In 2024, the crypto landscape is a high-wire act between privacy and compliance, and nowhere is that tension more electric than in the world of regulated crypto mixers. As governments sharpen their oversight tools and institutional players demand transparency, privacy-preserving technologies are being forced to evolve at breakneck speed. The question isn’t whether mixers can survive under new rules – it’s how they’re rewriting their playbooks to keep both regulators and privacy advocates satisfied.

![]()

The Regulatory Squeeze: U. S. and EU Clamp Down on Crypto Mixers

This year has been a regulatory gauntlet for mixers. In the United States, the introduction of the Blockchain Integrity Act in May 2024 marked a seismic shift. This proposed legislation aims for a two-year ban on all cryptocurrency mixers, threatening hefty fines up to $100,000 for financial institutions handling mixer-associated funds. Meanwhile, across the Atlantic, the European Union’s Innovation Hub for Internal Security has sounded alarms about privacy-enhancing tech like mixers and privacy coins. Their June 2024 report calls for upgraded law enforcement capabilities to keep pace with these obfuscation tools.

The result? Many mixer operators are now geo-blocking U. S. and EU users or reengineering their platforms to meet Know Your Customer (KYC) standards – but not without pushback from privacy purists who see KYC as antithetical to crypto’s original ethos.

Innovating Compliance: Selective De-Anonymization and zkMixer Lead the Charge

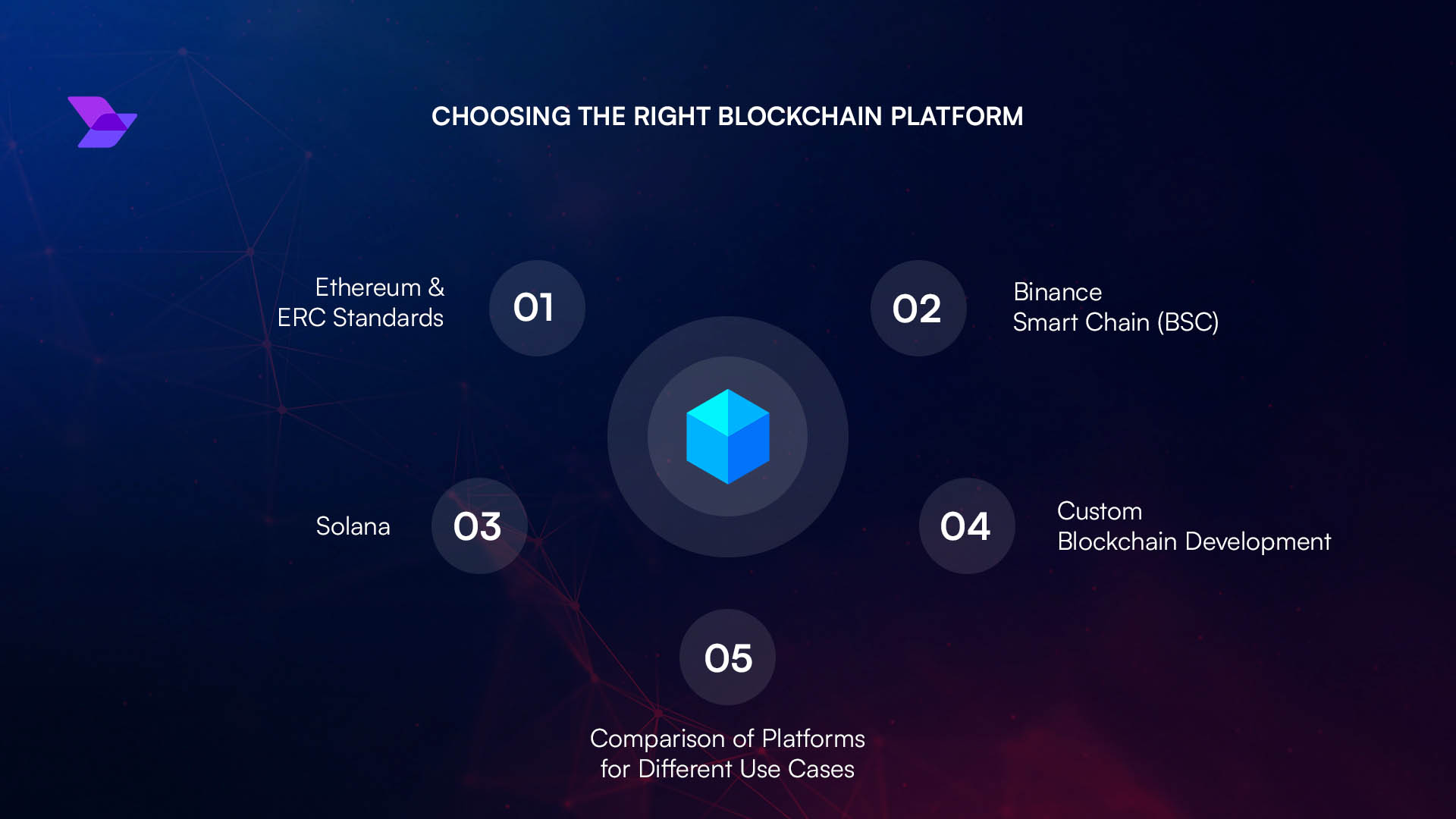

Regulated crypto mixers aren’t just waiting for regulatory shoes to drop – they’re innovating aggressively. Two standout technologies have emerged:

- Selective De-Anonymization (SeDe): This framework lets designated authorities trace illicit transactions without exposing legitimate users’ data. SeDe distributes de-anonymization powers across multiple entities, ensuring no single party can unmask users at will. It’s a tactical move that satisfies compliance demands while defending core user privacy.

