Cryptocurrency mixers, often known as tumblers, have long been a hot topic in the digital asset world. For privacy advocates, they’re essential tools that help keep crypto transactions confidential. But for regulators and compliance teams, these same mixers can look like a loophole for illicit finance. So how do regulated crypto mixers walk the line between privacy and compliance in 2025? Let’s dive into the evolving landscape where transparency and confidentiality aren’t mutually exclusive.

Why Crypto Mixers Matter: Privacy in a Transparent World

Every transaction on blockchains like Bitcoin or Ethereum is public by default. That’s great for transparency, but not so great if you’re a business protecting trade secrets or an individual who values financial privacy. Enter compliant cryptocurrency mixers: services that blend your coins with others to obscure their origin without breaking the law.

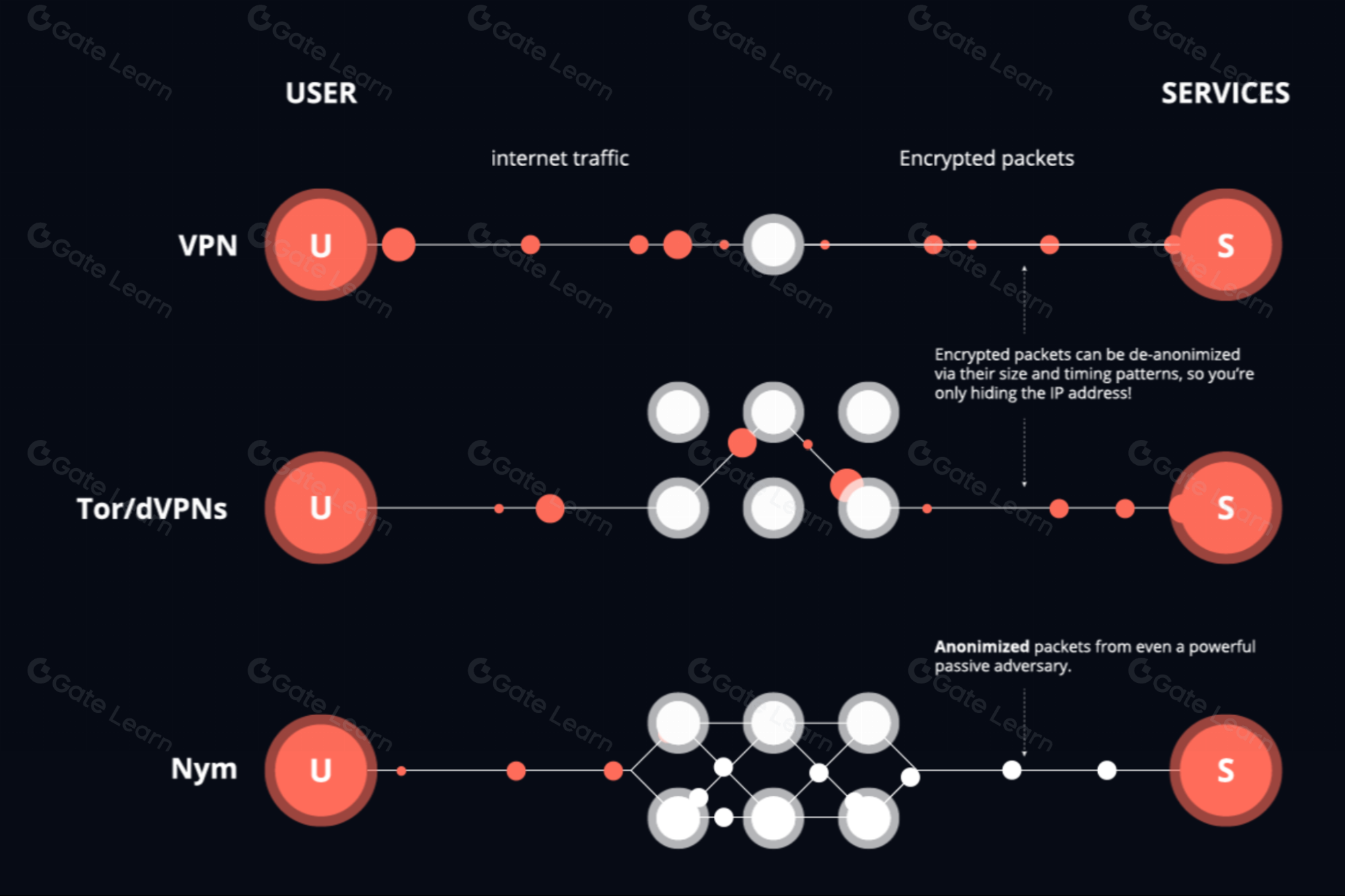

Mixers were originally designed to solve real-world problems of confidentiality and personal security. As noted by H-X Technologies, both crypto mixers and privacy coins emerged to give users control over their own data in an increasingly surveilled world. The catch? This same technology can be misused for money laundering or sanctions evasion, which brings us to the heart of regulatory scrutiny.

