In 2024, the world of regulated crypto mixers is at a crossroads. On one hand, users demand robust privacy for their digital transactions, wary of surveillance and data leaks. On the other, regulators are tightening the reins on anonymity tools, aiming to curb financial crime and ensure transparency. The result is an industry defined by both innovation and scrutiny, where privacy-compliant crypto mixers must walk a strategic tightrope between user demand and legal obligation.

Regulatory Pressure Mounts: The New Reality for Mixers

The regulatory environment for cryptocurrency mixers has never been more intense. In the United States, the proposed Blockchain Integrity Act seeks a two-year ban on mixer use by financial entities, threatening civil penalties up to $100,000 for violations. This follows high-profile enforcement actions stemming from OFAC sanctions against platforms like Tornado Cash in previous years. Meanwhile, European authorities are ramping up oversight as well; the EU’s Innovation Hub for Internal Security has explicitly flagged mixing protocols as a challenge for law enforcement, urging enhancements in investigative capabilities.

These developments have forced service providers to fundamentally rethink their operations. Some have opted to restrict access in high-risk jurisdictions entirely rather than risk non-compliance. Others are investing in compliance infrastructure or exploring advanced cryptographic techniques that can satisfy both privacy advocates and regulators.

Compliance by Design: How Mixers Are Adapting

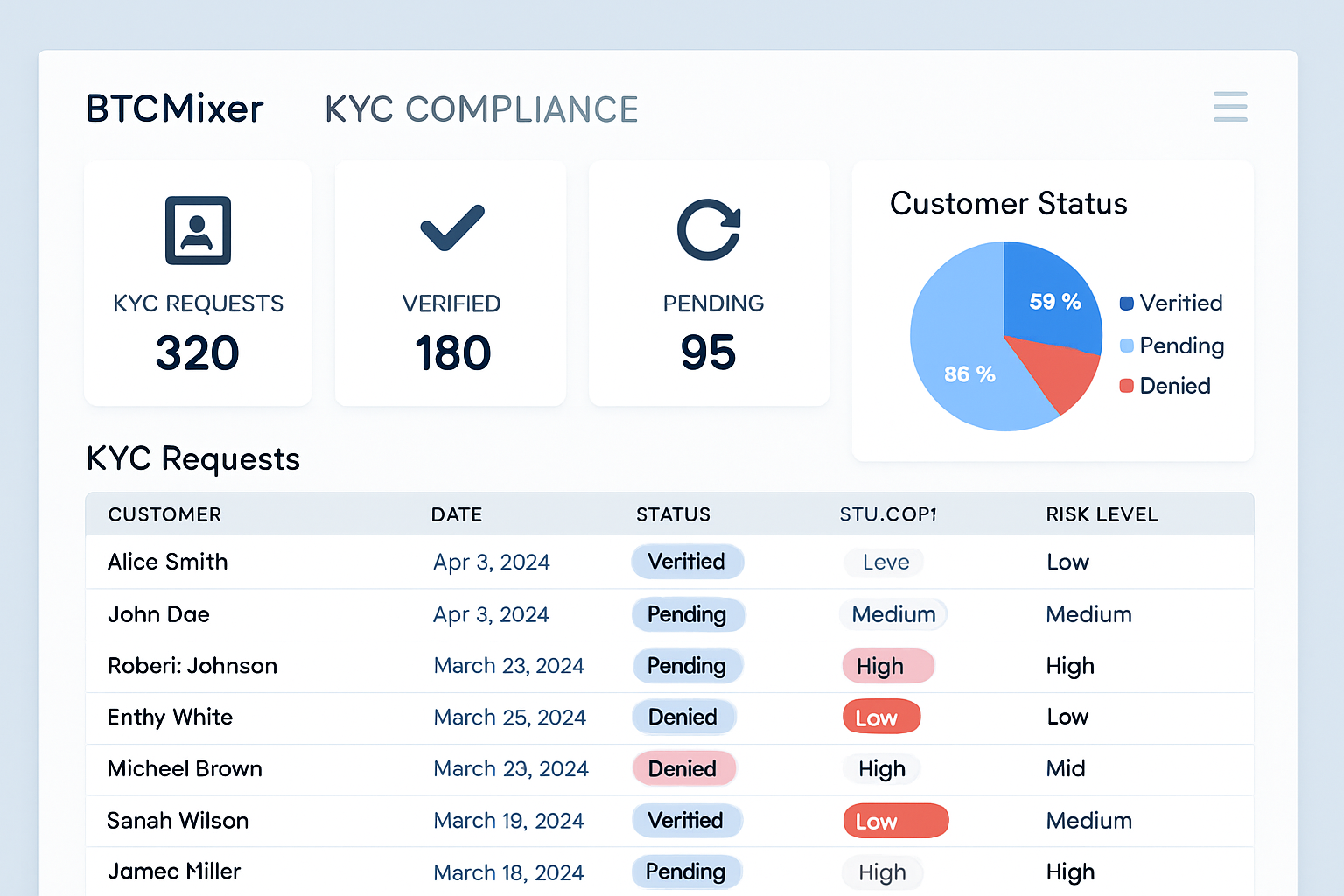

To remain viable in 2024’s climate, regulated crypto mixers are increasingly adopting proactive compliance measures. Many now offer optional Know Your Customer (KYC) tiers, letting users choose between basic privacy or higher transaction limits with identity verification. This dual-track approach attempts to balance privacy preferences with regulatory requirements, an evolution that would have seemed unthinkable just a few years ago.

