In 2024, the debate around cryptocurrency privacy has reached a critical juncture. On one side, regulators intensify their scrutiny of crypto mixers due to their potential misuse in money laundering and sanctions evasion. On the other, privacy advocates and legitimate users demand tools that safeguard financial confidentiality without running afoul of the law. This tension has catalyzed the emergence of regulated crypto mixers: solutions designed to enable privacy while maintaining strict compliance with evolving legal frameworks.

The Evolving Landscape: Crypto Mixer Regulations in 2024

The regulatory environment for crypto mixers has transformed rapidly over the past year. In May 2024, the U. S. Treasury Department clarified its approach, emphasizing transparency rather than outright bans. Under Secretary Brian Nelson acknowledged that while privacy is a legitimate concern for many users, mixing services must not be exploited to bypass Know Your Customer (KYC) or Anti-Money Laundering (AML) controls. This nuanced stance reflects a growing recognition that compliant cryptocurrency mixers can play a positive role if they integrate robust oversight mechanisms.

Meanwhile, European regulators have taken a more critical view. The EU’s Innovation Hub for Internal Security released a report in June 2024 explicitly calling out privacy coins like Monero and Zcash, as well as mixing services, for complicating law enforcement efforts. The report underscores both the necessity and risk of privacy-enhancing technologies, highlighting why regulated solutions are now at the forefront of industry innovation.

How Regulated Mixers Work: Privacy Without Sacrificing Compliance

The next generation of legal crypto mixing services leverages cutting-edge cryptography and governance protocols to achieve what was once thought impossible: strong transactional privacy aligned with regulatory requirements. Two standout innovations illustrate this shift:

- zkMixer: Launched in March 2025, zkMixer uses zero-knowledge proofs combined with ‘Proof of Innocence’ protocols. Users can configure mixing pools with governance rules such as deposit delays or conditions for refunding or confiscating suspicious funds. This design allows group participants to monitor activity and ensures illicit transactions can be flagged without exposing honest users’ identities.

