Cryptocurrency mixers, often called tumblers, have evolved from niche privacy tools to the center of a global regulatory conversation. As more individuals and organizations seek privacy for their digital assets, regulators worldwide are stepping up scrutiny to ensure these services don’t become havens for illicit activity. The challenge? Balancing privacy rights with the imperative to combat money laundering and terrorist financing.

Understanding Regulated Crypto Mixers and Their Role in Privacy

A crypto mixer blends transactions from multiple users, making it difficult to trace the origin or destination of funds. While this brings legitimate privacy benefits – shielding user identities from public blockchain explorers – it also raises red flags for compliance professionals and law enforcement. According to gsix.org, both the United States and the European Union now classify mixers as money transmitters or virtual asset service providers (VASPs), subjecting them to strict anti-money laundering (AML) laws.

The market has responded by developing regulated crypto mixers: platforms that preserve user anonymity while embedding compliance at every step. These services are not only legal but actively work with authorities to ensure transparency without compromising legitimate privacy needs.

The Regulatory Landscape: Global AML Laws in Action

Regulated crypto mixers operate under a patchwork of international rules:

- United States (FinCEN): Mixers must register as money transmitters, implement Know Your Customer (KYC) protocols, and report suspicious activity. Non-compliance can result in severe penalties or even criminal charges. See more on U. S. requirements at gsix.org.

- European Union (5AMLD): Virtual currency providers, including mixers, are required to conduct customer due diligence and submit reports for suspicious transactions.

- Evolving Standards: In October 2023, FinCEN proposed designating all transactions involving mixers as a “Primary Money Laundering Concern, ” increasing reporting obligations for U. S. financial institutions (dlapiper.com).

The Compliance Playbook: How AML-Compliant Mixers Operate Legally

The days of anonymous mixing with zero oversight are over – at least for any platform hoping to operate above board. Today’s AML compliant mixers employ a suite of strategies designed to satisfy both users’ privacy expectations and regulators’ demands:

Key Compliance Features of Regulated Crypto Mixers

-

User Verification (KYC): Regulated mixers require users to complete Know Your Customer (KYC) procedures, submitting identification documents and proof of address before accessing services. This helps verify user identities and supports monitoring for suspicious activity.

-

Transaction Monitoring: Continuous analysis of all transactions is conducted to detect and report unusual patterns or behaviors that may suggest money laundering or other illicit activities.

-

Registration with Regulators: In jurisdictions like the United States, regulated mixers are registered as money transmitters with FinCEN, ensuring adherence to Anti-Money Laundering (AML) laws and regulatory oversight.

-

Suspicious Activity Reporting (SAR): Regulated mixers file Suspicious Activity Reports with authorities when they detect transactions that may be linked to criminal behavior, as required by AML laws.

-

Transparent Record-Keeping: These mixers maintain clear and auditable records of transactions, enabling cooperation with law enforcement and regulatory bodies when necessary.

-

Compliance with International AML Directives: In the European Union, mixers comply with the Fifth Anti-Money Laundering Directive (5AMLD), which mandates customer due diligence and the reporting of suspicious activities.

-

Innovative Compliance Technologies: Some regulated mixers are adopting solutions like the zkMixer framework, which uses zero-knowledge proofs and configurable governance to balance privacy with regulatory requirements.

User Verification (KYC): Before accessing mixing services, users must provide identification documents and proof of address. This step is crucial not just for regulatory box-ticking but also for building trust among users who want assurance their funds aren’t mingling with criminal proceeds.

