require both privacy and the ability to demonstrate regulatory adherence.

For individuals, regulated mixers mean you can shield your spending patterns from prying eyes, think salary payments, business deals, or even charitable donations, while staying on the right side of the law. For institutions, it’s about protecting trade secrets and client confidentiality without risking regulatory backlash or reputational damage.

Regulated cryptocurrency tumblers also help crypto projects and exchanges demonstrate their commitment to compliance. By integrating these solutions, platforms can offer enhanced privacy features to users who demand them while maintaining full transparency with regulators, a critical factor as MiCA-style frameworks spread globally.

Looking Ahead: The Future of Stablecoin Privacy Compliance

The next wave of privacy tech is likely to be shaped by ongoing collaboration between developers, regulators, and industry leaders. As more jurisdictions adopt MiCA-like regulations, and as enforcement actions against non-compliant mixers ramp up, the demand for AML compliant mixers will only grow. Expect further advances in cryptography (think more robust zero-knowledge protocols), smarter selective disclosure mechanisms, and even automated compliance reporting tools built right into mixer platforms.

If you’re navigating this space today, it pays to stay nimble and informed. Choose regulated crypto mixers that not only promise privacy but also provide clear evidence of their compliance credentials. Look for transparent audit trails, robust KYC/AML processes where required, and technical integrations with leading stablecoins like USDT or USDC.

Ultimately, the evolution of privacy preserving crypto transactions is about giving users choice, not forcing them to compromise between security and legality. With MiCA raising the bar across Europe (and influencing policy worldwide), regulated mixers are poised to become essential infrastructure for anyone serious about both privacy and compliance in digital finance.