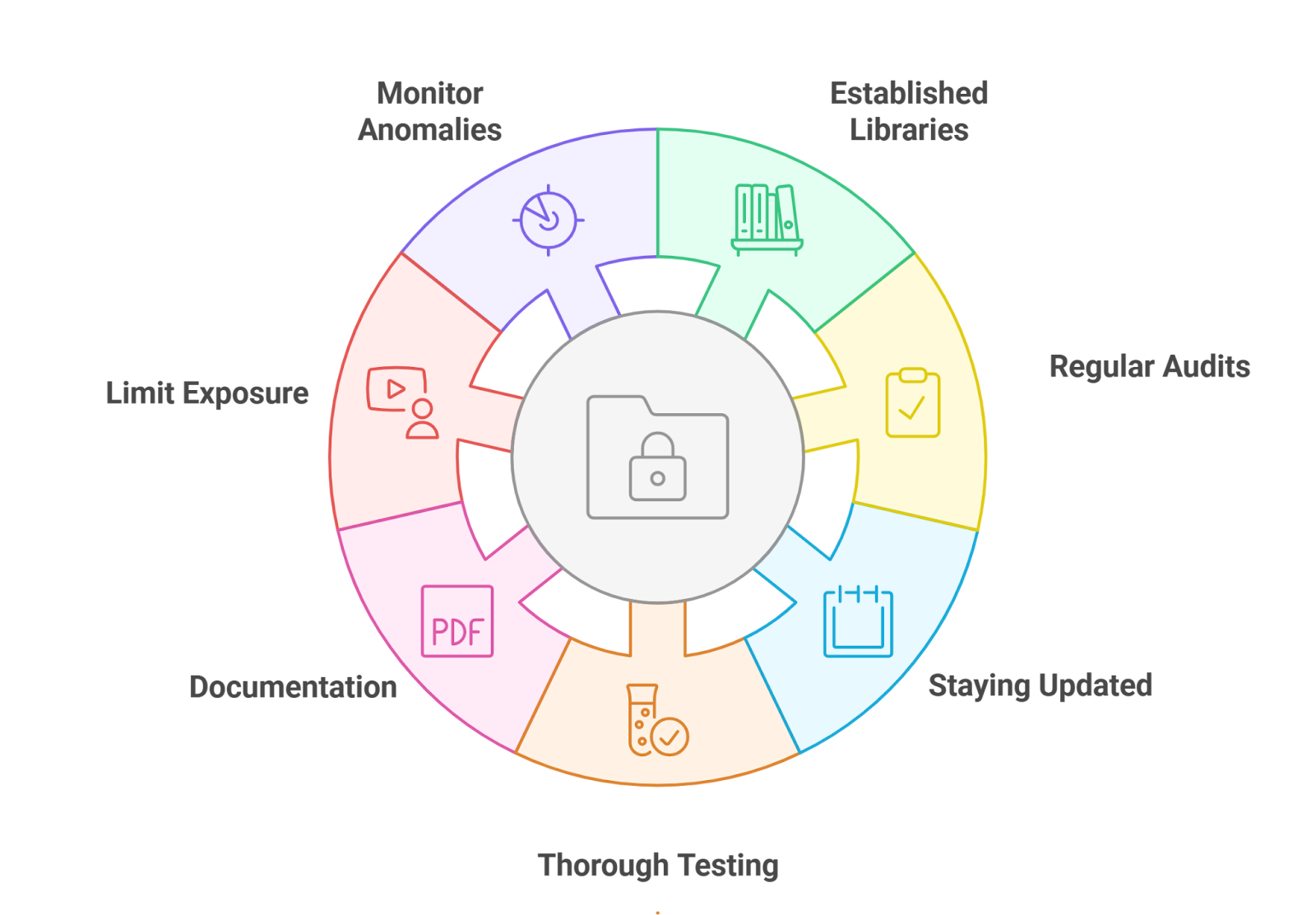

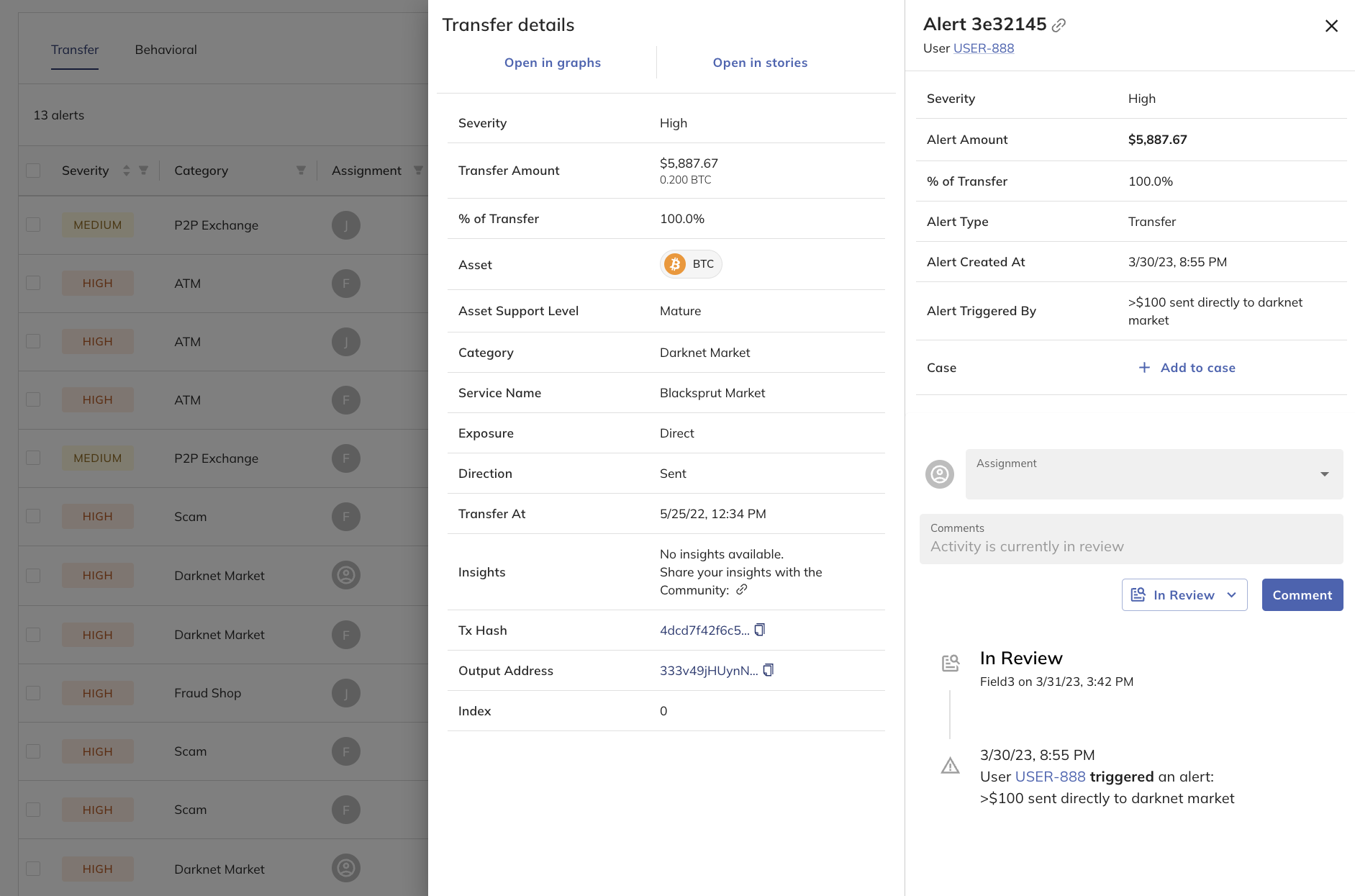

Beyond KYC, leading mixers integrate anti-money laundering (AML) screening tools directly into their workflows. Transaction monitoring systems flag suspicious patterns before funds even leave the platform; some go further by maintaining auditable logs (accessible only under lawful requests) to demonstrate good-faith compliance efforts should authorities come knocking.

Top Compliance Features in Regulated Crypto Mixers (2024)

-

Optional Know Your Customer (KYC) Tiers: Leading mixers like BTCMixer have introduced optional KYC verification, allowing users to choose between enhanced privacy or higher transaction limits with identity checks, aligning with evolving regulatory expectations.

-

Geofencing and Regional Restrictions: Platforms such as Whir restrict access for users in high-regulation regions (e.g., U.S., EU) to comply with local laws while maintaining privacy standards for other jurisdictions.

-

Integration of Zero-Knowledge Proofs (zk-SNARKs): Advanced mixers employ cryptographic technologies like zk-SNARKs to verify transactions without exposing user identities, enhancing privacy while supporting compliance audits.

-

Transaction Monitoring and Automated Risk Screening: Regulated mixers implement automated tools to detect suspicious activity and flag transactions linked to sanctioned addresses, supporting Anti-Money Laundering (AML) obligations.

-

Comprehensive Recordkeeping and Audit Trails: To meet regulatory requirements, some mixers maintain encrypted logs of transaction metadata, enabling compliance reviews without compromising user privacy.

The shifting regulatory landscape also means that many platforms now publish transparency reports or submit to third-party audits, moves designed to build trust with both users and regulators alike. For institutional clients especially, such assurance is quickly becoming table stakes.

