Privacy and regulatory compliance have long been seen as opposing forces in the crypto world, particularly when it comes to transaction anonymity. However, with the advent of zero-knowledge proof (ZKP) crypto mixers, a new path is emerging that could allow users to maintain privacy while still meeting Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) requirements.

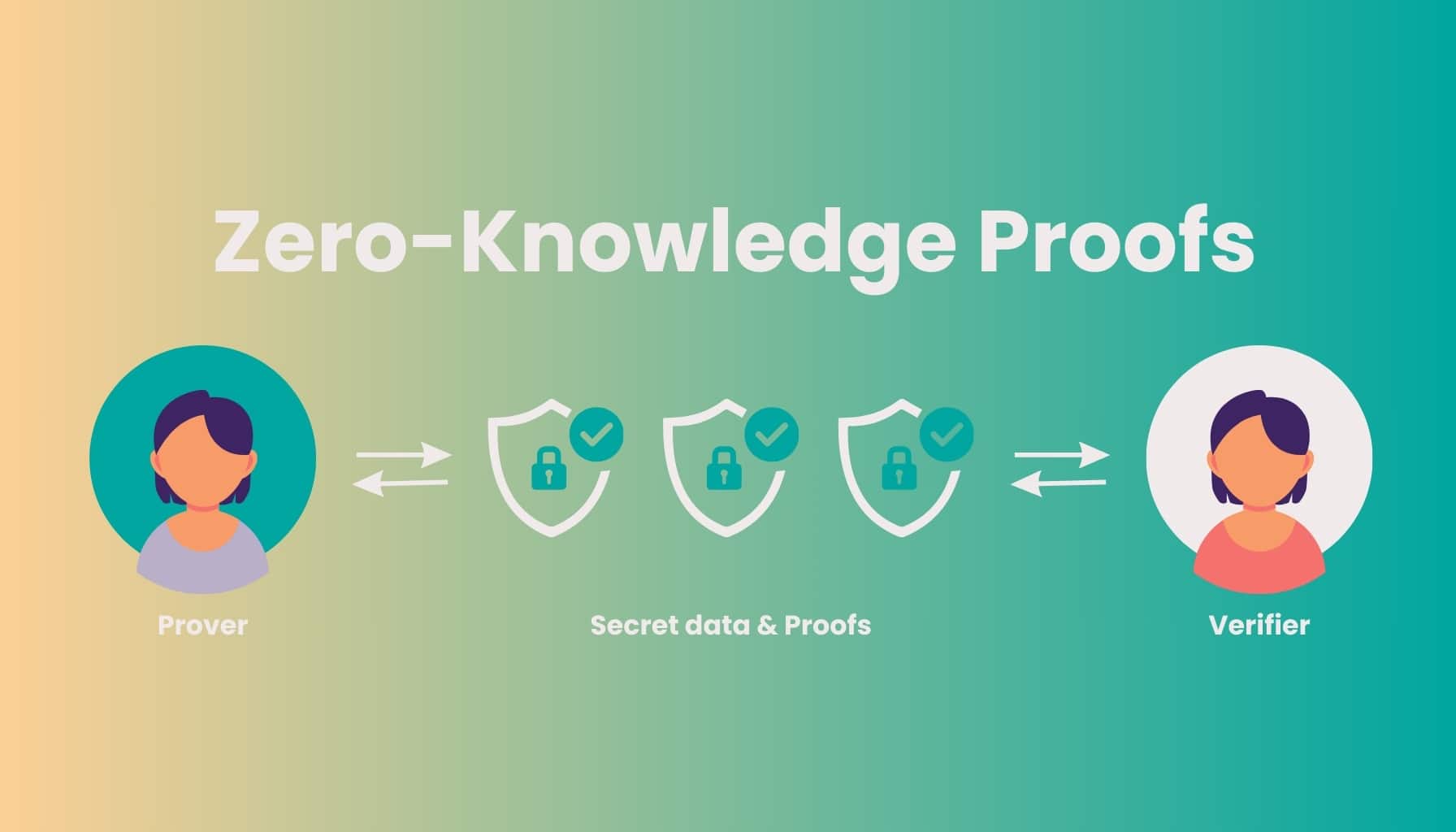

What Are Zero-Knowledge Proofs and Why Do They Matter for Crypto Mixers?