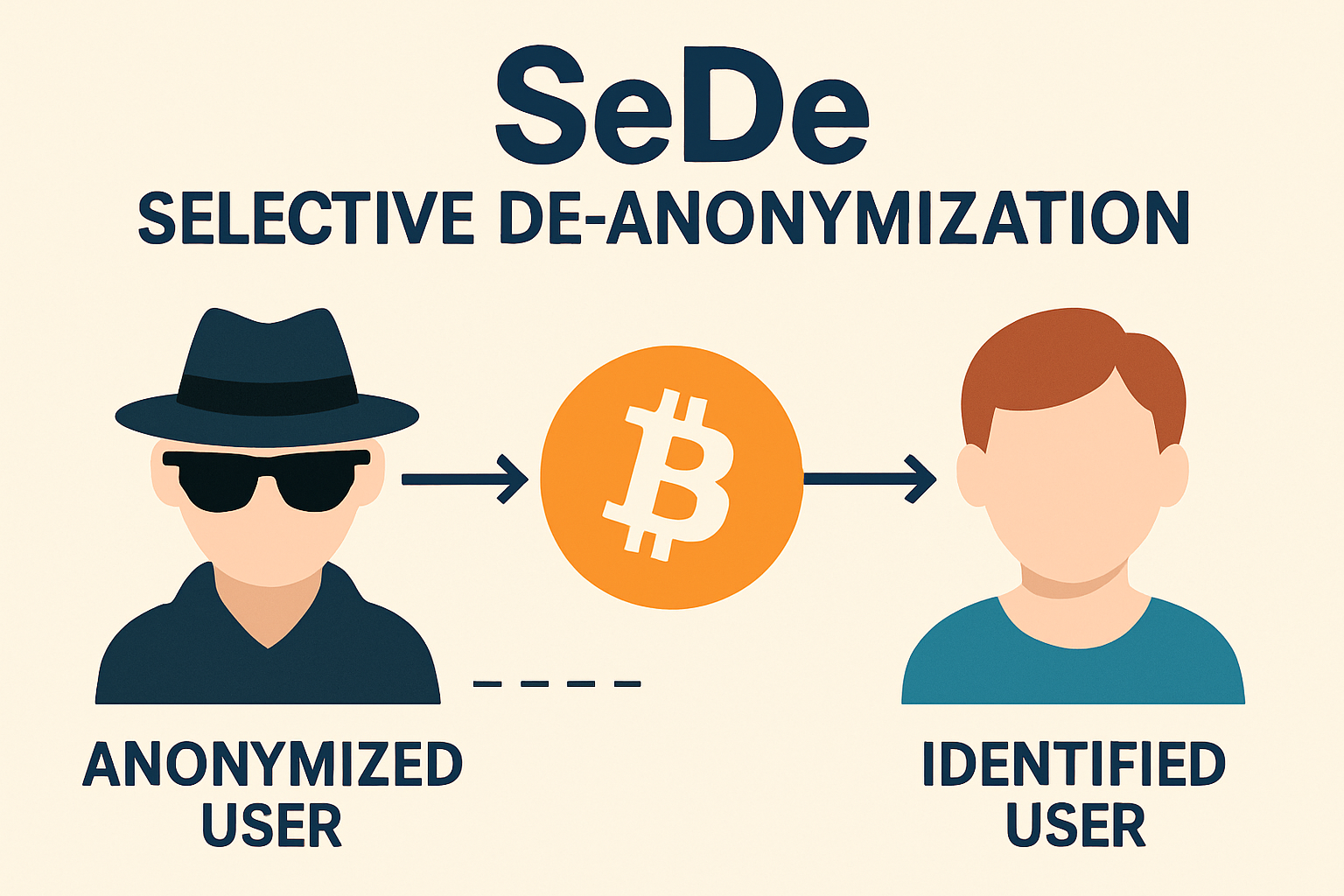

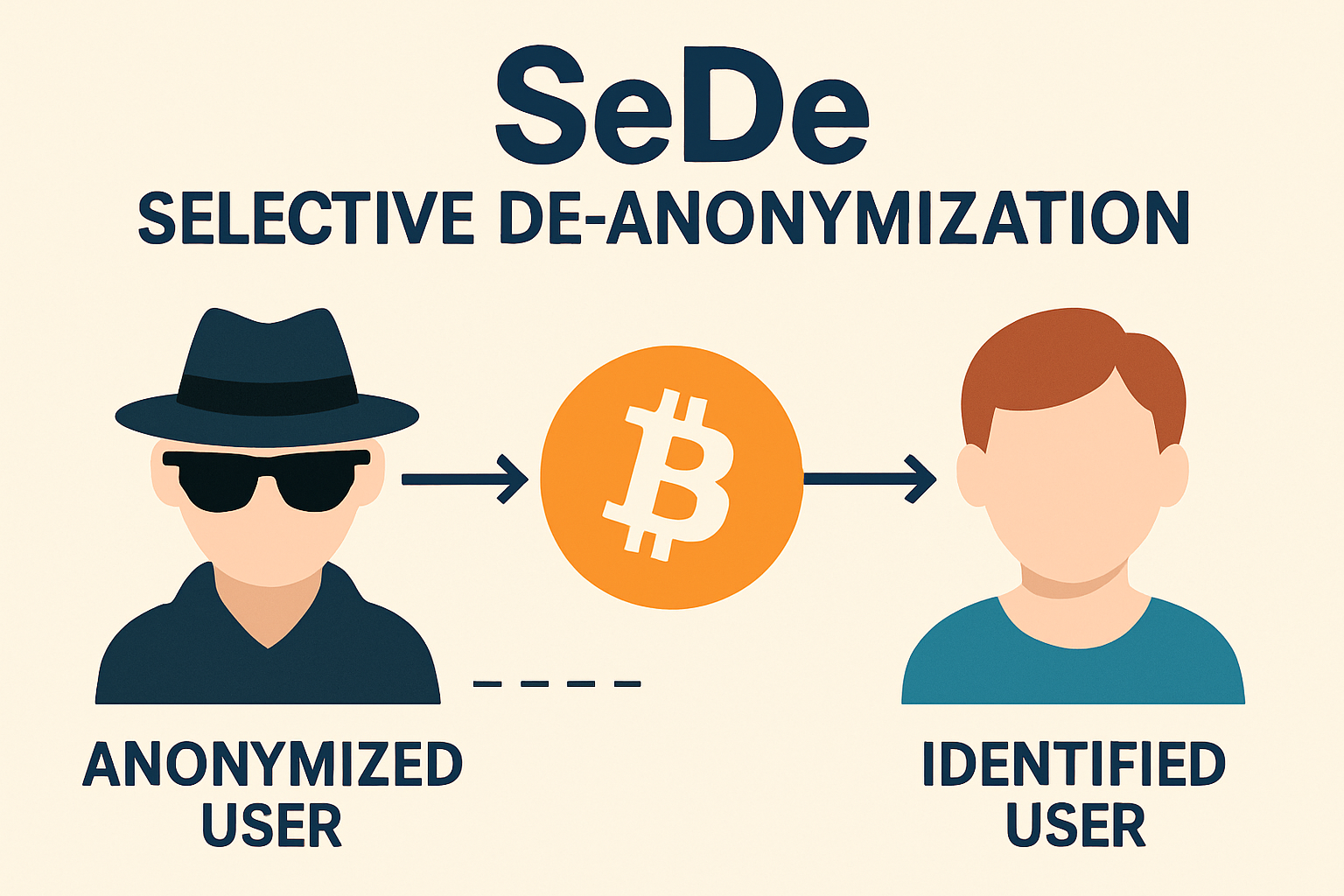

- SeDe (Selective De-Anonymization): Proposed in late 2023, SeDe introduces selective de-anonymization, enabling authorized entities to trace illicit flows across linked transaction subgraphs when necessary, but preventing unilateral deanonymization by any single party. This distributed accountability model is gaining traction among compliance-first blockchain applications.

Key Features of Regulated Crypto Mixers in 2024

-

Integrated KYC/AML Protocols: Regulated mixers implement robust Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, ensuring users are verified and transactions are screened for illicit activity. This contrasts with unregulated mixers, which typically do not require user identification.

-

Proof of Innocence Mechanisms: Solutions like zkMixer use zero-knowledge proofs to allow users to demonstrate that their funds do not originate from illicit sources, enabling privacy without facilitating criminal activity.

-

Selective De-Anonymization: Frameworks such as SeDe (Selective De-Anonymization) enable regulated mixers to reveal transaction details only under specific, legally defined circumstances, balancing user privacy with law enforcement needs.

-

Governance and Oversight Structures: Regulated mixers often feature transparent governance models, including multi-party oversight and mechanisms for dispute resolution, reducing the risk of unilateral misuse or abuse.

-