Technological Innovations: Privacy Without Breaking the Law

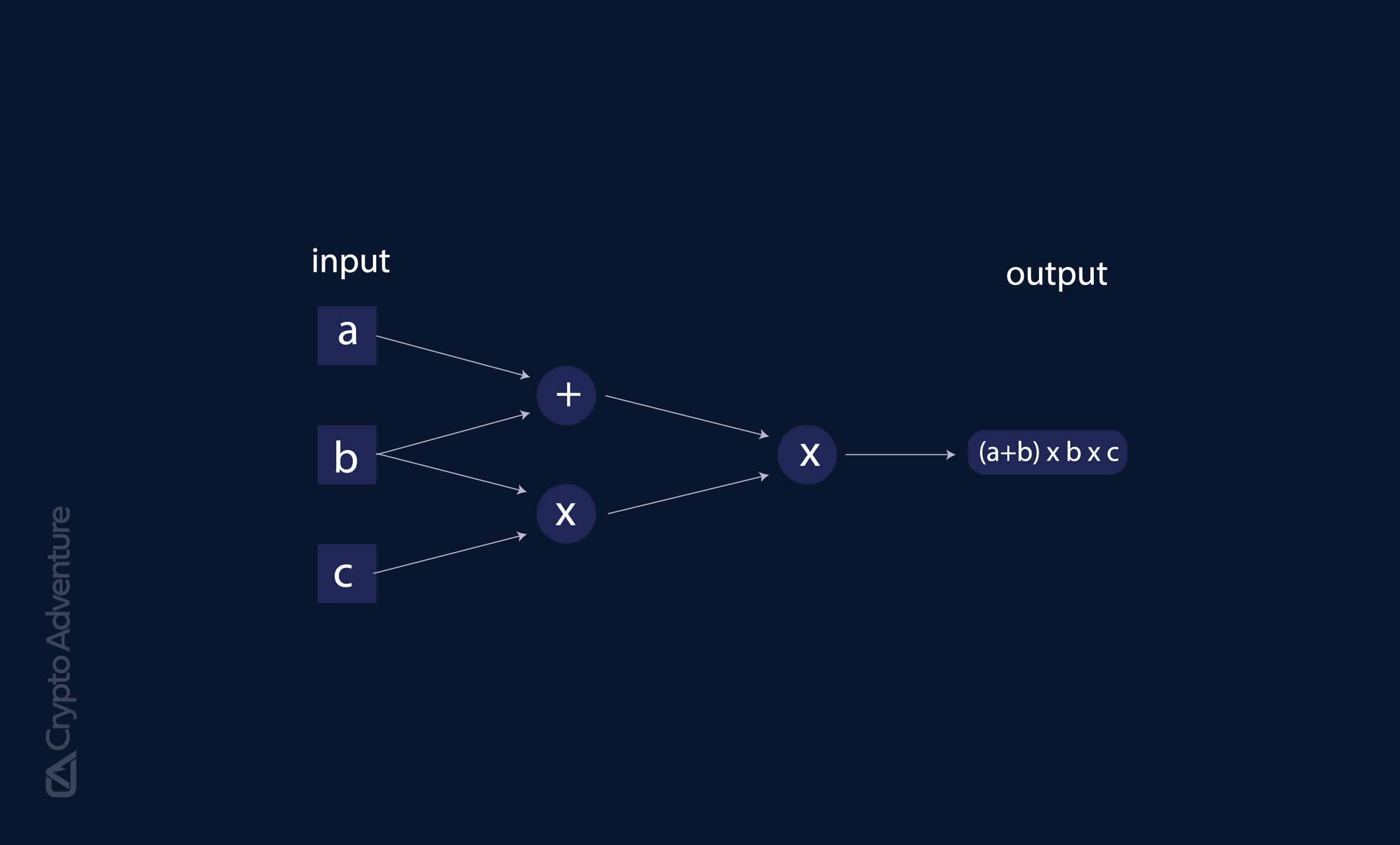

The arms race between privacy and oversight has catalyzed real technological progress within the mixer ecosystem. Advanced platforms employ zero-knowledge proofs (zk-SNARKs), which allow them to verify transaction validity without exposing any sensitive details about sender or recipient. This cryptographic method is rapidly gaining traction as it enables lawful operation without undermining user confidentiality.

Another innovation is time-decay protocols, mechanisms that increase transaction obfuscation based on how long funds remain within a mixer’s custody. These features add another layer of unpredictability for would-be forensic analysts while still allowing platforms to meet certain recordkeeping obligations required under evolving AML laws.

