The European Union’s regulatory landscape for cryptocurrency privacy has undergone a seismic shift in 2024. With the full enforcement of the Markets in Crypto-Assets Regulation (MiCA) and the General Data Protection Regulation (GDPR), crypto mixers operating in the EU now find themselves at the intersection of privacy innovation and strict compliance. For users and operators alike, understanding how these two frameworks interact is critical to navigating the future of regulated crypto mixers in Europe.

MiCA’s Impact: Raising the Bar for Crypto Mixer Compliance

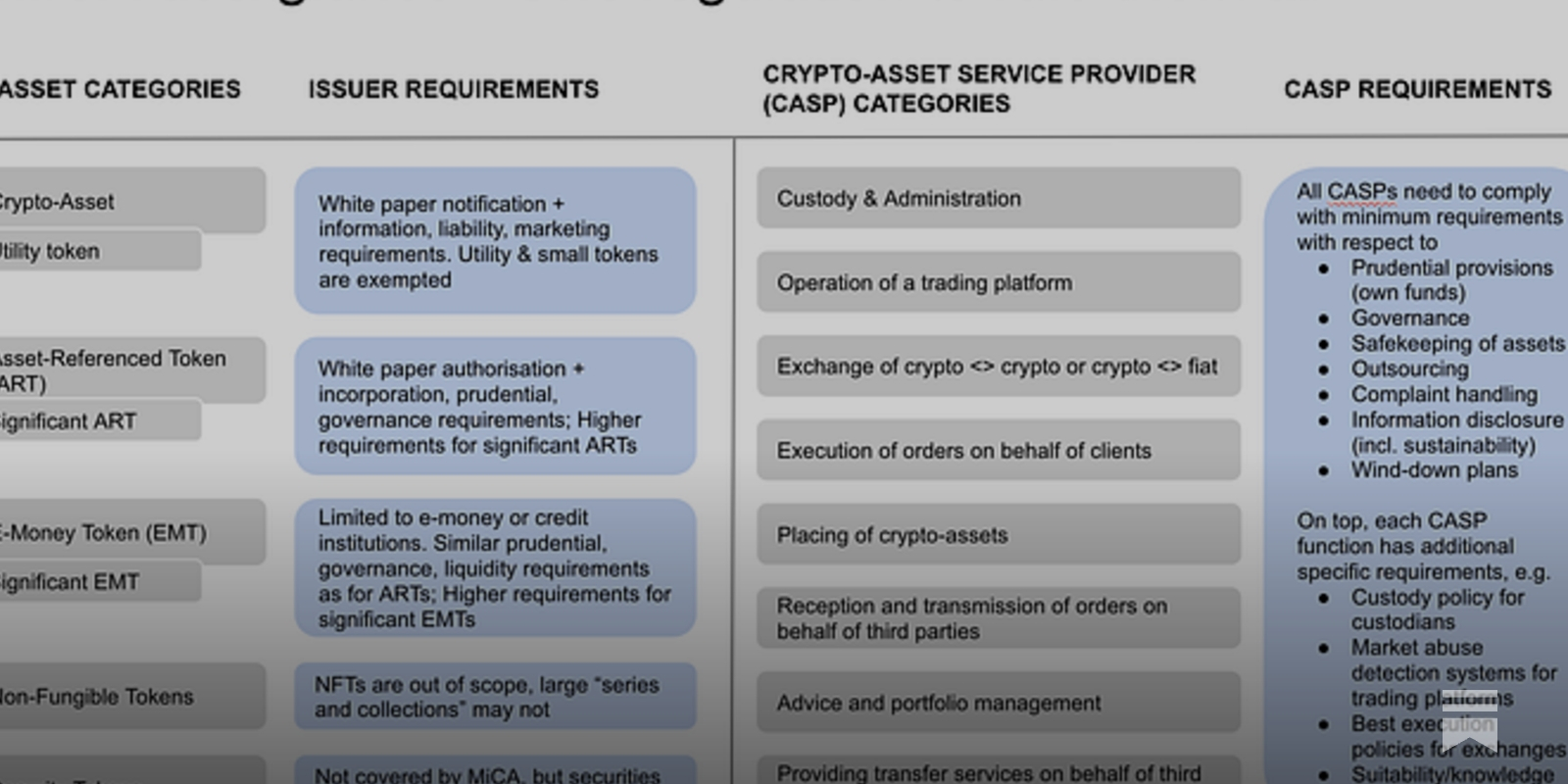

When MiCA became fully applicable across the EU on December 30,2024, it marked a new era for crypto-asset service providers (CASPs). MiCA’s reach is broad, imposing uniform rules that include mandatory licensing, minimum capital requirements, and, crucially, stringent anti-money laundering (AML) and know-your-customer (KYC) protocols. For cryptocurrency mixers, whose core function is to obfuscate transaction trails, these requirements present both operational and philosophical challenges.

Mixers must now verify user identities, monitor transactions for suspicious activity, and maintain detailed records. Failure to comply can result in regulatory fines, which, according to recent projections, are expected to surpass €1.2 billion for non-compliant exchanges in 2025. This has forced many privacy-focused platforms to overhaul their architectures or risk being barred from the EU market entirely.

