Bitcoin’s public ledger is a double-edged sword: it guarantees transparency but leaves every transaction open for the world to see. If you’re serious about privacy yet want to stay compliant, regulated crypto mixers are your best bet. With Bitcoin currently trading at $114,595 (as of September 30,2025), privacy-conscious users are increasingly seeking solutions that don’t put them on the wrong side of the law.

Why Use Regulated Crypto Mixers in 2025?

The days of “anything goes” Bitcoin mixing are over. Regulators worldwide have cracked down on unregulated mixers due to their potential misuse for money laundering and sanctions evasion. But not all mixers are created equal. Regulated crypto mixers blend your coins with others while adhering to strict Know Your Customer (KYC) and Anti-Money Laundering (AML) standards. That means you get robust privacy for your transactions, without risking legal trouble.

This approach is now essential for anyone moving significant volumes or operating in regions with aggressive enforcement. As highlighted by recent reports from Chainalysis and Merkle Science, compliant bitcoin mixing services can offer a legitimate path to privacy in an era of heightened scrutiny.

How Regulated Crypto Mixers Work: Privacy Without Paranoia

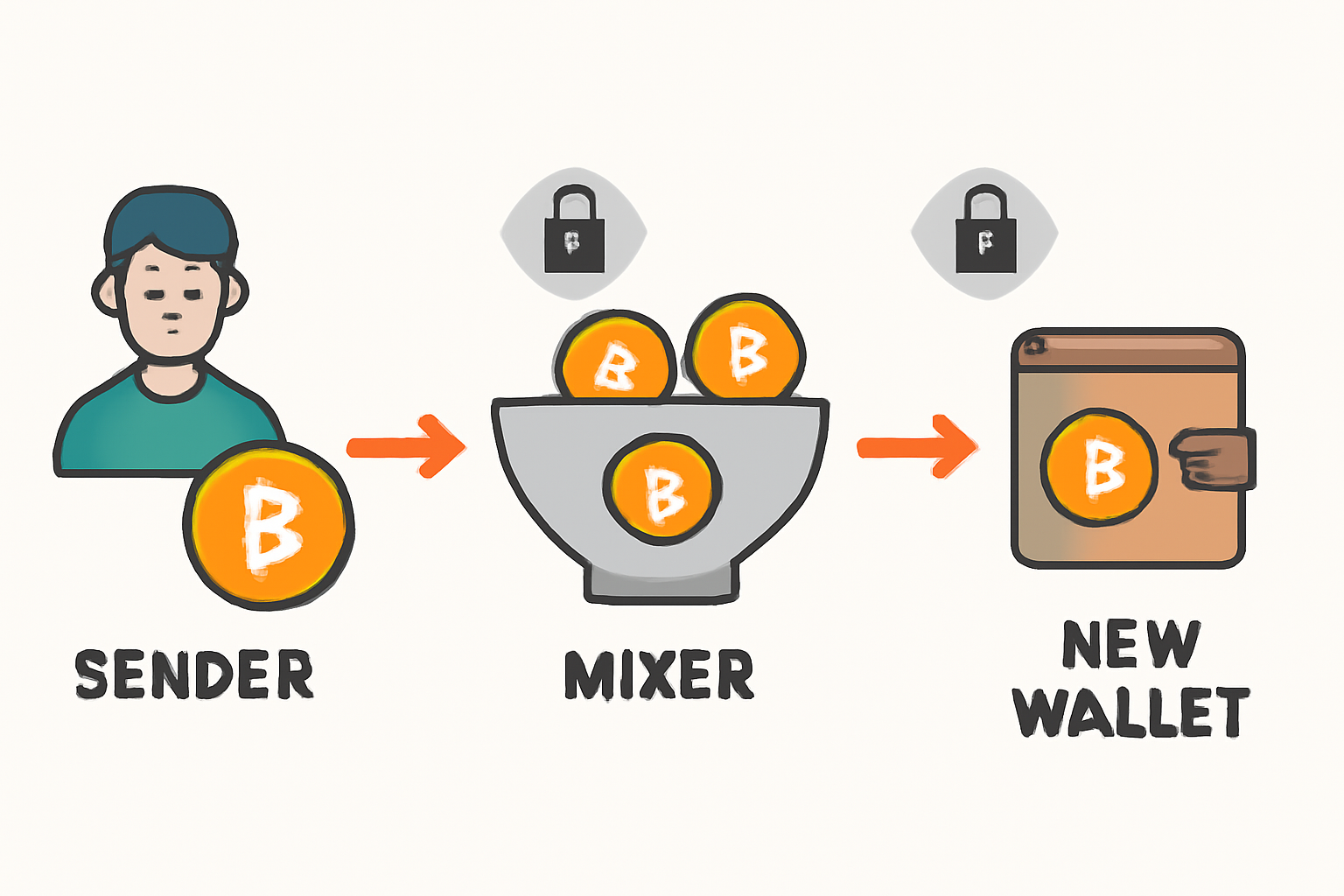

At their core, regulated mixers function much like traditional ones, they pool funds from multiple users and redistribute them, breaking the link between sender and recipient addresses. The difference? Compliance is built in from the ground up.

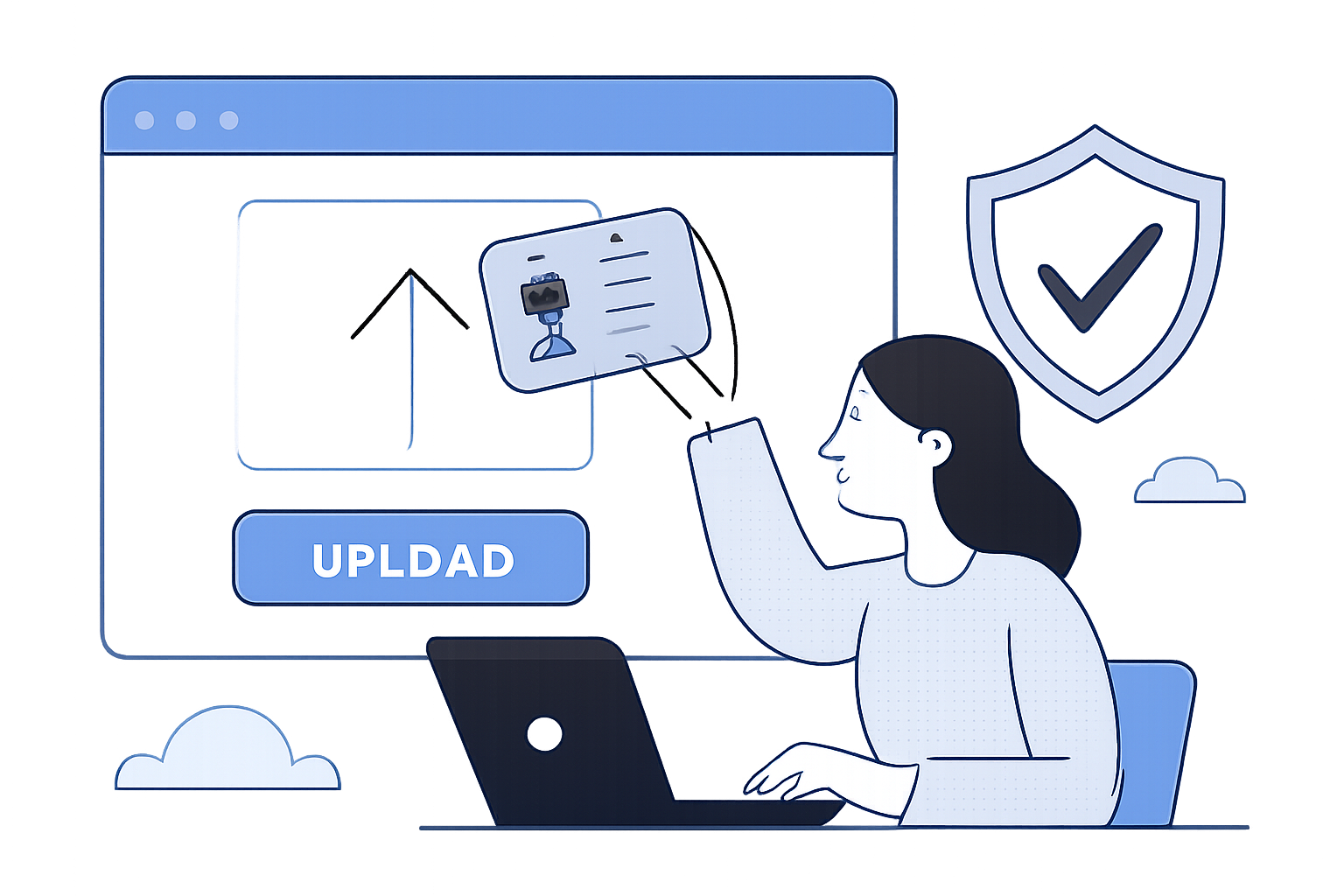

- KYC Onboarding: Users must verify their identity before using the service.