This technological pivot isn’t just theoretical, it’s being deployed in production today by services seeking to future-proof themselves against both regulatory risk and technical de-anonymization tactics observed by forensic firms (learn more about legal approaches here). As new rules from MiCA in Europe and anticipated updates to U. S. Treasury guidance loom large over 2024-2025, only those mixers willing to continuously evolve will survive, and thrive, in this complex market.

Yet, the journey toward true privacy-compliance equilibrium is far from straightforward. The majority of regulated crypto mixers in 2024 are acutely aware that even the most sophisticated technology can be undermined by poor operational controls or ambiguous legal interpretations. As a result, forward-thinking providers are proactively engaging with regulators and compliance experts to ensure their privacy protocols align not just with today’s laws, but with the anticipated direction of global policy.

For users, this means a rapidly changing landscape where due diligence is critical. Not all platforms advertising themselves as “regulated” or “compliant” offer the same level of assurance. Transparency reports, third-party audits, and clear documentation of KYC/AML procedures have become key differentiators for those seeking truly legal crypto mixing solutions.

Institutional Adoption: Why Compliance Matters More Than Ever

One of the most significant shifts in 2024 is the growing interest from institutional investors and businesses in privacy-compliant crypto mixers. With stricter enforcement on anti-money laundering (AML) and know-your-customer (KYC) regulations worldwide, institutions cannot afford exposure to non-compliant privacy tools. This demand has accelerated the professionalization of the mixer industry, driving adoption of compliance-first features such as transaction monitoring dashboards, secure custody options for pooled funds, and real-time reporting mechanisms.

Institutions also require detailed records for audit trails and regulatory filings. Mixers that can provide these without compromising user confidentiality are emerging as preferred partners for fintechs, hedge funds, and even some traditional banks exploring digital asset custody.

The reality is clear: compliance isn’t just a box-ticking exercise, it’s a competitive advantage. As more institutional players enter the space, expect further convergence between privacy innovation and regulatory rigor.

The Road Ahead: Evolving Standards and User Expectations

Looking forward into late 2024 and beyond, several trends are set to define the next chapter for regulated crypto mixers:

Key Trends in Regulated Crypto Mixers for 2025

-

Expansion of KYC-Optional Mixer Tiers: Major regulated mixers are offering optional Know Your Customer (KYC) tiers, letting users choose between enhanced privacy or higher transaction limits with identity verification, as seen on platforms like BTCMixer.

-

Adoption of Zero-Knowledge Proofs (zk-SNARKs): Advanced mixers are implementing zk-SNARKs to verify transactions without revealing user data, balancing privacy with compliance requirements.

-

Time-Decay Privacy Protocols: Some regulated mixers are integrating time-decay protocols, which increase privacy based on how long funds are held in the mixer, offering dynamic privacy levels.

-

Geo-Restriction Strategies: Platforms like Whir are restricting access for users in high-regulation regions (e.g., U.S. and EU) rather than implementing KYC, maintaining privacy commitments while navigating legal risks.

-

Regulatory Sandboxes and Industry Collaboration: Mixers are increasingly participating in regulatory sandboxes and collaborating with compliance technology firms to test privacy-preserving solutions under regulatory oversight, especially in the EU and UK.

First, expect greater harmonization between regional regulatory frameworks as organizations like FATF push for global standards on digital asset privacy tools. Second, user education will become paramount, platforms must clearly communicate how their compliance features work without alienating privacy-focused clients.

Finally, ongoing dialogue between industry leaders and policymakers will shape what “acceptable” privacy looks like in practice. The interplay between technological innovation (such as improved zero-knowledge systems), evolving AML guidance, and market demand will continue to redefine boundaries.

For individuals and organizations seeking reliable regulated crypto mixers in 2024, it’s vital to stay informed about both legal developments and technological advances. Resources like our comprehensive guides on balancing privacy with compliance or enabling transactional privacy within legal frameworks can help users navigate this complex terrain safely.