Cryptocurrency mixers have long been associated with both innovation and controversy. Originally developed to enhance transactional privacy, these services, also known as tumblers, blend users’ crypto assets with others, making it difficult to trace the origin or destination of funds. While this offers much-needed confidentiality in a transparent blockchain environment, it has also attracted regulatory scrutiny, especially as illicit actors exploit mixers for money laundering. The challenge for 2025 is clear: how can regulated crypto mixers provide privacy without crossing legal boundaries?

The Regulatory Landscape: Privacy Under the Microscope

Over the past few years, global regulators have intensified their focus on cryptocurrency mixing services. High-profile sanctions by the U. S. Treasury’s Office of Foreign Assets Control (OFAC) against platforms like Tornado Cash and Blender. io have sent a strong message: mixers must comply with anti-money laundering (AML) laws or face severe consequences. In parallel, the European Union now mandates that mixers register as Virtual Asset Service Providers (VASPs) and implement robust Know Your Customer (KYC) protocols.

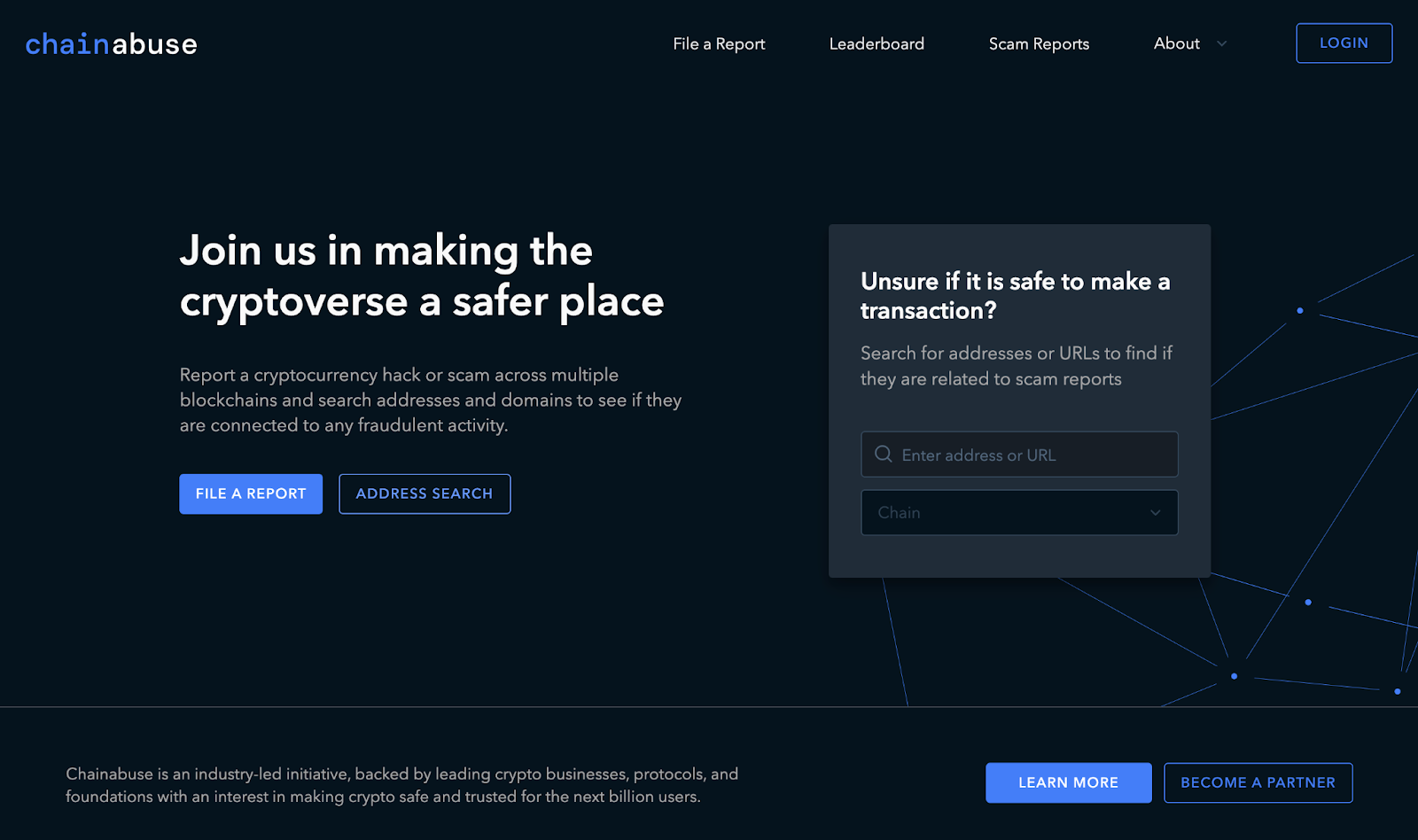

This heightened scrutiny is not unfounded. According to Chainalysis and other blockchain analytics firms, mixers have been linked to significant illicit activity flows in recent years. However, it’s important to distinguish between privacy-enhancing services designed for legitimate use and those that explicitly enable criminal behavior.

