Privacy and compliance can feel like they’re on opposite sides of the crypto spectrum, but regulated USDT mixers are proving that you don’t have to pick just one. If you’re moving Tether (USDT) and want to keep your transactions confidential without crossing regulatory lines, it’s all about choosing the right tools and understanding the evolving landscape.

Why USDT Privacy Matters in 2025

USDT, as a leading stablecoin, is everywhere – from DeFi protocols to cross-chain swaps to simple peer-to-peer payments. But with popularity comes scrutiny. Every transaction on blockchains like Tron (TRX), Ethereum (ERC20), or Solana (SOL) is public by default. That means your wallet balances, transaction history, and even your spending patterns are open for anyone to analyze. For individuals and businesses alike, this level of transparency can be a privacy nightmare.

Enter the regulated USDT mixer: a service designed to obscure the transaction trail while still meeting legal requirements. Unlike old-school mixers that operated in regulatory gray zones, today’s compliant cryptocurrency mixers are built with both privacy and lawfulness in mind.

The Compliance Tightrope: Mixers Under the Microscope

The regulatory heat is real. After high-profile cases like Tornado Cash’s OFAC sanctions for facilitating illicit flows (

How Regulated Mixers Keep You Both Private and Legal

The new wave of compliant cryptocurrency mixers isn’t about hiding from the law – it’s about using technology smartly so you can protect your financial privacy without risking sanctions or bans.

Key Features of Regulated USDT Mixers

-

Robust AML & KYC Protocols: Regulated USDT mixers implement anti-money laundering (AML) and know-your-customer (KYC) checks, verifying user identities and monitoring transactions to comply with FinCEN and global regulations.

