Cryptocurrency mixers have long stood at the intersection of privacy and compliance, offering users a way to obscure their transaction history while raising eyebrows among regulators. In the wake of recent enforcement actions and evolving regulations, a new breed of regulated crypto mixer has emerged, one that promises robust privacy without crossing legal lines or enabling illicit activity.

The Regulatory Pressure on Crypto Mixers

The past year has seen an undeniable clampdown on unregulated mixing services. The U. S. Department of Justice’s charges against Samourai Wallet’s founders in April 2024 sent shockwaves through the industry, highlighting the risks for mixers operating outside compliance frameworks. FinCEN’s proposed rules now officially designate crypto mixers as “Primary Money Laundering Concerns, ” requiring them to register, implement KYC AML crypto privacy protocols, and maintain detailed records.

This isn’t just about U. S. law. Across Europe and Asia, regulators are demanding that all privacy tools in the crypto space, mixers included, meet standards akin to those imposed on traditional financial institutions. The message is clear: privacy must not come at the expense of accountability.

How Regulated Crypto Mixers Achieve Privacy-Compliant Transactions

The key innovation behind today’s privacy-compliant crypto mixer is selective transparency. Modern solutions like SeDe (Selective De-Anonymization) and zkMixer employ cryptographic techniques such as zero-knowledge proofs and threshold encryption, allowing legitimate users to transact privately while empowering authorities to investigate suspicious activity when necessary.

Key Features of Regulated Crypto Mixers

-

Comprehensive KYC/AML Procedures: Regulated mixers implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, verifying user identities and monitoring transactions to prevent illicit activity. This ensures compliance with regulations set by authorities like FinCEN and the FATF.

-

Registration and Licensing: Unlike unregulated mixers, regulated platforms register with financial authorities such as FinCEN and obtain necessary money transmitter licenses, operating transparently within legal frameworks.

-

Selective De-Anonymization (SeDe) Frameworks: Advanced regulated mixers may use frameworks like Selective De-Anonymization (SeDe), enabling authorities to trace illicit funds when required—without compromising everyday user privacy. This balances privacy with compliance.

-

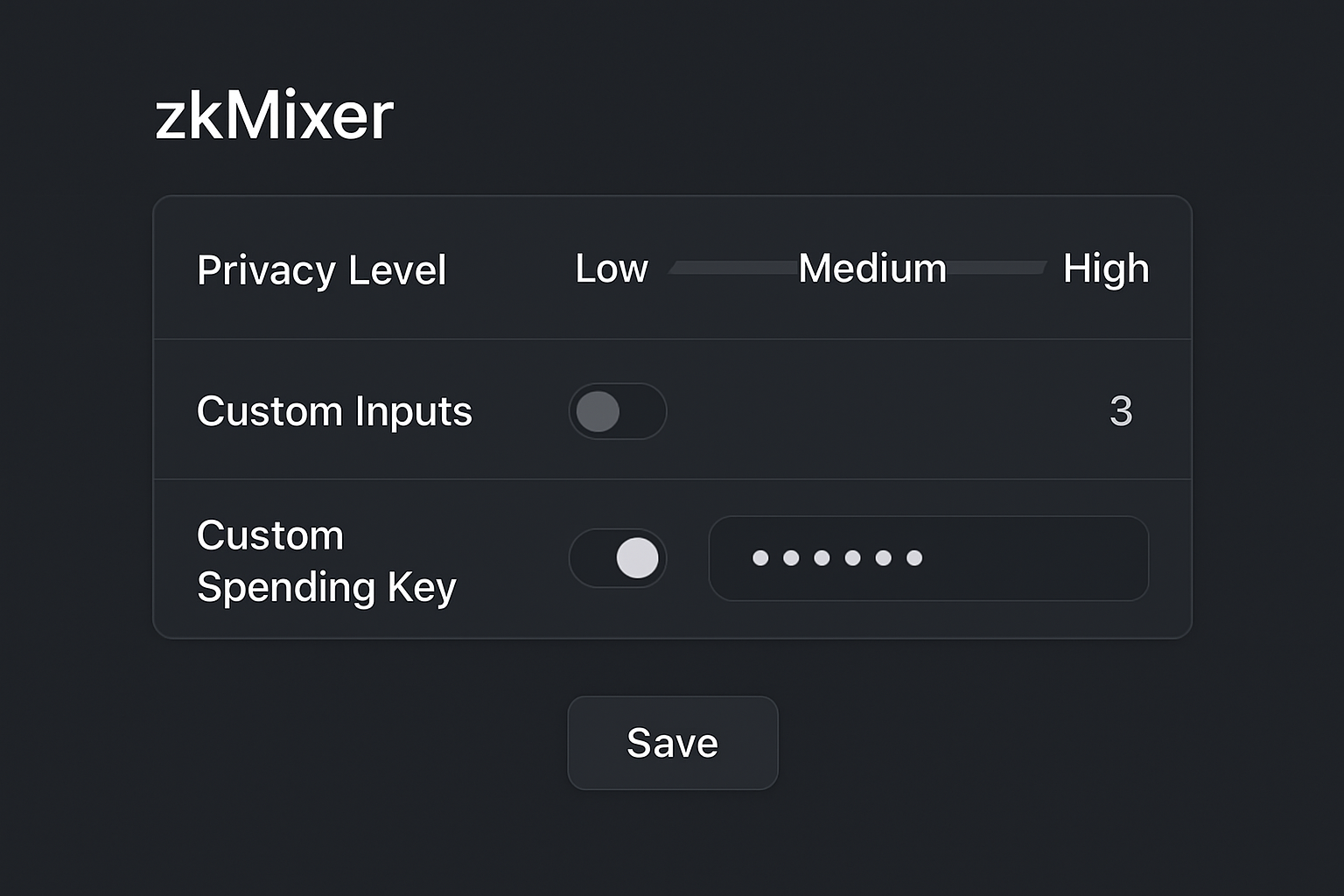

Configurable Zero-Knowledge Protocols: Platforms such as zkMixer employ configurable zero-knowledge proofs, allowing for privacy-preserving transactions while enabling governance features like deposit delays, refunds, or confiscations if criminal activity is detected.