- AML Monitoring: Transactions are screened against global watchlists and suspicious activity triggers.

- Transparent Operations: Many regulated mixers publish audit results or hold certifications from recognized authorities.

This hybrid model delivers both enhanced privacy and peace of mind, no more worrying about tainted coins or blacklists when you move assets to exchanges or custodians.

Top Benefits of Using Regulated Crypto Mixers

-

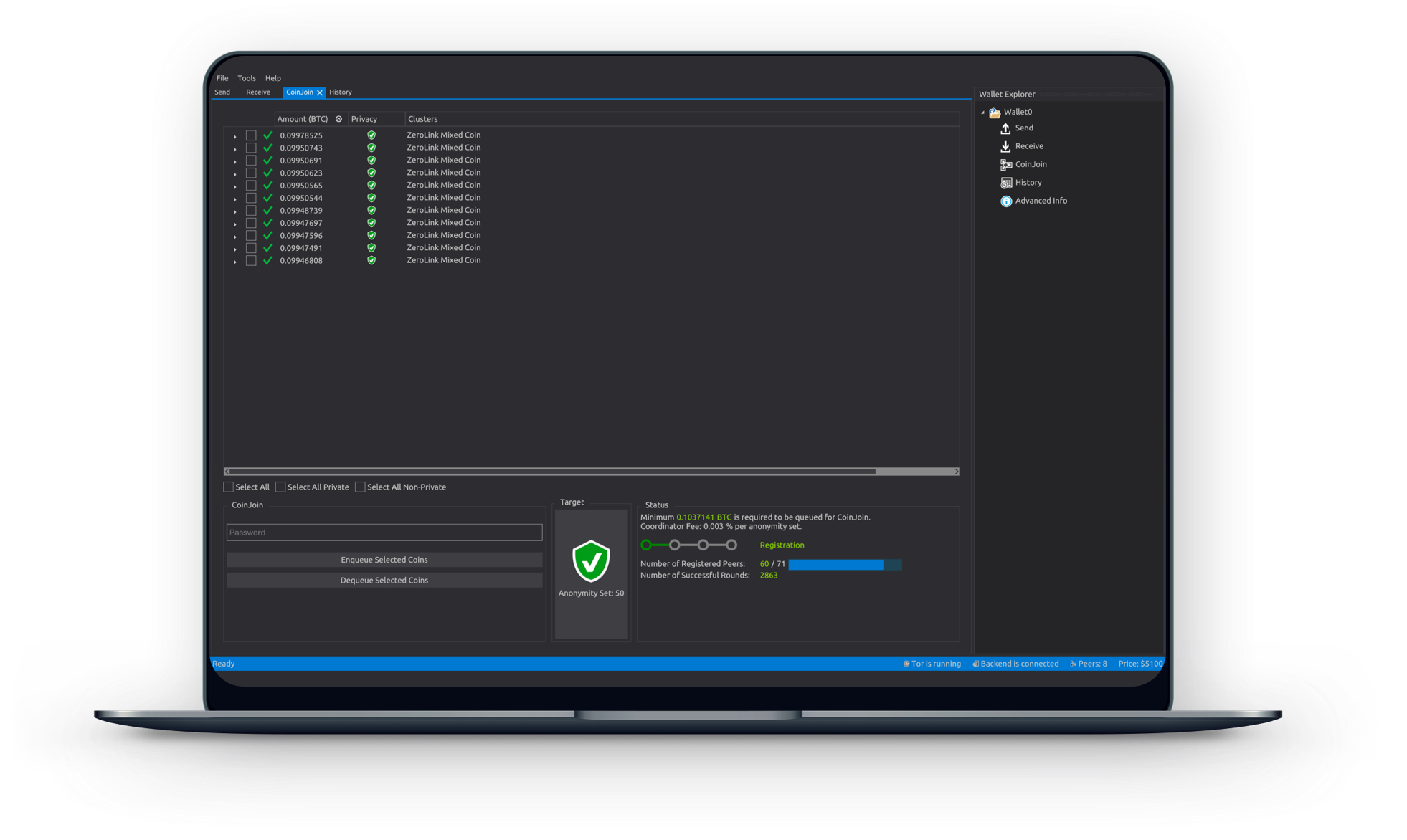

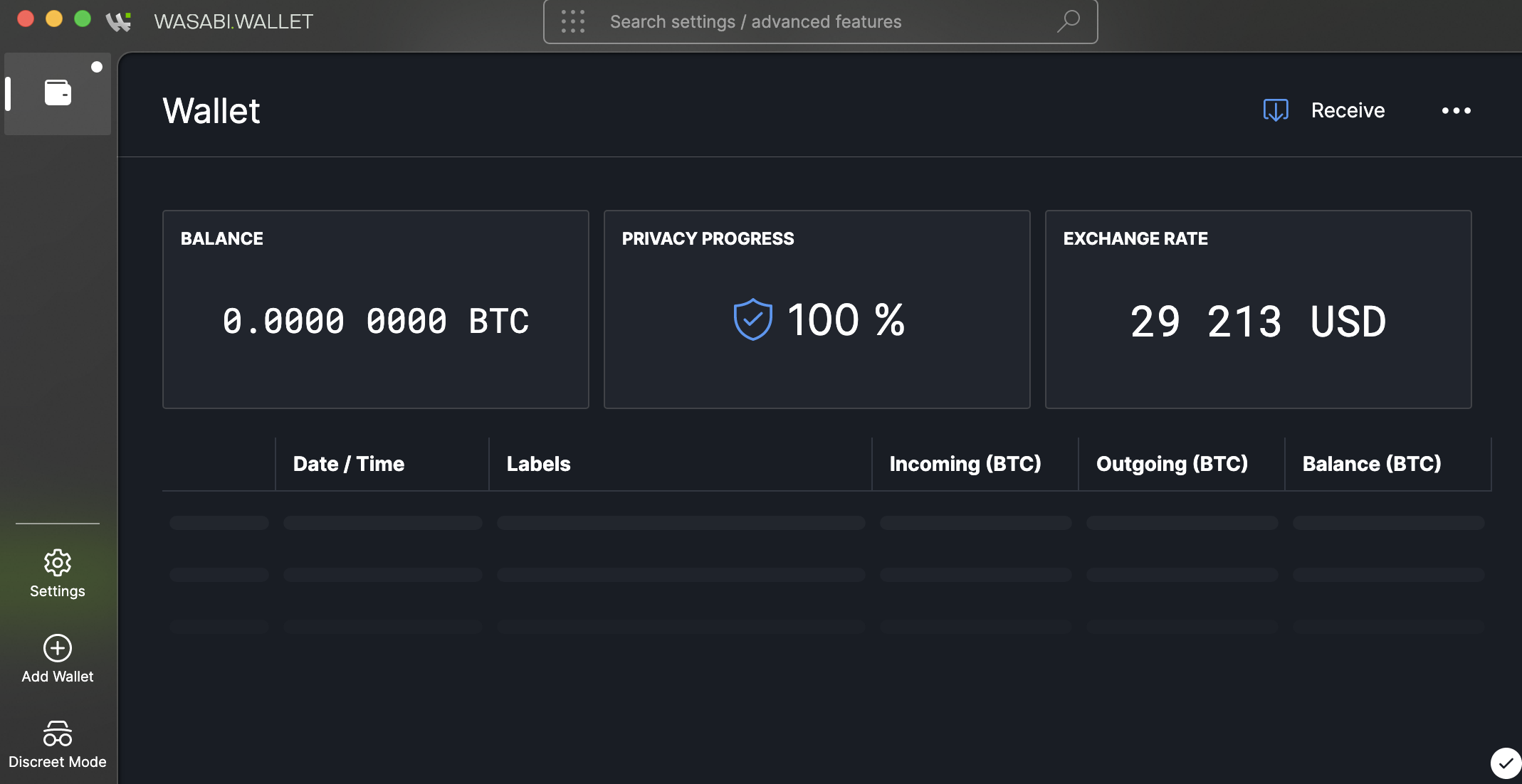

Enhanced Transaction Privacy: Regulated crypto mixers like CoinJoin and Wasabi Wallet break the direct link between sender and receiver, making it much harder to trace your Bitcoin transactions on the public blockchain.

