Privacy remains a fundamental concern for cryptocurrency users, yet the evolving regulatory landscape has made it clear that anonymity cannot come at the expense of compliance. Regulated crypto mixers have emerged as a response to this tension, offering privacy-preserving features while integrating robust anti-money laundering (AML) and know-your-customer (KYC) protocols. This article explores how compliant cryptocurrency mixers are redefining privacy and compliance in the digital asset sector, drawing on the latest regulatory developments and technical innovations.

The Dual-Use Dilemma: Privacy Enhancement vs. Illicit Activity

Cryptocurrency mixers, sometimes called tumblers, blend funds from multiple sources to obscure transaction trails. While this technology provides legitimate privacy benefits for law-abiding users, its dual-use nature has historically attracted scrutiny from regulators concerned about money laundering, sanctions evasion, and other illicit activities.

According to recent statements from the U. S. Department of the Treasury, there is a clear distinction between mixers that promote user privacy in good faith and those designed primarily to facilitate obfuscation for illegal purposes. As regulatory frameworks tighten globally, including new proposals from U. S. authorities and warnings from the EU Innovation Hub for Internal Security, the need for legal crypto mixers that balance privacy with traceability is more urgent than ever.

Regulatory Frameworks and Compliance Innovations

The challenge is not merely technical but also legal: how can crypto mixers provide meaningful privacy without enabling criminal activity? The answer lies in integrating advanced compliance mechanisms such as:

Key Features of Regulated Crypto Mixers Supporting Privacy and Compliance

-

Selective De-Anonymization (SeDe) Framework: Allows privacy-preserving transactions while enabling authorized entities to de-anonymize illicit activity through accountable, distributed decision-making. This balances user privacy with effective AML enforcement.