Innovations in Compliant Cryptocurrency Mixing

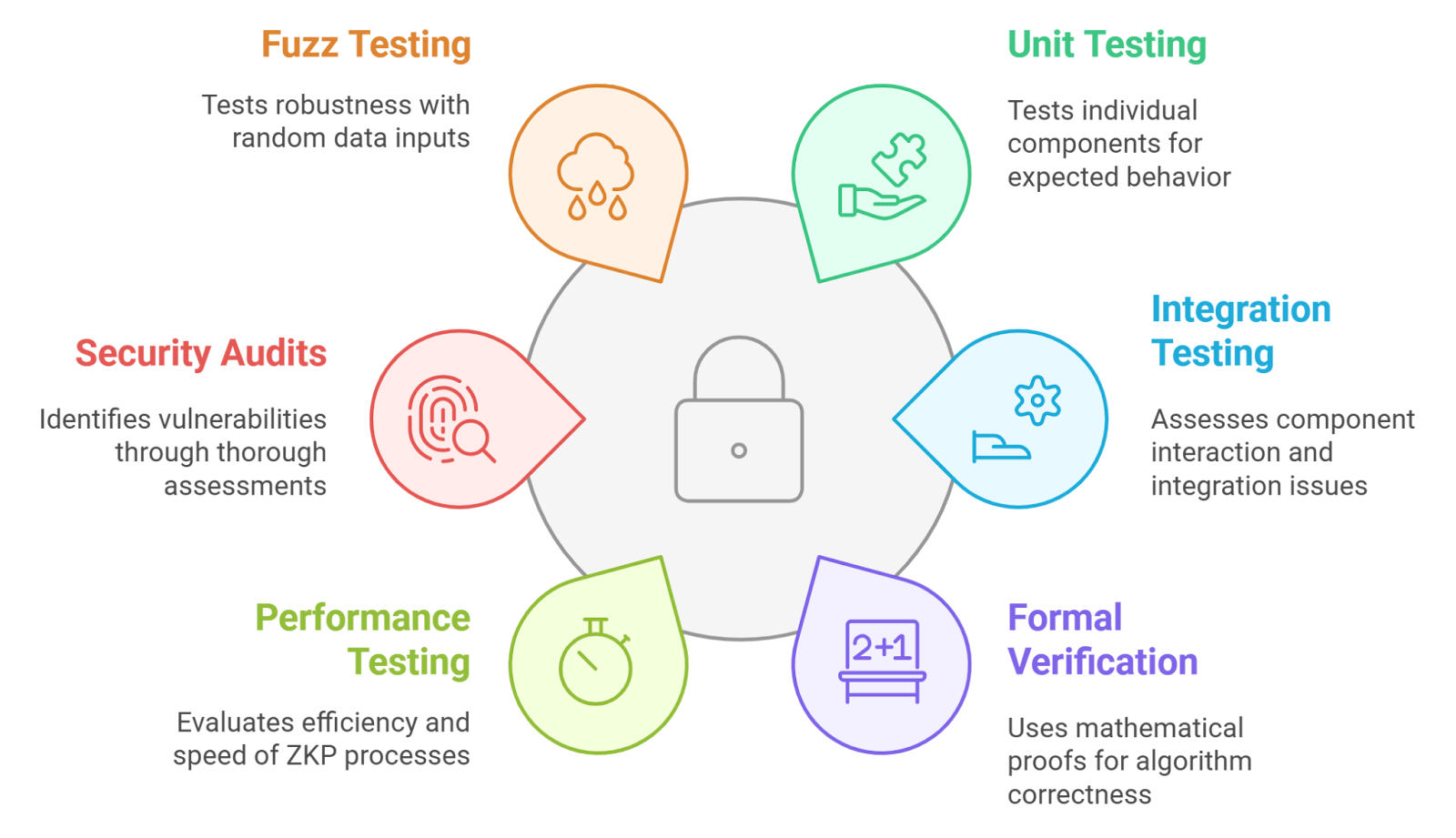

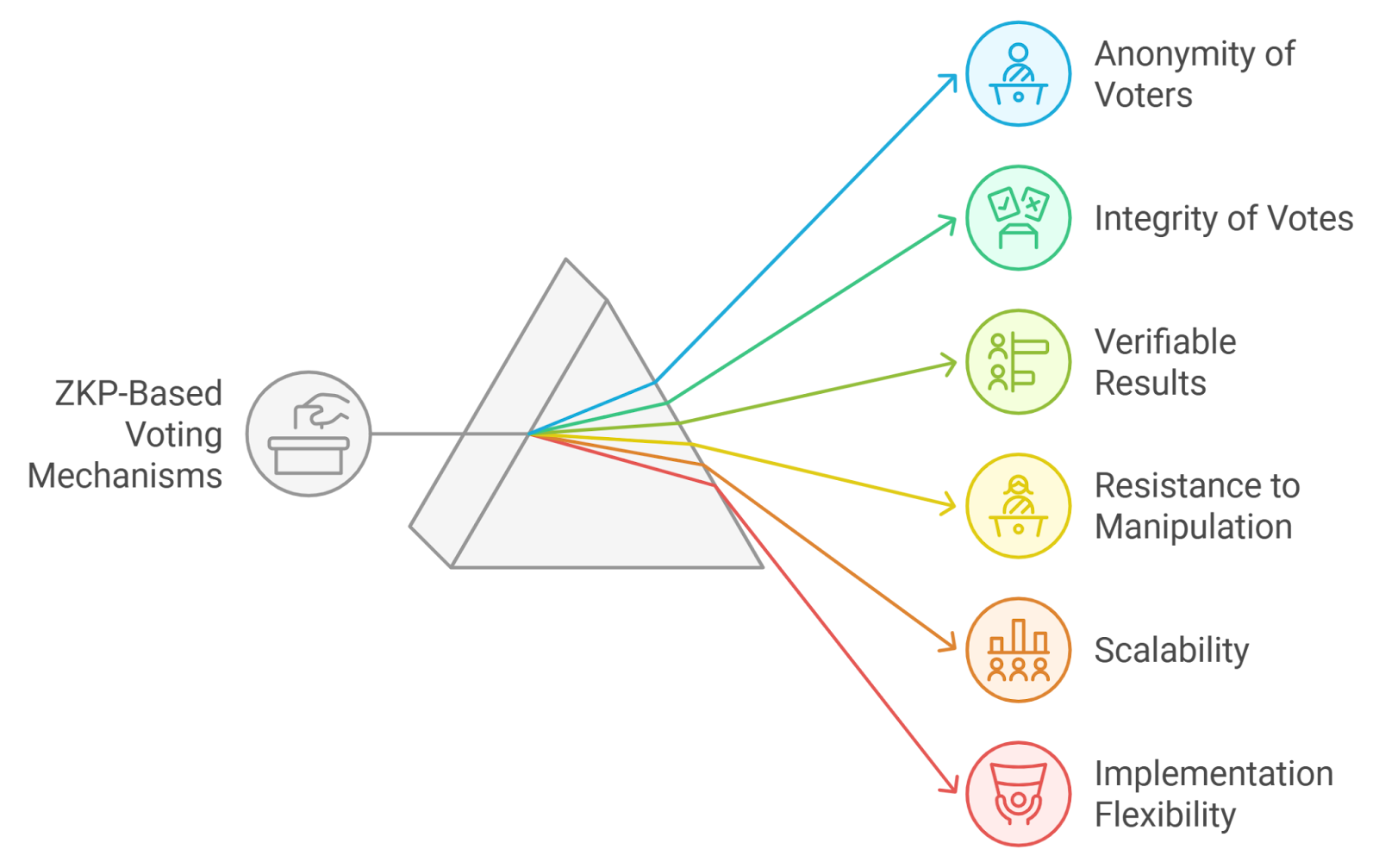

The next generation of compliant cryptocurrency mixing solutions integrates advanced cryptography with regulatory safeguards. For example, frameworks like Selective De-Anonymization (SeDe) employ threshold encryption and zero-knowledge proofs (ZKPs). These allow transactions to remain private under normal circumstances but enable controlled de-anonymization if suspicious activity is detected, striking a careful balance between user privacy and law enforcement needs.

Another breakthrough is the emergence of configurable zero-knowledge mixers, such as zkMixer pools. These let user groups set governance rules for their mixing pools, including consensus-driven mechanisms that can freeze or refund deposits flagged as risky under AML guidelines. Such innovations are designed to meet growing regulatory demands while still supporting privacy-preserving crypto transactions.

Key Features of Regulated Crypto Mixers in 2025

-

