Cross-chain transactions have rapidly evolved from a niche capability to a central pillar of decentralized finance (DeFi), enabling users to move assets and data between blockchains like Ethereum, Solana, and Cardano. However, as the crypto ecosystem grows more interconnected, privacy and compliance are colliding in new and complex ways. Sensitive transaction details are exposed across chains, while regulators demand transparency to combat illicit activity. This is where regulated mixers step in, offering privacy for multi-blockchain transactions without sacrificing legal compliance.

Why Cross-Chain Privacy Matters

At its core, cross-chain interoperability expands the utility of digital assets but also amplifies privacy risks. When you bridge tokens from Ethereum ($ETH) to Solana ($SOL) or Cardano ($ADA), transaction metadata, including wallet addresses and amounts, can be visible at multiple points. For individuals and organizations handling sensitive financial data or proprietary strategies, this exposure can be unacceptable.

Yet, regulators worldwide have flagged cross-chain bridges as anti-money laundering (AML) blind spots (Cointelegraph). DeFi protocols are now forced to choose between maintaining user privacy and meeting compliance requirements, a false dichotomy that regulated multi-chain mixers aim to resolve.

How Regulated Mixers Enable Compliant Cross-Chain Transactions

A cross-chain crypto mixer is a protocol that anonymizes transactions as they move across different blockchains. The best regulated solutions use advanced cryptography to break the direct link between sending and receiving addresses while embedding mechanisms for lawful oversight.

Key Features of Regulated Multi-Chain Mixers

-

Zero-Knowledge Proofs (ZKPs): Regulated mixers utilize advanced ZKPs to verify transaction validity across blockchains without revealing sensitive details, ensuring privacy for users while supporting regulatory audits. Example: zkFi protocol