-

Compliance with Legal Standards: These mixers implement KYC and AML protocols, ensuring your transactions meet regulatory requirements and reducing the risk of inadvertently violating the law.

-

Reduced Risk of Sanctions or Account Freezes: By using regulated services, you minimize the chance of your funds being flagged or frozen by exchanges and wallet providers that screen for illicit activity.

-

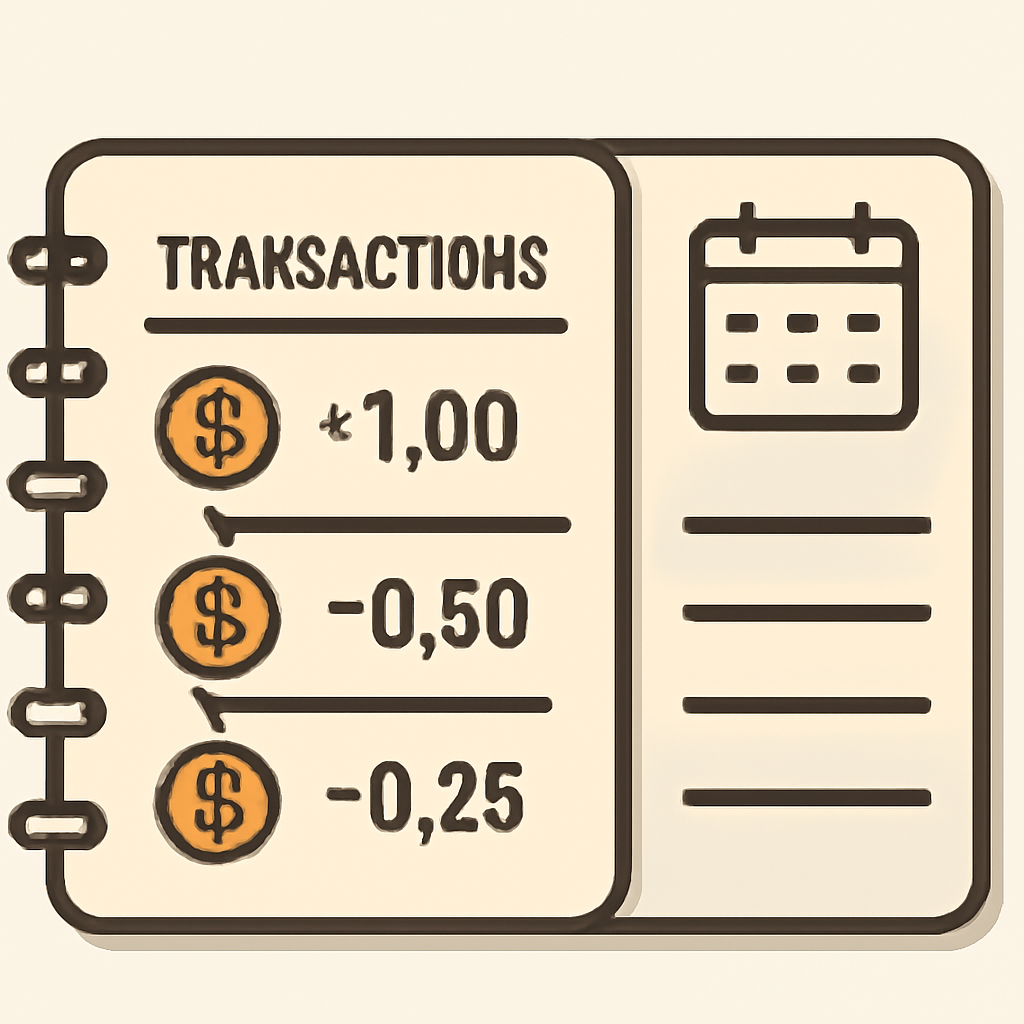

Transparent Audit Trails: Many regulated mixers provide transaction records and receipts, making it easier to document your Bitcoin activity for tax reporting or dispute resolution.

