Choosing a regulated crypto mixer in 2024 is no longer a matter of simply picking the most private tool available. The regulatory environment has shifted rapidly, especially after the U. S. appeals court’s November 2024 ruling overturning Treasury sanctions on Tornado Cash and the introduction of advanced compliance frameworks like zkMixer. As privacy tools evolve, so do expectations for transparency, security, and legal adherence. If you want to protect your privacy without risking non-compliance, you need to weigh your options against a clear set of critical factors.

Regulatory Compliance and Licensing: The Non-Negotiable Foundation

The first and most essential factor is regulatory compliance. In 2024, mixers that ignore KYC/AML obligations or lack proper registration with bodies like FinCEN (in the US) or fail to meet EU AMLD standards are increasingly at risk of enforcement actions or outright bans. The Blockchain Integrity Act’s proposed two-year ban on financial institutions interacting with mixer-tainted funds underscored just how high the stakes have become for users and providers alike.

When evaluating a compliant cryptocurrency mixer, confirm its licensing status and whether it follows KYC/AML procedures where required by law. Some mixers now offer tiered services: basic mixing for small amounts without KYC, but enhanced due diligence for larger transactions or business clients. This approach helps balance privacy with legal requirements, an absolute must as regulators focus on traceability instead of blanket prohibitions.

Transparency of Operations: Seeing Behind the Curtain

A regulated crypto mixer should never operate as a black box. Instead, look for platforms that provide clear disclosures about how they handle user funds and data. Leading services publish detailed privacy policies, undergo third-party audits, and may even offer real-time proofs of reserves or transaction traceability features to demonstrate lawful operation.

This transparency not only builds trust but also provides critical evidence should you ever need to prove that your mixed funds were processed through a legal service, helpful in audits or when interacting with exchanges that scrutinize deposit sources. In fact, some compliant mixers now issue cryptographic receipts or signed attestations of lawful mixing activity as part of their user experience.

Key Factors Every Regulated Crypto Mixer Must Provide in 2024

-

Transparency of Operations: Look for mixers that provide clear disclosures on fund handling, privacy policies, independent audit reports, and traceability features. Transparent operations help users verify lawful practices and build trust in the service.

-

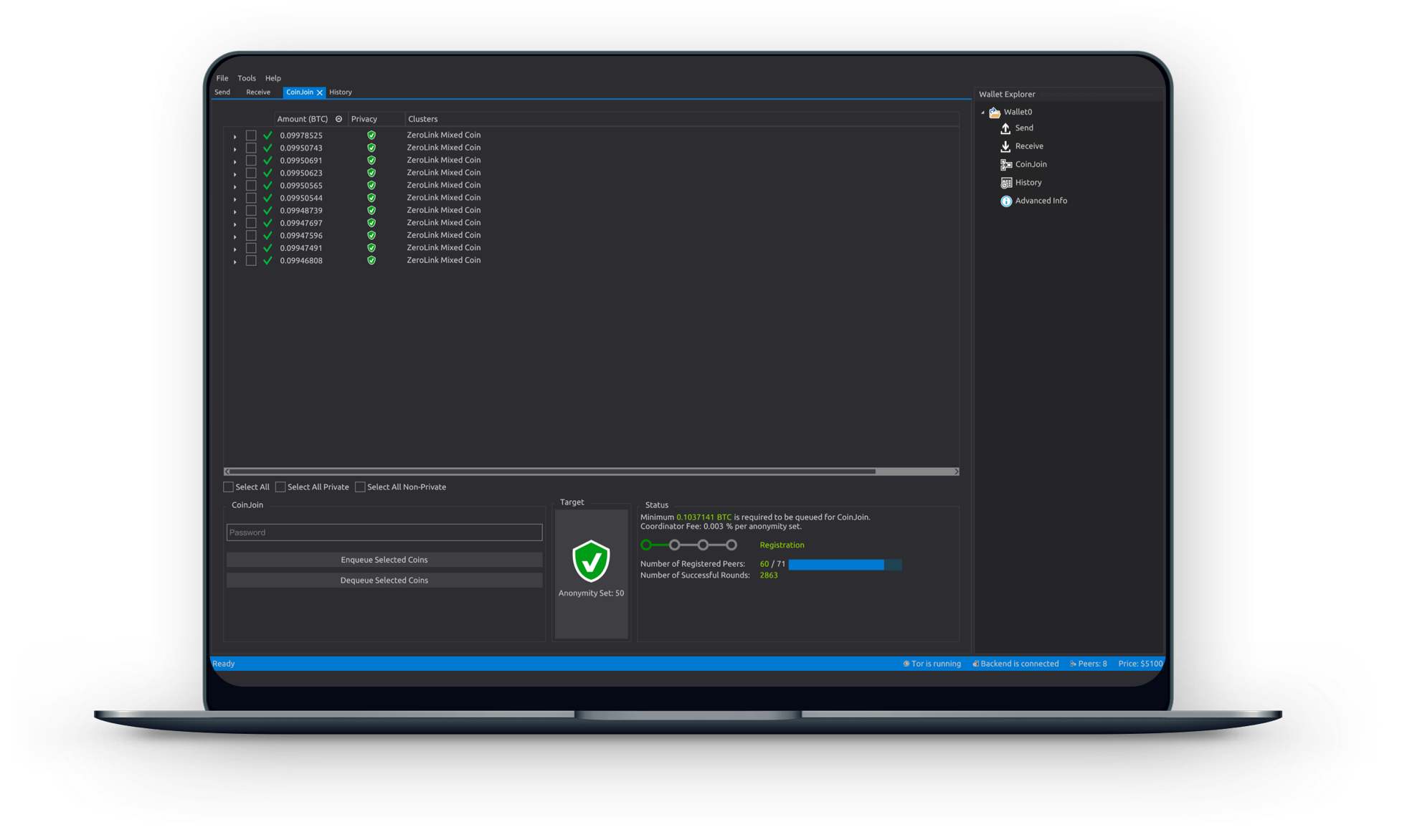

Privacy Features and Anonymity Levels: Assess the mixer’s technical privacy measures, such as zero-knowledge proofs (e.g., zkMixer), coinjoin implementations (as in Wasabi Wallet or Samourai Whirlpool), or ring signatures (used by Monero). These features maximize user anonymity while remaining within regulatory boundaries.