Selective De-Anonymization (SeDe): Modern mixers like those using the SeDe framework allow privacy for legitimate users while enabling de-anonymization of suspicious transactions via multi-party consensus. This balances user privacy with regulatory needs.

-

Zero-Knowledge Proof Integration: Advanced protocols such as zkFi and zkMixer use zero-knowledge proofs to let users prove transaction legitimacy without exposing sensitive details, enabling privacy and compliance simultaneously.

-

On-Chain Compliance Tools: Platforms like Tornado Cash have introduced compliance tools that let users generate cryptographically certified proof of deposit and withdrawal, helping demonstrate lawful fund origins when required by authorities.

-

Configurable Governance and Freezing Mechanisms: New mixer designs (e.g., zkMixer) allow user groups to set governance rules and freeze or refund deposits suspected of criminal origin, directly integrating AML measures into the mixing process.

-

Mandatory KYC/AML Registration: In regions like the European Union, regulated mixers must register as Virtual Asset Service Providers (VASPs) and implement KYC/AML protocols, ensuring all users are screened and transactions are monitored for suspicious activity.

-

Regulatory Reporting and Transparency: Under new rules (e.g., FinCEN’s Section 311 proposal), mixers are required to monitor and report transactions involving potential money laundering, supporting law enforcement while maintaining privacy for compliant users.

Mainstream Adoption Hinges on Trust and Compliance

The market for AML/KYC solutions in crypto is booming, projected to reach over USD 2 billion by 2031, as exchanges, DeFi protocols, and institutional investors seek reliable partners who can offer both confidentiality and legal assurance. Yet challenges persist:

- KYC/AML Integration: Many users worry about privacy erosion when submitting personal data to comply with KYC regulations.

- The Travel Rule: Mixers must now manage cross-border information sharing requirements without exposing sensitive user data unnecessarily.

- Law Enforcement Collaboration: There’s an ongoing debate about how much access authorities should have versus protecting civil liberties.

The line between legal bitcoin mixers operating within compliance frameworks and those facilitating illicit flows remains razor thin, and constantly shifting as new guidance emerges from agencies worldwide.