The Regulatory Tightrope: Compliance Without Compromise

Contrary to popular belief, there’s no outright ban on legal crypto mixing in most jurisdictions including the United States. According to Reddit’s r/CryptoCurrency community and legal analysis from CoinLaw, there are currently no specific laws that make all mixers illegal – it’s how they’re used that matters most.

The real challenge is anti-money laundering (AML) and know-your-customer (KYC) compliance. Regulators worry that by obscuring transaction trails, mixers could facilitate criminal activity. In response, agencies like the U. S. Treasury are shifting their approach: they want to distinguish between privacy tools that respect compliance requirements versus those designed solely for obfuscation.

This was underscored by the November 2024 U. S. appeals court decision overturning sanctions against Tornado Cash smart contracts. The ruling clarified that immutable code isn’t property under federal law – a landmark moment highlighting how complex regulating decentralized tech can be (read more here). It also opened the door for compliant innovation rather than blanket bans.

Key Features of Regulated Crypto Mixers

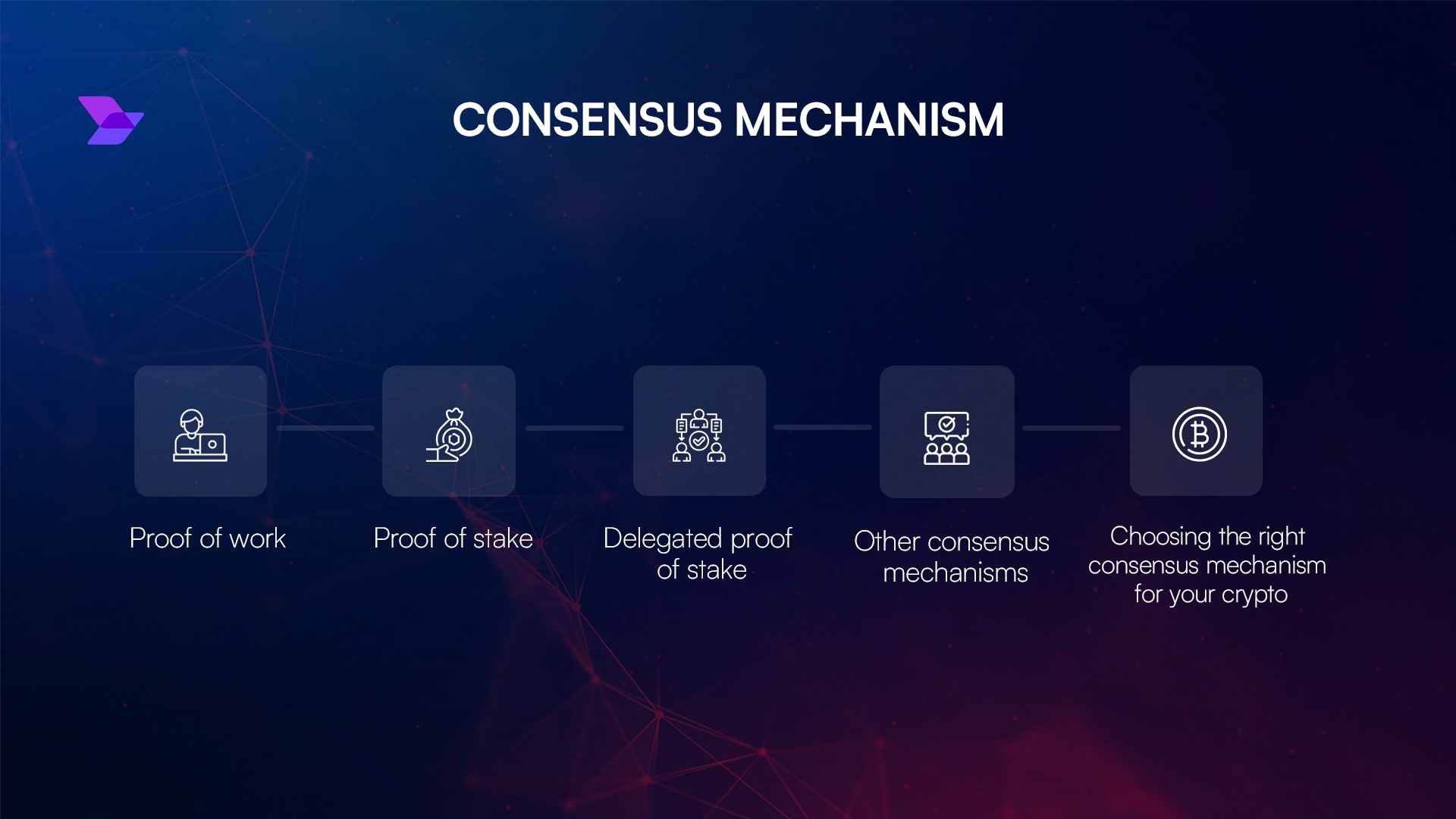

-

Selective De-Anonymization (SeDe) Frameworks: Innovative solutions like Selective De-Anonymization enable privacy for most users while allowing authorized parties to de-anonymize transactions linked to illicit activity through a consensus process.