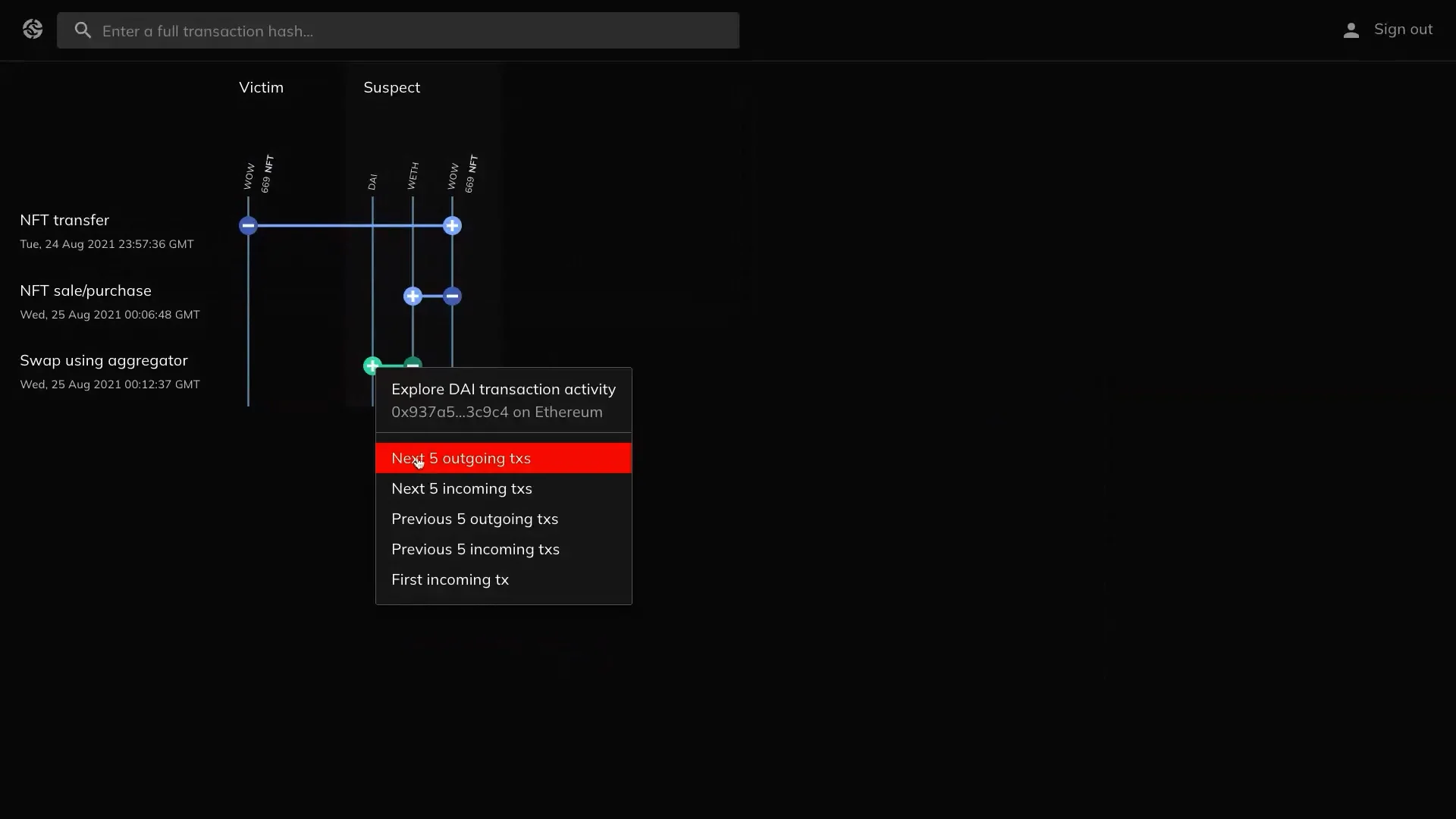

Transaction Monitoring: Advanced analytics scan every transaction for red flags – unusual patterns, rapid movements between wallets, or links to sanctioned addresses. When suspicious activity is detected, it’s reported immediately to relevant authorities.

Transparent Operations: Regulated platforms maintain clear records and cooperate proactively with regulators during audits or investigations. This transparency is key in distinguishing legal crypto mixers from illicit ones.