-

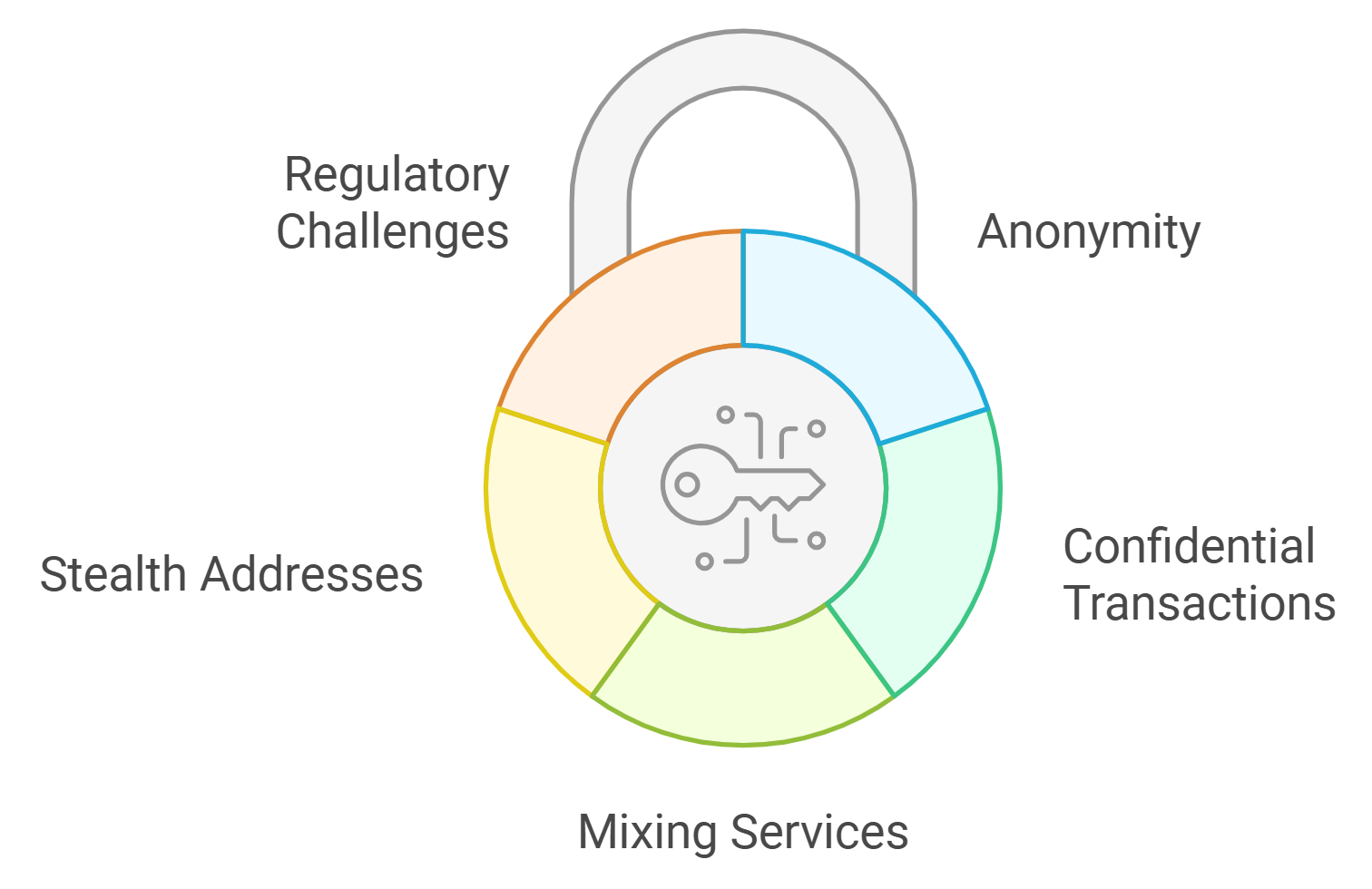

Selective De-Anonymization Capabilities: Advanced mixers like those using Selective De-Anonymization (SeDe) allow privacy for legitimate users while enabling authorities to trace illicit transactions through multi-party consensus.

