Privacy has always been a cornerstone of the crypto ethos, yet the regulatory landscape demands a delicate balance between anonymity and compliance. Nowhere is this tension more evident than in the use of Tether (USDT), the world’s most widely adopted stablecoin, which currently trades at $1.001 with an on-chain market cap of $192,943,317.51 and over 1.18 million holders on Ethereum’s OP Mainnet. As USDT expands across networks like TRON, Binance Smart Chain, Solana, Polygon, Arbitrum, and Avalanche, users are increasingly seeking compliant privacy solutions that don’t compromise on legal standards or operational flexibility.

Why Privacy Matters for USDT Across Multiple Networks

Tether’s multi-network presence means that individuals and institutions can move assets quickly and efficiently across ecosystems. However, every transaction leaves a public trail – a fact that’s antithetical to legitimate privacy needs for traders, businesses managing payrolls, or even DAOs distributing funds. More importantly, as regulators intensify scrutiny of crypto mixers due to concerns about money laundering and illicit finance, the demand for regulated USDT mixers has never been higher.

Unlike legacy mixers that operate in legal gray zones, regulated crypto mixers offer compliant Tether privacy by embedding KYC/AML protocols into their workflows. This ensures users can anonymize their transactions without running afoul of evolving global regulations.

How Regulated USDT Mixers Achieve Compliance and Privacy

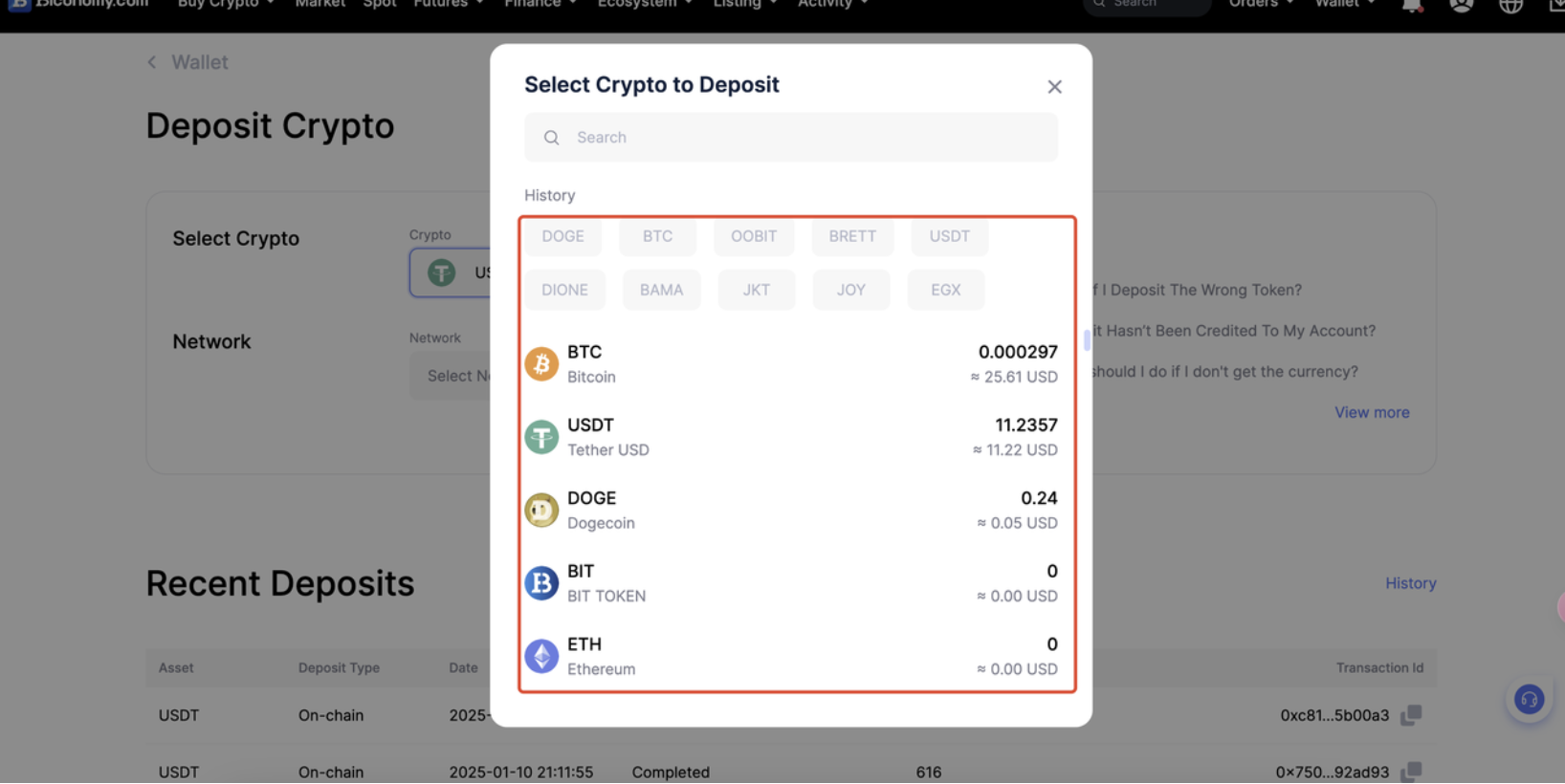

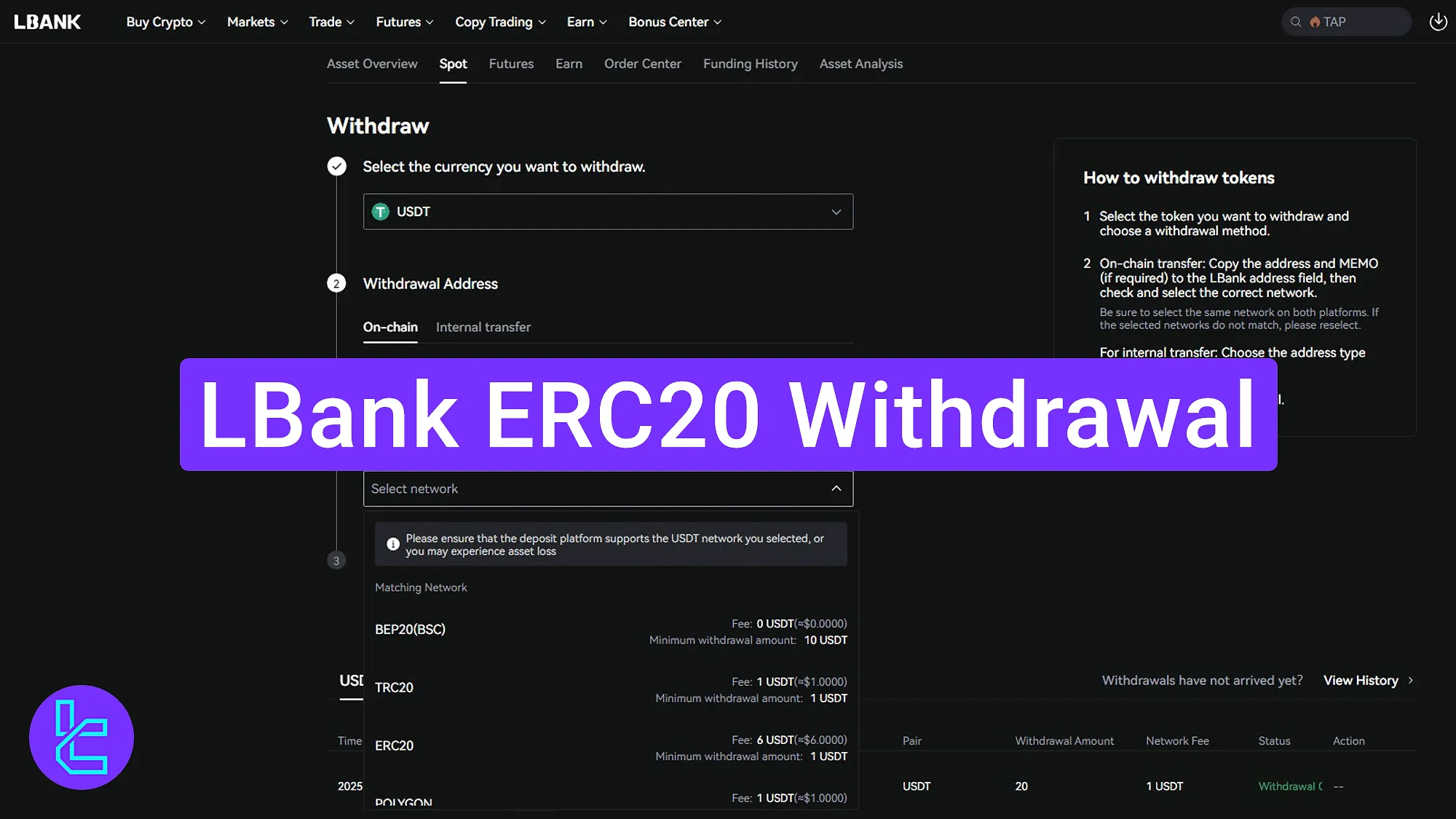

The process begins when a user chooses their preferred network – whether it’s ERC-20 on Ethereum for its deep liquidity or TRC-20 on Tron for lower fees. The regulated mixer generates a unique deposit address; once the user sends USDT to this address, the platform disperses funds through sophisticated pools and channels across multiple wallets.