Pioneering Privacy-Compliant Technology: The Rise of zkMixers and Governance Pools

The next wave of mixer technology isn’t just about hiding transaction trails; it’s about programmable compliance. Innovations like the zero-knowledge-based zkMixer framework allow users to create mixing pools governed by customizable rulesets – including mechanisms to refund or freeze deposits if criminal activity is suspected (arxiv.org). These advances prove that privacy and regulation can coexist when technology is designed thoughtfully from the ground up.

As regulatory expectations rise, so does the sophistication of compliance solutions within the crypto mixing sector. Modern regulated crypto mixers are embracing a proactive approach, leveraging both human expertise and machine learning to detect suspicious behavior in real time. This dual-layered defense not only satisfies legal requirements but also reassures users that their privacy is protected within a lawful framework.

One of the most significant developments is the increased adoption of continuous transaction monitoring. Rather than relying solely on upfront KYC checks, regulated mixers now monitor user activity throughout the entire lifecycle of a transaction. This ongoing vigilance ensures that even if bad actors slip through initial verification, their activities can still be flagged and reported before funds are withdrawn or laundered further.

Building Trust: Transparency and Accountability in Legal Crypto Mixers

Transparency is not just a buzzword; it’s a cornerstone of compliance for legal crypto mixers. By maintaining detailed logs and audit trails, these platforms demonstrate accountability to both users and regulators. Some mixers even publish transparency reports, outlining how many suspicious transactions were detected and reported over specific periods. This level of openness helps differentiate legitimate services from those operating in the shadows.

Another trust-building measure is cooperation with law enforcement. When warranted, regulated mixers respond swiftly to subpoenas or requests for information, providing authorities with the data needed to investigate criminal activity. This collaborative approach helps foster an ecosystem where privacy does not come at the expense of public safety.

Navigating the Future: Compliance as an Ongoing Journey

The regulatory landscape for cryptocurrency privacy tools is far from static. With proposals like FinCEN’s designation of mixer transactions as a “Primary Money Laundering Concern, ” compliance standards will likely become even more stringent in coming years (dlapiper.com). For regulated crypto mixers, staying ahead means investing in adaptive technology and regularly updating policies to reflect new laws across multiple jurisdictions.

This ongoing commitment extends beyond technology, it’s about fostering a culture of compliance at every level of the organization. From front-line customer support to executive leadership, everyone involved must understand both the letter and spirit of AML regulations.

