In late November 2025, Swiss and German authorities, backed by Europol and Eurojust, delivered a decisive blow to the shadowy world of unregulated crypto mixing. Cryptomixer. io, a service running since 2016, was dismantled after allegedly laundering over €1.3 billion in Bitcoin tied to ransomware, drug trafficking, and other crimes. Servers seized in Switzerland, the domain confiscated, 12 terabytes of data grabbed, and €25 million in crypto frozen, this operation signals a new era where unregulated crypto mixers face relentless pursuit. Yet, for privacy-conscious users who operate within the law, this crackdown highlights the urgent need for compliant alternatives that safeguard transactions without inviting legal peril.

The fallout from Cryptomixer’s demise reverberates across the crypto ecosystem. Law enforcement has long viewed mixers as enablers of illicit finance, and this takedown follows patterns seen with ChipMixer in 2023 and others before it. Cybercriminals favored Cryptomixer for its anonymity features, which pooled and redistributed funds to break blockchain trails. But for legitimate users, think investors shielding portfolios from market voyeurs or businesses protecting commercial secrets, these tools promised privacy at a steep risk. Now, with €1.3 billion in suspicious flows exposed, regulators are doubling down, demanding exchanges cough up more user data amid Europe’s tightening grip on crypto privacy controls.

The Cryptomixer Takedown: Details of a Coordinated Strike

Picture this: a nine-year-old platform, processing billions in Bitcoin, suddenly silenced. German and Swiss police led the charge, with Europol coordinating across borders. They didn’t just flip a switch; they hauled away three servers, locked down the cryptomixer. io domain, and sifted through massive data troves. Over €25 million in Bitcoin, worth about $29 million at seizure, sat frozen as evidence. Europol labeled it a go-to for ransomware gangs and darknet operators, underscoring how such services became cybercrime staples.

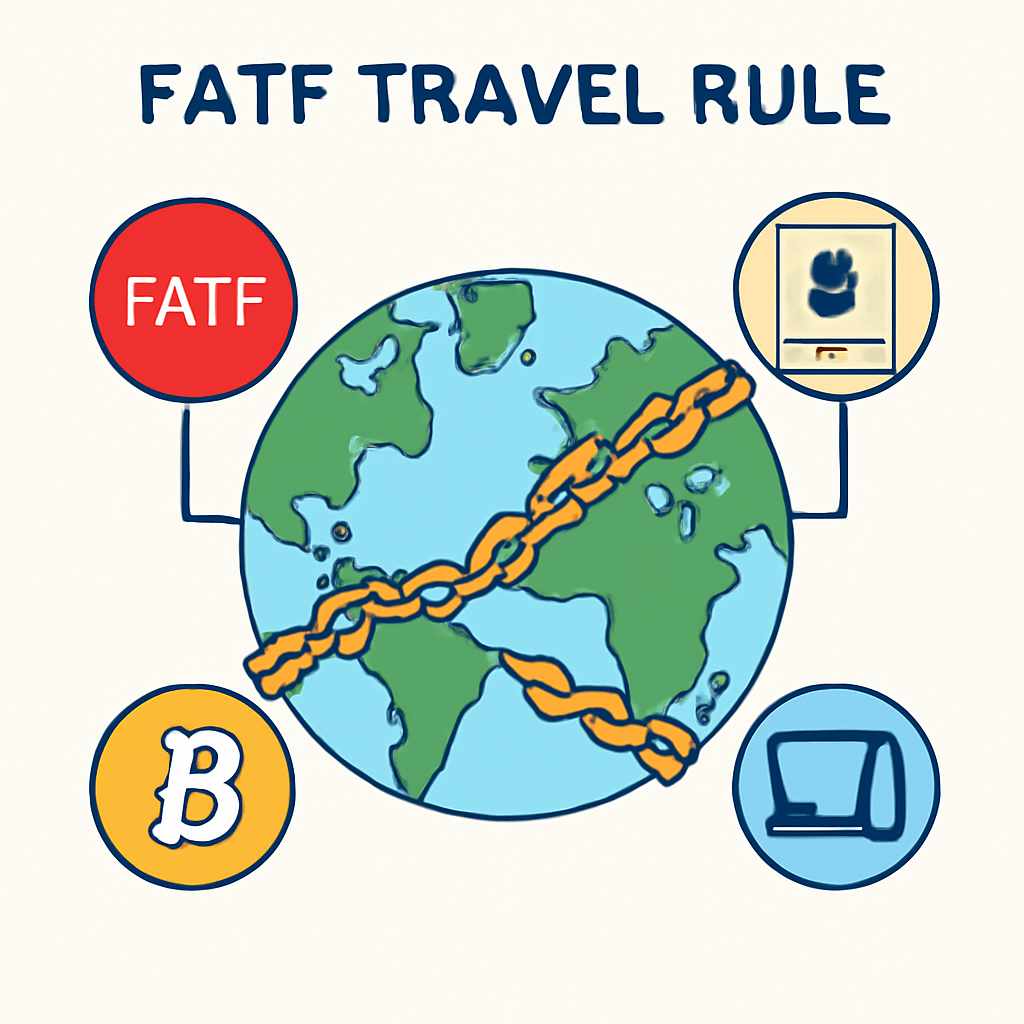

This wasn’t impulsive. Years of intelligence built the case, mirroring U. S. DOJ actions charging mixers for skipping Bank Secrecy Act registrations and money transmitter licenses. In Europe, it aligns with MiCA regulations and GDPR pressures, pushing for transparency without gutting all privacy. The message? Absolute anonymity breeds abuse, but selective obscurity can coexist with compliance.