This breaks the direct link between sender and recipient addresses while upholding strict compliance measures:

Key Compliance Features of Leading Regulated USDT Mixers

-

Comprehensive KYC/AML Procedures: Platforms like CoinJoin.io and Tornado Cash (regulated forks) implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, ensuring only verified users can access mixing services and deterring illicit use.

-

Multi-Network USDT Support: Leading mixers such as Mixer.Money and CryptoMixer enable compliant USDT mixing across major blockchains, including Ethereum (ERC-20), Tron (TRC-20), Binance Smart Chain (BEP-20), Polygon, Arbitrum, and Avalanche.

-

Regulatory Reporting and Audit Trails: Services like SmartMix.io provide transparent audit logs and regulatory reporting tools to facilitate compliance with local and international laws, supporting lawful privacy.

-

Configurable Privacy Controls: Platforms such as Mixer.Money allow users to set custom time delays and mixing parameters, balancing privacy needs with regulatory requirements.

-

Integration with Chain Analytics Providers: Regulated mixers often partner with analytics firms like Chainalysis or TRM Labs to monitor transactions for suspicious activity, ensuring ongoing compliance and risk mitigation.

The result is a robust privacy solution that doesn’t sacrifice legal assurance. Users benefit from enhanced confidentiality while remaining within the boundaries set by regulators.

The Expanding Role of Multi-Network Support in Privacy Crypto Mixers

USDT’s utility is magnified by its interoperability: transfers can now be executed not only on Ethereum but also on fast-rising networks like Arbitrum (now fully integrated by Binance), Optimism, Polygon PoS, Solana, Avalanche via bridges such as Celer cBridge – all supporting seamless movement at minimal cost.

This multi-network capability is critical because it allows users to select optimal transaction routes based on speed, cost efficiency or even jurisdictional requirements – all while maintaining privacy through compliant mechanisms.

