In 2024, the landscape for regulated crypto mixers is more complex and scrutinized than ever. As privacy advocates and compliance professionals collide, the challenge is clear: how can a compliant cryptocurrency mixer offer robust privacy while satisfying global anti-money laundering (AML) and know-your-customer (KYC) mandates? The answer lies in a careful blend of cryptographic innovation, regulatory adaptation, and a willingness to embrace transparency where it matters most.

Why Privacy Remains Essential in Cryptocurrency

The original promise of cryptocurrencies was financial freedom through pseudonymity. However, as adoption surged, so did illicit use cases – prompting regulators to demand greater traceability. For many legitimate users, privacy is not just about secrecy; it’s about protecting trade secrets, personal security, or sensitive business operations. Yet the line between privacy and non-compliance is razor-thin. This tension has fueled the rise of regulated bitcoin mixers that aim to preserve user confidentiality without enabling unlawful activity.

The Compliance Imperative: AML and KYC in Focus

Global regulators have dramatically ramped up enforcement against crypto mixing services perceived as facilitating money laundering or sanctions evasion. In March 2025, when the U. S. Treasury’s sanctions on Tornado Cash were reversed after a court found regulatory overreach, it sent ripples through both compliance circles and privacy communities. The debate was reignited: Can mixers be both private and compliant?

The answer increasingly depends on advanced compliance frameworks:

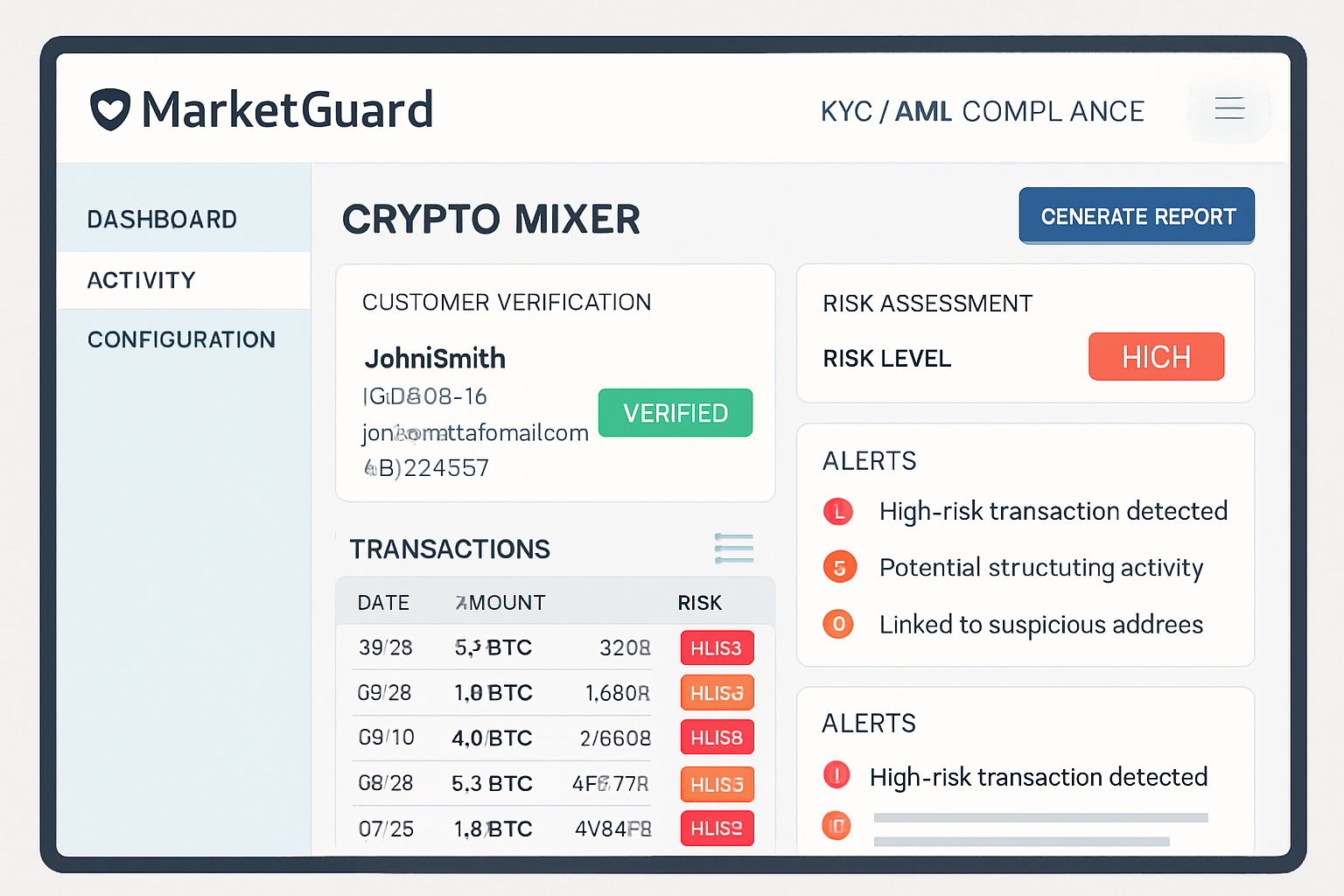

- KYC/AML Integration: Leading compliant cryptocurrency mixer platforms now employ automated document verification, biometric checks, and sanctions screening to verify users without exposing their transaction flows.

- Selective De-Anonymization (SeDe): Emerging protocols like SeDe allow for targeted de-anonymization of transactions if illegal activity is suspected – but only after a consensus-driven legal process is triggered.

- Travel Rule Solutions: Tools such as MarketGuard enable mixers to comply with the FATF Travel Rule by securely transmitting originator/beneficiary data between regulated entities while keeping transaction details private from third parties.

This dual approach ensures that regulated mixers do not become safe havens for illicit funds while still providing meaningful anonymity for lawful users. For a deeper dive into these strategies, see our guide on how regulated crypto mixers ensure compliance with global AML laws.

The Regulatory Tightrope: Regional Responses and Industry Adaptation

The regulatory environment remains highly fragmented. In the United States, the proposed Blockchain Integrity Act aims to impose a two-year ban on cryptocurrency mixers – reflecting persistent lawmaker concerns about misuse despite technological safeguards. Meanwhile, the European Union’s Innovation Hub for Internal Security highlights ongoing challenges posed by privacy coins and mixing services to law enforcement efforts.

This patchwork has forced some mixer operators to proactively restrict access from high-risk jurisdictions rather than risk non-compliance. Notably, Whir recently asked U. S. and EU users not to access its service due to its inability to implement KYC without undermining user privacy entirely.

Key Regulatory Developments for Crypto Mixers in 2024

-

Proposed U.S. Blockchain Integrity Act: In 2024, U.S. lawmakers introduced the Blockchain Integrity Act, aiming to impose a two-year ban on cryptocurrency mixers to address concerns over money laundering and illicit finance. This proposal reflects heightened regulatory scrutiny of privacy-enhancing technologies in the crypto sector.

-

EU Innovation Hub Report on Privacy Coins and Mixers: The European Union’s Innovation Hub for Internal Security released a report highlighting the challenges that privacy coins and crypto mixers pose to law enforcement, calling for enhanced regulatory measures and cross-border cooperation.

-

Selective De-Anonymization (SeDe) Framework Emerges: New compliance frameworks like Selective De-Anonymization (SeDe) have been proposed, enabling privacy-preserving mixers to de-anonymize illicit transactions by consensus without compromising general user privacy, offering a technological solution to regulatory demands.

-

Sanctions Reversal on Tornado Cash: In March 2025, the U.S. Treasury Department reversed sanctions on Tornado Cash after a court found the agency had exceeded its authority, setting a precedent for future regulatory actions and reigniting debate over the legality of crypto mixers.