-

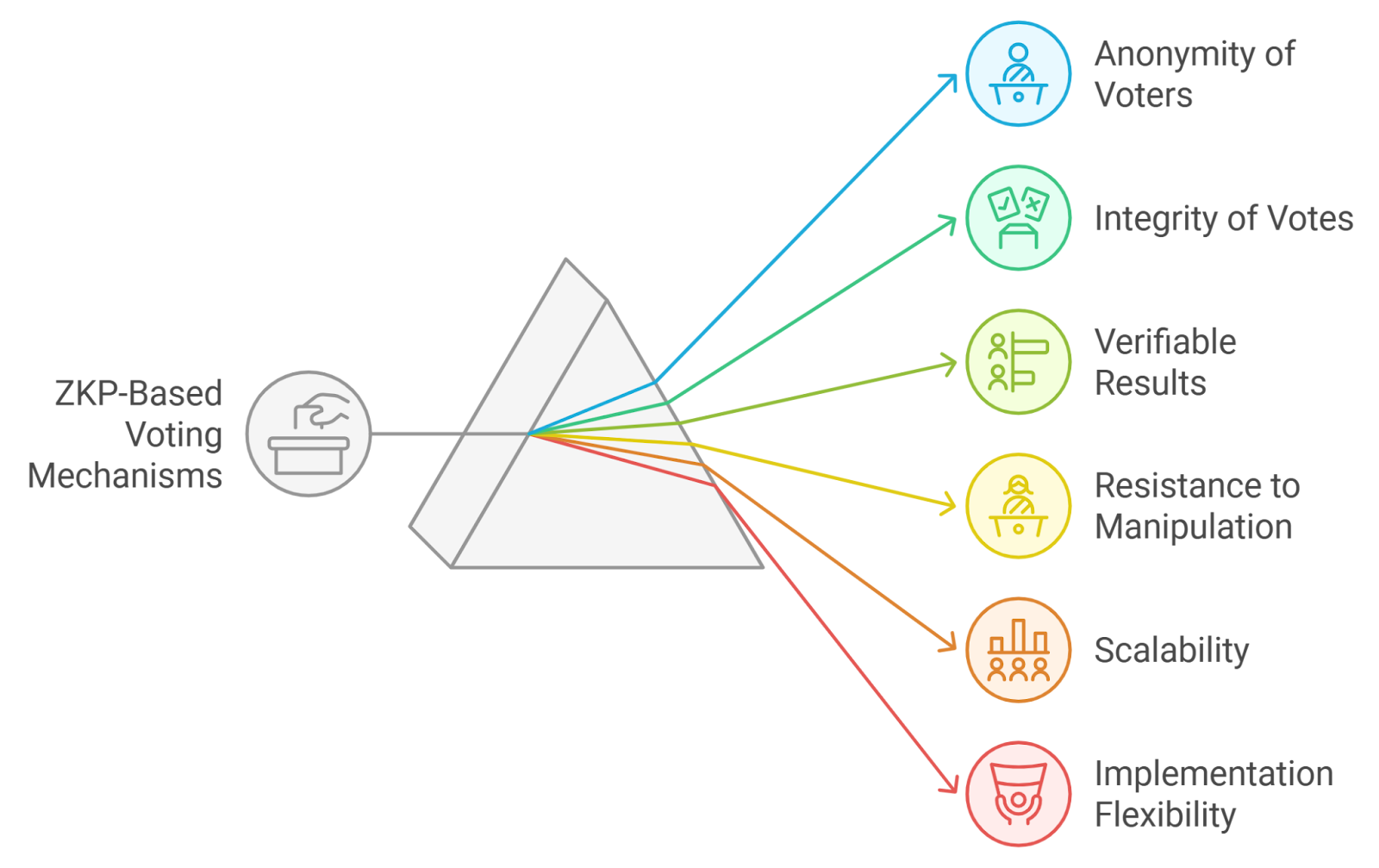

Zero-Knowledge Proof Integration: Leading platforms are adopting zero-knowledge proofs (e.g., zkMixer) to verify transaction legitimacy without revealing sensitive user data, balancing privacy with regulatory needs.

-

Configurable Governance & Compliance Controls: Some regulated mixers offer customizable governance—for example, the ability to freeze or refund suspicious deposits—ensuring compliance with sanctions and anti-crime directives.

-

Transparent Audit Trails: Unlike unregulated services, compliant mixers maintain auditable records and cooperate with regulators when required, fostering trust and accountability.

-

Cross-Chain Privacy Solutions: Regulated USDT mixers often support cross-chain transactions, allowing privacy-preserving transfers across multiple blockchains while upholding compliance standards.

For example, frameworks like zkMixer offer configurable pools where users’ funds are mixed using zero-knowledge proofs for privacy, but with built-in governance that can freeze or refund deposits if criminal activity is suspected (arxiv.org). Selective De-Anonymization (SeDe) protocols allow for illicit transactions to be unraveled through consensus among trusted entities – keeping honest users safe while giving authorities a path to investigate real threats (arxiv.org).

The bottom line? With a regulated USDT mixer, you get robust privacy for everyday use – not blanket secrecy for bad actors.

Your Checklist: Using USDT Mixers Without Breaking Compliance

If you value both your privacy and your peace of mind, here’s what you need to keep front-of-mind:

- Choose only regulated services: Look for mixers that clearly outline their compliance measures and have transparent policies.