Compliance with International Sanctions and Regulations: These mixers actively monitor and block transactions linked to sanctioned entities, aligning with global regulatory requirements and regularly updating their compliance frameworks.

-

Transparent Audit Trails and Reporting: Regulated mixers maintain auditable logs and can provide transaction reports to authorities when legally mandated, unlike unregulated mixers that typically obscure all transaction history.

The Regulatory Tightrope: Industry Perspectives and Ongoing Challenges

This push toward privacy blockchain compliance is not without controversy. In January 2024, leading firms such as Coinbase and Paradigm pushed back against proposed U. S. rules requiring bulk reporting on all mixer-related transactions, arguing these measures would overwhelm regulators with low-value data while eroding user trust in blockchain networks.

The European Union’s recent reports echo similar concerns but stress that law enforcement must adapt rapidly to keep pace with new technologies used by both legitimate actors and criminals alike. As regulatory frameworks mature, expect continued friction at the intersection of innovation and oversight, a dynamic explored further in our guide on choosing a compliant cryptocurrency mixer.

Why Demand Is Growing for Regulated Crypto Mixers

The surge in demand for compliant mixing solutions is driven by several factors:

- Institutional Adoption: Financial institutions entering digital assets require tools that balance privacy with full AML/KYC integration.

- User Awareness: Individuals are increasingly aware that unregulated mixers expose them to legal risks, even if their intent is innocent.