Zero-knowledge proofs are cryptographic techniques that let one party prove the validity of a statement without revealing any underlying information. In the context of cryptocurrency, this means you can prove you’re following compliance rules without exposing your identity or transaction details. This technology is especially relevant for mixers, services that blend potentially identifiable coins to obscure their origin, because it can provide privacy with KYC/AML compliance.

The controversy around mixers like Tornado Cash, which was sanctioned by the U. S. Treasury in 2022 for allegedly facilitating illicit transactions, underscores why compliance is so critical. Regulators worry about money laundering risks, but privacy advocates argue that financial confidentiality is a basic right. ZKPs may finally offer a solution that satisfies both sides.

The Rise of Compliant zk Mixers

Recent research and product launches highlight how compliant zk mixers are evolving. For example, protocols like zkFi act as plug-and-play solutions for developers who want to abstract away the complexities of zero-knowledge proofs while ensuring transactional compliance. Meanwhile, frameworks such as SeDe allow for selective de-anonymization, only illicit transactions can be traced by authorities, keeping honest users’ privacy intact (source).

This approach aligns with global standards set by organizations like FATF (Financial Action Task Force), which require crypto services to implement measures against money laundering but do not mandate full transparency for every transaction.

Key Benefits of Zero-Knowledge Proof Crypto Mixers

-

Enhanced Transaction Privacy: Zero-knowledge proof (ZKP) mixers, such as those proposed in the zkFi protocol, allow users to obscure sender, receiver, and transaction amounts while still ensuring transaction validity.

-

Regulatory Compliance Without Data Exposure: ZKP-based mixers enable users to prove compliance with Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) regulations without revealing personal or transactional details, as highlighted by a16z Crypto.

-

Selective De-anonymization for Law Enforcement: Frameworks like SeDe propose selective de-anonymization, allowing only illicit transactions to be traced while protecting honest users’ privacy.

-

Plug-and-Play Solutions for Developers: Protocols such as zkFi offer developers easy integration of privacy-preserving features, abstracting the complexity of ZKPs while maintaining compliance.

-

Prevention of Bad Actor Abuse: By enabling cryptographic proof of legitimacy, ZKP mixers help prevent misuse by malicious actors while preserving privacy for compliant users, as discussed by a16z Crypto.