For more details about how these solutions work in practice without breaking compliance rules, see our in-depth guide here.

Features That Set Regulated Mixers Apart From Legacy Solutions

- KYC/AML Integration: Ensures only legitimate actors can access mixing services.

- User-Controlled Parameters: Adjustable delays and fee structures maximize both privacy and convenience.

- Multi-Network Flexibility: Supports ERC20 (Ethereum), TRC20 (Tron), BEP20 (Binance Smart Chain), SOL (Solana), AVAX (Avalanche), ARB (Arbitrum), MATIC (Polygon).

- Regulatory Reporting: Transparent processes enable easy audit trails if required by law.

- No Compromise on Security: Leading platforms undergo regular audits and maintain full transparency with users regarding operational protocols.

As regulatory frameworks evolve and enforcement tightens, the distinction between compliant and non-compliant privacy solutions grows sharper. The best regulated USDT mixers are not just technical tools, they are strategic partners for individuals and organizations who need to safeguard transactional confidentiality without risking legal exposure. This is especially relevant for high-volume traders, institutional treasuries, and cross-border businesses leveraging Tether’s liquidity on networks such as Arbitrum, Optimism, and Avalanche.

Navigating the Legal Landscape of Crypto Privacy

Recent regulatory actions, including new standards from the SEC enabling streamlined crypto ETF listings, underscore the importance of transparent operations in the digital asset space. In this climate, regulated mixers stand apart by implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) measures as core features rather than afterthoughts. These compliance protocols ensure that while privacy is preserved at the transaction level, illicit activity is deterred and traceability can be provided if legally mandated.