- Evolving Threats: As law enforcement cracks down on illicit actors (e. g. , Sinbad shutdown in November 2023), criminals migrate to less transparent channels, raising the bar for compliance-first services.

This landscape demands nuanced solutions capable of protecting both user rights and systemic integrity, a challenge only addressed by truly regulated offerings.

With these trends in mind, regulated crypto mixers are evolving from niche privacy tools into essential infrastructure for the responsible digital asset economy. The best compliant cryptocurrency mixers now offer seamless integration with global AML laws, advanced cryptographic safeguards, and transparent governance, without sacrificing user experience or confidentiality.

Best Practices for Users and Providers in 2024

For users, selecting a regulated mixer is no longer about simply obscuring transaction trails. It’s about ensuring that privacy is protected within the boundaries of the law. Here are some best practices for both users and providers navigating the new compliance landscape:

Best Practices for Using Regulated Crypto Mixers in 2024

-

Verify Regulatory Status and Transparency: Always choose a crypto mixer that is registered or compliant with relevant regulations, such as KYC/AML requirements. Look for platforms that provide clear information about their compliance measures and undergo regular audits.

-

Utilize Mixers with Built-In Compliance Features: Opt for innovative solutions like zkMixer, which incorporates zero-knowledge proofs, ‘Proof of Innocence,’ and AML consensus protocols. These features help ensure privacy while enabling oversight and compliance with legal standards.

-

Understand and Respect Jurisdictional Laws: Research the legal status of crypto mixers in your country or region. For example, the U.S. Treasury now emphasizes transparency over outright bans, while the EU has increased scrutiny. Avoid using mixers in jurisdictions where they are prohibited or under active investigation.

-

Maintain Documentation of Transactions: Keep detailed records of your deposits, withdrawals, and transaction IDs when using regulated mixers. This documentation can be crucial if you need to demonstrate the legitimacy of your funds to exchanges or authorities.

-

Leverage Selective De-Anonymization Frameworks: Consider platforms that offer frameworks like SeDe (Selective De-Anonymization). These allow for privacy while enabling de-anonymization in the event of illicit activity, striking a balance between user rights and compliance.

-

Monitor Regulatory Updates and Industry Guidance: Stay informed about new laws, guidance, and compliance requirements from bodies like the U.S. Treasury, EU Innovation Hub, and major exchanges. Regularly review updates to avoid unintentional violations.

-

Avoid Mixing Illicit Funds: Never attempt to mix funds from suspicious or illegal sources. Regulated mixers like zkMixer can detect and confiscate deposits linked to illicit activity, and using such funds can result in legal consequences.

Providers, meanwhile, must maintain rigorous compliance documentation, perform ongoing risk assessments, and integrate with oversight tools that facilitate real-time monitoring and reporting. Solutions like MarketGuard and protocols such as SeDe are setting new industry standards for transparency and accountability.

What’s Next? The Road Ahead for Privacy and Compliance

The coming year will likely bring further regulatory clarity, as both U. S. and EU authorities refine their approaches to privacy blockchain compliance. Expect more nuanced rules that distinguish between legitimate privacy use cases and illicit activity, as well as greater collaboration between industry stakeholders and regulators. This ongoing evolution is essential for building trust in legal crypto mixing services and supporting mainstream adoption.

For those seeking to stay ahead of the curve, understanding the distinctions between regulated and unregulated mixers is crucial. Our resource on how regulated crypto mixers enable transactional privacy without breaking compliance offers a deeper dive into these differences.

Key Takeaways for 2024

- Regulated mixers are now indispensable for institutions and individuals who value both privacy and compliance.

- Technological innovation, especially zero-knowledge proofs and selective de-anonymization, allows privacy without enabling illicit finance.

- Collaboration between regulators, technologists, and users is vital to strike the right balance between confidentiality and oversight.

As the regulatory landscape continues to shift, only those mixers that embrace both cutting-edge privacy features and robust compliance frameworks will thrive. For anyone navigating the world of compliant cryptocurrency mixers, vigilance, education, and a commitment to best practices remain the keys to secure, lawful, and truly private digital asset transactions.