-

Ongoing Transaction Monitoring and Reporting: Regulated mixers conduct continuous monitoring for suspicious activity and adhere to mandatory reporting obligations, such as filing Suspicious Activity Reports (SARs), to relevant authorities.

-

Adherence to the Travel Rule: Regulated services comply with the Travel Rule, ensuring that sender and receiver information accompanies transactions above regulatory thresholds, further deterring money laundering.

This dual mandate is not easy to achieve. It requires:

- KYC/AML Integration: Users must verify their identities before mixing funds, satisfying regulatory requirements without exposing transaction details publicly.

- Configurable Governance: Platforms can delay deposits or refund suspicious transactions based on consensus among participants, offering both flexibility and compliance.

- GDPR Alignment: By minimizing data retention and giving users control over their information, regulated mixers can adhere to stringent data protection laws while still deterring illicit finance.

Navigating Compliance Without Sacrificing User Trust

The challenge for any regulated crypto mixer is to deliver meaningful privacy in a transparent world. Regulators themselves are beginning to recognize that not all privacy tools are created equal; what matters is intent, governance, and auditability. As highlighted by recent FinCEN commentary, the focus is shifting toward monitoring activity rather than banning technology outright, a nuanced approach that rewards proactive compliance.

This evolution is critical for institutional adoption as well as individual confidence in digital assets. Financial institutions exploring blockchain need assurances that any privacy-enhancing service they use will not jeopardize their reputation or regulatory standing. For individuals, especially those in high-risk jurisdictions or under oppressive regimes, the ability to transact privately remains a fundamental right, but one that must be balanced against society’s need for oversight.

As regulated mixers implement robust KYC AML crypto privacy protocols, they create a landscape where privacy and compliance are not mutually exclusive. The best services now feature user-centric controls, audit trails for authorities (triggered only under legitimate legal requests), and adherence to global standards like GDPR. This careful architecture not only deters bad actors but also reassures users that their legitimate privacy needs are being respected.

Real-World Impact: Privacy-Compliant Mixers in Action

What does this look like in practice? Regulated mixers have started to partner with compliance technology providers, integrating transaction monitoring tools that flag suspicious patterns without exposing ordinary users. For instance, platforms utilizing configurable zero-knowledge protocols can allow participants to vote on refunding or freezing questionable deposits, effectively crowd-sourcing governance while keeping personal data shielded from public view.

The result is a new standard for transactional privacy: one that satisfies regulators and users alike. Institutions can confidently use these tools knowing they meet both AML requirements and the letter of the law. Meanwhile, individuals benefit from anonymity where it matters most, protecting their financial sovereignty, without risking association with illicit finance.

What to Look For in a Regulated Crypto Mixer

If you’re evaluating privacy solutions for yourself or your business, here are essential criteria:

Key Criteria for Choosing a Regulated Crypto Mixer in 2025

-

Comprehensive KYC & AML Compliance: Ensure the mixer enforces robust Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols, including identity verification and transaction monitoring, as required by regulators like FinCEN.

-

Registration with Regulatory Authorities: Choose mixers that are officially registered with relevant bodies such as FinCEN in the U.S. or equivalent authorities in other jurisdictions, signaling adherence to legal standards.

-

Transparent Privacy Frameworks: Look for mixers implementing advanced privacy technologies, such as Selective De-Anonymization (SeDe) or configurable zero-knowledge proofs (e.g., zkMixer), which balance user privacy with regulatory transparency.

-

Clear Governance and Reporting Policies: The platform should have well-defined governance structures, including transparent reporting, record-keeping, and mechanisms for handling suspicious activity in line with the Travel Rule and other regulatory requirements.

-

Reputation and Track Record: Select mixers with a proven history of regulatory compliance and no association with illicit activities, as highlighted in industry analyses by Chainalysis and Elliptic.

-

Configurable User Controls: Opt for platforms offering user-configurable privacy settings, deposit delays, and consensus-based monitoring (as seen in zkMixer), allowing users to tailor privacy while maintaining compliance.

- Registration and Licensing: Confirm the service is registered with relevant authorities (such as FinCEN or EU equivalents).

- KYC/AML Frameworks: Ensure identity verification is required before mixing begins.

- Selective Transparency Tools: Look for zero-knowledge proof or threshold encryption implementations.

- User Data Rights: The platform should clearly state how user data is handled, stored, and deleted per GDPR or similar regulations.

- Auditability and Governance: There must be mechanisms for lawful investigation of suspicious activity without compromising everyday user privacy.

The Road Ahead: Privacy Without Compromise

The path forward is clear: only those mixers that proactively embrace compliance will survive regulatory scrutiny and mainstream adoption. As more jurisdictions clarify their stance on cryptocurrency mixing, expect further innovation at the intersection of cryptography and policy. Projects that lead with transparency, both technical and operational, will set the tone for what responsible privacy looks like in digital finance.

If you want a deeper dive into how these frameworks work in practice or need guidance on selecting a compliant solution, explore our detailed resource on how to choose a regulated crypto mixer for privacy and compliance.

The future of transactional privacy lies not in evading oversight but building systems where trust is programmable, and compliance is built-in by design.