“MiCA doesn’t just raise the bar, it redraws the playing field for privacy technologies in crypto. Compliance isn’t optional, and the penalties for falling short are historic. “

GDPR: Data Privacy Meets Blockchain Anonymity

While MiCA targets market conduct and financial transparency, GDPR zeroes in on personal data protection. Any mixer collecting personal information for KYC purposes must ensure that this data is processed lawfully, transparently, and securely. Explicit user consent, robust data encryption, and prompt breach notification are now non-negotiable standards. The stakes are high, with GDPR violations carrying penalties up to €20 million or 4% of global annual turnover, whichever is higher.

This creates a paradox for regulated crypto mixers: they must collect and store identifying information to satisfy MiCA, yet minimize and protect that same data to comply with GDPR. The challenge is not just technical but also ethical, as privacy-oriented users may be wary of any service that holds their personal information, regardless of regulatory assurances.

Top 5 GDPR Compliance Requirements for EU Crypto Mixers

-

Explicit User Consent for Data Collection: Crypto mixers must obtain clear and informed consent from users before collecting any personal data for KYC or AML purposes, as required by GDPR Article 7. Consent must be freely given, specific, and easily withdrawable.

-

Data Minimization and Purpose Limitation: Operators are required to collect only the minimum data necessary for regulatory compliance and ensure it is used strictly for stated purposes, in line with GDPR Articles 5(1)(c) and 5(1)(b).

-

Robust Data Security Measures: Mixers must implement state-of-the-art technical and organizational safeguards to protect personal data against unauthorized access, breaches, or leaks, as mandated by GDPR Article 32.

-

Transparent Privacy Policies and User Rights: Operators must provide clear privacy notices detailing data processing activities and inform users of their rights (access, rectification, erasure, etc.) under GDPR Articles 12–22.

-

Timely Data Breach Notification: In the event of a data breach, crypto mixers are obligated to notify relevant authorities within 72 hours and, when appropriate, affected users, as per GDPR Article 33.