-

Peace of Mind for Institutional and Individual Users: Knowing that your privacy measures are compliant allows both individuals and businesses to operate confidently, without fear of regulatory backlash or reputational harm.

Your Step-by-Step Guide to Privacy-Compliant Bitcoin Mixing

If you’re ready to shield your BTC transactions without running afoul of regulators, here’s how to do it right:

1. Research and Choose Wisely: Not all services are equal! Look for mixers that openly display their compliance credentials, think third-party audits or regulatory certifications.

2. Prepare Your Documents: Have your ID handy for KYC checks. This step might feel counterintuitive if you value anonymity, but it’s essential for legal operation.

3. Understand the Process: You’ll send your BTC to the mixer’s address; after a specified delay (which you can often customize), your freshly mixed coins arrive at your destination address, minus any service fees.

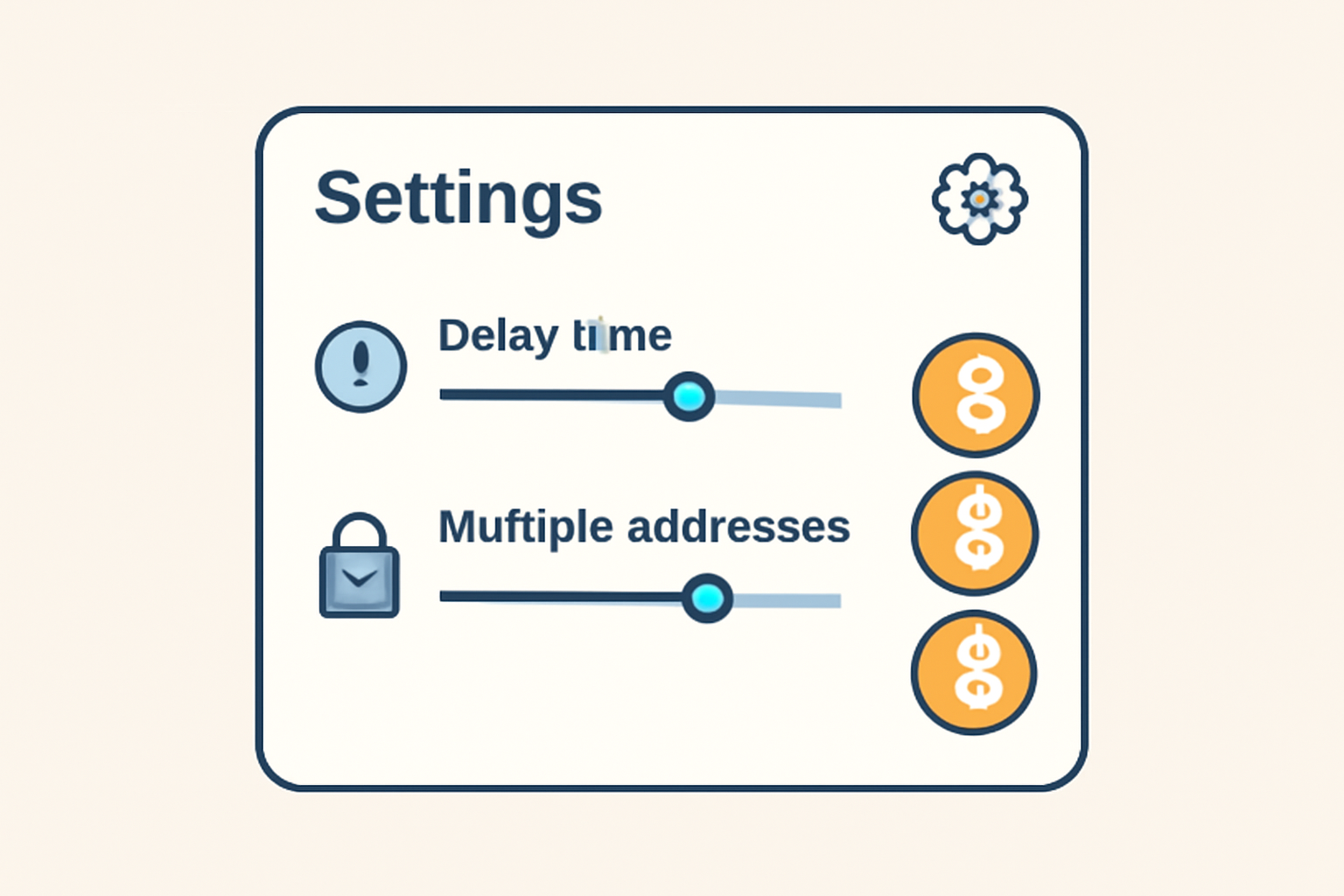

4. Set Privacy Preferences: Some platforms let you split funds across several addresses or schedule delayed payouts for maximum obfuscation.

5. Track Fees and Limits: Regulated services may cost a bit more due to compliance overhead, but that’s the price of peace of mind!

6. Keep Detailed Records: Don’t skip this! Save receipts, transaction hashes, and time stamps for every step. These records could be crucial for tax reporting or if you ever need to prove the source of your funds to an exchange or regulator.

Avoiding Pitfalls: What Not to Do When Mixing Bitcoin

Even with compliant bitcoin mixing, a few missteps can land you in hot water. Here’s what savvy users avoid:

Common Mistakes to Avoid with Regulated Crypto Mixers

-

Skipping KYC Verification: Many regulated mixers, such as CoinJoin.io, require Know Your Customer (KYC) checks. Failing to complete these steps can result in rejected transactions or account suspension. Always finish KYC to stay compliant.

-

Using Unregulated or Sanctioned Mixers: Services like Tornado Cash have faced sanctions and legal action. Using non-compliant mixers can expose you to legal risks and frozen funds. Stick to platforms that are transparent about regulatory adherence.

-

Neglecting Record-Keeping: Not saving transaction receipts, addresses, or timestamps can create headaches during audits or tax reporting. Use mixers that provide downloadable transaction logs and keep your own secure backup.

-

Overlooking Transaction Limits and Fees: Regulated mixers like Wasabi Wallet often have minimum and maximum limits, plus higher fees due to compliance. Double-check these details before mixing to avoid failed transactions or unexpected costs.