-

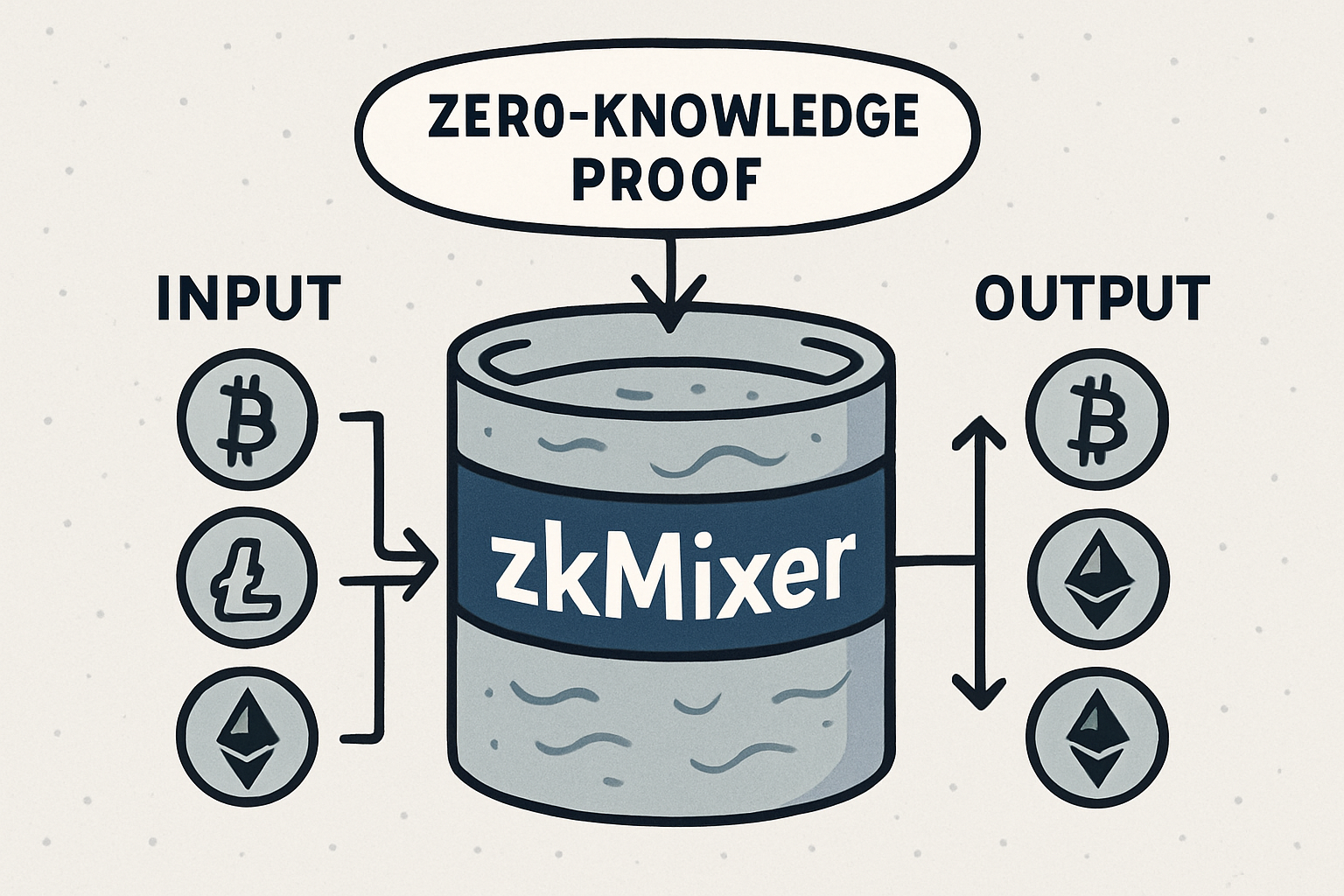

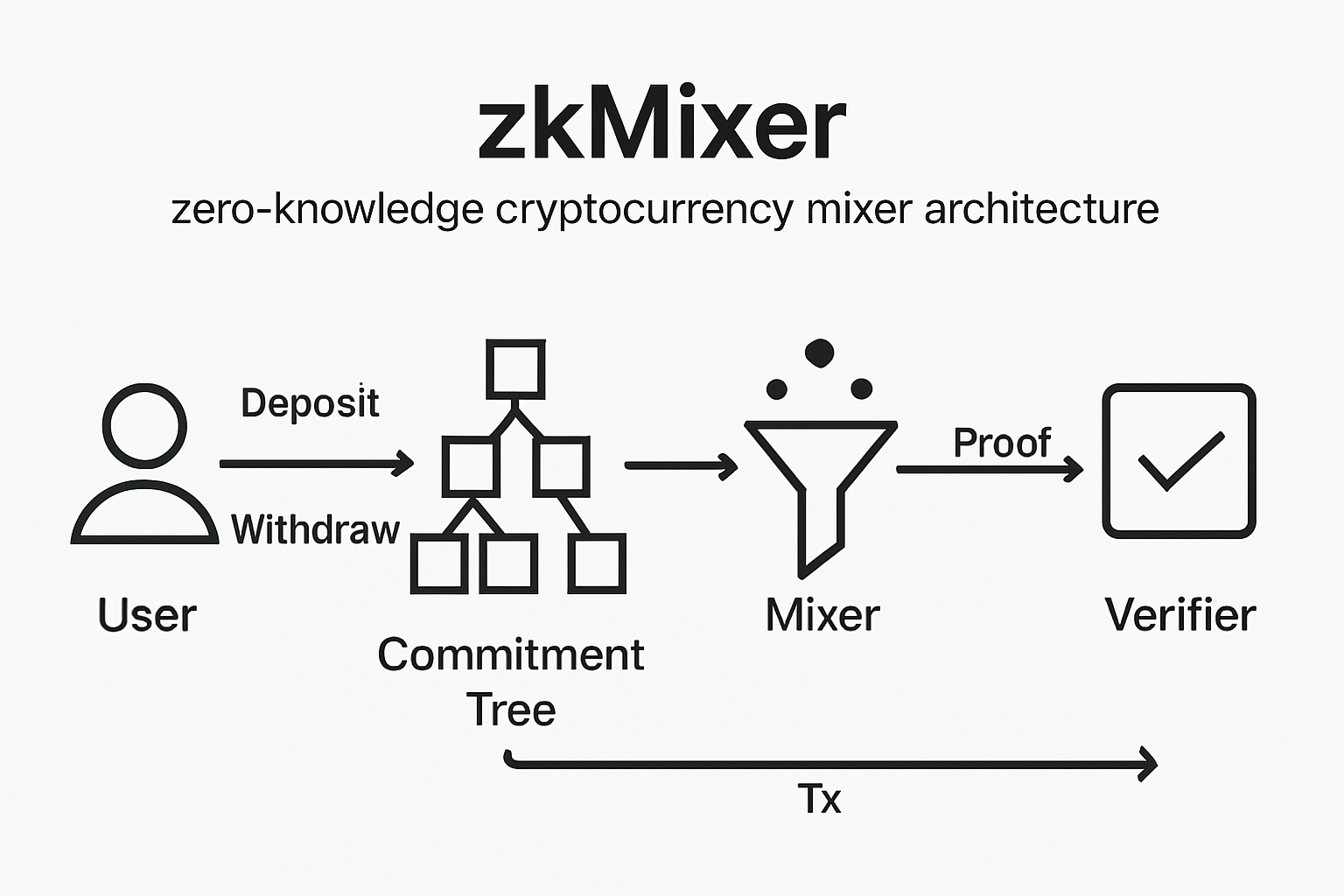

Zero-Knowledge Proofs (e.g., zkMixer): Utilizes advanced cryptography to enable transaction privacy without revealing user identities, while allowing for compliance actions such as blacklisting or confiscating illicit funds based on group consensus.

