Cryptocurrency mixers, or tumblers, have always walked a fine line between privacy and regulation. As blockchain analytics evolve and regulatory scrutiny intensifies, the crypto community faces a pressing question: Can you achieve robust privacy without violating anti-money laundering (AML) laws? The answer, increasingly, is yes, thanks to regulated crypto mixers that blend compliance with confidentiality.

Why Traditional Mixers Trigger Regulatory Red Flags

Unregulated crypto mixers gained notoriety for their ability to obfuscate transaction trails, making it difficult to link senders and recipients on public blockchains. While this privacy boost was a boon for individuals concerned about surveillance or doxxing, it also provided a gateway for illicit activity. Regulators responded with force, as U. S. agencies and the Financial Action Task Force (FATF) cracked down on services enabling money laundering and sanctions evasion.

The core issue? Traditional mixers lacked transparency and customer identification. Without Know Your Customer (KYC) protocols or transaction monitoring, these platforms couldn’t distinguish between legitimate users and bad actors. As a result, many ended up on regulatory blacklists, leaving privacy-conscious but law-abiding users in the lurch.

The Rise of Regulated Crypto Mixers: Privacy Meets Compliance

Regulated crypto mixers are rewriting the narrative. Rather than ignoring compliance, these services integrate robust AML controls directly into their operations. Here’s how:

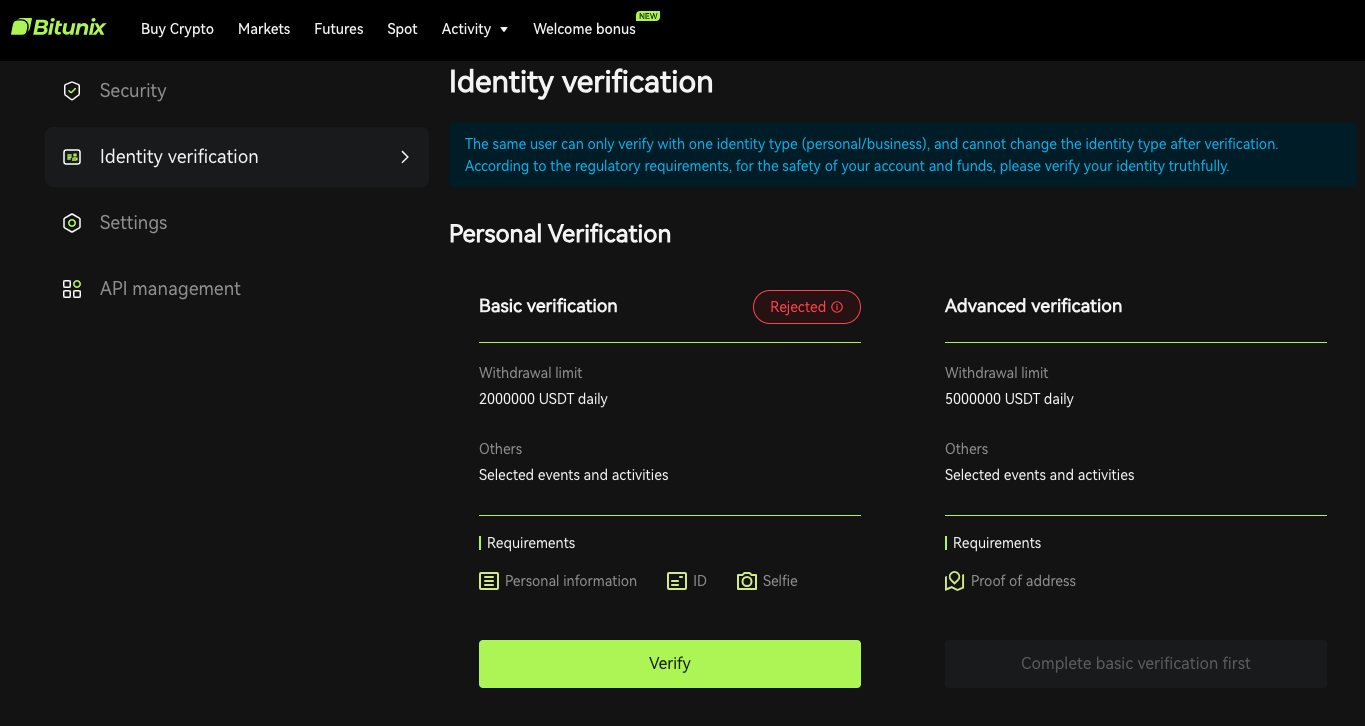

- KYC Verification: Users must verify their identities before accessing mixing features. This step weeds out sanctioned individuals and ensures only legitimate participants enter the pool.