-

Security Infrastructure: Evaluate whether the mixer offers end-to-end encryption, non-custodial options, secure code audits, and robust protection against hacks or data leaks. Strong security safeguards user assets and sensitive information from unauthorized access.

-

Reputation and Track Record: Check independent reviews, user feedback, and the mixer’s history regarding regulatory incidents or law enforcement actions. Established mixers like Wasabi Wallet, Samourai Whirlpool, and Mixero.io have public records and community discussions that help verify reliability and standing in the market.

Privacy Features and Anonymity Levels: Advanced Tech Without Overstepping Boundaries

The technical sophistication of privacy features sets top-tier mixers apart, but so does their ability to implement these tools without violating regulations. In 2025, leading platforms are deploying zero-knowledge proofs (as seen in zkMixer), coinjoin implementations (like those used by Wasabi Wallet), and ring signatures inspired by privacy coins such as Monero. These methods obfuscate transaction trails while allowing for selective transparency when required by law enforcement or compliance teams.

The key is configurability: choose mixers that let you control your desired level of anonymity while still offering mechanisms for dispute resolution or lawful investigation if necessary. Avoid services that promise absolute secrecy at the expense of all oversight, these are increasingly targeted by regulators worldwide.

Security Infrastructure: Protecting Assets and Data Above All

No amount of regulatory compliance can compensate for weak security infrastructure. Modern users should demand end-to-end encryption throughout the entire mixing process, non-custodial options where possible (so funds are never held centrally), and regular independent code audits published for public review.

The best mixers also offer robust protection against hacks or data breaches, features such as multi-signature withdrawal processes, hardware security modules (HSMs), and rapid incident response protocols are now industry standards among compliant providers.

Security is not just about technology – it is also about operational discipline. Examine how a mixer manages its infrastructure, what insurance or compensation mechanisms are in place in the event of a breach, and whether they have a proven record of safeguarding user data. As high-profile incidents have shown, even technically advanced platforms can fall if their processes are lax or their staff are not properly vetted.

Reputation and Track Record: Trust Built Over Time

Finally, reputation matters more than ever. Before choosing any regulated crypto mixer, research independent reviews and user feedback on trusted forums or aggregator sites. Look for evidence of timely customer support, transparent dispute resolution, and most importantly – an absence of unresolved regulatory issues or law enforcement actions.

Platforms with long-standing positive reputations generally signal reliability. Conversely, mixers that have been associated with blocked funds, regulatory takedowns, or repeated negative press should be approached with caution regardless of their technical claims. Remember that in 2025’s environment, history is often the best indicator of future compliance and service quality.

Key Factors Every Regulated Crypto Mixer Must Provide in 2024

-

Regulatory Compliance and Licensing: Ensure the mixer is registered with relevant authorities (such as FinCEN in the US or compliant with EU AMLD) and adheres to KYC/AML protocols where required. This is crucial for legal operation and to avoid exposure to sanctions or enforcement actions.

-

Transparency of Operations: Look for mixers that provide clear disclosures about fund handling, privacy policies, independent audit reports, and traceability features. Transparency builds trust and demonstrates a commitment to lawful operation.

-

Privacy Features and Anonymity Levels: Assess the technical privacy measures offered, such as zero-knowledge proofs (e.g., zkMixer), CoinJoin implementations (e.g., Wasabi Wallet), or ring signatures (e.g., Monero), to maximize user anonymity while remaining compliant with regulations.

-

Security Infrastructure: Evaluate the mixer’s use of end-to-end encryption, non-custodial options, secure code audits, and protections against hacks or data leaks. A robust security setup is essential to safeguard user assets and personal information.

-

Reputation and Track Record: Check independent reviews, user feedback, and any history of regulatory incidents or law enforcement actions. Reliable mixers like Wasabi Wallet and Samourai Wallet’s Whirlpool have established reputations and transparent operational histories.

Making Your Choice: A Checklist for 2024

To distill these considerations into actionable steps:

- Verify registration with relevant authorities (FinCEN, EU AMLD) and check for up-to-date licenses.

- Demand transparency: review published audits, privacy policies, and any available attestations.

- Evaluate privacy tech: zero-knowledge proofs or coinjoin should be configurable for compliance needs.

- Scrutinize security: look for encryption standards, non-custodial options, and regular code audits.

- Research reputation: read independent reviews and check for any public regulatory issues.

The intersection of privacy and regulation will only become more complex as blockchain adoption grows. By focusing on these five critical factors – regulatory compliance, transparency, privacy features, security infrastructure, and reputation – you can confidently select a legal crypto mixing service that meets your privacy needs without exposing you to unnecessary risk. For deeper insight into how leading mixers balance these priorities worldwide, see our guide on how regulated crypto mixers balance privacy and compliance in 2024.