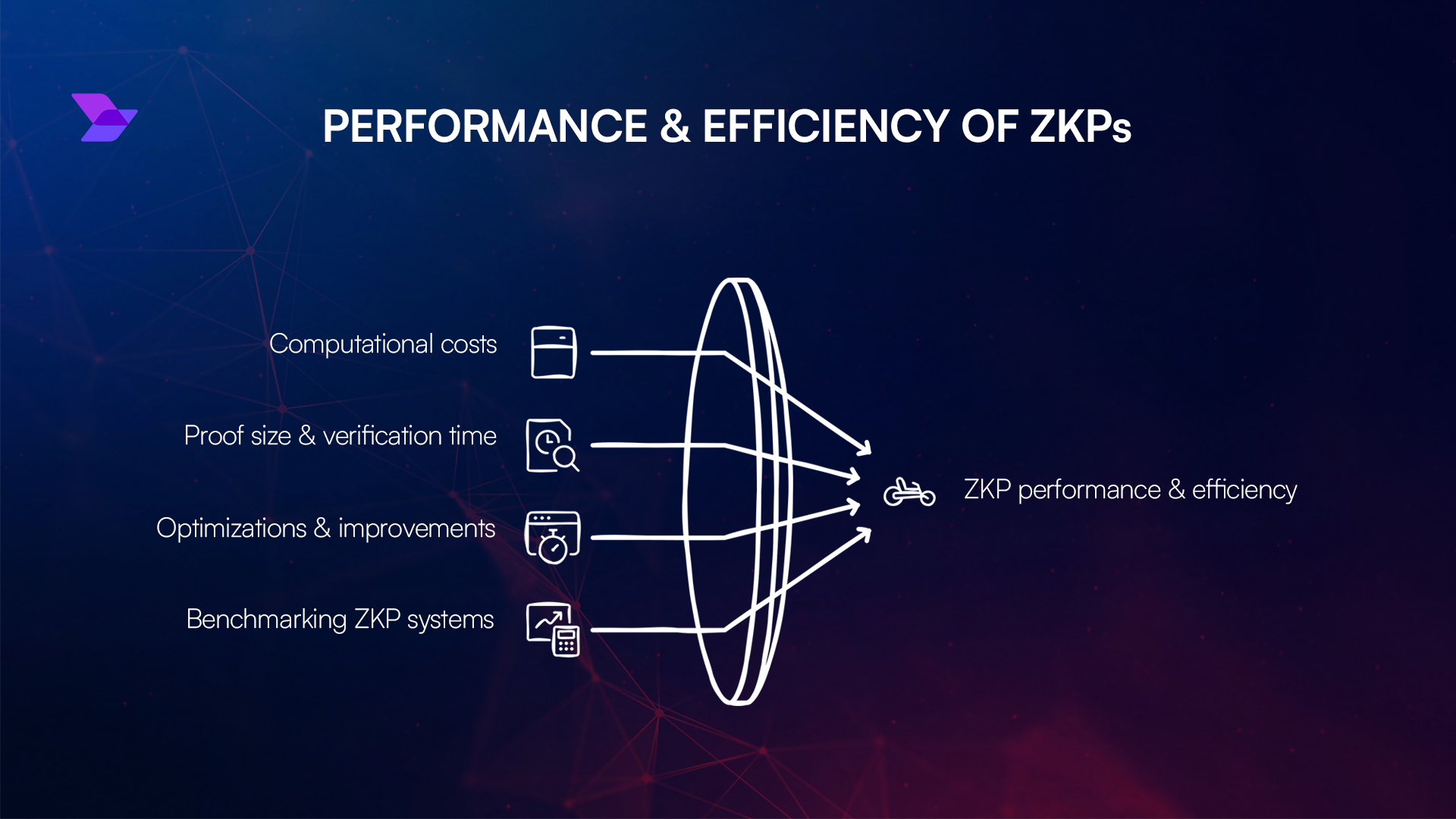

How Zero-Knowledge Proofs Enable Privacy With KYC/AML Compliance

The core advantage of ZKPs in this space is their ability to separate proof from disclosure. Users can demonstrate they’ve met certain criteria, such as passing KYC checks or proving funds aren’t linked to blacklisted sources, without revealing personal data or transaction specifics. This is sometimes called zkKYC or privacy-preserving KYC.

For example, a mixer could require users to generate a zero-knowledge proof that their wallet has passed AML screening before allowing them into a mixing pool. The mixer never sees who you are or your transaction history, it only receives mathematical assurance that you’re compliant.

Current Innovations: Beyond Simple Mixing

The latest generation of compliant zk mixers goes further than just anonymizing coins. Some platforms now offer configurable governance conditions, reversible unlinkability (so links between deposits and withdrawals can be restored if required by law), and anti-money laundering modules built directly into smart contracts (details here). These features are designed to meet evolving regulatory expectations without sacrificing user privacy.

Industry leaders and researchers agree: the next wave of crypto privacy tools must be both user-centric and regulator-friendly. As the market matures, zero-knowledge proof crypto mixers are gaining traction among exchanges, wallet providers, and even some institutional players looking for FATF-compliant privacy solutions. The result is a new breed of mixers that offer granular control over compliance settings, such as allowing only wallets that have passed zkKYC checks to participate in mixing pools.

“Zero-knowledge proofs are not just a technical upgrade, they represent a fundamental shift in how we think about compliance and privacy. They empower users to retain control over their data while giving regulators the assurances they need. “

This vision is already being realized in projects like zkFi and configurable mixer frameworks. These platforms enable developers to integrate privacy with KYC/AML compliance into their DeFi applications without reinventing the wheel. In essence, these compliant zk mixers act as middleware, abstracting away cryptographic complexity and offering plug-and-play privacy with regulatory guardrails.