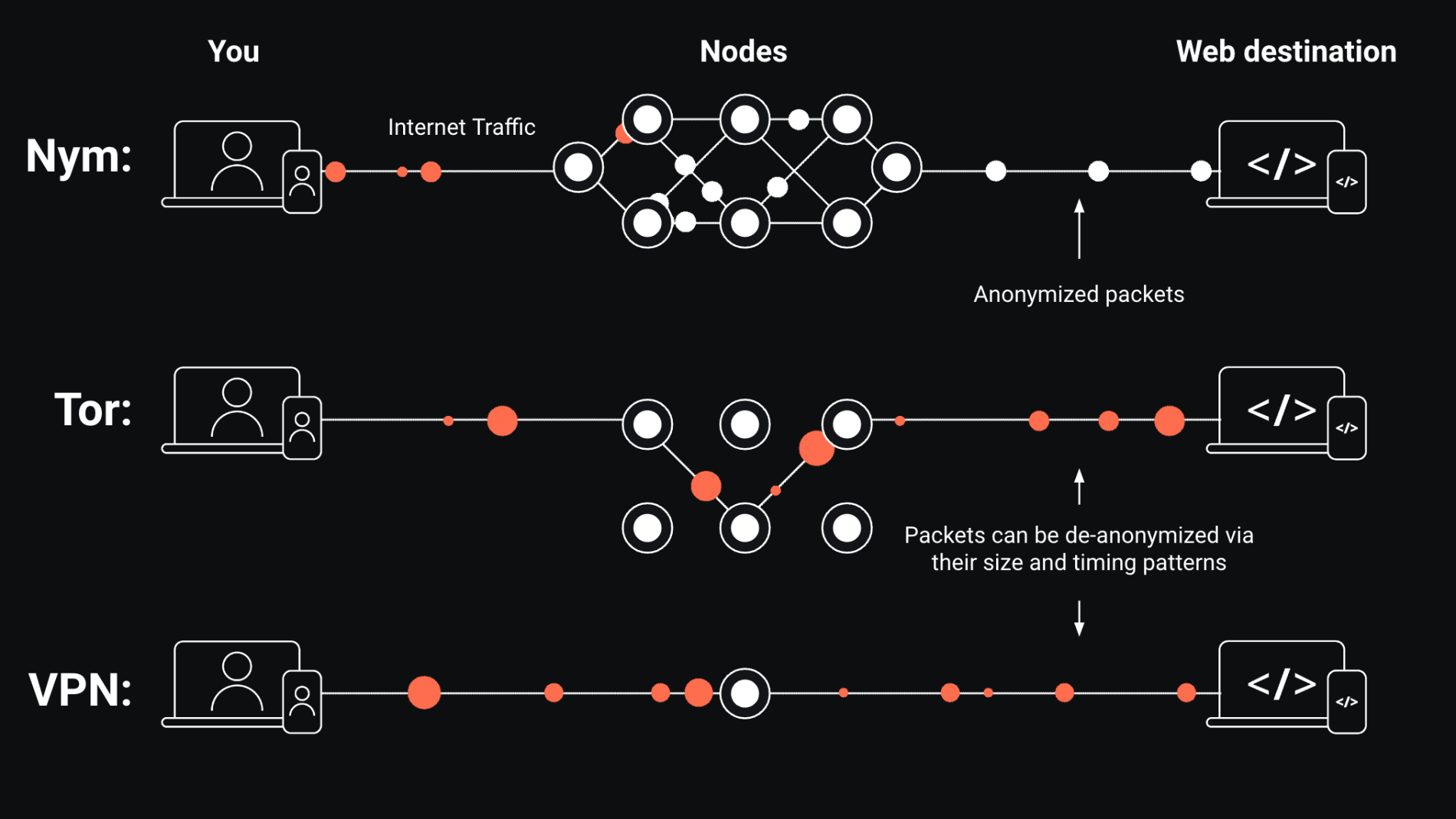

- Diversify across chains: Use multichain mixing options (TRX, ERC20, SOL) to further obfuscate trails while staying within legal bounds.

- Stay updated on regulations: The rules change fast; make sure your chosen solution adapts quickly too.

Transparency is a double-edged sword in crypto, and nowhere is this more apparent than with Tether. Public ledgers are great for trust, but not everyone wants their payroll, investment moves, or business partnerships broadcast to the world. The latest generation of compliant mixers is finally giving users a way to opt out of this radical transparency, without opting into legal headaches.

What sets today’s regulated USDT mixers apart isn’t just fancy tech, it’s the operational safeguards built right in. These platforms typically require some level of KYC (Know Your Customer) on deposits or withdrawals, maintain robust audit trails for regulators, and use advanced analytics to screen for sanctioned addresses. If you’re looking for Tether privacy solutions that won’t get you into hot water, these are the features you want front and center.

USDT Mixing in Action: What Users Should Expect

So what does it look like when you use a compliant cryptocurrency mixer? When you deposit your USDT, whether it’s on TRX, ERC20, or SOL, the mixer blends your funds with those from other verified users, breaking the link between sender and recipient. But because these platforms operate under clear regulatory guidelines, they can intervene if suspicious patterns emerge.

This means that if you’re an everyday user looking to keep your business private, your experience is seamless and secure, but illicit actors face real friction. And thanks to multichain support, you can mix assets across different blockchains for even greater anonymity without raising compliance red flags.

The Future: Privacy Tech That Plays by the Rules

The days of “privacy at any cost” are over, regulators have made that clear with crackdowns on non-compliant services. But that doesn’t mean you have to give up on anonymity entirely. Instead, we’re seeing a shift toward crypto mixer regulatory compliance as a feature, not a flaw. Zero-knowledge proofs (ZKPs), selective de-anonymization protocols, and community-driven governance are turning privacy into something responsible users can actually trust.

If you want anonymous USDT transactions that won’t come back to haunt you later, stick with platforms that boast transparency about their operations, and don’t be afraid to ask hard questions about how they handle compliance.

Top Takeaways for USDT Users in 2025

- Regulated mixing is here to stay: As demand grows and tech matures, expect more options that blend privacy with accountability.

- Compliance isn’t optional: Platforms ignoring AML/KYC rules are likely short-lived, or soon under investigation.

- Your privacy matters, but so does playing by the rules: Choose mixers that let you have both.

The bottom line? Regulated mixers offer a practical path forward for anyone who wants financial confidentiality without crossing legal lines, whether you’re mixing $500 or $500,000 worth of USDT across TRX, ERC20, or SOL networks. With careful selection and awareness of evolving rulesets, Tether users can finally enjoy peace of mind along with their privacy.