-

Industry Self-Regulation and Service Restrictions: Some mixer services, such as Whir, have proactively restricted access for users in the U.S. and EU, citing the inability to implement KYC measures without undermining privacy, reflecting the sector’s adaptation to evolving compliance expectations.

The net result? Only those platforms willing to invest in both cutting-edge cryptography and robust compliance infrastructure are poised to survive regulatory scrutiny, and earn user trust, in this new era.

For privacy-focused users, the evolution of crypto mixer compliance means more than just ticking regulatory boxes. It’s about ensuring that privacy is not sacrificed for the sake of bureaucracy, but rather enhanced through technology that aligns with legal frameworks. The latest generation of regulated mixers now routinely deploys zero-knowledge proofs and multi-party computation to shield transaction details while still enabling selective auditability if required by law.

Technological Innovations: The Future of Privacy and Compliance

Innovative frameworks like Selective De-Anonymization (SeDe) are game-changers in 2024. SeDe protocols empower mixers to respond to legitimate legal requests without opening the floodgates to mass surveillance or arbitrary de-anonymization. Instead, a consensus-driven process involving multiple stakeholders must be triggered before any private data is revealed, striking a nuanced balance between user rights and regulatory obligations.

Other solutions focus on seamless integration with existing compliance tools. Automated KYC systems now leverage biometric verification and real-time sanctions screening, reducing friction for users while satisfying global standards such as the FATF Travel Rule. These advancements not only address regulator concerns but also make it harder for illicit actors to exploit mixing services.

The upshot? Users can enjoy enhanced privacy without fearing blanket exposure or arbitrary blacklisting, provided they use a regulated crypto mixer that enables privacy without breaking the law.

Industry Best Practices: What Sets Leading Mixers Apart?

The most trusted regulated bitcoin mixer platforms share several best practices:

Key Features of Leading Compliant Crypto Mixers in 2024

-

Selective De-Anonymization (SeDe) Frameworks: Advanced mixers like those piloting SeDe enable privacy for regular users while allowing authorities to de-anonymize transactions linked to illicit activities through a consensus process, supporting both privacy and compliance.

-

Integrated KYC/AML Procedures: Leading mixers such as MarketGuard offer built-in Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, including automated document verification and sanctions screening, to meet regulatory standards without excessive user data exposure.

-

Geo-Restriction and Access Controls: Services like Whir restrict access for users in highly regulated regions (e.g., the U.S. and EU) to avoid compliance conflicts, demonstrating proactive risk management and regulatory awareness.

-

Travel Rule Compliance Tools: Solutions such as BitGo integrate Travel Rule protocols, ensuring that required user and transaction information is securely shared between Virtual Asset Service Providers (VASPs) as mandated by global regulators.

-

Transparent Audit Trails and Reporting: Compliant mixers increasingly provide auditable logs and suspicious activity reporting features, aligning with guidance from organizations like FinCEN and supporting investigations while maintaining user privacy for legitimate transactions.

These include transparent audit trails (for compliance officers only), robust user consent mechanisms, and adaptive risk scoring that flags suspicious activity without casting too wide a net. Importantly, these platforms often collaborate with independent auditors and legal experts to validate their controls, building confidence among institutional clients and regulators alike.

What’s Next? Navigating Uncertainty in Global Regulation

The path forward remains unpredictable. As lawmakers debate measures like the Blockchain Integrity Act in the U. S. , and EU agencies push for tighter oversight, the industry will likely see further consolidation around platforms capable of demonstrating both technical excellence and regulatory maturity.

This means users must be vigilant: always verify whether your chosen mixer is operating within your jurisdiction’s legal boundaries, and look for evidence of third-party audits or published compliance reports. For institutional investors especially, demand for compliance-friendly mixers with clear regulatory assurance is at an all-time high.

The bottom line: In 2024, regulated crypto mixers are proving that it’s possible to protect financial privacy while respecting AML/KYC mandates, so long as innovation keeps pace with regulation.