The integration of regulated mixers with multi-chain bridges, such as Celer cBridge for Arbitrum to Avalanche USDT transfers, further enhances operational flexibility. Users can anonymize funds on one network and withdraw them on another, all while maintaining compliance with jurisdictional requirements. This ability is increasingly vital as ecosystems like Polygon PoS compete with optimistic Layer 2 solutions, each offering unique trade-offs in speed, cost, and regulatory posture.

Steps for Safely Using a Compliant USDT Mixer Across Blockchains

-

Choose a Reputable, Regulated Mixer: Select a well-established, regulated mixer such as CoinJoin (for Bitcoin) or a compliant USDT mixer that supports multiple networks and enforces KYC/AML protocols. Research recent reviews and ensure the platform is recognized for compliance.

-

Select the Correct Blockchain Network: Confirm that the mixer supports your desired network, such as Ethereum (ERC-20), Tron (TRC-20), Binance Smart Chain (BEP-20), Arbitrum, or Avalanche. For example, USDT on Ethereum currently trades at $1.001 (as of Oct-21-2025).

-

Complete KYC Verification: Prepare to verify your identity as part of the platform’s compliance requirements. Upload valid identification documents and follow the mixer’s KYC process to ensure legal usage.

-

Set Mixing Preferences and Fees: Configure your transaction by selecting parameters like time delays and mixing fees. Understand that regulated mixers often provide transparent fee structures for each supported network.

-

Deposit USDT to the Unique Address: Send your USDT to the deposit address generated by the mixer. Double-check the address and network to avoid loss of funds. For example, verify if you are sending ERC-20 USDT to an Ethereum address.

-

Wait for the Mixing Process to Complete: The mixer will anonymize your transaction by dispersing funds through various pools. Adhere to the selected time delay for optimal privacy.

-

Withdraw Anonymized USDT: After the mixing process is complete, withdraw your anonymized USDT to your chosen address. Confirm the transaction on the appropriate blockchain explorer (e.g., OP Mainnet Explorer for Ethereum).

-

Maintain Transaction Records for Compliance: Keep records of your transactions and KYC confirmations. This ensures you can demonstrate compliance if required by authorities or exchanges.

Transparency remains a cornerstone of trust in this sector. Leading platforms publish audit reports and operational disclosures so users can verify both their security practices and adherence to evolving laws. For those navigating complex regulatory environments or seeking to understand how compliance dovetails with privacy tech, resources such as this detailed breakdown offer valuable insights.

Practical Considerations: Fees, Timing, and Service Selection

While regulated mixers deliver robust privacy for USDT transactions at $1.001, users should carefully weigh several practical factors:

- Fee Structures: Mixing services typically charge a percentage fee; reputable platforms disclose these transparently upfront.

- Transaction Timing: Adjustable delays help obscure withdrawal patterns but may impact liquidity planning for active traders or businesses.

- Service Reputation: Only choose mixers with established track records, look for published audits, clear compliance documentation, and positive user feedback.

- Network Support: Confirm support for all required blockchains (ERC20/TRC20/SOL/AVAX/BEP20/ARB/MATIC) to maximize flexibility.

The market’s appetite for privacy-centric tools that do not compromise on legality continues to grow, and so does the sophistication of both technology providers and regulators. As Tether’s market cap on OP Mainnet stands at $192,943,317.51, it is clear that compliant privacy solutions are no longer niche: they are foundational infrastructure for the next phase of crypto adoption.

The strategic use of regulated USDT mixers enables traders and institutions to enjoy both anonymity and peace of mind when transacting across chains like Ethereum, Tron, Solana, Avalanche, Polygon PoS, Arbitrum One, and more as integrations expand. By prioritizing platforms that blend rigorous KYC/AML controls with seamless multi-network support, users position themselves at the intersection of innovation and compliance, a necessity in today’s rapidly maturing digital asset landscape.

If you’re ready to explore compliant Tether privacy or want further clarity on how these services work across networks at today’s price point ($1.001 per USDT), consult our comprehensive guide: How To Mix USDT Legally: Guide To Regulated Tether Mixers For Multi-Chain Privacy.