- Real-Time Transaction Monitoring: Advanced analytics flag suspicious patterns, large volumes, rapid cycling, or connections to high-risk wallets, triggering additional scrutiny or reporting as needed.

- Selective De-Anonymization (SeDe): Regulated mixers employ frameworks that allow authorities to de-anonymize transactions only under specific legal conditions, such as a court order or regulatory request. This means users retain privacy unless there’s a legitimate reason to pierce the veil.

- Global Regulatory Alignment: By adhering to FATF guidelines and local AML/CTF laws, these mixers offer a legal pathway for privacy. Users can remain confident their activities are above board.

This approach creates a new class of compliant crypto mixing platforms that deliver strong privacy protections without running afoul of regulators.

Selective Disclosure: The Future of Privacy AML Crypto

The real breakthrough lies in selective disclosure protocols. Technologies like zero-knowledge proofs and SeDe frameworks let mixers prove compliance without exposing user identities or full transaction histories. For example, a mixer can demonstrate that no sanctioned addresses participated in a transaction, without revealing who the legitimate users were.

This aligns with evolving privacy principles such as those outlined in NIST SP 800-63 and is gaining traction among both privacy advocates and regulators. By enabling granular control over what gets disclosed and when, regulated mixers offer tailored confidentiality that doesn’t come at the expense of legal obligations.

As we move into 2025 and beyond, expect more platforms to adopt these hybrid solutions, blending cryptographic privacy with transparent compliance checks. The result? A practical middle ground where both individual rights and societal safeguards are respected.

Regulated mixers are not just a regulatory checkbox, they’re a tactical upgrade for anyone who wants transactional privacy without the risk of being caught up in enforcement sweeps. By leveraging selective disclosure, these platforms give users confidence that their privacy is protected unless there’s a legitimate legal trigger. This is a dramatic shift from the old days, where using a mixer was automatically seen as suspicious.

How Regulated Mixers Actually Work in Practice

Let’s break down what using a KYC compliant cryptocurrency mixer actually looks like for the end user:

Key Steps and Features of Using a Regulated Crypto Mixer

-

Identity Verification (KYC): Users must complete Know Your Customer (KYC) checks by submitting personal identification documents before accessing mixing services. This step ensures compliance with AML regulations and deters illicit activity.