Innovation or Extinction? Privacy Technologies Under Pressure

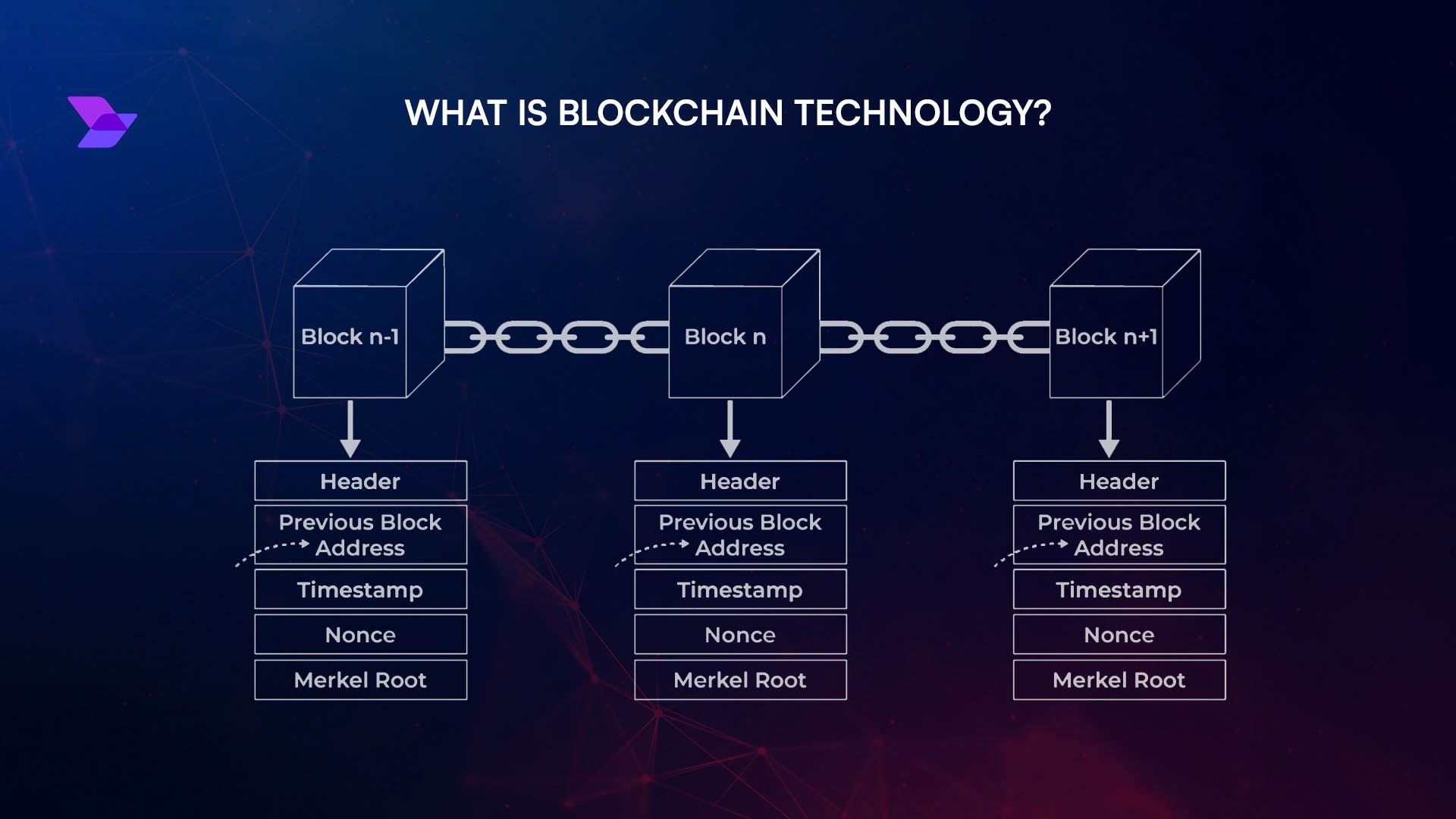

Rather than retreat from the EU, some mixers are experimenting with advanced cryptographic solutions to reconcile privacy with compliance. Zero-knowledge proofs (ZKPs) have emerged as a promising tool, allowing mixers to verify transactions and user compliance without revealing underlying personal data. For example, the zkMixer framework enables configurable governance, including the ability to refund or confiscate deposits if illicit origins are detected, all while preserving user anonymity at the protocol level.

However, these innovations are not a panacea. They require significant investment, technical expertise, and ongoing dialogue with regulators to ensure that privacy features do not inadvertently enable criminal activity. The cost of compliance, both financial and technical, has risen sharply, with smaller operators struggling to keep pace with evolving standards.

For more on how regulated mixers are adapting, see How Regulated Crypto Mixers Balance Privacy and Compliance in 2024.

As the regulatory environment matures, the crypto privacy sector is experiencing a profound realignment. The tension between user anonymity and legal accountability is driving both consolidation and rapid technological advancement in the regulated crypto mixer market. Larger providers with the resources to invest in compliance infrastructure are thriving, while smaller, less sophisticated mixers are exiting or pivoting to other jurisdictions. This dynamic is fundamentally reshaping what it means to be a “regulated crypto mixer” in the EU.

Practical Implications for Users and Operators

For users, the days of anonymous, no-questions-asked mixing services in Europe are over. Regulated crypto mixers now require identity verification and may even monitor transaction patterns for suspicious behavior. While this may deter some privacy maximalists, it also opens the door for mainstream adoption by institutions and individuals who value both privacy and legal certainty. The new paradigm is one of measured privacy within a compliant framework.

Operators, meanwhile, must navigate a labyrinth of legal obligations. Beyond MiCA and GDPR, they face ongoing scrutiny from national regulators, data protection authorities, and even banking partners. Strategic investments in compliance technology, staff training, and legal counsel are now essential for survival. Those who succeed will be those who can demonstrate proactive risk management, transparent governance, and a willingness to engage constructively with regulators.

Looking Ahead: The Future of Crypto Privacy in the EU

The interplay of MiCA and GDPR is likely to set a global precedent for crypto privacy regulation. As other jurisdictions watch the EU’s experiment unfold, the lessons learned here will inform future policy and technological development worldwide. We may see further innovation in privacy-preserving compliance tools, such as decentralized identity (DID) systems or privacy coins designed with built-in regulatory hooks.

Yet, it is clear that the era of regulatory arbitrage is waning. For those who want to operate or use a regulated crypto mixer in the EU, the message is unequivocal: privacy is still possible, but only within the boundaries of transparency, accountability, and user protection. As the sector matures, responsible operators will continue to push for solutions that honor both the spirit of privacy and the letter of the law.

Innovative Approaches Crypto Mixers Use to Balance GDPR and MiCA

-

Integration of Zero-Knowledge Proofs (ZKPs): Leading regulated mixers, such as zkMixer, are implementing zero-knowledge proof frameworks. These cryptographic tools allow mixers to verify transaction legitimacy without exposing underlying user data, enabling compliance with MiCA’s transparency requirements while preserving user privacy as mandated by GDPR.

-

Configurable Governance and Transaction Controls: Platforms like zkMixer have adopted governance mechanisms that allow for the refund or confiscation of deposits if transactions are flagged as suspicious. This approach aligns with MiCA’s AML/KYC obligations, ensuring that mixers can intervene in cases of suspected illicit activity without broadly compromising user anonymity.

-

GDPR-Compliant Data Handling Practices: Regulated mixers are enhancing their data protection protocols to comply with GDPR. This includes obtaining explicit user consent for KYC data collection, implementing robust encryption, and adopting strict data minimization policies. These measures help protect user information from breaches and ensure lawful data processing, reducing the risk of severe GDPR penalties.

Ultimately, the push-and-pull between privacy and compliance will define the next chapter for crypto mixers in Europe. Those able to adapt, by embracing new cryptographic methods, fostering open communication with regulators, and building trust with users, will not only survive but help shape the future of digital privacy in a regulated world.

If you’re interested in a deeper dive into how regulated crypto mixers enable privacy without breaking compliance, explore this comprehensive guide.