Navigating Privacy Without Breaking the Law

If you’re considering using a mixer service today, understanding this evolving landscape is crucial. Choose platforms that are transparent about their compliance measures, from KYC onboarding processes to detailed audit trails for regulators when required. For more on how regulated mixers achieve this balance without sacrificing your right to transactional privacy, see our deep dive here: How Regulated Crypto Mixers Enable Privacy Without Breaking The Law.

Regulated crypto mixers are carving out a new standard, aiming to empower users with privacy while maintaining full alignment with global compliance requirements. The best platforms now offer clear disclosures about their AML and KYC processes, giving users confidence that their activities remain legal and above board. This level of transparency is essential not only for individual peace of mind but also for institutional adoption, as companies seek to avoid the reputational and legal risks associated with non-compliant services.

Industry observers note that the most successful compliant cryptocurrency mixing solutions go beyond box-ticking exercises. They actively engage with regulators, implement ongoing risk assessments, and update protocols in response to new threats or evolving rules. As a result, these platforms help legitimize privacy-preserving crypto transactions in the eyes of both regulators and mainstream financial partners.

What to Look for in a Legal Bitcoin Mixer

With so many options on the market, how can users identify truly regulated crypto mixers? Here are some practical tips:

Key Factors for Choosing a Compliant Crypto Mixer

-

Regulatory Registration & Licensing: Ensure the mixer is registered as a Virtual Asset Service Provider (VASP) in its jurisdiction (e.g., EU, UK, or US) and complies with local regulations such as the Bank Secrecy Act (BSA) or EU AMLD5.

-

KYC & AML Protocols: Look for mixers that implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. This includes identity verification and transaction monitoring to detect suspicious activity, in line with guidance from the Financial Action Task Force (FATF).

-

Selective De-Anonymization Mechanisms: Choose platforms utilizing frameworks like Selective De-Anonymization (SeDe), which allow transaction tracing under legal request while preserving privacy for legitimate users. Examples include mixers integrating Zero-Knowledge Proofs (ZKPs) and threshold encryption.

-

Transparent Governance & Auditability: Favor mixers with transparent governance, published compliance policies, and regular third-party audits. Open-source codebases and public compliance reports increase trust and accountability.

-

Integration of the Travel Rule: Confirm the mixer supports the Travel Rule for crypto transactions, ensuring required information is shared between VASPs as mandated by regulators (e.g., FinCEN, FATF).

-

Reputation & Regulatory Standing: Research the platform’s reputation, checking for any OFAC sanctions or legal actions (e.g., Tornado Cash, Blender.io). Only use mixers with a clean compliance record and positive industry standing.

-

User Data Privacy & Security: Verify the mixer’s data handling practices, ensuring user information is protected with strong encryption and not misused or shared without consent. Look for privacy certifications or endorsements.

Platforms that meet these criteria don’t just protect your privacy, they also safeguard your assets from being frozen or seized due to inadvertent exposure to illicit flows. This dual-layer protection is what sets regulated mixers apart in 2025’s complex landscape.

The Road Ahead: Collaboration and Continuous Improvement

The conversation around crypto privacy compliance is far from over. As technologies like zero-knowledge proofs become more sophisticated and regulatory frameworks evolve, expect further innovation at the intersection of privacy and oversight. Industry groups are already working closely with policymakers to develop standards that respect both user rights and societal needs for financial integrity.

For founders building new mixing solutions or enterprises considering integration, it’s vital to stay informed about developments such as the EU’s VASP requirements or the U. S. Treasury’s stance on mixer registration under the Bank Secrecy Act. Regular audits, transparent governance models, and open lines of communication with regulators will remain best practices going forward.

Ultimately, compliant cryptocurrency mixing is not just about following rules, it’s about shaping a future where individuals can transact privately without fear of regulatory backlash or association with criminal activity. By supporting platforms dedicated to both innovation and accountability, users can help drive positive change throughout the digital asset ecosystem.