Cryptocurrency mixers, often called tumblers, have long been associated with controversy. While they provide a crucial layer of privacy for users seeking to keep their financial activities confidential, they have also drawn the attention of global regulators due to their potential misuse in money laundering and sanctions evasion. However, a new generation of regulated crypto mixers is emerging, designed to deliver privacy without sacrificing compliance. Let’s explore how these compliant cryptocurrency mixers are reshaping the landscape, drawing on real-world case studies and best practices.

Regulatory Pressures and the Evolution of Crypto Mixers

The last few years have seen a marked increase in regulatory scrutiny toward crypto mixers. High-profile cases, such as the U. S. Treasury’s Office of Foreign Assets Control (OFAC) sanctions against Blender. io and Tornado Cash, have sent a clear message: privacy tools that ignore anti-money laundering (AML) and know-your-customer (KYC) requirements risk being shut down or blacklisted. These actions have forced the industry to innovate, giving rise to privacy-preserving compliance frameworks that enable transactional privacy without violating the law.

One such innovation is the Selective De-Anonymization (SeDe) model. This approach allows mixers to maintain user anonymity under normal circumstances but enables authorized parties to trace illicit funds through a controlled, multi-entity process if required by law. Similarly, protocols like Haze and Daze only permit withdrawals from non-banned addresses or allow for retroactive de-anonymization of non-compliant users. These developments illustrate that it’s possible to balance privacy with legal obligations, a vital shift for anyone seeking lawful crypto privacy compliance.

Case Studies: How Regulated Mixers Achieve Compliance

Let’s look at practical examples where regulated mixers have successfully enabled privacy while meeting regulatory expectations:

- OFAC-Compliant Mixers: Some services now use on-chain analytics to screen incoming funds against sanctioned addresses. If a user attempts to mix tainted coins, the system automatically blocks the transaction, demonstrating that mixers can self-police without exposing all user data.

- KYC-Integrated Protocols: Emerging mixers incorporate lightweight KYC or risk scoring at entry points. While not as invasive as traditional exchanges, these checks help prevent bad actors from abusing privacy tools while preserving the anonymity of legitimate users.

- Decentralized Governance: Community-driven governance models allow users and regulators to participate in setting compliance parameters, ensuring the service remains adaptable to evolving legal requirements.

These approaches align with recommendations from compliance experts and regulators worldwide, supporting both operational security and legal integrity. For more on how regulated crypto mixers achieve this delicate balance, see our deep dive on compliant mixing solutions.

Best Practices for Using Regulated Crypto Mixers

-

Choose Reputable, Compliant MixersOpt for mixers that are well-reviewed, have a transparent compliance policy, and are not subject to current sanctions (e.g., avoid services like Tornado Cash and Blender.io, which have been sanctioned by OFAC).

-

Verify KYC/AML ProceduresUse mixers that integrate Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, such as those following frameworks like REGKYC or SeDe, to ensure legal compliance while maintaining privacy.

-

Stay Updated on Local RegulationsRegularly check the legal status of mixers in your jurisdiction to avoid inadvertent violations. Laws can change quickly—what’s legal today may be restricted tomorrow.

-

Implement Operational Security MeasuresEnhance your privacy by using Tor or VPNs, regularly changing wallet addresses, and avoiding address reuse when interacting with mixers.

-

Document Your TransactionsKeep records of your mixing activity (such as transaction hashes and compliance confirmations) in case you need to prove the legitimacy of your funds to exchanges or authorities.

-

Support Mixers with Selective De-AnonymizationConsider using privacy solutions like the Haze or Daze protocols, which allow for user privacy while enabling compliance teams to de-anonymize transactions if required by law.

Best Practices for Privacy-Conscious Users

As regulatory frameworks tighten, users must also adapt their operational habits. Here are essential best practices for anyone seeking transactional privacy without crossing legal lines:

- Choose reputable, regulated services with transparent compliance policies.

- Stay updated on local regulations: what’s legal in one country may be restricted in another.

- Use operational security tools like Tor and regularly rotate wallet addresses.

- Document your transactions for personal records in case you need to demonstrate compliance with AML/KYC requirements.

Adopting these practices helps protect your privacy while ensuring you remain on the right side of the law. To learn more about best practices in this space, visit our guide on privacy and compliance.

Looking ahead, the intersection of privacy and compliance in the crypto world is only going to become more complex. Yet, as demonstrated by innovative regulated mixers and privacy-preserving protocols, it’s possible to create systems that respect individual confidentiality while deterring illicit finance. The real differentiator is the willingness of both service providers and users to embrace best practices and technological advancements that support both sides of the equation.

Emerging Best Practices: A Roadmap for Legal Crypto Privacy

For privacy-focused individuals and organizations, here are actionable strategies that stand out in today’s regulatory climate:

Best Practices for Secure and Legal Use of Regulated Crypto Mixers

-

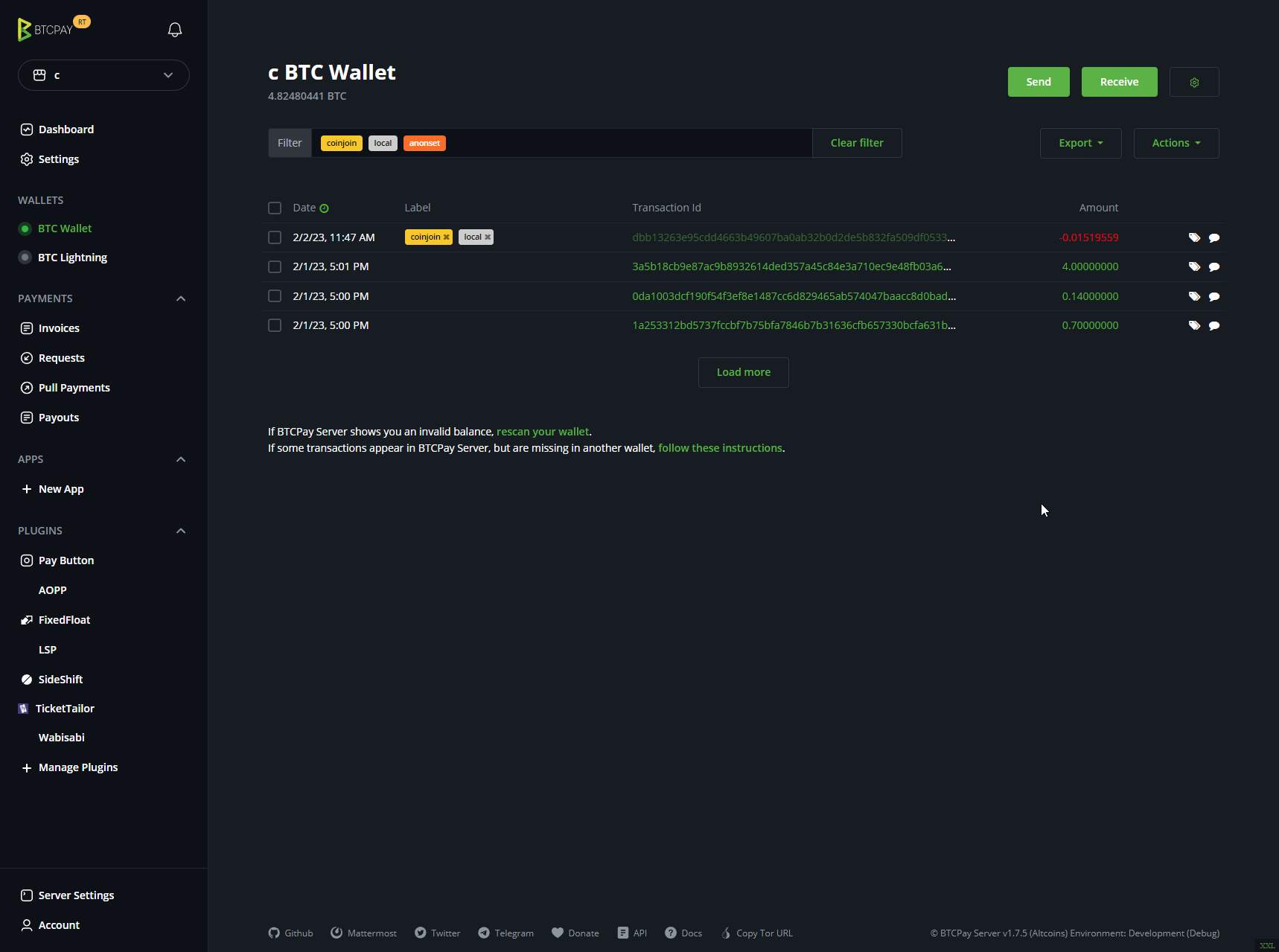

Choose Reputable, Regulated Mixers: Select mixers with a proven track record of compliance, such as CoinJoin implementations (e.g., Wasabi Wallet, Samourai Whirlpool) that publicly commit to regulatory standards and transparency.

-

Verify KYC/AML Compliance: Use services that implement Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, like Chainalysis-monitored mixers, to ensure your transactions are not linked to illicit activity.

-

Stay Updated on Local Regulations: Regularly check the legal status of mixers in your jurisdiction. For example, the OFAC sanctions on Tornado Cash highlight the importance of compliance with government mandates.

-

Utilize Privacy Tools Responsibly: Enhance operational security by using tools like Tor Browser and regularly changing wallet addresses to minimize traceability, as recommended by privacy advocates.

-

Support Mixers with Selective De-Anonymization: Consider using privacy solutions based on frameworks like Selective De-Anonymization (SeDe) or protocols like Haze and Daze, which enable privacy while allowing for regulatory compliance and the prevention of illicit use.

- Opt for mixers with transparent compliance disclosures. Reputable platforms now publish their risk assessments and outline how they screen for sanctioned or high-risk wallets.

- Integrate AML/KYC processes where appropriate. Even minimal KYC checks can dramatically reduce exposure to regulatory action without fully eroding user anonymity.

- Support protocols with selective de-anonymization capabilities. These frameworks ensure privacy for compliant users but allow investigation if required by law enforcement, striking a pragmatic balance between safety and secrecy.

- Participate in decentralized governance initiatives. When users have a say in compliance parameters, services remain agile and aligned with both community values and legal standards.

The rapid evolution of compliance technology means that what works today may need revisiting tomorrow. Staying informed about new frameworks, like SeDe, Haze, or Daze, and engaging with reputable providers is crucial for long-term success. For an up-to-date overview on how these systems work in practice, check our 2024 guide on regulated mixer compliance.

The Future: Privacy That Stands Up to Scrutiny

The trend is clear: as regulators continue to clamp down on unregulated mixing services, only those platforms that blend robust privacy features with strong compliance controls will thrive. This means more adoption of advanced analytics, selective de-anonymization tools, and decentralized oversight. Users who prioritize both security and legality will find themselves best served by mixers that proactively engage regulators while defending user confidentiality where it matters most.

If you’re navigating this evolving landscape, remember that effective privacy isn’t just about hiding your tracks, it’s about choosing partners who value transparency, accountability, and lawful innovation. For more insights into how regulated crypto mixers enable transactional privacy without breaking compliance requirements, explore our detailed resources at this link.