-

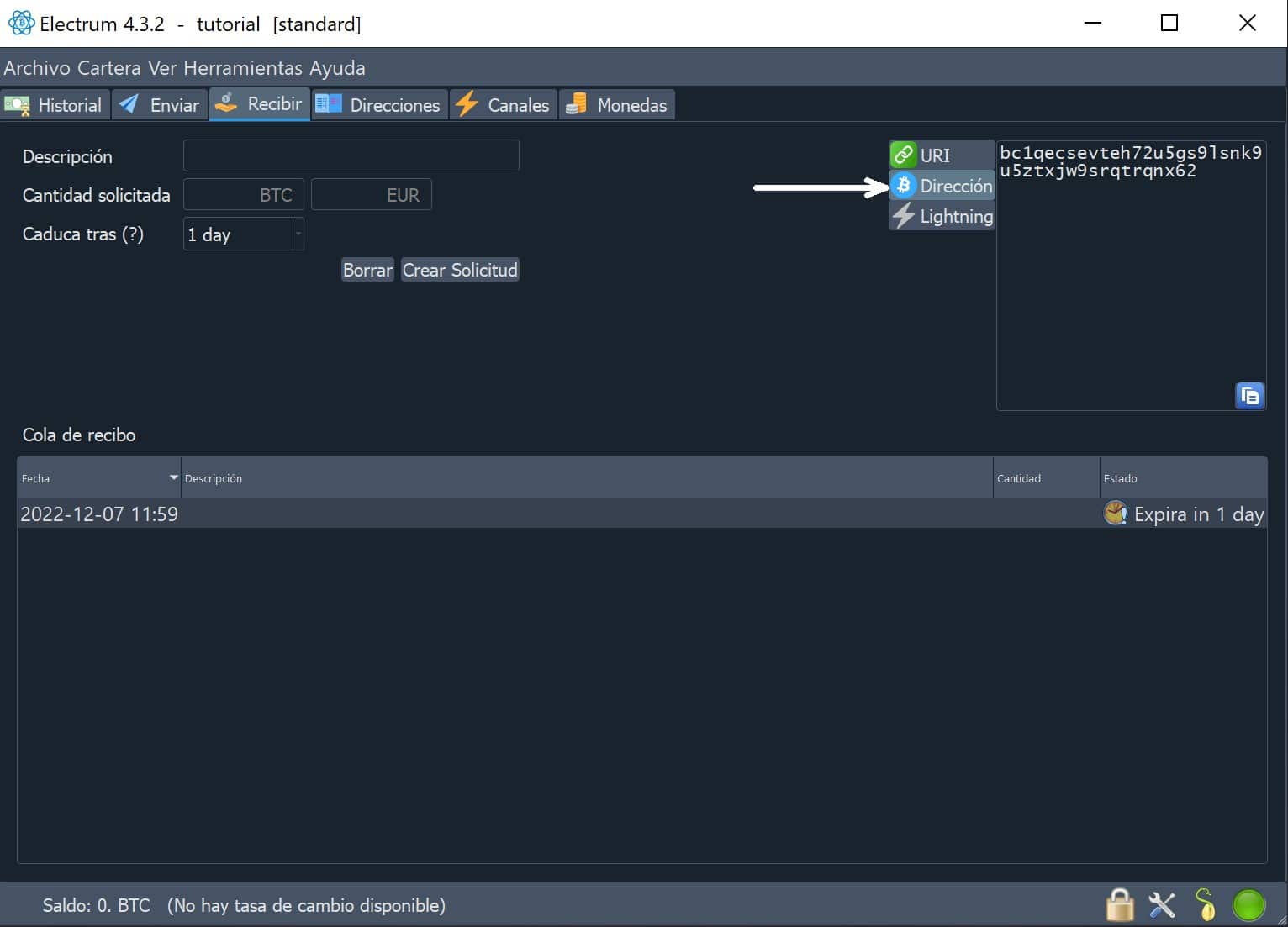

Sending Funds Directly from or to Exchanges: Many exchanges monitor for mixed coins and may freeze accounts if they detect mixer involvement. Instead, use non-custodial wallets like Electrum for receiving mixed coins before moving them to an exchange.

-

Ignoring Jurisdictional Laws: Crypto regulations differ by country. Using mixers in restricted regions—even if they are regulated elsewhere—can still be illegal. Always check your local laws before using any mixer service.

Skip unregulated mixers entirely. They may offer lower fees or skip KYC, but they also put your assets at risk of seizure, blacklisting, or legal repercussions. Exchanges are increasingly screening and banning mixed coins from dubious sources.

Don’t ignore your jurisdiction’s rules. Crypto regulations vary by country and can change quickly. Always check that your chosen mixer operates legally where you live.

Avoid mixing coins linked to illicit activity. Even with a regulated service, if your BTC is tainted from hacks or scams, reputable mixers will flag and reject those transactions.

Regulated Mixers vs. Privacy Coins and Layer 2: What’s Best for You?

With Bitcoin at $114,595, privacy is more valuable than ever – but so is compliance. While privacy coins like Monero (XMR) offer built-in anonymity features such as stealth addresses and ring signatures, they’re often delisted from major exchanges due to regulatory pressure. Layer 2 options like the Lightning Network provide some off-chain privacy but aren’t a silver bullet for full transaction obfuscation.

If you want the best of both worlds – robust privacy plus peace of mind – regulated crypto mixers are hard to beat. They let you transact confidently on mainstream platforms without worrying about future compliance headaches.

The key takeaway? Privacy and legality don’t have to be at odds. By choosing secure crypto mixers that prioritize regulatory compliance, you protect both your financial privacy and your reputation in the evolving crypto ecosystem.

Ready to Mix? Your Next Steps

If you’re ready to start mixing securely and compliantly:

- Vet services thoroughly: Look for transparency around KYC/AML protocols and audit history.

- Stay informed: Regulations evolve fast; subscribe to updates from trusted crypto compliance sources.

- Document everything: Treat every transaction as if it could be audited later.

The bottom line? As Bitcoin hovers above six figures, the stakes have never been higher for privacy-compliant bitcoin transactions. With a little diligence and the right tools, you can enjoy true financial sovereignty without sacrificing legality or security.