-

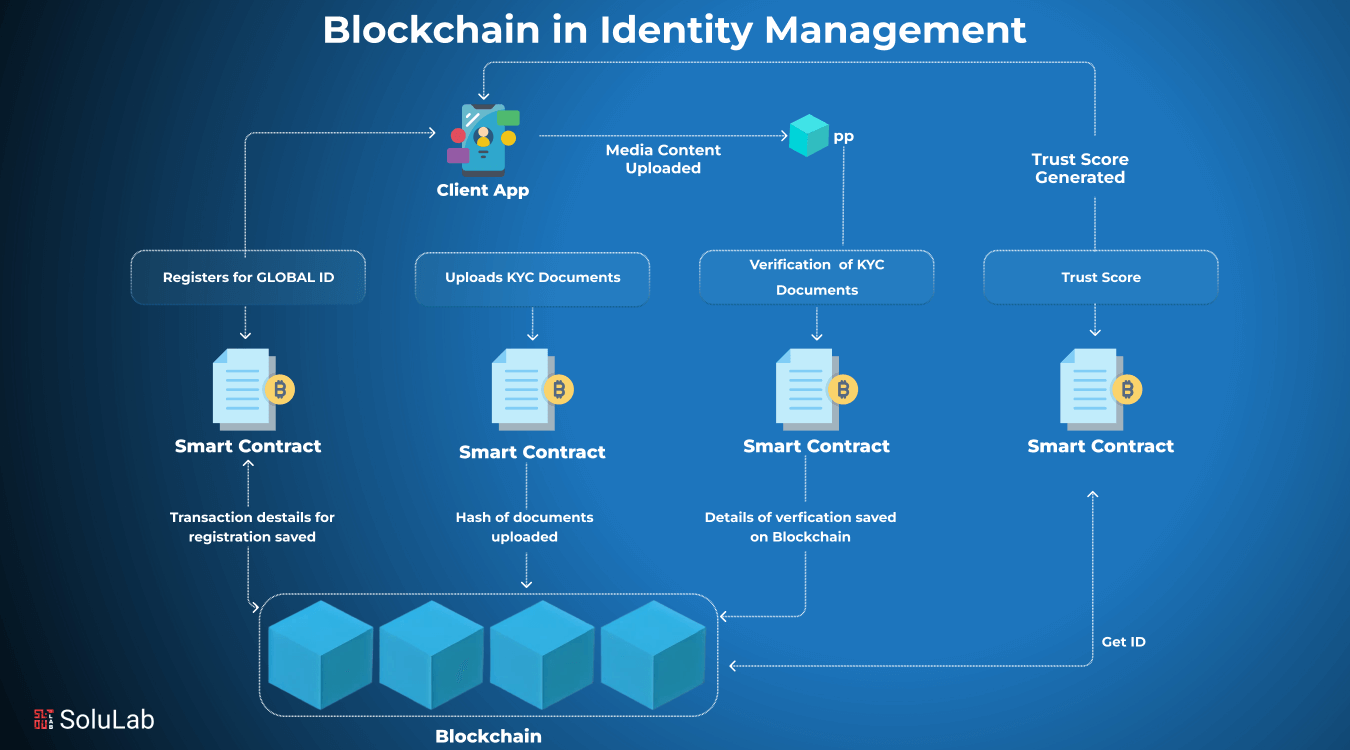

Integrated KYC/AML Controls: Implements Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures at onboarding or withdrawal stages, ensuring that only verified users can access mixing services and suspicious activity can be reported to authorities.

-

Configurable Governance and Compliance Policies: Provides mechanisms for mixer participants or operators to define and enforce rules for transaction monitoring, suspicious activity reporting, and compliance with regulatory requirements (e.g., Travel Rule).

-

Auditability and Transparency for Regulators: Maintains secure logs and reporting functions that allow regulators to audit mixer operations without exposing user identities, supporting investigations while preserving legitimate privacy.

Recent academic proposals like the Selective De-Anonymization (SeDe) framework demonstrate how blockchain applications can allow selective transparency. SeDe enables authorized parties to recursively de-anonymize suspicious transactions while distributing accountability across multiple entities, a significant step toward balancing oversight with individual rights.

An alternative approach comes from zkMixer, which leverages zero-knowledge proofs to enable group-controlled mixing pools with configurable governance rules. Participants collectively decide if deposits meet compliance standards or should be flagged for potential confiscation or refunding, offering a programmable layer of trust without exposing all user data.

The Privacy-Compliant Mixer Market in 2025

The market context has shifted rapidly in 2025. Regulatory scrutiny is fueling demand for AML-compliant solutions; according to industry analysts, the AML compliance solutions market is projected to reach $2,486.86 million by 2031 (read more about compliance trends here). Exchanges must now implement stricter KYC processes even as users seek robust transactional confidentiality, a paradox only resolved by innovative mixer designs that embed compliance directly into their protocols.