How Regulated Crypto Mixers Balance Privacy and AML Compliance

-

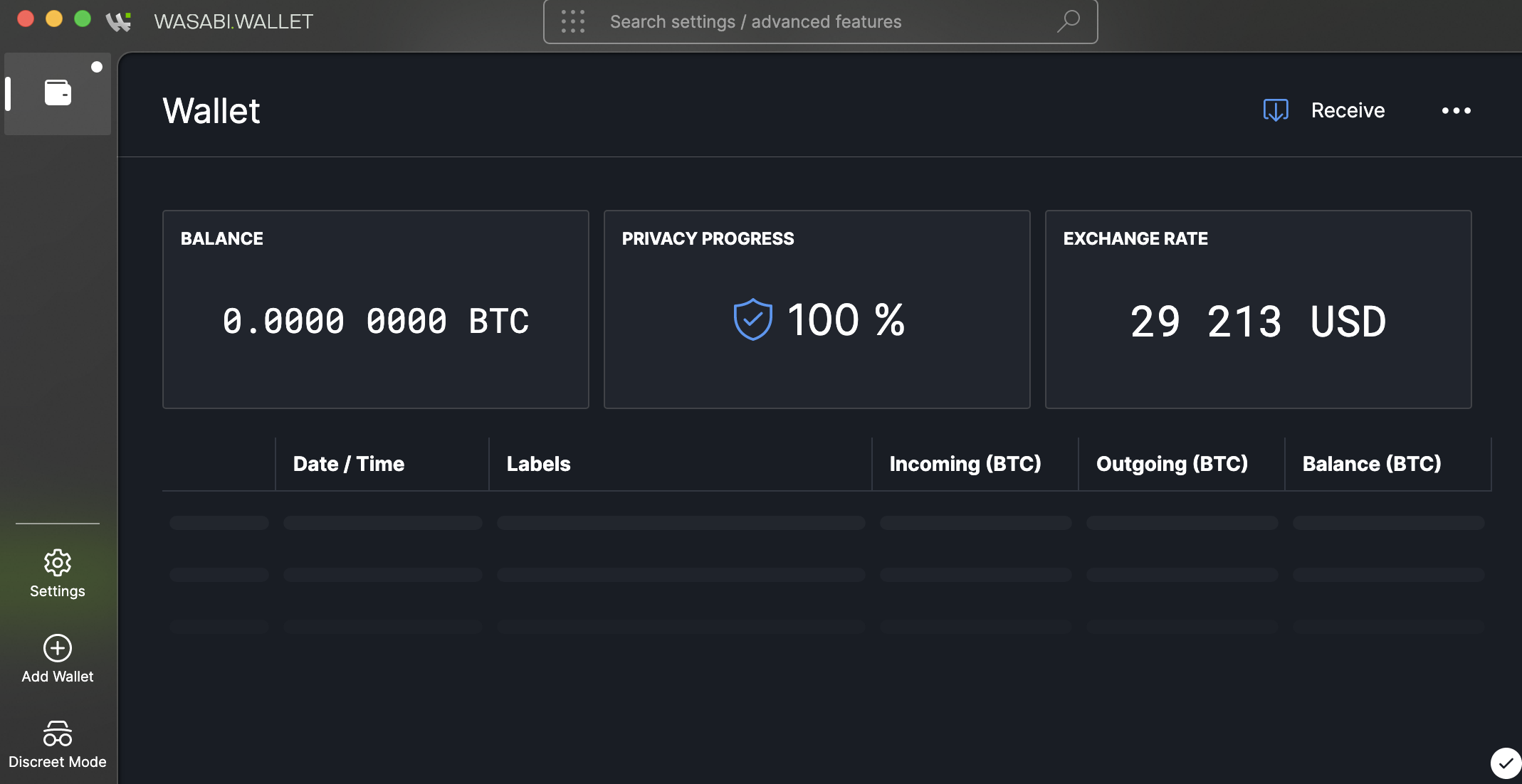

Implementing Robust KYC Procedures: Regulated mixers like Wasabi Wallet and zkMixer require users to undergo Know Your Customer (KYC) checks, verifying identities with official documents before granting access. This ensures only legitimate users can utilize their services while deterring illicit activity.

-

Continuous Transaction Monitoring: Platforms such as Chainalysis Reactor and Elliptic provide transaction monitoring tools that regulated mixers integrate to detect suspicious patterns and flag potential money laundering activities in real time.

-

Transparent Record-Keeping and Reporting: Leading mixers maintain detailed transaction logs and readily cooperate with authorities by reporting suspicious activities, in line with FinCEN and EU 5AMLD requirements.

-

Adopting Privacy-Preserving Compliance Technologies: Solutions like zkMixer leverage zero-knowledge proofs to enable privacy without sacrificing compliance, allowing mixers to verify transactions without exposing user data, and even enforce governance rules for fund confiscation or refunds when criminal activity is suspected.

-

Adapting to Evolving Regulations: Regulated mixers stay current with global AML laws, such as FinCEN’s designation of mixers as a “Primary Money Laundering Concern” in 2023, and update their compliance protocols to meet new standards while preserving user privacy.

Why Choose Regulated Mixers?

If you value both privacy and peace of mind, choosing an AML-compliant mixer is non-negotiable. These platforms offer robust security features without exposing you to unnecessary legal risks or reputational harm. By prioritizing transparency, user verification, and innovative compliance solutions like zkMixers, they set a new standard for responsible cryptocurrency privacy.

The future will undoubtedly bring more regulatory changes, and perhaps even stricter oversight, but one thing remains clear: privacy and regulation can coexist when approached thoughtfully. The best regulated crypto mixers prove that it’s possible to protect your digital assets while contributing to a safer financial system worldwide.