-

Compliance with AML and KYC Regulations: Regulated mixers implement Anti-Money Laundering (AML) and Know Your Customer (KYC) checks, helping prevent misuse while maintaining user privacy for legitimate transactions.

-

Transparency and Auditability: Leading mixers provide transparency reports and undergo independent audits to demonstrate compliance and build trust with regulators and users alike.

-

Sanctions Screening and Transaction Monitoring: Regulated mixers screen wallet addresses against sanctions lists and monitor for suspicious activity, ensuring they do not facilitate transactions involving sanctioned entities.

-

Privacy-Enhancing Technology with Regulatory Safeguards: These mixers use advanced cryptographic techniques to protect user privacy, while embedding controls that allow intervention in cases of proven illicit activity.

-

Collaboration with Regulatory Authorities: Many compliant mixers work proactively with regulators and law enforcement to address evolving legal requirements and swiftly respond to misuse.

How Regulated Mixers Work: Selective De-Anonymization and Transparency

The future of privacy and compliance crypto lies in clever frameworks like Selective De-Anonymization (SeDe). Instead of making every transaction totally anonymous forever, SeDe allows for de-anonymization if there’s consensus about potential illicit activity, think of it as an emergency escape hatch built into privacy tech.

This approach has gained traction with regulators who want to respect user rights while still having options to address crime when necessary. The U. S. Treasury now focuses on bringing more transparency around mixing services rather than banning them outright, aiming to manage risk without stifling innovation (explore Treasury guidance here).

By combining robust AML checks with technical safeguards like SeDe, today’s best regulated crypto mixers offer users true confidentiality while staying on the right side of the law.

Regulated mixers typically implement a layered approach to compliance. This means integrating KYC procedures, transaction monitoring, and real-time risk assessment without sacrificing the privacy that users crave. Think of it as having a lockbox for your financial data, but with a legal key available only when absolutely necessary. These mixers often work closely with compliance experts and regulators to ensure their protocols meet evolving standards.

One of the most promising aspects is the ability for institutional investors and enterprises to finally access crypto transaction privacy law-compliant solutions. For businesses transacting large volumes or handling sensitive partnerships, privacy isn’t just about secrecy, it’s about competitive advantage and client confidentiality. Regulated mixers are now being tailored to these use cases, offering features like auditable logs (visible only under regulatory request), whitelisting for compliant wallets, and built-in reporting tools.

What to Look For: Choosing a Trusted Regulated Mixer

Not all mixers are created equal. If you’re considering using one, here’s what you should prioritize:

Top Criteria for Evaluating Regulated Crypto Mixers in 2025

-

Robust AML & KYC Integration: Ensure the mixer implements comprehensive Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols that meet current regulatory standards. This is crucial for compliance and user accountability.

-

Selective De-Anonymization Frameworks: Look for mixers adopting innovative solutions like Selective De-Anonymization (SeDe), which enable privacy while allowing authorities to trace illicit transactions through a consensus process.

-

Transparent Operations & Audits: Favor mixers that provide regular transparency reports and undergo independent security audits, boosting trust and regulatory alignment.

-

Clear Regulatory Registration: Choose platforms registered with financial authorities such as FinCEN (U.S.) or their local equivalents, signaling a commitment to legal compliance.

-

Privacy-by-Design Architecture: Evaluate whether the mixer uses privacy-preserving technologies (like zero-knowledge proofs) that protect user data without facilitating illicit activity.

-

Responsive Customer Support & Reporting Mechanisms: Reliable mixers offer 24/7 support and easy channels for reporting suspicious activity, ensuring both user safety and regulatory cooperation.

Look for clear disclosures about compliance measures, transparent user agreements, and evidence of ongoing audits or third-party reviews. A reputable regulated mixer will make it easy to understand how your data is protected, and under what circumstances it might be disclosed.

Another tip: check if the service is actively engaging with regulatory updates and industry best practices. The crypto landscape moves fast, and so do the rules around privacy tech. Services stuck in the past are more likely to run afoul of new guidance or enforcement actions.

The Road Ahead: Balancing Innovation with Accountability

The conversation around regulated crypto mixers is shifting from fear to pragmatism. Rather than viewing privacy as inherently suspicious, regulators are starting to recognize its legitimate role in finance, provided there’s a safety valve for misuse. The Selective De-Anonymization model is just one example of how technical innovation can answer both sides of the equation.

This new era is also seeing closer collaboration between developers, users, and policymakers. As frameworks mature and compliance becomes embedded by design rather than bolted on as an afterthought, we’re likely to see greater adoption by mainstream users who previously shied away from mixing due to legal uncertainty.

If you want a deeper dive into why institutional players now demand these compliance-friendly privacy solutions, and how they’re reshaping expectations, check out our detailed guide on compliance-friendly mixers here.

The bottom line? You no longer have to choose between total transparency or total secrecy when sending crypto. With regulated solutions leading the way, privacy in digital assets can finally coexist with robust oversight, unlocking new possibilities for everyone who values both freedom and responsibility in their financial lives.