Unregulated Mixers’ Fatal Flaws Exposed

Cryptomixer thrived on zero oversight, no KYC, no transaction monitoring, just blind tumbling. That allure drew fraudsters, but it doomed the service. Regulators see mixers as high-risk for sanctions evasion and terror financing, especially post high-profile hacks. Ransomware groups like LockBit leaned on them to clean dirty crypto, frustrating investigators tracing funds via blockchain analytics.

European police dismantle cryptocurrency mixer popular with ransomware gangs. Authorities have spent years trying to cripple the ecosystem.

Yet, privacy isn’t inherently villainous. Blockchain’s transparency exposes wallets to competitors, hackers, and governments alike. Legitimate needs persist: protecting dissidents in authoritarian regimes, or investors dodging front-running bots. Unregulated mixers ignored this nuance, offering a one-size-fits-all veil that screamed suspicion. Post-shutdown, users scramble for Europol Cryptomixer alternatives that won’t land them in hot water.

Regulated Crypto Mixers Emerge as the Compliant Path Forward

Enter regulated crypto mixers, a breed apart designed for the compliance age. These platforms weave privacy into AML frameworks, using optional KYC for bigger limits, AI-driven monitoring for red flags, and automated suspicious activity reports. Unlike Cryptomixer’s wild west, they register as money services businesses, adhere to global standards, and even support USDT privacy mixing for stablecoin users.

Consider the shift: where illicit mixers pooled blindly, regulated ones segment funds legally, ensuring clean inflows and outflows. They balance user choice, basic privacy sans verification, or verified tiers for high-volume trades. This model, gaining traction post-2025 crackdowns, lets businesses and individuals enjoy transactional opacity without regulatory roulette. As one analyst notes, it’s reshaping blockchain privacy, proving you can have both security and scrutiny.

Platforms like those at Regulated Mixers pioneer this space, offering compliant alternatives after Cryptomixer takedown. They’re not just surviving enforcement; they’re thriving by meeting demands head-on. For the long-term investor, this evolution means generational wealth-building without the paranoia of exposure.

I’ve watched this space evolve over nearly two decades, from Bitcoin’s wild inception to today’s regulated maturity. What strikes me is how regulated crypto mixers don’t just react to shutdowns like Cryptomixer’s; they anticipate the regulatory tide. These services register under frameworks like the EU’s MiCA or U. S. BSA equivalents, implementing tiered verification that unlocks privacy without full exposure. A basic user might tumble small amounts anonymously, while high-stakes traders opt for light KYC, blending opacity with accountability.

Key Differences: Regulated Mixers vs. Cryptomixer

Let’s break it down practically. Cryptomixer operated in the shadows, pooling funds indiscriminately and vanishing traces for anyone, criminal or not. Regulated alternatives flip the script: they use advanced heuristics to flag patterns matching known illicit flows, report only what’s required, and maintain audit trails for authorities if summoned. This isn’t dilution of privacy; it’s precision-engineered discretion. For stablecoin enthusiasts, USDT privacy mixers within these platforms offer seamless swaps, preserving peg stability amid obfuscation.

Regulated Crypto Mixers vs Cryptomixer

| Feature | Regulated Mixers | Cryptomixer |

|---|---|---|

| KYC/AML | Optional and monitored | None |

| Compliance | Registered MSB/MiCA | Unlicensed |

| Privacy Level | Tiered and legal | Absolute but risky |

| Seizure Risk | Low | High as seen in 2025 |

| Use Cases | Legit privacy/business | Cybercrime heavy |

Users benefit tangibly. Businesses shield supply chain payments from competitors scanning the chain; investors rotate positions quietly, evading whale-watchers who front-run trades. In my analysis, this setup fosters sustainable privacy, aligning with macroeconomic shifts where central banks eye CBDCs with built-in surveillance. Post-Europol, demand for crypto mixer after shutdown solutions spikes among compliant users, not outlaws.

Implementation matters too. These mixers employ non-custodial pools segmented by risk scores, ensuring your clean BTC doesn’t mingle with suspect coins. Fees stay competitive, often 0.5-2%, with lightning-fast cycles under 30 minutes. They’re battle-tested against chain analysis firms like Chainalysis, which now endorse certain regulated flows as low-risk.

Challenges remain, sure. Skeptics decry any KYC as a slippery slope, but optional models mitigate that, preserving choice. Innovations like zero-knowledge proofs further anonymize proofs of compliance, not identities. Looking ahead, as quantum threats loom and DeFi matures, these services will integrate seamlessly, becoming infrastructure rather than afterthoughts.

Ultimately, the shift to compliant cryptocurrency mixers and regulated crypto mixers balancing privacy and compliance redefines the game. Privacy endures, not as rebellion, but as a regulated right. For investors eyeing enduring portfolios, embracing these tools means navigating uncertainty with fortified resolve. The blockchain’s promise of freedom sharpens when tempered by law.