-

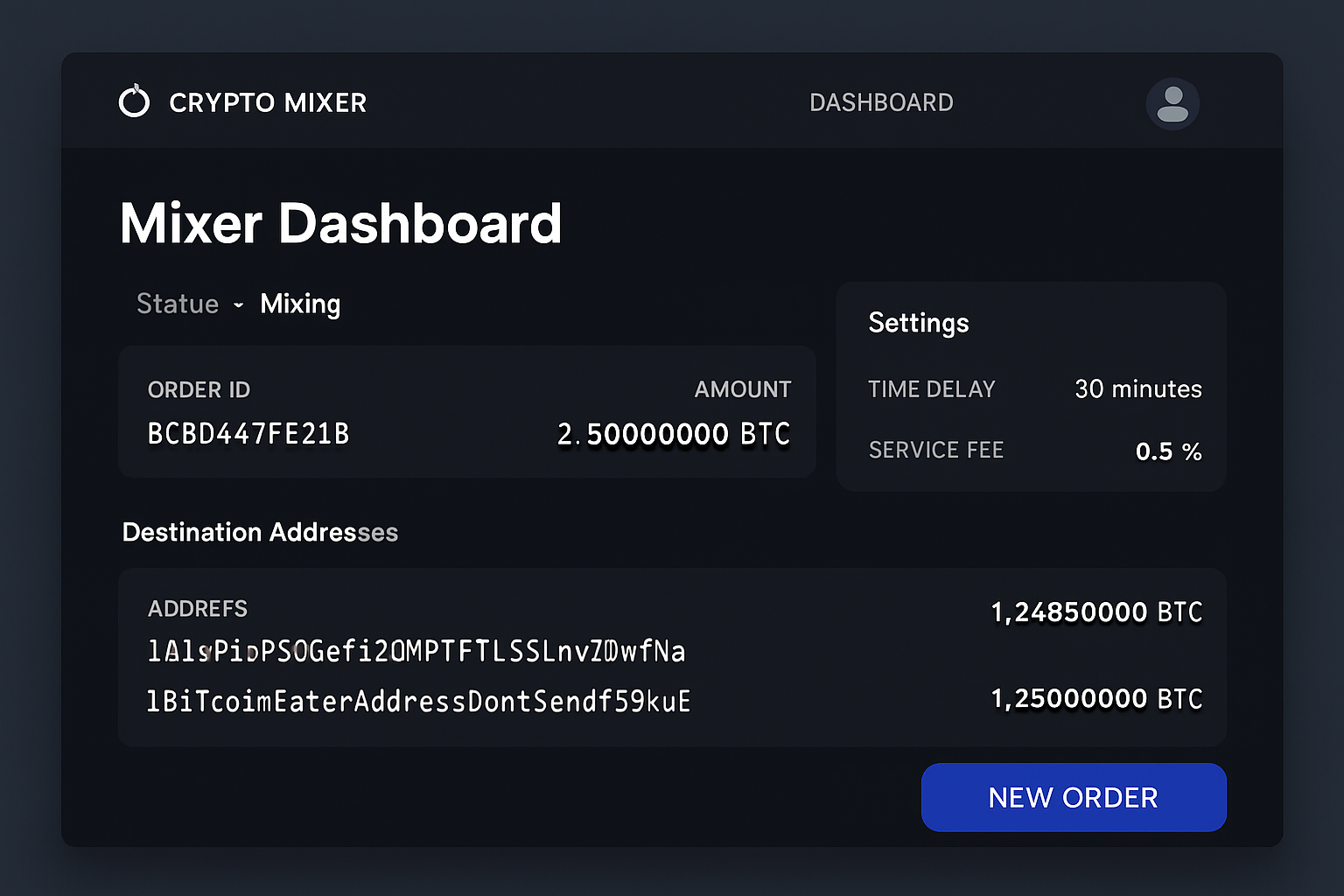

Deposit and Mixing Request: After verification, users deposit cryptocurrency (e.g., Bitcoin or Ethereum) into the regulated mixer’s platform and initiate a mixing request. The platform blends these funds with others to obscure transaction trails.

-

Real-Time Transaction Monitoring: The mixer employs automated systems to monitor transactions for suspicious patterns. Flagged activities are reviewed and, if necessary, reported to regulatory authorities in accordance with AML laws.

-

Selective De-Anonymization (SeDe): Advanced mixers use frameworks like Selective De-Anonymization to protect user privacy while allowing authorities to trace transactions under legally justified circumstances.

-

Compliance with International Standards: Regulated mixers adhere to FATF guidelines and other global AML/CTF standards, ensuring lawful operation and international acceptance.

-

Transparent User Dashboard: Users have access to a secure dashboard showing deposit status, mixing progress, and withdrawal options, providing clarity and control throughout the process.

-

Withdrawal to Clean Address: Once mixing is complete, users withdraw their funds to a new, unrelated wallet address, enhancing privacy while maintaining a documented audit trail for compliance.

Instead of the wild-west approach, you get clear onboarding, transparent policies, and visible compliance controls. If you’re running a business or simply want to keep your personal finances private without raising red flags, this structure is not just reassuring, it’s essential.

Benefits for Individuals and Businesses

The advantages of compliant crypto mixing go beyond peace of mind. For individuals, it means you can protect your wallet history from prying eyes, whether you’re concerned about stalkers, competitors, or simply don’t want your spending habits publicized. For organizations, especially those handling sensitive contracts or payrolls in crypto, regulated mixers offer an auditable privacy layer that stands up to due diligence checks.

Key takeaways:

- Reduced legal risk: Using platforms aligned with FATF and local AML rules drastically lowers your exposure to regulatory action.

- Selective transparency: Only relevant details are disclosed under strict conditions, protecting both user privacy and law enforcement needs.

- Future-proofing: As regulations tighten globally, choosing regulated solutions means you won’t have to switch providers or face service disruptions down the line.

Why Staying Informed Matters

The regulatory landscape for privacy AML crypto is still evolving. New guidance from the EU, US Treasury, and other global bodies continues to shape what’s considered acceptable. Staying current isn’t optional, it’s critical if you want to avoid accidental non-compliance or getting caught up in enforcement actions targeting unregulated services.

If you’re considering using or building on top of these technologies, dig into resources like how regulated crypto mixers ensure compliance with global AML laws. These guides detail the latest best practices and can help you choose platforms that won’t just protect your privacy today but will remain viable as regulations evolve.

The bottom line: Regulated crypto mixers are proving that privacy and compliance aren’t mutually exclusive. By adopting KYC checks, real-time monitoring, and selective disclosure protocols, these services enable confidential transactions while meeting the demands of regulators worldwide. It’s not just about keeping your balance hidden, it’s about doing so in a way that stands up to legal scrutiny now and in the future.