- zkMixer: Debuting in March 2025, zkMixer harnesses zero-knowledge proofs alongside anti-money laundering consensus protocols. It empowers communities to set custom governance on mixing pools – even enabling refunds or forfeiture of deposits if tainted origins are detected. This is next-level AML compliant coin mixing where flexibility meets accountability.

The upshot? These technologies give regulated mixers powerful new levers to balance privacy and compliance, letting them adapt quickly as legal frameworks shift beneath their feet.

Top 5 Features of Regulated Crypto Mixers in 2024

-

Selective De-Anonymization (SeDe): This advanced cryptographic framework enables regulated mixers to trace illicit transactions when required, distributing de-anonymization decisions among multiple entities for accountability—without sacrificing user privacy for compliant users.

-

Zero-Knowledge Proofs (zkMixer): Leveraging zero-knowledge technology, platforms like zkMixer offer configurable privacy pools with built-in ‘Proof of Innocence’ and anti-money laundering consensus, letting users prove the legitimacy of funds without revealing identities.

-

Customizable Compliance Controls: Regulated mixers in 2024 feature governance tools that allow user groups to set rules for refunds or confiscations, ensuring that deposits linked to suspicious activity can be flagged or returned based on consensus protocols.

-

Geo-Restriction and User Screening: Services like Whir have implemented geo-blocking and user screening, restricting access from jurisdictions with strict KYC/AML requirements to maintain compliance without compromising privacy for eligible users.

-

Transparent Audit Trails for Regulators: Modern regulated mixers provide selective transparency features, enabling authorized regulators to audit transaction histories when legally mandated, while still preserving privacy for regular, compliant transactions.

User Impact: Privacy Without Breaking the Law?

For users who crave confidentiality but won’t risk crossing legal lines, today’s regulated mixers promise something radical: transactional anonymity that plays by the rules. But there are trade-offs:

- KYC friction: Some platforms now require identity verification before mixing – a controversial step that deters hardcore privacy seekers but opens doors for institutional adoption.

- Geo-restrictions: Services like Whir have asked U. S. and EU residents not to use their platform at all due to regulatory uncertainty around KYC requirements.

- Bespoke governance: Newer protocols let user groups set their own risk thresholds and compliance triggers inside mixing pools, making GDPR crypto mixing feasible for organizations with strict data policies.

This evolving toolkit means you no longer have to choose between total exposure or total secrecy; instead, you can dial in your level of transparency while staying within legal bounds.

But these advances come with a new set of questions: Who decides when privacy should be pierced? Can compliance-first mixers avoid becoming surveillance tools in disguise? The answer, for now, lies in the hands of both developers and regulators willing to collaborate on frameworks that are transparent, auditable, and fair. As the crypto community adapts, the demand for AML compliant coin mixers that offer granular privacy controls is only intensifying.

The Compliance Playbook: How Mixers Are Meeting Global Standards

Modern mixer platforms aren’t just layering on compliance for show. They’re building robust infrastructures to satisfy global anti-money laundering (AML) and counter-terrorism financing (CTF) laws while preserving user trust. Here’s how they’re doing it:

- Multi-jurisdictional risk engines: Automated systems screen deposits and withdrawals against international watchlists and sanctions databases, flagging suspicious activity before it enters the pool.

- GDPR-aligned data handling: Leading platforms now encrypt user data at rest and in transit, storing only what’s necessary for compliance audits, and purging everything else on a rolling schedule.

- Transparent reporting: Some mixers publish anonymized transparency reports, showing aggregate compliance actions taken without exposing individual users.

This tactical approach means regulated crypto mixers can serve both retail users seeking privacy and institutions that must adhere to strict reporting standards. For organizations operating under GDPR or similar frameworks, this new breed of mixer removes a significant compliance headache, making privacy-preserving cryptocurrency tools not just viable but preferable.

What’s Next? The Future of Regulated Mixers

The regulatory chess game is far from over. With U. S. lawmakers proposing sweeping bans and EU agencies calling for advanced tracing capabilities, the pressure on mixer operators will only intensify into 2025. Yet innovation is outpacing regulation: frameworks like SeDe and zkMixer prove that it’s possible to engineer solutions where privacy isn’t sacrificed for compliance, it’s architected into the protocol from day one.

If you’re navigating this space, whether as an investor, developer, or institution, the next move is clear: stay agile. Evaluate platforms not just on their privacy promises but on their demonstrated ability to adapt to evolving legal realities. When done right, regulated crypto mixers can deliver robust confidentiality without crossing regulatory red lines, a win-win for everyone who believes financial freedom shouldn’t come at the cost of legality.

Essential Questions Before Using a Regulated Crypto Mixer

-

Does the mixer comply with current regulations in my jurisdiction? Regulatory requirements vary by country—ensure the service is transparent about its compliance with laws like the Blockchain Integrity Act (U.S.) or EU directives.

-

What Know Your Customer (KYC) and Anti-Money Laundering (AML) measures are in place? Leading mixers may require identity verification or implement selective de-anonymization frameworks, such as SeDe, to meet AML standards.

-

How does the mixer balance privacy with compliance? Look for mixers using advanced cryptographic solutions like zkMixer, which offers zero-knowledge proofs and ‘Proof of Innocence’ protocols to preserve privacy while enabling regulatory oversight.

-

Are there restrictions for users from certain regions? Some mixers, like Whir, restrict access for U.S. and EU users due to compliance limitations—verify your eligibility before proceeding.

-

What is the platform’s policy on handling suspicious or illicit funds? Modern mixers may allow for deposit confiscation or refunds if funds are linked to illicit activity, as seen in customizable governance pools like those in zkMixer.

If you want to dive deeper into how these new models are changing blockchain privacy without breaking the law, check out our coverage at How Regulated Crypto Mixers Enable Privacy Without Breaking the Law.