This evolution is also shaped by industry feedback: major exchanges argue that existing suspicious activity reporting requirements are sufficient, cautioning regulators against policies that would lead to excessive data collection without tangible law enforcement benefits.

What Makes a Crypto Mixer Truly Compliant?

A regulated mixer must go beyond simple transaction obfuscation:

- KYC/AML Integration: Verifying user identities while minimizing data exposure through cryptographic techniques.

- Selective Transparency: Allowing de-anonymization only under well-defined legal circumstances.

- Programmable Governance: Using smart contracts or off-chain consensus for real-time monitoring of suspicious activity.

- Audit Trails: Maintaining tamper-proof logs accessible only when triggered by regulatory requests.

This approach ensures both user trust and institutional acceptance, key factors driving adoption among individuals and organizations alike seeking privacy-preserving compliance solutions.

As regulatory frameworks mature, the architecture of regulated crypto mixers is evolving well beyond basic privacy tools. Next-generation mixers now embed compliance at the protocol level, leveraging advanced cryptography and programmable controls to address both user needs and legal mandates. This shift is not just theoretical: it is already influencing how exchanges, DeFi platforms, and even institutional players approach privacy and risk management in 2025.

Technical Building Blocks: Privacy-Preserving Compliance

The most promising regulated mixer designs employ a blend of zero-knowledge proofs, multi-party computation, and selective disclosure mechanisms. For example, zero-knowledge frameworks such as those underpinning zkMixer allow users to prove compliance with AML/KYC requirements without revealing their full identity or transaction history. This minimizes data exposure while still enabling robust oversight when necessary.

Additionally, programmable governance, achieved through smart contracts or consortium-based decision models, lets stakeholders collectively flag suspicious deposits or approve refunds for legitimate users. These technical features are not only theoretical; they are being piloted in live environments to demonstrate real-world feasibility.

Technical Innovations Powering Compliant Crypto Mixers in 2025

-

Selective De-Anonymization (SeDe) Framework: SeDe enables privacy-preserving blockchains to selectively reveal transaction details for illicit activity, using a distributed approach where multiple entities must agree to de-anonymize suspicious transactions. This balances user privacy with regulatory accountability.

-

zkMixer: Zero-Knowledge Mixer with Governance Controls: zkMixer leverages zero-knowledge proofs to allow users to mix funds privately, while integrating governance features that let participants collectively decide on refunding or confiscating deposits linked to crime, enhancing compliance without compromising privacy.

-

Configurable Mixing Pools with Compliance Triggers: Modern mixers now support customizable pools where compliance rules—such as transaction monitoring and suspicious activity triggers—can be set by pool participants, enabling rapid response to regulatory requirements.

-

Multi-Party Accountability Mechanisms: By distributing decision-making among multiple independent parties, compliant mixers ensure that no single entity can unilaterally de-anonymize users, reducing abuse risk and increasing transparency for regulators.

-

Integration with AML/KYC Monitoring Tools: Leading regulated mixers now integrate directly with established anti-money laundering (AML) and know-your-customer (KYC) platforms, allowing real-time screening and reporting of suspicious transactions in accordance with global standards.

The result is a new class of compliant cryptocurrency mixers that can:

- Support law enforcement requests for de-anonymization under clear legal standards

- Minimize false positives by distributing compliance decisions among multiple accountable parties

- Enable users to retain transactional privacy unless regulatory thresholds are objectively met

Market Adoption: Who Is Using Regulated Mixers?

This new paradigm is attracting a diverse user base:

- Institutional investors, who require both privacy and auditable compliance for large-scale transactions

- Web3 project teams, seeking to avoid inadvertent AML violations when receiving funds from anonymous sources

- Privacy-conscious individuals, who value confidentiality without risking regulatory sanctions or account freezes

The adoption curve is steepening as more jurisdictions clarify their expectations for mixer operators. Platforms that cannot demonstrate integrated KYC/AML controls risk delisting or outright bans, while compliant solutions gain market share by offering peace of mind alongside privacy.

Looking Ahead: The Future of Privacy-Compliant Crypto Mixing

The direction of travel is clear: only those mixers that embed regulatory safeguards at every layer, from user onboarding to transaction processing, will thrive. Expect ongoing refinement of selective disclosure protocols, broader adoption of programmable governance models, and increasing cooperation between industry consortia and regulators.

This new landscape does not spell the end of privacy in crypto; rather, it signals a maturation where privacy and compliance co-exist by design. As technological standards evolve and best practices emerge, regulated crypto mixers will play a pivotal role in ensuring that digital asset transactions remain both confidential and lawful.