-

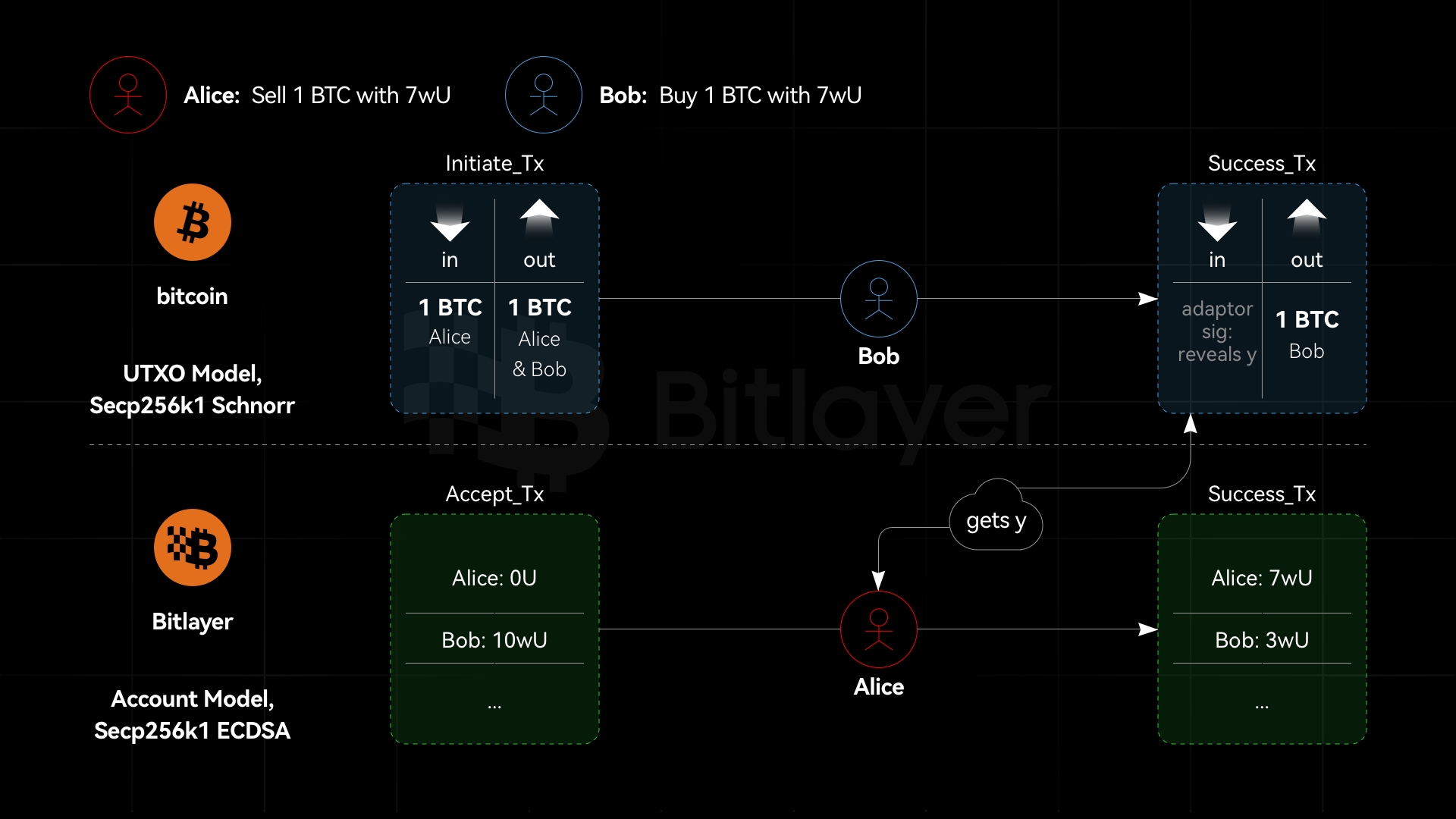

Conditional Transfers with Adaptor Signatures: These cryptographic signatures enable atomic swaps between blockchains, allowing private, linked transactions without exposing transaction data on public ledgers.

-

Trusted Execution Environments (TEEs): TEEs provide secure enclaves for processing private computations, protecting transaction information during cross-chain operations and enhancing overall confidentiality.

-

Regulatory Auditability: Regulated mixers incorporate mechanisms for authorized, selective disclosure, allowing compliance teams and regulators to trace transactions when required, balancing privacy and oversight.

-

Integration with Multi-Chain Platforms: Leading platforms like Chainlink’s Privacy Suite and the PXCrypto Framework offer regulated, privacy-focused solutions for cross-chain transactions.

-

Policy Enforcement Mechanisms: Protocols such as PCP (Privacy-preserving Cross-chain Protocol) embed compliance policies, enabling authorities to trace illicit activity while maintaining user privacy for legitimate transfers.

The technological backbone includes:

- Zero-Knowledge Proofs (ZKPs): These allow validators to confirm transaction validity without revealing any confidential information. For example, zkFi uses ZKPs for privacy-preserving swaps across blockchains (arxiv.org).

- Adaptor Signatures: Enabling atomic swaps where a transfer on one chain triggers a corresponding transfer on another, without exposing private details (mdpi.com).

- Trusted Execution Environments (TEEs): Secure enclaves process sensitive data off-chain before broadcasting anonymized results back onto public ledgers (medium.com).

This combination ensures that privacy is preserved at every stage of an asset’s journey, even as it hops between chains, while still allowing for selective disclosure if required by law enforcement or compliance teams.

The New Standard: Real-World Implementations of Regulated Multi-Chain Mixers

The industry is moving quickly toward integrating compliant privacy solutions into major DeFi infrastructure. Chainlink’s Privacy Suite now includes tools like the Blockchain Privacy Manager and CCIP Private Transactions, which let institutions keep cross-chain activities confidential but auditable when necessary (blog.chain.link). The PXCrypto Framework takes this further by supporting regulated transactions across heterogeneous blockchains with built-in compliance controls (dl.acm.org).

This shift isn’t just about technology, it’s about creating a new standard for how value moves in Web3 without compromising on either user confidentiality or regulatory integrity.

As cross-chain activity accelerates, the pressure is on for both DeFi innovators and compliance officers to adapt. The emergence of regulated multi-chain mixers brings a much-needed middle ground, where privacy for ETH, SOL, ADA, and other assets is preserved without opening the door to unchecked illicit flows. This is a significant leap from legacy privacy tools that often ignored the realities of global AML and sanctions frameworks.

Protocols like PCP (Privacy-preserving Cross-chain Protocol) are setting benchmarks by embedding policy enforcement directly into their architecture. This means authorities can trace transactions if required, but user data remains shielded in all other cases (dl.acm.org). The result? A compliant cross-chain transaction landscape that respects both personal privacy and institutional accountability.

Challenges and Considerations for Adoption

Despite these breakthroughs, several challenges remain for widespread adoption:

- User Education: Many crypto users still conflate privacy tools with non-compliance. Clear guidance is needed to distinguish regulated mixers from unregulated or illicit services.

- Interoperability: Ensuring seamless operation across diverse blockchains (including emerging L2s) requires ongoing collaboration between protocol developers.

- Regulatory Clarity: Jurisdictions worldwide are still refining their stance on privacy protocols. Staying ahead of evolving guidelines will be critical for mixer operators and users alike.

The intersection of compliance and privacy is also a hot topic among industry leaders and regulators. As highlighted by recent research from Elliptic and Chainalysis, compliance teams must now learn to navigate the unique risks posed by cross-chain crime while leveraging analytics tools that can keep pace with these innovations (Cointelegraph). The days of one-size-fits-all monitoring are over; dynamic solutions are needed to keep up with evolving threats without stifling legitimate use cases.

What’s Next for Regulated Mixers in Multi-Chain DeFi?

The future of compliant cross-chain transactions looks promising as more projects incorporate advanced cryptographic techniques alongside robust regulatory controls. Expect to see further integration of regulated mixers into wallets, exchanges, and DeFi protocols, making privacy an accessible feature rather than a risky workaround.

The end goal is simple: empower users to transact securely across any blockchain while giving regulators confidence that bad actors can be identified if necessary. In this way, regulated multi-chain mixers are not just responding to today’s challenges, they’re shaping the future standards for digital asset movement worldwide.