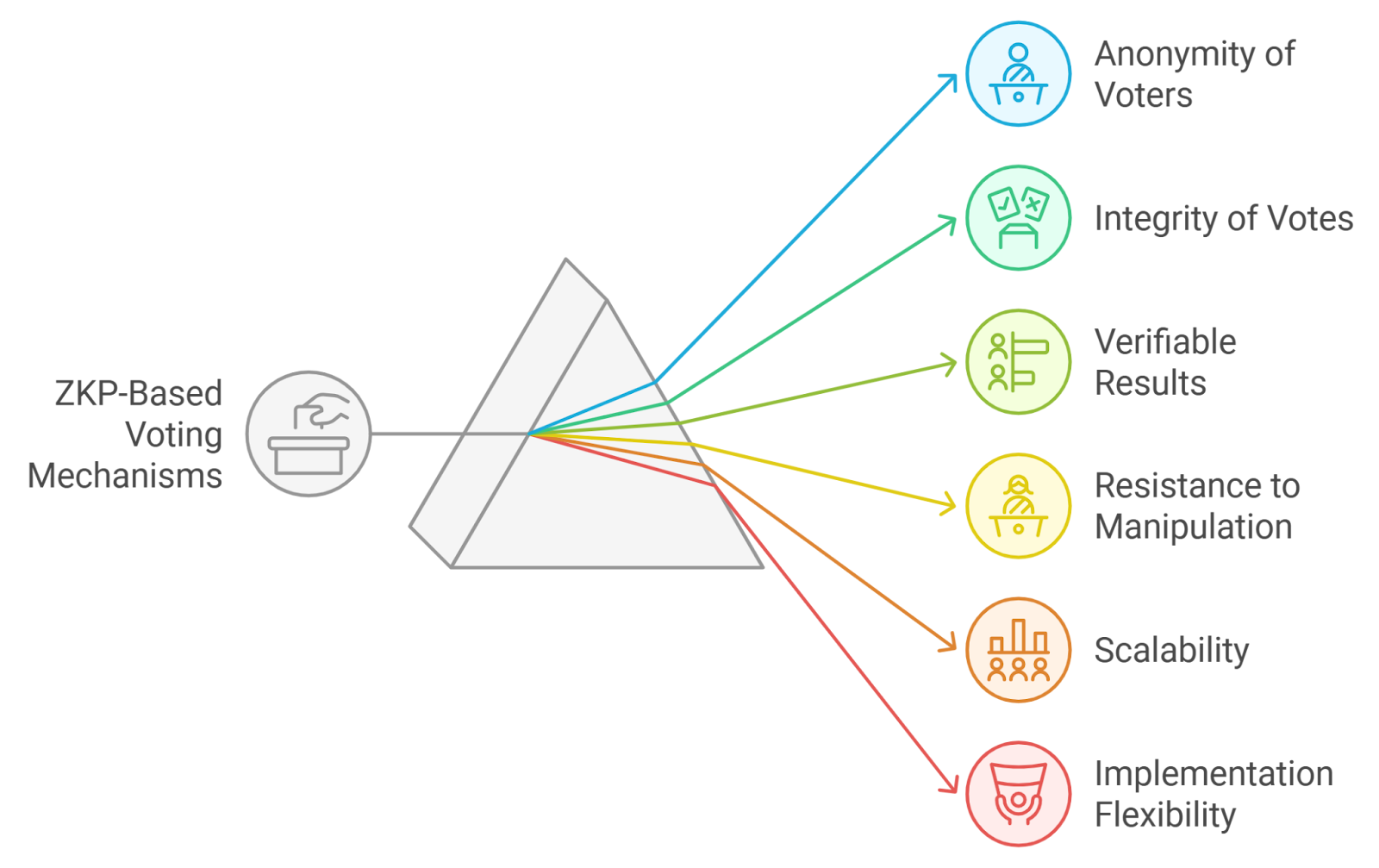

Balancing Privacy Rights With Regulatory Demands

The debate around crypto mixers is often framed as a zero-sum game: more privacy means less oversight, and vice versa. But zero-knowledge proofs disrupt this binary thinking. By enabling selective disclosure, where only the minimum necessary information is revealed, ZKP-powered mixers can satisfy both user expectations for confidentiality and regulator demands for accountability.

The SeDe framework’s approach to selective de-anonymization is particularly notable here. Rather than exposing all transactions or none at all, it allows authorities to trace only those flows that raise legitimate red flags, leaving compliant users untouched. This model aligns with emerging global norms around data minimization and proportionality in regulation.

What’s Next? The Road Ahead for Compliant zk Mixers

The future of compliant zk mixers will likely involve even closer collaboration between technologists, regulators, and industry bodies like FATF. We’re seeing early signs of regulatory sandboxes where new privacy-preserving protocols are tested under controlled conditions before wider adoption.

For users: Expect more options for privacy with KYC/AML compliance built-in by default, no more trade-off between anonymity and legality.

For developers: Toolkits like zkFi are lowering barriers to entry for building robust privacy solutions that meet global standards.

For regulators: Zero-knowledge proof crypto mixers provide unprecedented transparency without mass surveillance or bulk data collection.

If you’re considering using or building on compliant zk mixers, keep an eye on evolving standards from both technology consortia and global regulators. The intersection of cryptography, law, and financial innovation has never been more dynamic, or promising, for those who believe privacy and regulation can coexist.